The full text is divided into 4 parts: main points, preface, 10 major narratives, and conclusion. The top ten narratives are: return of stablecoin supply, increase in NFT transaction volume, increase in project fee income, return of DeFi, Bitcoin, other L1, SocialFi, RWAs, ZK, and global central bank interest rates.

1. Key points

- The total market value of crypto has increased by more than 110% compared to the beginning of the year, an increase of more than 870 billion US dollars. So far in the fourth quarter, the market is up 55% (about $596 billion).

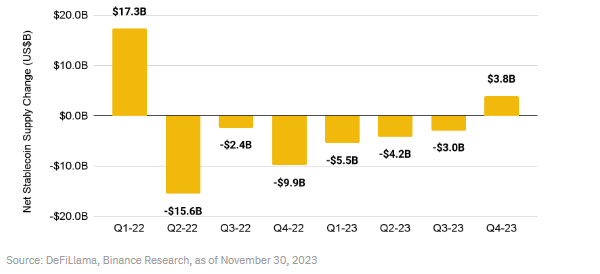

- Stablecoin supply is back, with the quarterly net supply of the top five stablecoins turning positive for the first time since the first quarter of 2022.

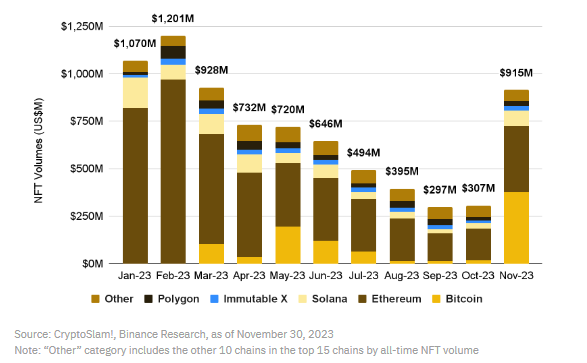

- NFT trading volume broke an 8-month downward trend and surged nearly 200% month-on-month in November. Bitcoin has become the most popular chain, with NFT transaction volume on Bitcoin exceeding $375 million, even surpassing Ethereum NFT ($348 million).

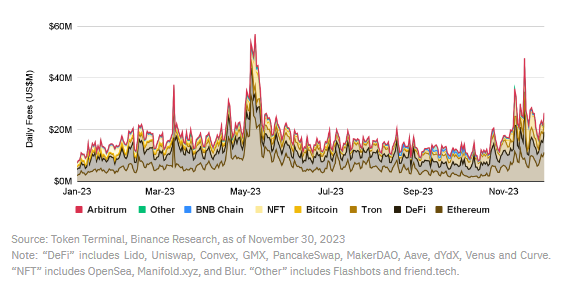

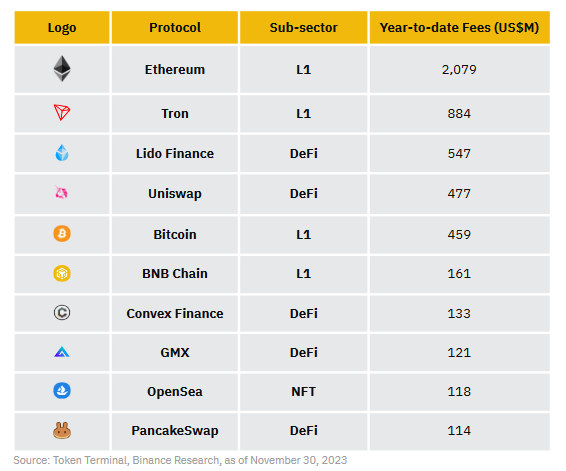

- Fees for the top 20 crypto projects increased in November, about 84% higher than in October; more than 100% higher than in September. DeFi TVL has also grown, and DeFi’s market capitalization share has increased by 18% month-on-month.

- Bitcoin has had an eventful year, including the emergence of Ordinals and BRC-20, and renewed interest in November. The news about the spot Bitcoin ETF is exciting, with the market expecting it to be approved in January, and the Bitcoin halving in April is another important point to watch.

- A number of other L1 blockchains have performed better than Ethereum recently, with Solana and Toncoin particularly prominent. There are also new protocols emerging in the SocialFi space, such as friend.tech, while platforms such as Farcaster, Lens, and Binance Square have also been updated.

- RWA is growing in importance and currently accounts for over 49% of MakerDAO’s balance sheet assets. Chainlink also hopes to bring TradFi, RWA and cryptocurrencies closer together through its new CCIP solution.

- ZK technology is in its infancy, with various ZK-rollups recently launched and increased research and discussion on ZK coprocessors.

- U.S. interest rates are at their highest level in 22 years, with markets expecting a rate cut next year. China has already begun cutting interest rates, while falling inflation in Europe has prompted investors to begin anticipating rate cuts from the European Central Bank.

2. Preface

After riding high in 2021, the cryptocurrency market has largely been a construction-focused market over the past few years. As the frenzy over celebrity-endorsed NFTs, $69,000 Bitcoin, Dogecoin on SNL and other narratives subsides, some are leaving the industry while others are doubling down and staying true to their vision. In recent weeks, we have seen an increase in market excitement, with some bear market building results starting to show up in crypto activity and asset prices.

While it's too early to say we're back in a bull market, things are certainly looking better than they have been in a while. That's why we've prepared this report to provide our readers with some key narratives and metrics to follow in the coming months.

Figure 1: The total cryptocurrency market capitalization has increased by approximately 110% year-to-date, adding more than $870 billion. The market is up 55% so far in the fourth quarter (about $596 billion)

3. 10 key narratives worth paying attention to

3. 10 key narratives worth paying attention to

1. Stablecoin supply returns

Stablecoin supply is a measure of the amount of money available to invest in crypto assets at any given point in time. Recent data shows that the quarterly net change in supply of the top five stablecoins (by market capitalization) turned positive for the first time since the first quarter of 2022.

