The overall performance of the Solana ecosystem was strong, driven by DePIN and MEME coins, and the price of SOL also rose to nearly $100 on December 22. The trading volume of DEX on Solana briefly exceeded Ethereum, and calls for "Solana Flip Ethereum" rose.

At the same time, Ethereum began to encounter various FUDs. In particular, DeFi projects on Ethereum, which led the last bull market through liquidity mining, were no longer optimistic. In addition to the recently popular MEME and DePIN, how are the DeFi projects on Solana performing? Is there a real revival of old projects?

Liquidity Staking

Liquidity staking is an important growth project on Solana. The staking itself will lock in funds, which is conducive to the rise of SOL. Various liquidity staking tokens (LST) can be applied in other DeFi projects. The wealth creation effect of new project airdrops And incentives also enable the funds participating in liquidity staking to continue to grow.

The largest liquidity staking projects on Solana are Marinade Finance and Jito. According to DefiLlama data, as of December 22, their TVLs were US$1.05 billion and US$626 million respectively, which are also the top two TVLs in the Solana ecosystem.

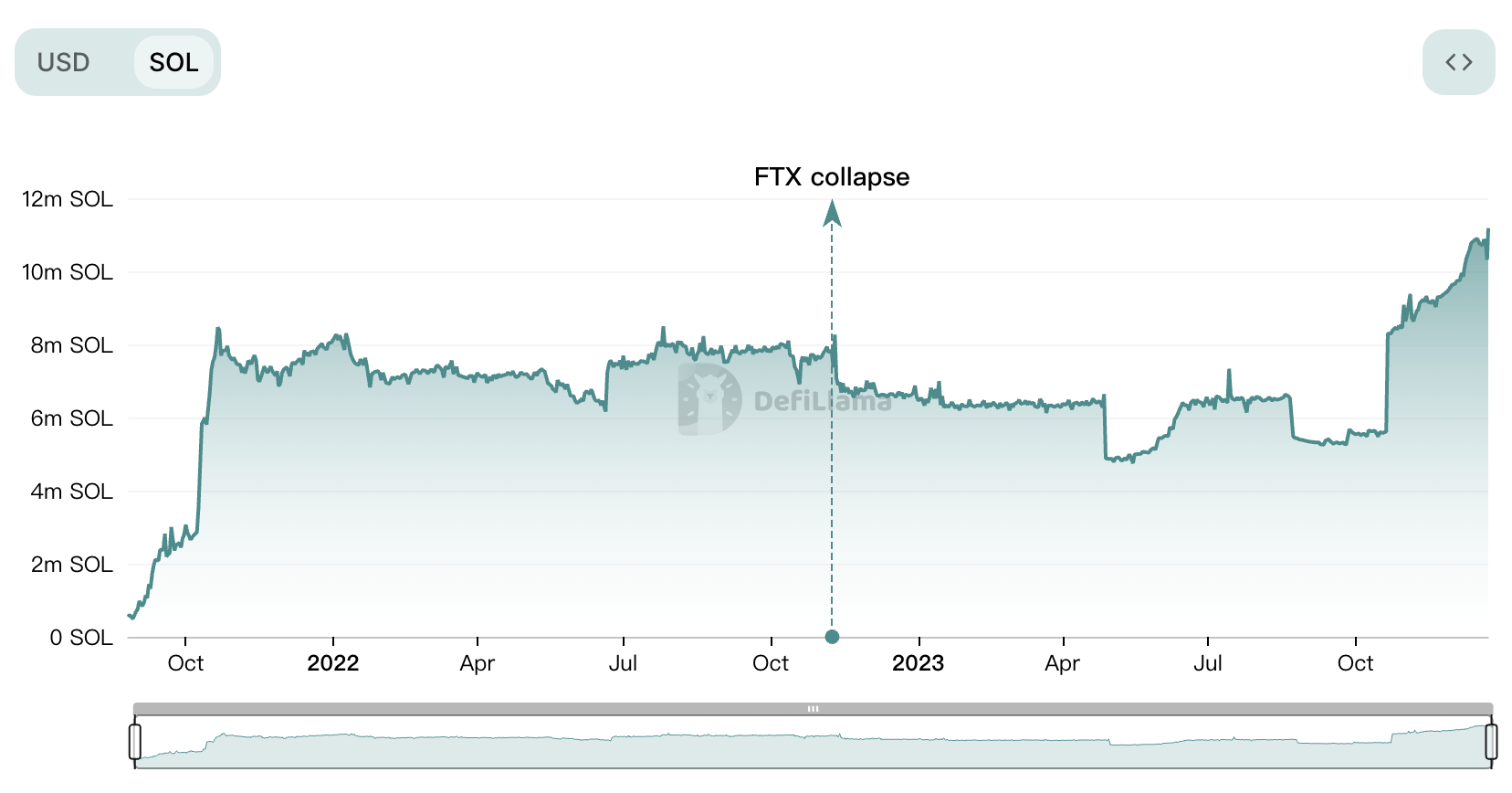

Although the amount of pledged funds in Marinade is only 57% compared to the high point in terms of US dollars, the number of pledged SOL (11.15 million SOL) has reached a record high.

