Author: Jake Pahor, crypto analyst; Translation: 0xxz@Jinse Finance

Powerful artificial intelligence controlled by a few large corporations scares everyone.

But what if there is another way? Bittensor is democratizing artificial intelligence and putting power back into the hands of the people.

The following is my research report on TAO, divided into 11 parts: 1. Overview; 2. Use cases; 3. Adoption; 4. Revenue; 5. Token economics; 6. Treasury; 7. Governance; 8. Team and investors; 9. Competitors; 10. Risk and audit; 11. Summary.

1 Overview

Bittensor is an open source protocol that enables decentralized, blockchain-based machine learning networks.

The main goal of the project is to solve the problem of artificial intelligence centralization and the concentration of power in a few companies.

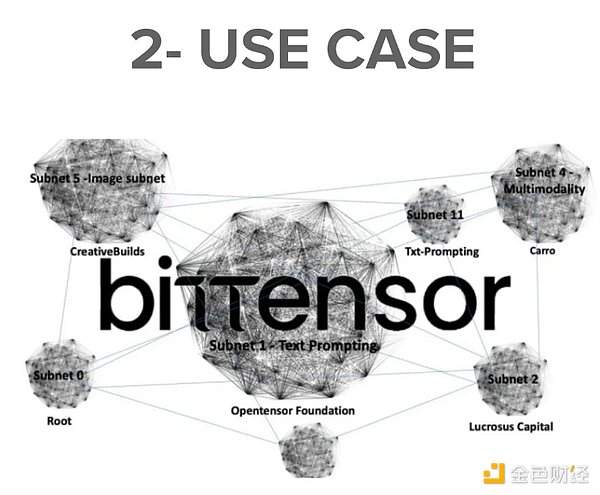

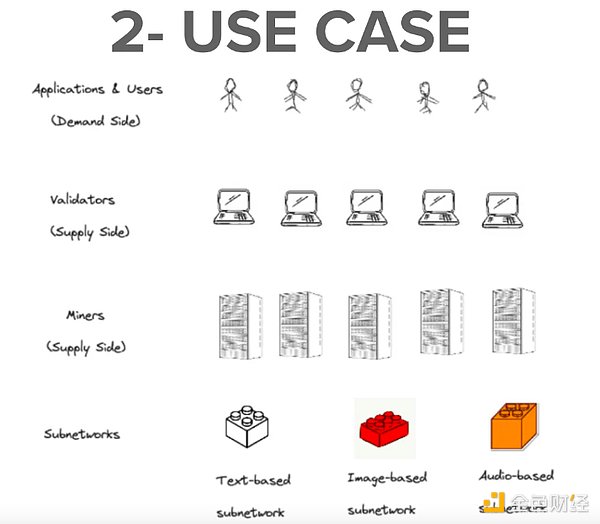

2. Use cases

It is "a special network that teaches computers how to become smart":

Optimizing the development and distribution of artificial intelligence technology using distributed ledgers.

Open access machine intelligence repository to enable global innovation.

Rewards are distributed based on user contributions.

Bittensor’s revolutionary October upgrade introduced subnets, allowing anyone to create their own subnets with custom incentives and different use cases.

Cultivate a wider range of services in the Bittensor ecosystem.

For example, Subnet 5 is similar to Midjourney’s AI image generation.

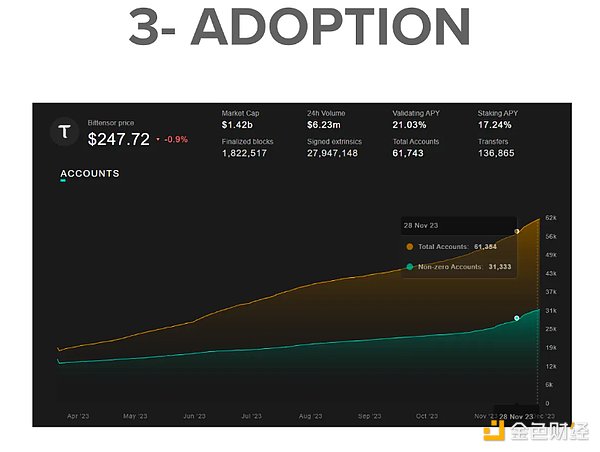

3. Adopt

I can't find the TVL numbers. But their dashboard shows the following statistics:

Run for 756 consecutive days

61,500 accounts

5 million TAO are pledged, accounting for 88% of the TAO supply

More than 30 subnets

Showing strong growth among network participants and stakers/validators.

