Written by: Thor Hartvigsen

Compiled by: TechFlow TechFlow

How has the crypto market financing landscape evolved over time? Which categories receive the most funding? Who are the top investors? This report will answer these questions and more.

Topic of this article

introduce

Financing Panorama

Financing this year (2023)

Selected Financing Highlights

introduce

Financing plays an important role in both cryptocurrency and traditional markets, as it is a way for projects to raise early capital by selling equity to private investors and funds. While these opportunities are often not available to the average investor, it's a good idea to be aware of general financing conditions for a number of reasons. On the one hand, when analyzing token economics and processes, knowing whether a project sells tokens to investors through a private placement is key.

The funding landscape has changed significantly over the past few years as new crypto industries and protocols attract significant amounts of capital. Today’s report will cover the past few years of funding and dive into the details of this year’s funding.

Investments by venture capital and angel investors can be divided into different stages.

Pre - Seed

Seed roundSeed

Series (AE) wheel

strategy wheel

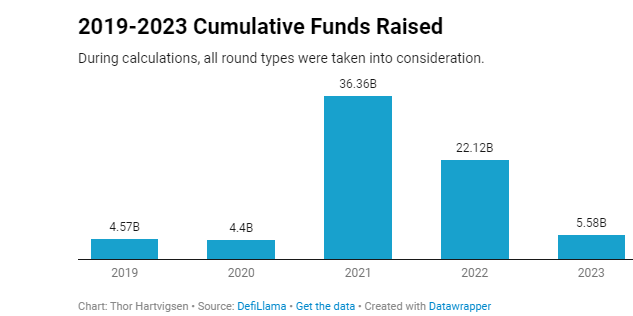

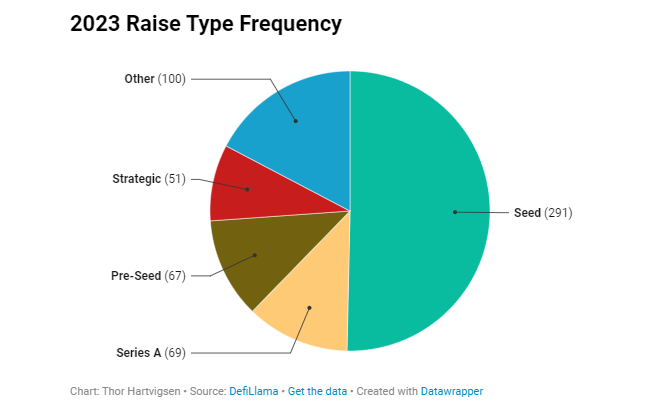

In 2023 alone, 1957 independent investors raised approximately 641 rounds of financing for 617 projects, with a cumulative financing amount totaling $5.58b. The most popular round type is the seed round.

Financing Panorama

In the years leading up to the 2021 bull market, most financings were fairly concentrated in terms of the number of unique investors involved. As the industry matures, more investors have been seeking exposure in the space. In 2021 and early 2022, we saw incredible disbursements being made to projects seeking investor funding due to "up only" price action and low interest rates. It’s clear that this period for cryptocurrencies is over, with cumulative funding amounts in 2023 only slightly above 2019 and 2020 levels.

When it comes to raising funds, companies like a16z, Paradigm, and Jump Crypto are known for actively leading many high-profile rounds and doling out large amounts of cash from their seemingly endless pockets. Most of the big stakes rounds occurred during times when things were more optimistic, although activity hasn’t completely died out. A recent relic of the cryptosphere, 3AC, also made the list with 7 rounds of funding led by Su Zhu and other members of the company.