Figure 2: Quarterly net change in supply of the top five stablecoins turns positive for the first time since Q1 2022

Given that increased stablecoin supply is a measure of cryptocurrency inflows and an indicator of potential buying pressure, the recent move can be viewed as a positive sign. It's worth keeping a close eye on how this indicator develops over the coming months, and whether it's a temporary change or represents a more sustained upward trend.

2. NFT trading volume increases

Since NFTs can be considered a riskier variant of the cryptocurrency industry, NFT trading volume can be considered a leading indicator of market sentiment. For example, if we consider Bitcoin as a benchmark asset, Altcoin like Ethereum are generally more volatile, i.e. have a higher beta than BTC. If we continue down the risk spectrum, we eventually reach NFTs, which have much higher betas than BTC.

The fact that NFT trading volume broke the downward trend and increased significantly month-on-month indicates positive market sentiment and that NFT speculation is reviving, indicating that NFT prices are starting to rebound after several months of sluggishness.

Figure 3: NFT trading volume has broken this year's downward trend and showed significant month-on-month growth in November.

We should also note the significant growth of Bitcoin NFTs (discussed in more detail in the “Bitcoin” section). Their growth is incredible, as shown in Figure 3, especially considering they were “invented” in late 2022 and didn’t become popular until March 2023.

We should also note the significant growth of Bitcoin NFTs (discussed in more detail in the “Bitcoin” section). Their growth is incredible, as shown in Figure 3, especially considering they were “invented” in late 2022 and didn’t become popular until March 2023.

Bitcoin NFTs had close to zero transaction volume in January, but reached over $375 million in November, surpassing Ethereum NFTs ($348 million). This is a huge achievement for a chain that has long been considered unsuitable for applications and NFTs, and we will be watching developments closely in the coming months.

3. Increase in project fee income

As the industry continues to mature and protocols turn into profitable businesses, the fee revenue generated by the top 20 crypto projects is an important metric to watch. Fee revenue has risen steadily over the past year, with month-on-month growth of more than 88% in November, compared with zero in January.

- Figure 4: Revenues of the top 20 crypto projects (all tracks) rose in November, approximately 84% higher than October and over 100% higher than September

In terms of cumulative fees, Ethereum has generated over $2 billion in total revenue so far in 2023, more than double that of any other single protocol . In second place is Tron, which generated approximately $880 million in revenue. Ethereum generates revenue by essentially selling its block space. Users paying these fees can be anyone from retail traders using Uniswap to trade memecoin, to L2 protocols like Arbitrum, which pay fees to Ethereum to settle transactions on it.

In terms of cumulative fees, Ethereum has generated over $2 billion in total revenue so far in 2023, more than double that of any other single protocol . In second place is Tron, which generated approximately $880 million in revenue. Ethereum generates revenue by essentially selling its block space. Users paying these fees can be anyone from retail traders using Uniswap to trade memecoin, to L2 protocols like Arbitrum, which pay fees to Ethereum to settle transactions on it.

- DeFi is the second largest fee generator after Ethereum, with Lido and Uniswap being the leaders . Convex, GMX, PancakeSwap and MakerDAO have also generated over $100 million in fees so far this year, with Aave not far behind.

- In terms of NFT, OpenSea is firmly in the lead, with fees almost twice that of Manifold and more than twice that of Blur. OpenSea's lead over Blur is notable as we've seen a back-and-forth battle between these two major NFT players over the past year for the top spot. While Blur managed to increase its share of the Ethereum NFT market from about 40% to about 80%, while OpenSea dropped from about 43% to about 20%, OpenSea still leads in terms of fees.

- Figure 5: The top 10 fees are dominated by L1 and DeFi projects

Notably, friend.tech, which launched in the summer alone, is among the top 20 protocols this year (over $50 million in fees). This suggests that there are opportunities for products that can generate traction and hype, especially in the growing and relatively young SocialFi subsector.

Notably, friend.tech, which launched in the summer alone, is among the top 20 protocols this year (over $50 million in fees). This suggests that there are opportunities for products that can generate traction and hype, especially in the growing and relatively young SocialFi subsector.

- It's also worth noting that Arbitrum is the only L2 (costing over $50 million) in the top 20 list. This is noteworthy given the ongoing discussion around L2 and the narrative of the L2 sub-sector becoming increasingly important. Still, only Arbitrum appears on the list. This might be an interesting metric to take into account with all the new L2s that have been launched or come to market recently.

Overall, fee income is the hallmark of any truly sustainable business. It’s clear that parts of the cryptocurrency market are capable of generating meaningful fees, and it’s encouraging to see these numbers grow in 2023. Keeping an eye on which protocols and sub-tracks are showing the best fee growth will definitely be an important aspect as the market enters the next market cycle.

4. The return of DeFi

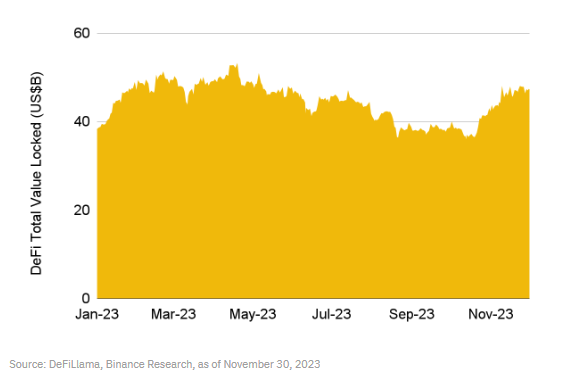

After several months of relatively limited DeFi activity, we are starting to see some activity return in the space. DeFi total value locked (“TVL”) has increased by nearly 25% since the beginning of the year, with a month-on-month increase of 14% in November. TVL has been limited to between $45 billion and $50 billion since December, so it will be important to monitor whether this latest trend can continue and easily cross the $50 billion mark in the coming weeks and months. Figure 6: DeFi TVL returns

In terms of public chains, Ethereum is still the most dominant player, accounting for more than 56% of the total TVL. Tron accounts for ~16%, while BNB Chain accounts for just over 6%. Arbitrum (~4.5%) and Polygon (~1.8%) are the remaining two in the top five. It is worth noting that among the top ten public chains in DeFi TVL, four are Ethereum L2s (in addition to the previously mentioned, there are also OP Mainnet and Base).

