Author: TaxDAO&BaiShun Fund Services

As a world-famous offshore financial center, the Cayman Islands is also the world's largest offshore fund establishment place. More than 85% of offshore funds are registered in the Cayman Islands. At the same time, Cayman provides very favorable tax policies. Funds do not need to pay income tax, capital gains tax, dividend tax, etc. in the Cayman Islands; it has also signed tax information exchange agreements with countries such as the United Kingdom, the United States, and Australia. According to the Cayman Islands Monetary Authority (CIMA), as of the end of 2020, there were 2,6351 regulated open-end funds and 9,857 regulated closed-end funds in the Cayman Islands, with a total asset size of more than two Trillions of dollars. There are countless funds established in Cayman that are exempt from regulation.

Registering funds in Cayman has become an important way of cross-border investment, and the establishment of private equity funds for digital asset investment is gradually favored by Web3 investors. This article mainly introduces three structures for setting up offshore funds for investment in Cayman, and analyzes the tax risks designed under the LP (limited partnership) structure.

1 Three typical organizational forms of Cayman funds

Funds exempted from regulation in Cayman mainly have the following organizational forms: Exempted Company (EC), Exempted Limited Partnership (ELP), etc. This article first selects three more typical fund structures for analysis.

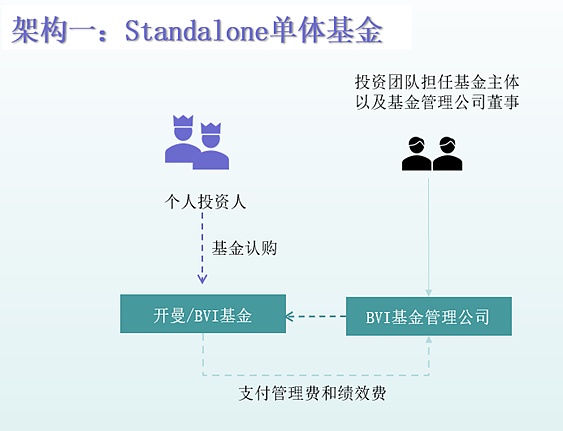

1.1 Stand-Alone Fund Structure

There are two entities in a single fund. The fund entity is usually established in the form of an exempted limited partnership, and the investment team subscribes to the participating shares of the fund (with the right to dividends, but no voting rights). At the same time, the investment team established a fund management company in the British Virgin Islands (BVI) as the management shareholder of the fund (it does not participate in dividends, but has the right to vote at shareholders' meetings), and the rights to the fund's daily decision-making and operations are vested in it. The investment team serves on the fund's board of directors.

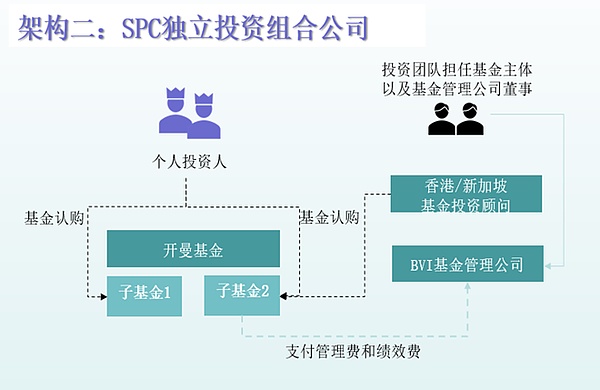

1.2 Separate Portfolio Company (SPC) Structure

The Segregated Portfolio Company (SPC) is a special case of the EC structure and a unique form of Cayman law. In the SPC structure, the SPC as an exempt entity can set up up to 25 independent investment portfolios (Segregated Portfolio, SP). At the same time, the assets and liabilities between these investment portfolios are completely independent. The actual effect of operating multiple different funds under an SPC is similar to setting up multiple individual funds. Therefore, the SPC is more cost-effective. The specific SPC architecture is shown in the figure below.