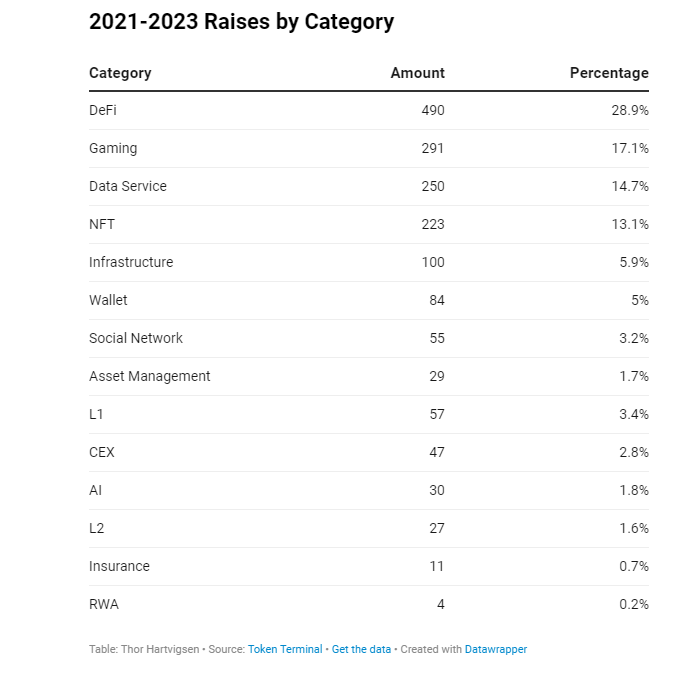

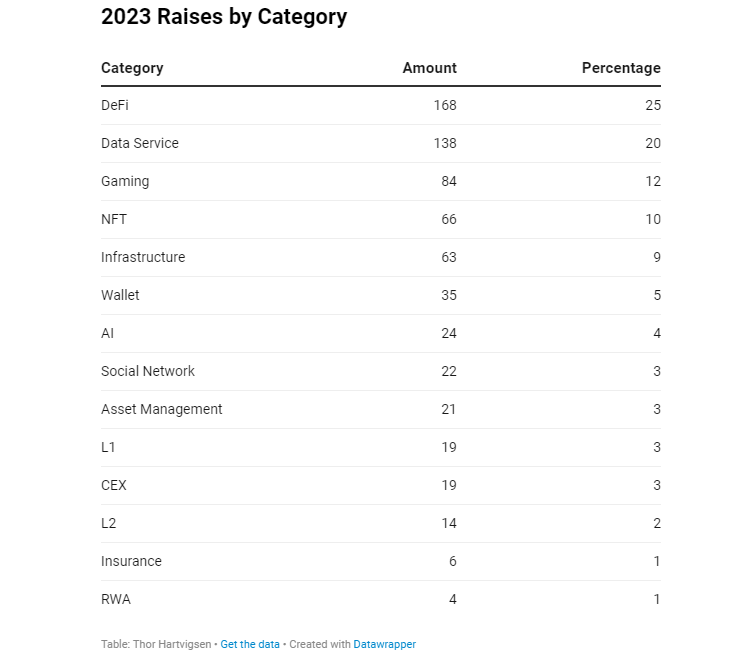

Beyond that, it's worth examining which categories received the most funding during this period. As shown in the figure below, DeFi Investments accounted for 29% of total financing during this period. Some of the larger DeFi investments include Li.Fi, M^ZERO, and Radiant. In addition, games are also a popular category for venture capital, with the majority of investments occurring in 2021 and 2022. However, to this day, it remains one of the most well-funded crypto circuits.

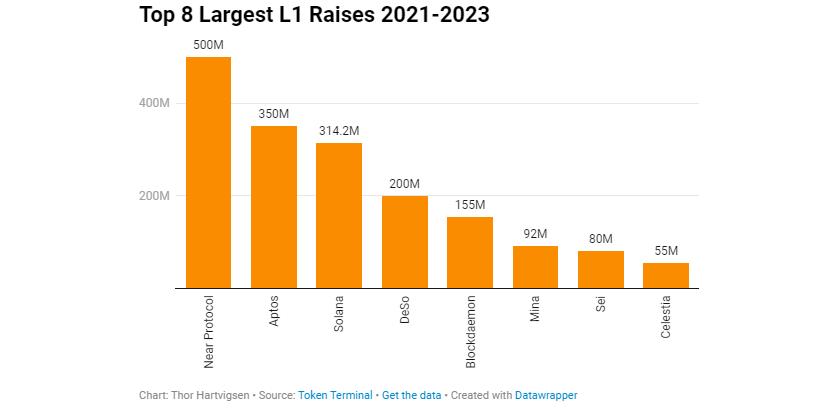

Another popular category for dollar investments is L1 blockchain. These corresponding tokens have led the 2021 bull run, with some achieving 100x returns upon launch. The chart below shows the 8 largest layer 1 blockchain financings in 2021-2023, with Near, Aptos, and Solana at the top. Projects that have recently raised funds include Celestia and Sei, who are also on the list, but these projects have raised much lower amounts compared to projects launched in the 2021 bull market.