In terms of public chains, Ethereum is still the most dominant player, accounting for more than 56% of the total TVL. Tron accounts for ~16%, while BNB Chain accounts for just over 6%. Arbitrum (~4.5%) and Polygon (~1.8%) are the remaining two in the top five. It is worth noting that among the top ten public chains in DeFi TVL, four are Ethereum L2s (in addition to the previously mentioned, there are also OP Mainnet and Base).

Category-wise, Liquidity Staking ($27 billion) was one of the biggest winners this year, with Lido being the dominant player with a TVL of over $20 billion. The Shanghai Upgrade, which allows users to withdraw staked ETH, has been very helpful to Lido, growing its TVL from $12 billion to over $20 billion now. Lending ($19 billion), DEX ($13 billion), and cross-chain bridges ($13 billion) are the next popular categories.

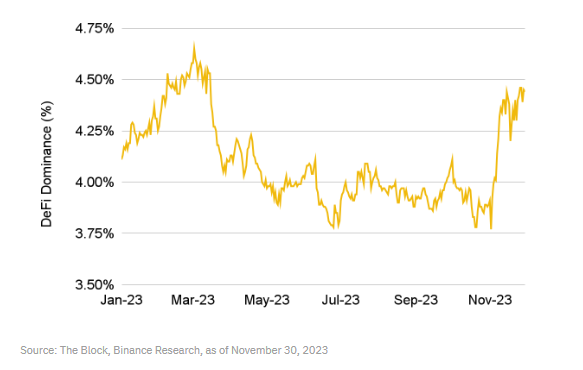

Another chart worth paying attention to is the DeFi market capitalization ratio. This is measured by looking at the top ten DeFi tokens and calculating their total market capitalization as a percentage of the total cryptocurrency market capitalization. After remaining in the 3.8% to 4.1% range since April, the number began to surge, rising 18% during November to end the month at 4.44%. Thorchain, PancakeSwap, Uniswap, and Synthetix, among others, are among the main factors driving this move.

Figure 7: The proportion of DeFi increases

Some key developments to watch :

Some key developments to watch :

- MakerDAO will continue to advance its “Endgame” plans, with Phase 1 expected to launch in early 2024.

- PancakeSwap recently launched its gaming marketplace and improved its governance system with the launch of its new “ve” (vote-locked) token $veCAKE.

- Synthetix's new product, Infinex, will be launched soon. Infinex is an upcoming decentralized perpetual contracts exchange.

- The launch of Fluid, a highly capital efficient multi-layer DeFi protocol from the Instadapp team.

5. Bitcoin, Bitcoin, Bitcoin

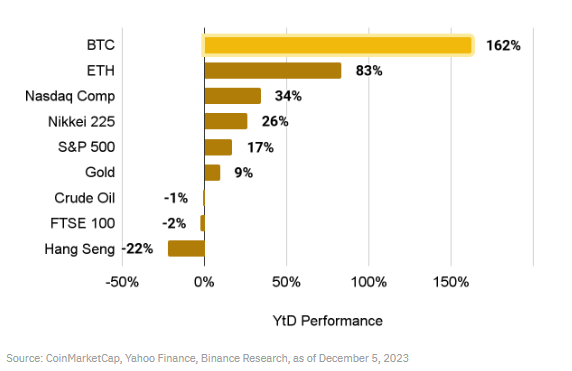

2023 is a year full of events for Bitcoin. From Ordinals (Bitcoin NFT) collectors who are very crypto-native, to more traditional institutional investors who are beginning to approach Bitcoin ETFs, investor groups have emerged in all aspects. new development. This corresponds to a 162% increase in Bitcoin market capitalization so far in 2023, outpacing most of the other top crypto assets on the market. Figure 8: Bitcoin’s year-to-date performance has been very strong

Some of the most important Bitcoin narratives:

Some of the most important Bitcoin narratives:

A. Spot Bitcoin ETF approval is more likely than ever

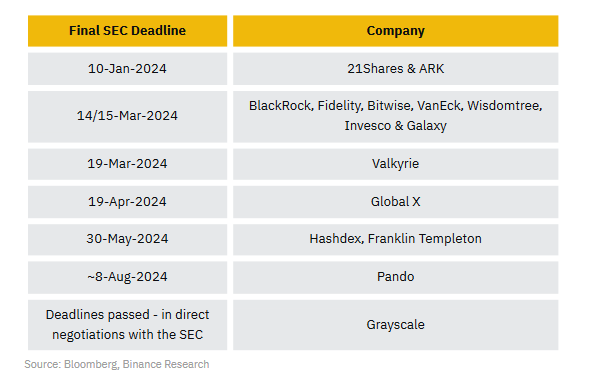

While the possibility of a U.S.-regulated spot Bitcoin ETF has been around for a long time, 2023 has seen significant positive developments. In particular, the dispute between the U.S. Securities and Exchange Commission (SEC) and Grayscale over the conversion of its Grayscale Bitcoin Trust (“GBTC”) into a spot Bitcoin ETF essentially ended in Grayscale’s favor. This has led a number of other players, including BlackRock, Fidelity and Invesco, to also submit applications for spot Bitcoin ETFs in recent months. All told, there are currently 13 spot Bitcoin ETF applications under review by the SEC, with the earliest final deadline being January 2024 and the latest being August 2024. It is widely expected that these ETFs will be approved in the coming weeks or months, especially given the outcome of the SEC's case against Grayscale and the continued resubmission and revision of ETF applications by each applicant to maximize the chances of approval. Figure 9: Most deadlines for SEC decisions on spot Bitcoin ETFs occur in the first quarter of 2024, starting in January