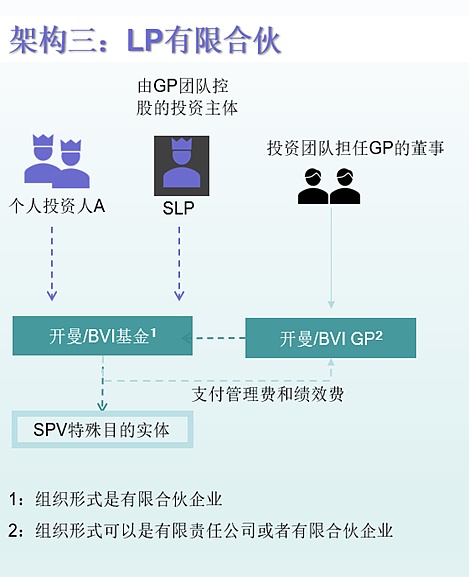

1.3 Exempted limited partnership (ELP) structure

The ELP structure is mainly divided into three steps. First, the investor first sets up a GP (general partner) company in Cayman/BVI as the general partner of the ELP. The second is to form an ELP fund entity with individual investors, the GP company established in the first step, and the investment entity SLP (limited partner) controlled by the GP team. The ELP then sets up an SPV (special purpose entity) to carry out investment business. Among them, GP has management and control rights over ELP fund affairs and is responsible for the operation, management, control and fund business of ELP funds.

An SPV under a fund entity refers to a subsidiary or sub-partnership established by the fund entity to invest in a certain project, usually in the form of an ELP, with the fund entity as the general partner or limited partner, and the project party as the limited partner or General Partner. The ELP architecture can bring the following benefits:

Take advantage of the Cayman Islands’ favorable tax policies and avoid double taxation and exchange controls.

According to the characteristics and needs of different projects, flexibly design the SPV's investment strategy, income distribution, exit mechanism, etc., and protect the interests of investors and project parties.

Like SPC, ELP can also separately account for the risks and benefits of different projects to avoid mutual influence and improve transparency and efficiency.

2 Selection of SPV location under ELP structure

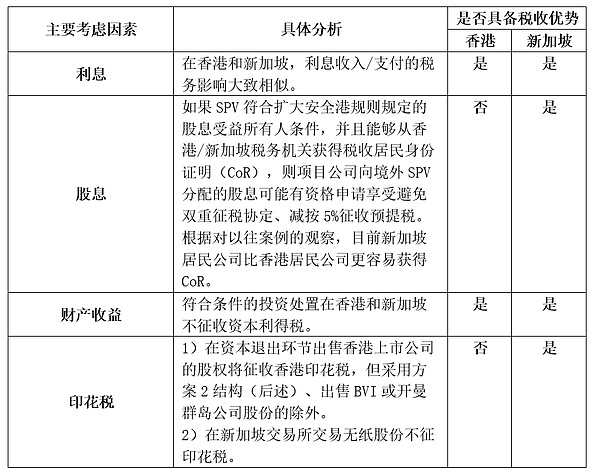

Under the ELP structure, fund entities invest in downstream companies through SPVs, which can be independently liquidated to protect shareholders' rights and achieve risk isolation. In practice, the location of the SPV is generally located in Hong Kong or Singapore, which not only facilitates financial activities, but also obtains the low tax rates of both places. This article analyzes the impact of four factors: interest, dividends, property income and stamp duty on SPV location selection, as shown in the table below.

It can be seen that in terms of dividends and stamp duty, Singapore, as the location of SPV, has more cost advantages than Hong Kong: the dividend tax exemption of Singapore SPV is more relaxed; its stamp duty regulations are also simpler and lower-cost. However, transaction costs are only one consideration for the landing location of an SPV. The specific landing choice must be judged based on different industries, structures, and corresponding policies of the two places.