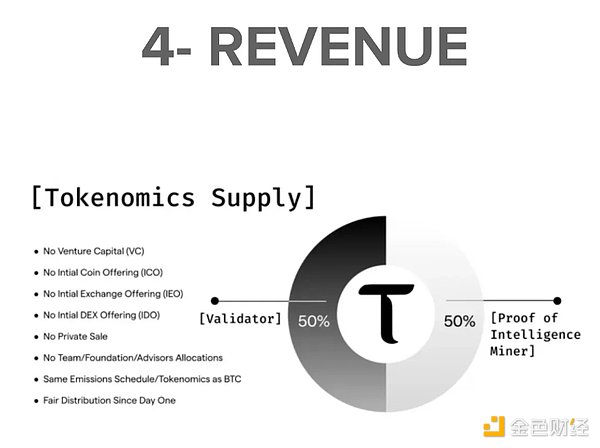

4. Income situation

Bittensor is a hybrid blockchain with POW (like BTC) and POS (like ETH) elements.

Miners host AI models and provide them to the network

Validators act as evaluators within the network

Each block has 1 TAO reward, and the rewards are equally distributed.

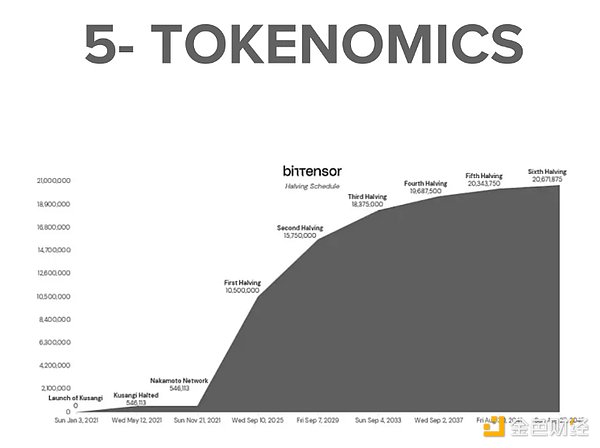

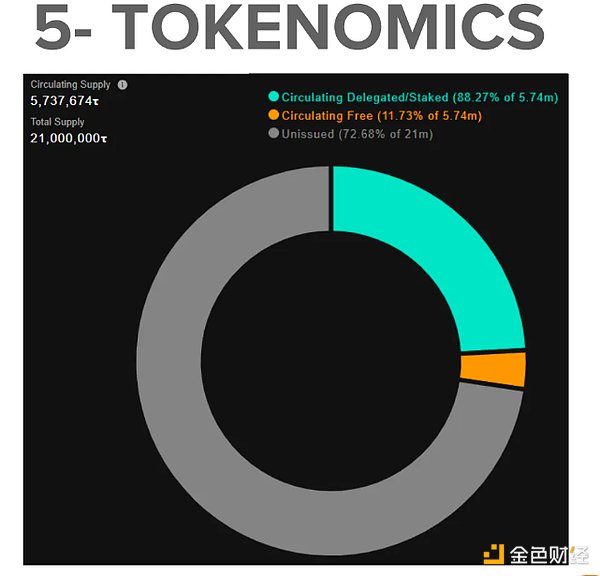

5. Token Economics

Bittensor “fair launch” (no token pre-mining) in 2021 .

The supply of TAO is 21 million, and there is also a halving cycle. Every 10.5 million blocks, the block reward is halved.

Currently, one TAO is released to the network every 12 seconds (one block) (7,200 per day).

Halving events occur every four years, and the first halving will occur in August 2025.

The number of halvings is determined by the total number of tokens issued, not the number of blocks.

Current supply statistics:

Circulating supply = 5.7 million

Total supply = 21 million

Market cap = $1.4 billion

FDV = $5.2 billion

Market cap/FDV = 0.27

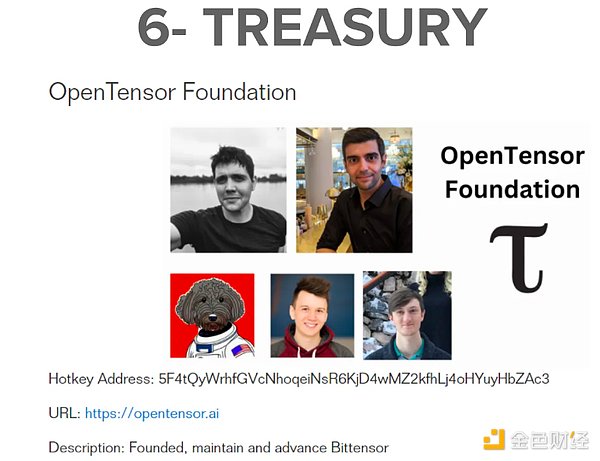

6. Treasury

Bittensor has no vault. It is similar to Bitcoin in that rewards are obtained through mining.

The Opentensor Foundation funds current infrastructure development through delegated licensing rewards.

Third-party validators fund their own development through delegation.