If approved, a spot Bitcoin ETF would address the two main drivers of Bitcoin adoption: convenience/accessibility and mainstream acceptance. The launch of spot ETFs will provide many institutional investors with a simple, compliant and widely accepted way to add Bitcoin exposure to their portfolios and improve distribution. The support of global asset management giants like BlackRock, Fidelity, and Invesco will enhance Bitcoin’s image as a legitimate asset class and help eliminate regulatory/compliance concerns among new investors. This is expected to result in a significant increase in capital and user inflows into Bitcoin, both from institutional investors who were previously excluded and from new retail investors who may have been cautious before.

If approved, a spot Bitcoin ETF would address the two main drivers of Bitcoin adoption: convenience/accessibility and mainstream acceptance. The launch of spot ETFs will provide many institutional investors with a simple, compliant and widely accepted way to add Bitcoin exposure to their portfolios and improve distribution. The support of global asset management giants like BlackRock, Fidelity, and Invesco will enhance Bitcoin’s image as a legitimate asset class and help eliminate regulatory/compliance concerns among new investors. This is expected to result in a significant increase in capital and user inflows into Bitcoin, both from institutional investors who were previously excluded and from new retail investors who may have been cautious before.

A new study from Galaxy puts a fairly conservative estimate of $14 billion in inflows into a spot Bitcoin ETF by the end of its first year. Additionally, we can consider the case study of spot gold ETFs. Specifically, the first spot gold ETF listed in the United States was launched in 2004, and before that, investing in gold was very difficult. Following the launch of the ETF, gold prices rose for seven consecutive years. This suggests that gold is significantly undervalued due to a lack of suitable investment vehicles. While not directly comparable to Bitcoin, it’s worth considering whether we might see similar moves in Bitcoin if spot ETFs do get approved in the near future.

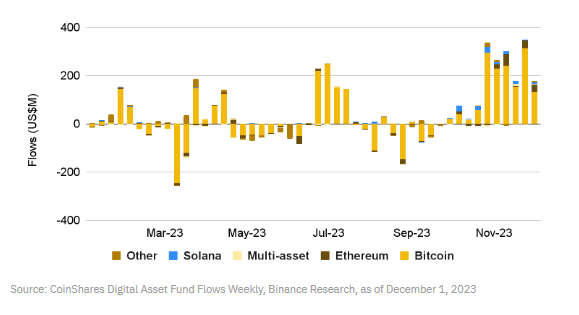

In fact, recent cryptocurrency exchange-traded product (“ETP”) data shows that inflows continue to grow. While much of this data is retail-driven, the CoinShares team has also seen an uptick in institutional interest. Additionally, increased inflows into cryptocurrency ETPs (including ProShares’ Bitcoin Futures ETF, Bitwise 10 Crypto Index, and other products) also indicate investors’ desire to gain exposure to cryptocurrencies in a more traditional regulated manner (as opposed to using centralized or decentralized Centralized crypto-native exchange). Digging deeper into the CoinShares ETP data, we can see that the Bitcoin ETP has seen over $1.6 billion in inflows this year and is by far the most popular asset. Total assets under management (AUM) have increased more than 100% since the beginning of the year to $46.2 billion, the highest level since May 2022.

Figure 10: Global cryptocurrency ETP capital inflows increased significantly in October and November, and Bitcoin is by far the largest asset.

B. The upcoming Bitcoin halving

B. The upcoming Bitcoin halving

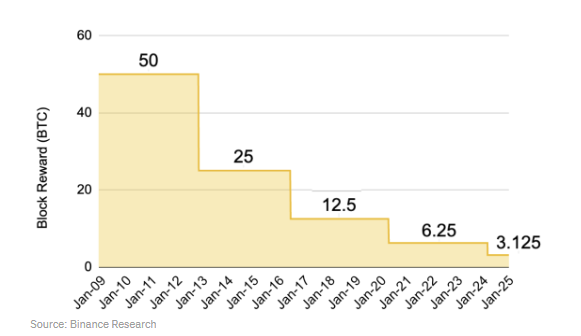

Bitcoin miners are rewarded through two mechanisms: block rewards and transaction fees. Block rewards have traditionally accounted for the majority of miner revenue, while transaction fees have only recently seen an increase in transaction volume (after the launch of Ordinals). These block rewards are paid out every 10 minutes on average when a new block is mined, and are halved approximately every four years. When the Bitcoin blockchain was first launched in 2009, the block reward was 50 BTC per block. After halvings in 2012, 2016 and 2020, the block reward is currently 6.25 BTC per block. This number will be halved to 3.125 BTC/block in April 2024.

Figure 11: Bitcoin’s mining rewards are halved approximately every four years. The next halving is expected to take place in April 2024.

Since Bitcoin is an asset with a fixed issuance limit (21 million), halving will reduce the generation rate of new Bitcoins by 50%. Basic economic principles determine that price increases are the natural next step. The halving essentially creates scarcity for Bitcoin and further reinforces Bitcoin’s narrative as digital gold. Historically, the halving event itself has been associated with increased market volatility, although the overall cryptocurrency market has typically performed well in the years following the halving.

