Author: Jesse Coghlan, Cointelegraph; Compiler: Songxue, Jinse Finance

Australians are increasingly looking to cryptocurrencies to secure a good retirement, with asset class allocations to self-managed super funds increasing by 400% in just four years, outpacing stocks and bonds.

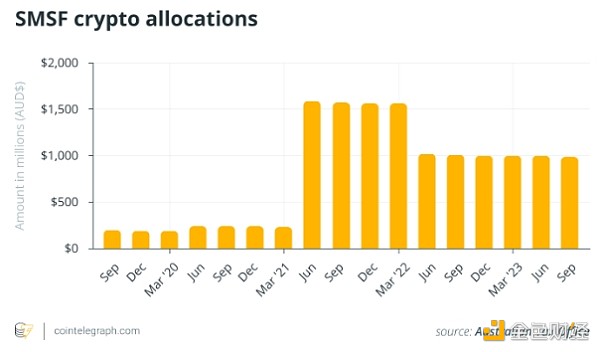

Statistics released by the Australian Taxation Office (ATO) on November 26 showed that nearly 612,000 self-managed super funds (SMSF) held cryptocurrencies worth a total of US$658.6 million (A$992 million) in the quarter ended in September.

The latest figure represents a 400% increase from the same quarter in 2019, closing at just under US$131.5 million (AU$198 million).

In Australia, self-managed superannuation funds (also known as private superannuation funds) allow individuals to control how their superannuation funds are invested. Retirement schemes are regulated by the Australian Taxation Office and SMSFs are still required to comply with superannuation laws.

Danny Talwar, head of tax at cryptocurrency tax provider Koinly, said this makes cryptocurrencies “the largest growing asset class among SMSFs.”

By comparison, listed equities - SMSF's largest allocation category at the end of last quarter - grew 28% over the same period. Allocations to debt securities such as bonds have fallen 5.8% over the past four years.

However, total SMSF allocations to cryptocurrencies were slightly down 0.8% from the quarter ended June 2023 and down 2.4% from the previous year.

Quarterly cryptocurrency allocation amounts for all SMSFs since September 2019. Source: ATO

Although it has increased in recent years, the amount of cryptocurrencies held in self-managed funds currently compares favorably with the all-time high of nearly US$1.06 billion (AU$1.6 billion) in the quarter to June 2021 during the last crypto bull run. Still down 38%.

Talwar also highlighted that cryptocurrencies accounted for just 0.1% of total net assets held by Australian SMSFs at the end of last quarter. He also noted that smaller SMSFs tend to allocate more cryptocurrencies in their portfolios.

Talwar said he is seeing “more and more” holdings of cryptocurrencies in super funds, while the number of local crypto exchanges offering crypto superannuation products is “continuously increasing”.

“People want to hold cryptocurrencies. You can hold cryptocurrencies in super accounts, but there are some stricter rules,” he warned.

“Your SMSF strategy must allow you to hold cryptocurrencies. Its sole purpose must be to provide you with retirement benefits. You need to audit everything. You need to keep your SMSF holdings separate from your personal holdings. Both The lines between them cannot be blurred.”

The specific cryptocurrencies held by SMSFs and the resulting gains or losses are not known as the ATO does not provide information about portfolio holdings or performance.