3 Three Links of ELP Structure Investment and Tax Risk Analysis

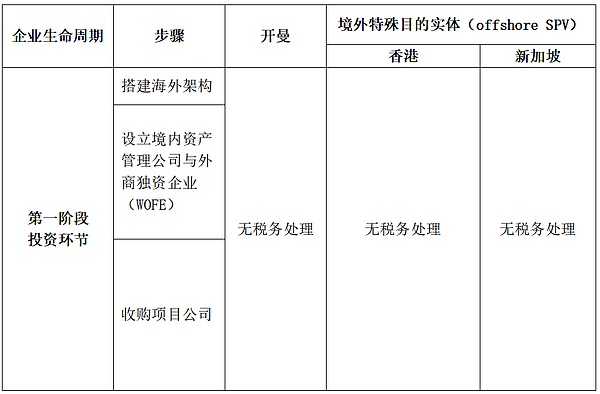

3.1 Taxation on investment

The investment process is mainly divided into three steps: establishing an overseas structure, establishing a domestic asset management company and a wholly foreign-owned enterprise (WOFE), and acquiring a project company. There are fewer tax issues involved in this link.

Establishing an overseas structure can be roughly divided into the following two options: The first option is a simplified version of the Cayman structure, which is to set up a holding company in the Cayman Islands and then invest in overseas or domestic project companies or special purpose entities through the company; the second option is the BVI /Cayman - Cayman structure, that is, setting up a holding company in the Cayman Islands and setting up a sub-holding company in the British Virgin Islands (BVI) or Cayman, and then investing in overseas or domestic project companies or special purposes through the sub-holding company entity.

The advantages of option one are simple structure, low cost and convenient management. You only need to register and maintain a holding company in Cayman and do not need to register and maintain another holding company in BVI. You can also enjoy Cayman’s tax benefits. But its disadvantages are higher risks, poorer confidentiality and lower flexibility. If a Cayman holding company directly invests in projects in other countries, it may be restricted or regulated by the laws of other countries. If Cayman Holdings goes public, information about its investors and investment projects may be exposed. If Cayman Holdings needs to change its investment strategy or withdraw from a project, there will be corresponding additional costs.

The advantages of option two are lower risk, better confidentiality and higher flexibility. By setting up a sub-holding company in the BVI or Cayman, the risks between the Cayman holding company and the investment project can be isolated; this structure also provides higher confidentiality and does not require the disclosure of information such as its directors, shareholders, beneficial owners, etc. . By establishing a sub-holding company in the BVI, the SPV's investment strategy, income distribution, exit mechanism, etc. can be flexibly designed according to the characteristics and needs of different projects, and the interests of investors and project parties can be protected. Its disadvantages are complex structure, high cost and troublesome management. The need to register and maintain two holding companies in two regions increases compliance risks and management difficulties.

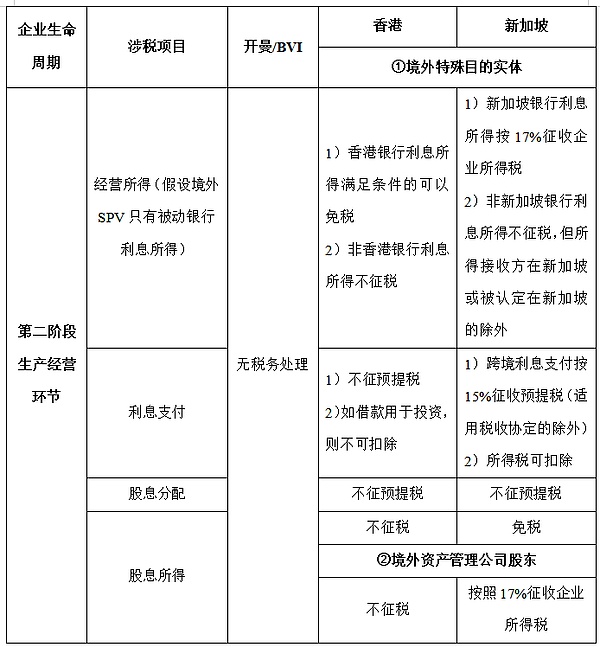

3.2 Taxation in production and operation links

Production and operation are the direct source of profits and the main channel for controlling tax risks. Generally speaking, Hong Kong's tax policy is simpler and the tax burden on enterprises is lower. Singapore has higher tax rates on certain tax-related items, such as bank interest income and cross-border interest payments. The tax regulations for different tax-related items in Hong Kong and Singapore are as shown in the table below.