Since Bitcoin is an asset with a fixed issuance limit (21 million), halving will reduce the generation rate of new Bitcoins by 50%. Basic economic principles determine that price increases are the natural next step. The halving essentially creates scarcity for Bitcoin and further reinforces Bitcoin’s narrative as digital gold. Historically, the halving event itself has been associated with increased market volatility, although the overall cryptocurrency market has typically performed well in the years following the halving.

C. Ordinals and Inscriptions continue to grow

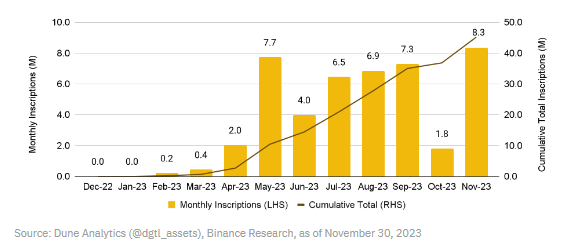

One of the most significant developments in Bitcoin in 2023 is the emergence of Ordinals and Inscriptions. Casey Rodarmor’s “Ordinal Theory” allows tracking of individual Satoshis (the smallest unit of Bitcoin) and assigns each Satoshi a unique identifier. These individual Satoshis can then be "engraved" with any content, such as text, images, videos, etc. This created an “inscription” or what was soon dubbed a Bitcoin NFT. Figure 12: Total number of Bitcoin inscriptions approaching 50 million after recent rebound in minting volume in November

Inscriptions led to the creation of the BRC-20 token, which made it possible to deploy, mint, and transfer fungible tokens on Bitcoin for the first time.

Inscriptions led to the creation of the BRC-20 token, which made it possible to deploy, mint, and transfer fungible tokens on Bitcoin for the first time.

After the initial market frenzy when Ordinals and BRC-20 were first introduced, the market cooled off a bit. However, November saw a clear recovery in activity in these markets. The total number of inscriptions increased by 362% from the October low and hit an all-time single-month record with more than 8.3 million. In addition to the upcoming Bitcoin halving (which will also reduce miner income), Inscription has generated over $140 million in fees for miners, which is a welcome addition to Bitcoin, which has traditionally had very low transaction fees. Replenish.

Perhaps most important is the potential excitement and innovation Ordinals generate within and beyond the Bitcoin ecosystem. Many new builders are flocking to Bitcoin, many existing projects are being updated at a faster pace, and a variety of new ideas are currently circulating within the Bitcoin community.

A recent example is the $7.5 million round raised by Taproot Wizards, an Ordinals project based on the famous Bitcoin wizard meme. The impact of Ordinals and BRC-20 on increasing transaction fees and congestion on the Bitcoin network has also helped rekindle the discussion of Bitcoin Layer-2s (“L2s”). Notably, Bitcoin project Stacks and its upcoming sBTC solution to create a decentralized, non-custodial Bitcoin L2 is an interesting development to watch. All in all, between spot Bitcoin ETFs, the Bitcoin halving, and the innovation brought about by Ordinals, it’s clear that Bitcoin is in the midst of an exciting period in its history that deserves close attention.

6. Development of other L1

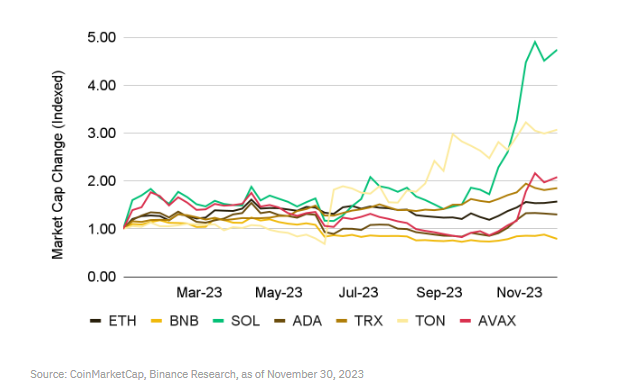

While Ethereum still maintains dominance by most typical metrics, the L1 alternative has also shown promise over the past year.

Figure 13: Some other L1s have outperformed ETH over the past year

Solana has been the most notable standout, especially recently, with SOL's market cap growing by about 56% in November.

Solana has been the most notable standout, especially recently, with SOL's market cap growing by about 56% in November.

➢ Solana was deeply affected by the FTX crash in 2022, but the project has regained optimism after going through the entire incident and continuing to release new products and improvements. Additionally, while Solana has experienced several network outages in 2022, there has only been one such incident so far this year (in February). It is expected that these incidents will further decrease over the next year with the upcoming release of Firedancer, a new independent validator client.

➢ Solana DeFi performed well in November, with TVL increasing by 57% from $418 million to over $650 million, exceeding any other major public chain. This is consistent with recent airdrop activity and attention from oracle project Pyth Network, DEX aggregator Jupiter Exchange, and Jito Network, a liquid staking provider associated with MEV. Additionally, several other major DeFi projects, including MarginFi and Kamino Finance, have implemented (or hinted at) points systems. User activity generates points, which many in the community believe could be a factor in upcoming airdrops for these protocols.

Toncoin is also performing well, with their partnership announcement with Telegram being a major recent highlight.

➢ The partnership announced in September means Telegram will rely entirely on TON for its web3 blockchain infrastructure and integrates TON Space, a self-hosted web3 wallet, for all of Telegram’s 800 million monthly active users. In addition, TON projects and ecosystem partners will benefit from in-app promotion within Telegram and priority display on its advertising platform. ➢ Recently, gaming/ metaverse VC Animoca Brands announced its investment in the TON Foundation and became the largest validator on the TON chain.

Numerous other announcements and developments have also occurred across all other major L1s . After Ethereum was upgraded in Shanghai, it successfully enabled pledged ETH withdrawals, becoming a largely deflationary asset, and gave birth to huge DeFi markets such as liquid staking and LSDfi.