Note that this is not the valuation of these L1 rounds, but the dollar amount they raised from investors.

Financing situation in 2023

As mentioned in the previous section, the most popular round among investors is the seed round . Their popularity can be attributed to having the highest ROI, as solid products with good market fit have proven their astronomical valuations multiple times, enough to convince investors that they are a viable investment strategy.

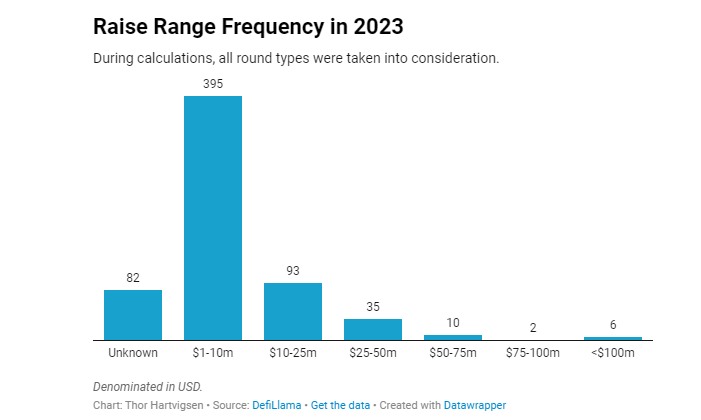

Times are tough because market conditions in 2023 are not as good as in previous years, liquidity is hard to come by and investors are less willing to take on additional risk. Most projects tend to receive funding of over $1 million to $10 million, with only a few mature projects raising $50 million or more.

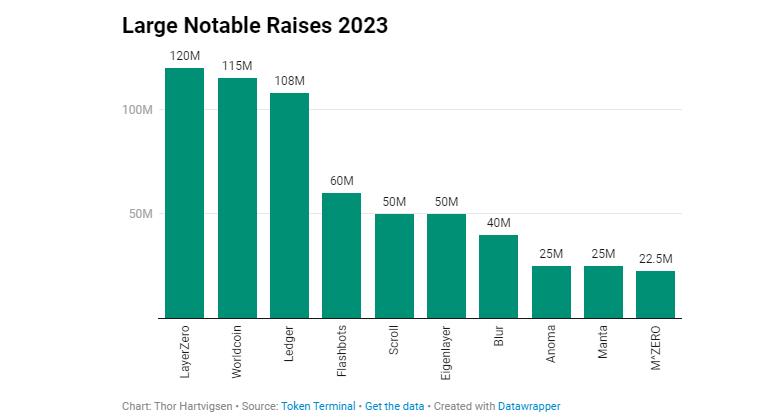

Which established companies have successfully attracted significant funding this year? As shown below, these include LayerZero, Worldcoin, Scroll, and Eigenlayer, among others. It’s worth noting that most of these products are some kind of blockchain infrastructure, either a cross-chain bridge, a blockchain, or a privacy protocol.

Despite not making the list of this year’s largest funding rounds, DeFi projects remain the most sought-after cryptocurrency sector among venture capital and private investors. Binance Labs is an example of venture capital investing heavily in DeFi, investing in Pendle, Radiant, Helio, etc. this year.

With all this in mind, let's take a look at some interesting investments happening in the second half of the year.

Selected L1 financing projects in the second half of 2023

Sei

Sei is a layer 1 blockchain based on Cosmos that specializes in optimizing the infrastructure of trading applications through the "Twin Turbo" consensus mechanism. Sei claims to be able to process up to 20,000 transactions in 0.5 seconds and is specifically focused on enhancing the decentralized exchange (DEX) ecosystem.