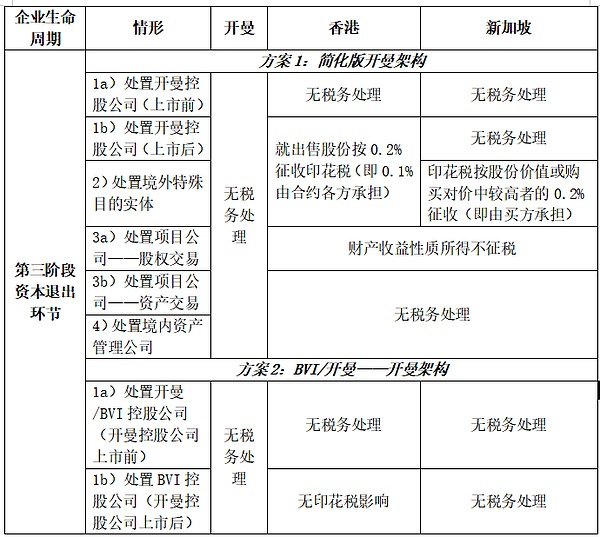

3.3 Taxation on capital withdrawal

In the capital withdrawal process, Plan 1 and Plan 2 face different tax issues. Generally speaking, there is not much difference in taxation between the two exit plans, except that Plan 2 has an additional BVI sub-holding company, but this does not have much impact on taxation.

As shown in the table below, no tax is payable in the Cayman Islands on the disposal of either a holding company or a special purpose vehicle. When exiting investments in Hong Kong, only the post-listed Cayman Holdings and SPVs need to pay stamp duty, and the proportion is relatively low, with each buyer and seller bearing 0.1%. No other types of disposals are taxable. When exiting an investment in Singapore, only the disposal of the SPV requires stamp duty, which is 0.2% for the buyer. No other types of disposals are taxable.

4 Risk expansion and discussion of Cayman funds

4.1 The risk of separation of the location of the actual management body and the place of registration

The actual management institution of offshore funds is often established in Hong Kong or Singapore. Since the location of the management institution is inconsistent with the place of registration, tax risks arise accordingly. Considering that the Cayman Islands has not signed a DTA agreement with Hong Kong or Singapore, the actual tax situation will be more complicated.

The main tax risk of Cayman offshore funds is that they may be deemed to have tax residence or have tax source income in the place where their actual management institutions are located, and thus need to pay income tax or other taxes in that region. Risk treatment mainly depends on the tax laws and regulations of the place where the actual management organization is located. Different regions may adopt different judgment standards and taxation principles. Therefore, when offshore funds choose the location of their actual management institutions, they should fully understand and compare the tax laws and regulations in these regions, so as to choose the most favorable region, or take corresponding measures to avoid or reduce tax risks.

Singapore’s tax laws stipulate that whether a company is a tax resident in Singapore mainly depends on whether the company is controlled and managed in Singapore. Control and management here refers to the location of the company's top decision-making level, usually where the company's board of directors meets. Therefore, if a Cayman offshore fund has its effective management body in Singapore, it may be deemed to be controlled and managed in Singapore and thus become tax resident in Singapore. Tax residents in Singapore are subject to global income tax in Singapore (at a rate of 17%).

Hong Kong's tax laws stipulate that whether a company needs to pay profits tax in Hong Kong mainly depends on whether the company's profits come from Hong Kong's trade, commerce or business, that is, whether the company's profits have a substantial connection with Hong Kong. Therefore, if the actual management institution of an offshore fund is located in Hong Kong, its investment income may also be deemed to be "sourced in Hong Kong" and will need to pay profits tax in Hong Kong (the tax rate is 16.5%).