BNB Chain continues to maintain ecosystem growth with important announcements such as BNB Greenfield (a next-generation data storage platform) and opBNB (OP Stack-based BNB Chain Optimistic L2). Avalanche continues to announce partnerships, especially in the gaming and RWAs space. Their recent partnership with JP Morgan's Onyx and Apollo Global is a noteworthy move. Cardano continues its efforts to expand, developing Hydra and the upcoming data protection-focused sidechain Midnight. Tron remains the public chain with the largest issuance of USDT and continues to serve as an effective way to send USDT payments between users and businesses.

7. The emergence of SocialFi

Social media apps have long been considered potential partners for blockchain technology and cryptocurrencies. 2023 has seen product-driven growth in this cryptoeconomic sub-sector, with friend.tech in particular attracting a lot of attention.

friend.tech, a SocialFi dApp, was first launched on Ethereum L2 Base in early August. friend.tech basically allows users to trade tokenized shares of Twitter profiles (called "Keys"). Holding a Key gives you access to exclusive content and private chat rooms with profile owners (called "Subjects"). Users pay transaction fees, part of which goes to the protocol and part to the Subjects. friend.tech has generated over $25 million in total agreement fees since launch. They have also been running an activity-based points system, which is rumored to be related to potential future airdrops.

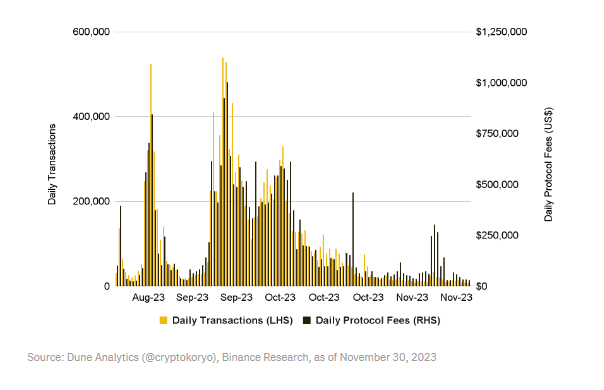

After huge hype in August and September, daily activity has slowed down in the last two months. Nonetheless, the product is still in beta and is about to be fully launched. Perhaps most importantly, the attention and attention that friend.tech has been able to gather, including from non-crypto influencers, is encouraging and shows the potential that web3 social applications can achieve. Figure 14: friend.tech daily trading volume (LHS) and daily protocol fees (RHS)

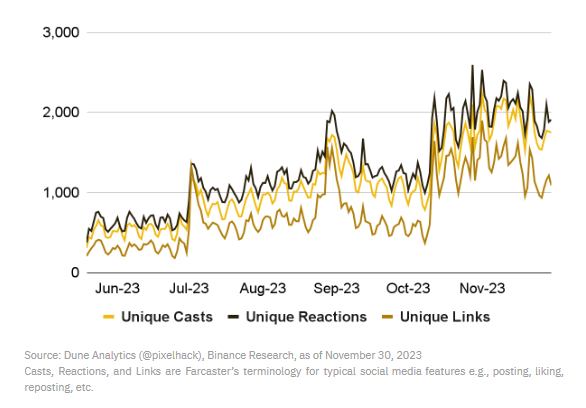

Another web3 social application worth mentioning is Farcaster. Farcaster is a decentralized social media protocol running on the Ethereum L2 OP mainnet. In October, the protocol opened up to unlimited registration (no longer invitation-only), and daily participation has grown significantly since then. Farcaster aims to promote a community platform oriented towards quality discussion. To that end, they've recently been hosting a Farcaster AMA series, featuring a variety of high-profile guests, including Balaji and Vitalik Buterin.

Another web3 social application worth mentioning is Farcaster. Farcaster is a decentralized social media protocol running on the Ethereum L2 OP mainnet. In October, the protocol opened up to unlimited registration (no longer invitation-only), and daily participation has grown significantly since then. Farcaster aims to promote a community platform oriented towards quality discussion. To that end, they've recently been hosting a Farcaster AMA series, featuring a variety of high-profile guests, including Balaji and Vitalik Buterin.

Figure 15: Farcaster’s daily unique interactions have increased steadily since opening the platform in October

Another noteworthy web3 social media platform is Lens Protocol. The platform, built by the Aave team and deployed on Polygon, has shown a lot of interest in NFTs and targets creators and artists to a certain extent. After an initial launch in early 2022, they announced the v2 version earlier this year. New features include "Open Actions" to help embed external smart contracts in Lens publications, improved value sharing opportunities, and a new set of profile-related updates (called "Profiles V2").

Another noteworthy web3 social media platform is Lens Protocol. The platform, built by the Aave team and deployed on Polygon, has shown a lot of interest in NFTs and targets creators and artists to a certain extent. After an initial launch in early 2022, they announced the v2 version earlier this year. New features include "Open Actions" to help embed external smart contracts in Lens publications, improved value sharing opportunities, and a new set of profile-related updates (called "Profiles V2").

The launch of Binance Square is also noteworthy, providing crypto users with a new platform to exchange views and opinions, as well as a channel to stay informed about the latest news events.

8. RWAs enter the encryption system

Real World Assets (“RWAs”) is a collective term used to describe assets that exist in the physical world off-chain and are tokenized and purchased on-chain. Examples of RWA include real estate, bonds, commodities, stocks, etc. While tokenizing assets and bringing them on-chain has long been discussed, there have been some particularly noteworthy developments this year.