About a week ago, L1 based on the Cosmos SDK received a strategic investment from Circle Ventures for an undisclosed amount, aiming to continue to expand USDC’s business on various blockchains. Sei’s fast transaction processing and promising scalability features are worth the investment.

Noble

Noble is a new application-specific blockchain in the Cosmos ecosystem, built for native asset issuance. It aims to increase the efficiency and interoperability of native assets within the Cosmos ecosystem, starting with the USDC stablecoin. Noble’s vision is to become the world’s premier digital asset issuance center, promoting seamless connections with other blockchains.

Noble raised $3.3 million in a seed round led by Polychain Capital with participation from Circle Ventures, Wintermute and many other investors.

Linera

is a layer 1 blockchain that uses "microchains" to enhance scalability, allowing lightweight blockchains to run in parallel on a single validator set. This multi-chain infrastructure is designed for scalable Web3 applications to address block space scarcity and deliver predictable performance, security, and responsiveness at scale.

With Borderless Capital at the helm and participation from investors including DFG, a16z, and GSR, Linera has raised an additional $6 million in seed funding to set out to create the first low-latency blockchain that will work like a web2 application Expand easily.

Selected L2 financing projects in the second half of 2023

Blast

It attracted more than $500 million in funding within seven days of launch. Blast successfully raised $20 million with the help of major investors including eGirl Capital, Manifold, Standard Crypto, Paradigm, and Santiago R. Santos. Blast aims to introduce native yields to various assets such as ETH and stablecoins, allowing for automatic compounding while earning additional Blast rewards. Blast further plans to distribute all revenue to protocol developers through sequencer fee sharing.

Fhenix

An L2 that uses fully homomorphic encryption and focuses on creating a confidential environment for Ethereum-compatible smart contract development.

Fhenix has raised $7 million in seed funding, led by Multicoin Capital and Collider Ventures, with investments from Node Capital, Robot Ventures, Tane, Hack VC, Metaplanet and Bankless Ventures. The funding will be used to deploy crypto-focused Rollup.

Layer N

In a collaborative seed project led by dao5 and Founders Fund, Layer N received $5 million in funding to guide the delivery of high-performance L2 to meet the needs of financial applications requiring speed and scalability in an effort to replicate the performance of traditional financial markets. efficiency while providing decentralized, non-custodial products for CEX.

Selected DeFi financing projects in the second half of 2023

Ekubo Protocol

Ekubo Protocol, which is solely funded by the Uniswap DAO, received 3M UNI tokens (valued at $18 million) in exchange for 20% of the supply of its upcoming governance token. Ekubo is an AMM DEX designed specifically for the Starknet architecture, with a strong focus on capital efficiency and third-party developer support. Received 3M UNI tokens (valued at $18 million) in exchange for 20% of their upcoming governance token supply. Ekubo is an AMM DEX designed specifically for the Starknet architecture, with a strong emphasis on capital efficiency and third-party developer support.

Definitive

Definitive, a non-custodial execution platform and API, raised $4.1 million in a seed round earlier this month led by BlockTower Capital, with participation from high-profile entities such as Coinbase Ventures, Nascent, and Robot Ventures. The ultimate goal is to enhance the trading experience in the DeFi space by providing trade execution with optimal slippage and price impact, as well as advanced yield strategies.

Flashwire

Gate.io Labs, VeChain, CyberX, Legend Trading, Cobo, and SuperChain Capital invested a cumulative $10 million in Flashwire in a Series A round in October. Flashwire is a Singapore-based digital bank with a mission to increase the visibility of financial services by making them more accessible and user-friendly.

in conclusion

Some key points from this study:

Compared with 2021 and 2022, total funding this year has dropped significantly. However, given the recent market uptrend and BTC ETF expectations, it would not be surprising for this number to increase in 2024.

DeFi is the most funded category, but the largest individual funding is for L1 and L2 blockchains.

Gaming remains one of the biggest bets for cryptocurrency funds.

Seed rounds are more common than any other type of funding round.

There have been only a few RWA-related funding rounds this year. We expect this number to grow significantly in 2024.