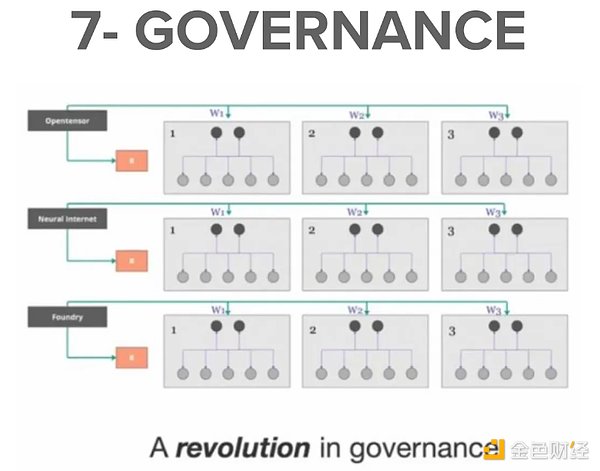

7. Governance

The Route network distributes released tokens among subnets based on consensus among major representatives.

Representatives in the "root" network now have the power to distribute rewards, not the Opentensor Foundation.

Eliminate individual dependence on any single entity.

8. Team and investors

Bittensor was founded in 2019 by Jacob Robert Steeves and Ala Shaabana.

The original mainnet(Kusangi) was launched in January 2021, but was later stopped and migrated to the current chain Nakamoto (launched in November 2021).

Investors include DCG, Polychain Capital, FirstMark Capital and GSR.

important hint:

TAO tokens are not distributed through ICO, IDO, private sale or privilege distribution. Circulating tokens must be earned by actively participating in the network.

The aforementioned investors invest money and participate in the network as miners or validators.

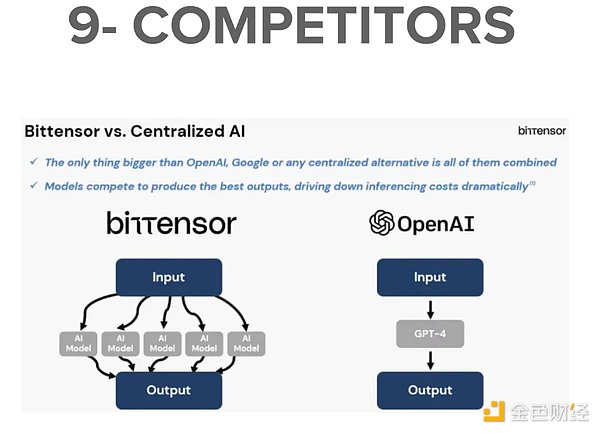

9. Competitors

The main competitors of Bittensors are centralized artificial intelligence companies, such as: OpenAI, Midjourney, Bard (Google)

They are trying to disrupt the industry through decentralized artificial intelligence.

It's a competitive environment, but Bittensor is delivering innovative solutions.

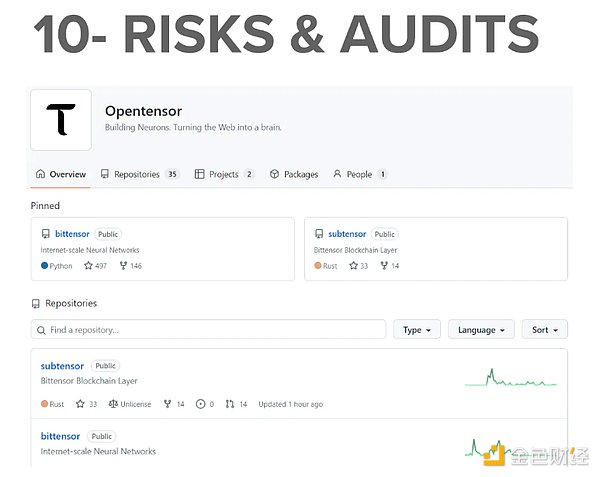

10. Risk and audit

Bittensor planned to become a parachain on Polkadot, but due to concerns about the development speed of Polkadot, it decided to use its own independent L1 blockchain built on Substrate.

The code is open source and the mainnet has been running for more than a year. There are no audit records yet.

11. Summary

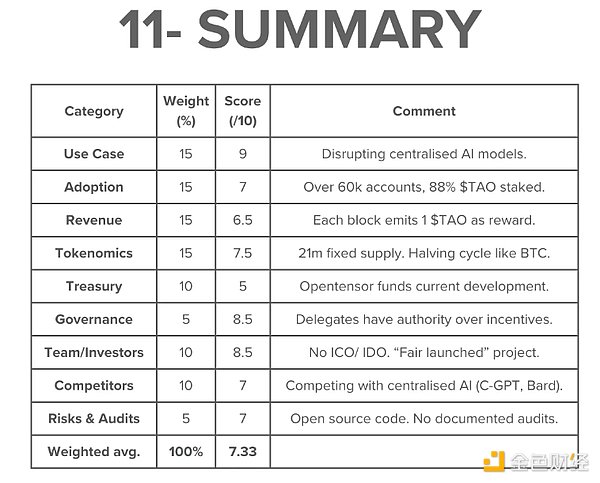

Bittensor is an interesting project that brings together two rapidly growing industries: artificial intelligence and blockchain.

Upcoming Catalysts:

Growing subnet

Artificial Intelligence Adoption

Risks include:

High operating expenses

Fierce competition

Total weighted score = 7.33

NOTE: I am not an ambassador or consultant for Bittensor. Not investment advice.