A. MakerDAO

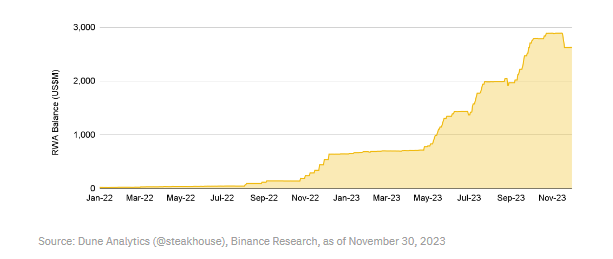

Maker, the protocol behind the stablecoin DAI, has been involved in RWA since at least 2020 and experienced significant growth in 2023. As a quick overview, Maker allows users to deposit collateral into its vault and lend out an equivalent amount of DAI debt. While once only ETH was accepted as collateral, this has expanded to other assets, including stablecoins, wrapped BTC, Liquid Collateralized Derivatives (“LSDs”), and more. Maker also provides RWA collateral in exchange for DAI loans to borrowers approved by MakerDAO. Borrowers include Huntingdon Valley Bank, which has a $100 million RWA mortgage vault with Maker. Figure 16: MakerDAO’s RWA balance has grown by more than 300% this year, reaching more than $2.6 billion

RWAs currently account for more than 49% of Maker's balance sheet assets, compared with around 12% at the beginning of the year. A large portion of these RWAs are U.S. Treasury securities, which have enjoyed high yields over the past 18 months or so due to the rising interest rate environment. That means RWAs now account for more than 60% of Maker's revenue, which itself topped an all-time high of $200 million (annualized) in early November.

RWAs currently account for more than 49% of Maker's balance sheet assets, compared with around 12% at the beginning of the year. A large portion of these RWAs are U.S. Treasury securities, which have enjoyed high yields over the past 18 months or so due to the rising interest rate environment. That means RWAs now account for more than 60% of Maker's revenue, which itself topped an all-time high of $200 million (annualized) in early November.

B. Chainlink and CCIP

Best known for its oracle network, Chainlink is a web3 infrastructure company that provides a range of solutions. This includes their data flows, functions (connecting smart contracts to APIs), automation (smart contract automation), etc.

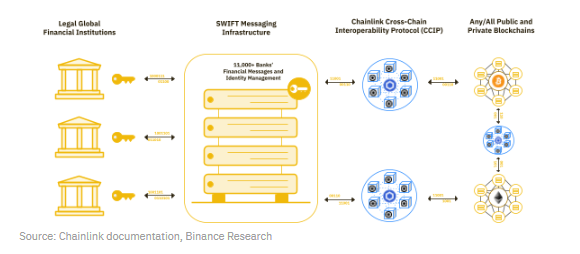

The Cross-Chain Interoperability Protocol (“CCIP”) is a new development worth noting. CCIP is a decentralized cross-chain message/data transmission protocol. The goal of CCIP is to create a shared global liquidity layer where all blockchains can connect to each other, whether they are public or private TradFi chains.

Chainlink hopes CCIP can help build a value bridge between TradFi and cryptocurrencies and improve interoperability between the two worlds. Tighter integration of RWAs onto the blockchain is a natural part of this process.

A major advantage of CCIP is that it allows users to use their existing APIs and messaging services to define their goals, connect to CCIP, and then transact on-chain. One of the key integrations established by CCIP is with Swift , the messaging service used by more than 11,000 TradFi institutions worldwide to communicate. Given that Swift can communicate with CCIP, it helps reduce friction when TradFi connects to the blockchain and will hopefully aid in further integration of RWA.

Figure 17: How the global banking industry uses CCIP to access web3

We have already seen the launch of CCIP’s early access mainnet, with more developments expected in the coming weeks. We've also seen examples of partnerships with the likes of ANZ Bank, as well as a host of major banks and financial institutions including Citibank, BNY Mellon and others. CCIP and what institutions it can attract will be an important development in the coming months.

We have already seen the launch of CCIP’s early access mainnet, with more developments expected in the coming weeks. We've also seen examples of partnerships with the likes of ANZ Bank, as well as a host of major banks and financial institutions including Citibank, BNY Mellon and others. CCIP and what institutions it can attract will be an important development in the coming months.

9.ZK-Everything

The growth of ZK technology has been a big topic in the crypto space for years. However, 2023 saw significant ZK-related initiatives, including a series of ZK-rollup releases. Some key developments include:

To briefly review, there are two types of L2 rollup solutions: optimistic rollup and ZK rollup. **While optimistic rollups currently account for the majority of the L2 market share, ZK rollups are developing rapidly and are widely considered as a solution for future expansion. This is because they rely on zero-knowledge proofs (“ZKPs”), which are extremely efficient methods of proving the validity of transactions and have many different applications in the crypto world.

One reason ZK rollups didn’t gain popularity until this year was their previous lack of integration with the Ethereum EVM. Given that EVM is the dominant smart contract engine on the market, early ZK rollups were unable to support it in a simple and easy way, which gave optimistic rollups an advantage (they were EVM compatible). However, zkEVM changes this. zkEVM is a special ZK rollup that allows smart contracts to be easily deployed on EVM, allowing developers to easily port EVM dApps to their zkEVM.

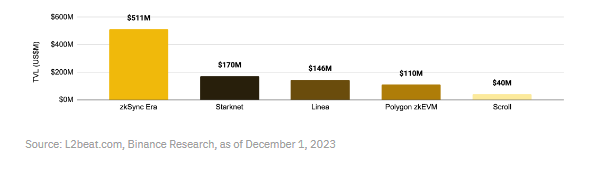

2023 saw a number of zkEVM releases, starting with zkSync Era and Polygon zkEVM in March, followed by Linea and Scroll. Another pioneer of ZK technology, StarkNet, also has a ZK rollup in production. Kakarot zkEVM brings EVM compatibility to Starknet technology. Taiko is another upcoming zkEVM, expected to be launched early next year.