In addition to tax risks, regulatory risks and legal risks are also issues that require attention during the investment process. First, if the financial regulatory authorities in Hong Kong or Singapore determine that an offshore fund is engaged in financial services activities there, the fund entity may be required to comply with regional financial regulatory regulations, including but not limited to obtaining corresponding licenses, disclosing relevant information, and accepting supervision. Inspections of agencies, etc. Secondly, the actual management agency needs to comply with relevant local legal provisions and may also respond to litigation or arbitration under the local legal framework, which requires dealing with issues of jurisdiction and applicable law.

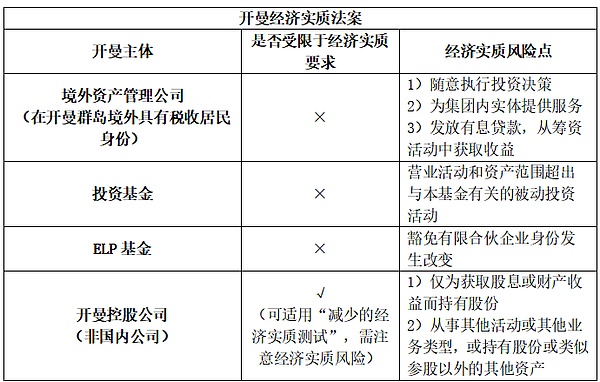

4.2 Risks brought by Cayman’s Economic Substance Act to fund investment

The Cayman Economic Substance Act was introduced in 2018 by the Cayman government to comply with the OECD’s requirements for tax transparency and fair competition, in particular in response to the international standards proposed by the OECD to combat tax base erosion and profit shifting in activities with high geographical mobility. A law was promulgated in December and came into effect in January 2019. The bill requires relevant entities (Relevant Entities) incorporated in Cayman to pass the corresponding economic substance (Economic Substance) test for the relevant activities (Relevant Activities) they engage in, otherwise they may face the risk of fines or even being deregistered. And the local tax authorities may exchange information about such related entities to the tax authorities where the ultimate beneficial owners are located.

This article summarizes the relevant requirements of the Economic Substance Act for different entities and the risk points in actual operations as shown in the table below. Among the four types of investment entities, overseas asset management companies, general partner funds and funds are not subject to economic substance requirements, but there are also corresponding risk operations that may be subject to economic substance requirements. A Cayman holding company is subject to (reduced) economic substance requirements. It only needs to have sufficient personnel and office space in Cayman to hold and manage other entities, and can meet the above economic substance requirements through its registered agent. The "economic substance risk point" in the table means that after performing certain operations, the entity changes from being exempt from the economic substance requirements to being subject to the economic substance requirements; or it is not allowed to enjoy reduced economic substance test benefits. Therefore, during the investment process, investors should pay close attention to such risk points and consult professionals when necessary.

4.3 Discussion and Outlook

The Cayman Economic Substance Act is a legal risk that cannot be ignored for investors and managers setting up funds in Cayman. Failure to meet the economic substance requirements may affect the tax status of the fund, impose additional information disclosure obligations, and even lead to the cancellation of the fund. Therefore, investors and managers need to reasonably select and design the structure and operation of the fund based on their own specific circumstances. At the same time, you also need to pay close attention to the further interpretation and implementation of the Economic Substance Act by the Cayman government and tax authorities, and promptly adjust and optimize your fund strategies.

Setting up a fund in Cayman to invest in digital assets has corresponding potential and prospects, but it also faces many challenges and risks. Therefore, investors and managers need to fully understand the characteristics and laws of digital assets, and rationally allocate and manage their digital asset portfolios in order to achieve long-term and stable investment returns.

This article only analyzes and compares three structures for setting up funds in Cayman to invest in digital assets from a tax perspective. In practice, investors and managers also need to consider various factors based on their specific goals and needs to choose the fund structure that best suits them.