Growth among rollup-as-a-service (“RaaS”) providers has also been strong in recent months. While many providers initially focused on optimistic rollups, the zkRaaS sub-industry is growing, with companies such as AltLayer, Gelato, and Lumoz among the leaders. This may lead to more ZK rollups entering the market next year.

Figure 18: TVL of main ZK-rollup

In addition to rollup, there are various other applications of ZK technology. A key upcoming example is the ZK coprocessor. The basic idea of the ZK coprocessor is that it is a tool that dApps can use to move data-intensive and expensive computations off-chain. This allows dApps to keep user gas costs low while allowing them to run more complex functions and calculations, resulting in a better user experience. Thanks to the use of ZK technology, dApps can still benefit from the complete security of Ethereum even if part of the computation is moved off-chain.

In addition to rollup, there are various other applications of ZK technology. A key upcoming example is the ZK coprocessor. The basic idea of the ZK coprocessor is that it is a tool that dApps can use to move data-intensive and expensive computations off-chain. This allows dApps to keep user gas costs low while allowing them to run more complex functions and calculations, resulting in a better user experience. Thanks to the use of ZK technology, dApps can still benefit from the complete security of Ethereum even if part of the computation is moved off-chain.

An analogy is that in a computer, a graphics processing unit ("GPU") acts as a co-processor for the computer's underlying central processing unit ("CPU").

- In web2, many of the top applications are highly data-driven, meaning they capture previous user behavior and use the data to shape the user experience. For example, consider web2 mobile games. As users play the game, the game is able to record data in a centralized database and use it to inform future decisions, such as when to offer rewards and when to send you push notifications based on your purchase history. What kind of reward will be given to you, etc.

- Web3 dApps can't really provide this service because both data storage and running queries through it to consume it are expensive on-chain tasks. This is a simple example of how many current web3 dApps are limited when executing fully on-chain. Being able to move some of these expensive calculations off-chain using ZK coprocessors can help unlock a new generation of web3 dApps.

- Use cases include on-chain gaming, DeFi loyalty programs, variable incentive programs, digital identity and KYC, and more.

The recently released Alpha version of the new ZK protocol Succinct is also an interesting development.

- Succinct provides a platform for developers to discover, collaborate and build applications using ZK technology. As part of the platform, developers can use the Succinct protocol, an infrastructure layer designed to make ZK development more coordinated and seamless.

- One notable recent collaboration is with data availability solution Avail. Other upcoming collaborations include Lido and Celestia.

10. Will global interest rates fall?

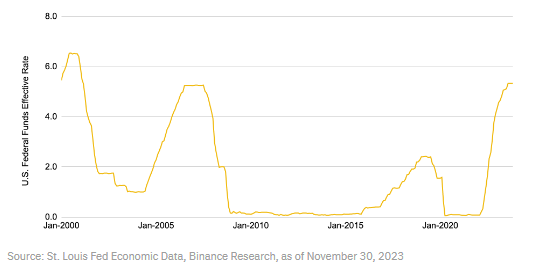

From a macroeconomic perspective, interest rates are one of the most important factors affecting asset valuations. In the United States, for example, the higher the benchmark interest rate set by the Federal Reserve (Fed), the higher the risk-free return investors can earn by investing in ultra-safe government bonds. Naturally, this has reduced interest among many investors in more volatile investment options such as tech stocks and cryptocurrencies, as they can earn good returns on capital simply through government bonds.

Figure 19: U.S. interest rates are at their highest level in 22 years, and the United States has experienced one of the fastest interest rate hike cycles in history.

In order to encourage consumer spending during the epidemic, the Federal Reserve set the benchmark interest rate at 0-0.25%, causing inflation to begin to rise rapidly. Subsequently, the Federal Reserve began a historic interest rate increase plan, from 0-0.25% in March 2022. Increase to 5.25-5.5% in July 2023. However, the last two Fed meetings have kept interest rates on hold. Although inflation remains above the Fed's 2% target (3.2% in October), it is still significantly below the 5-8% level in 2022. Additionally, the latest Fed forecasts show interest rates falling in 2024 and 2025, meaning rates may have peaked or are close to their peak.

In order to encourage consumer spending during the epidemic, the Federal Reserve set the benchmark interest rate at 0-0.25%, causing inflation to begin to rise rapidly. Subsequently, the Federal Reserve began a historic interest rate increase plan, from 0-0.25% in March 2022. Increase to 5.25-5.5% in July 2023. However, the last two Fed meetings have kept interest rates on hold. Although inflation remains above the Fed's 2% target (3.2% in October), it is still significantly below the 5-8% level in 2022. Additionally, the latest Fed forecasts show interest rates falling in 2024 and 2025, meaning rates may have peaked or are close to their peak.

In addition, other countries have begun to cut interest rates. The People's Bank of China has lowered bank deposit reserve ratios twice this year and also lowered one-year loan interest rates. Falling inflation in Europe has also prompted investors to begin expecting the European Central Bank (ECB) to cut interest rates ahead of schedule. While this is only one part of the overall macroeconomic picture, it is an important one. As global interest rate cuts begin to take effect, investors will naturally need to look beyond government bonds for opportunities to earn returns, and the impact of rate cuts on high-growth industries such as technology and cryptocurrencies cannot be ignored. At the very least, this will be a positive for the cryptocurrency market while other web3 developments are still in full swing.

4. Summary

The past few weeks have been full of surprises and a welcome change from the construction-focused pace of the previous months. As the noise gets louder, new entrants join the market, and things get crazier, it's critical to make sure you're tracking the right metrics and focusing on the narratives that matter. This report hopes to serve as a primer on some of the most relevant discussion points and numbers as we look ahead to 2024.