Jito also provides MEV infrastructure on the basis of staking. Because of the unexpected airdrop, Jito has gained a good mass base. Recently, as incentives have begun to encourage the adoption of JitoSOL in DeFi projects, the number of pledges in Jito continues to grow rapidly, with 6.42 million SOL currently pledged.

Decentralized exchange

The two most important projects on the decentralized exchange (DEX) track are still Raydium and Orca, and no outstanding new projects have emerged. They have also developed centralized liquidity functions on the original basis, but their status has been reversed.

For DEX, the two indicators of liquidity and trading volume are the most important. Raydium's liquidity peaked at $2.21 billion and currently stands at $113 million, which is just 5.1% of its high. Orca's liquidity peaked at $1.41 billion and currently stands at $184 million, just 13% of its high.

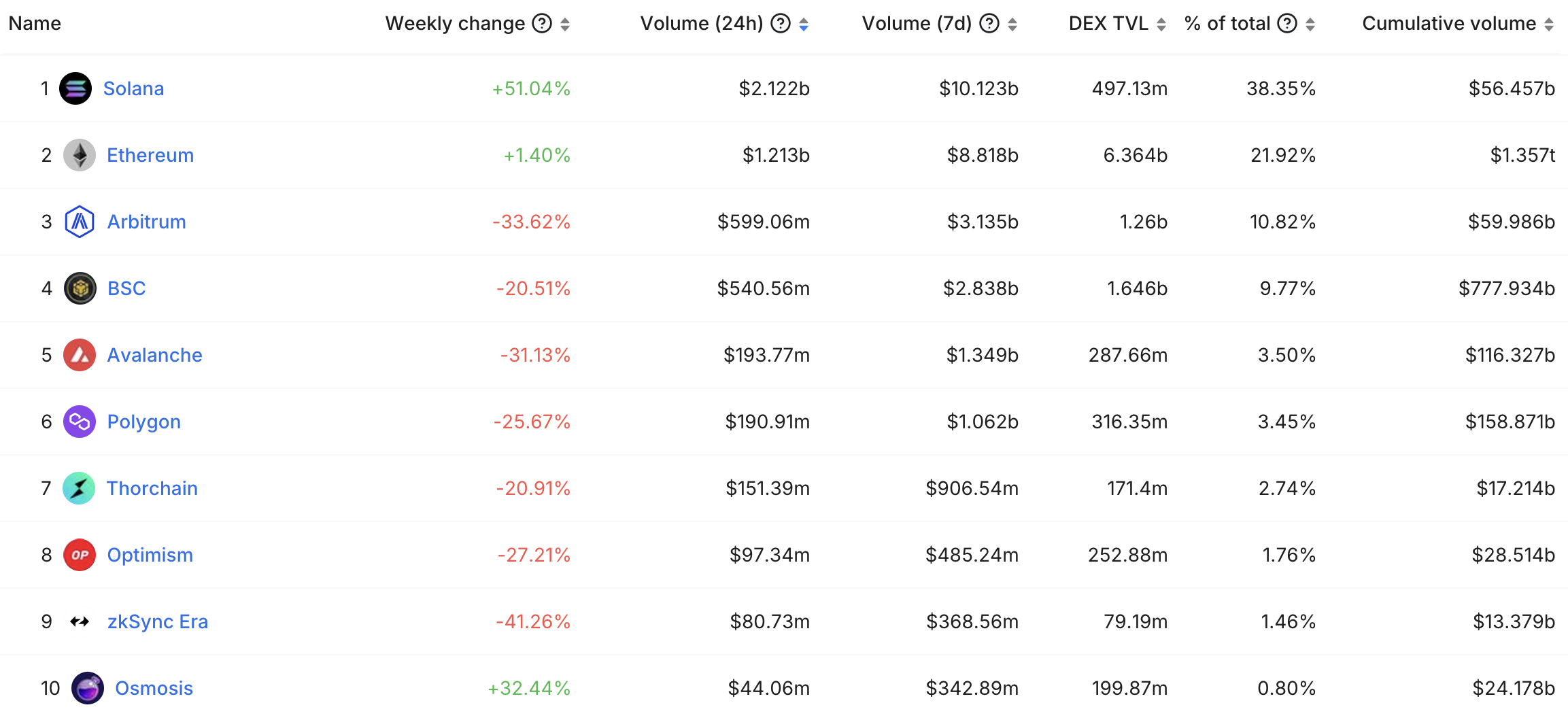

Recently, a piece of data that everyone is concerned about is that Solana’s DEX trading volume has exceeded that of Ethereum. As shown in the DefiLlama data below, Solana's transaction volume is higher than that of Ethereum, both in the past 24 hours and in the past 7 days. Although some people have questioned that this may be double-counting the transaction volume of the transaction aggregator, Solana relies more on the transaction aggregator (Jupiter) than Ethereum (1inch), and the amount of double-counting is also greater.

However, according to the calculation of the transaction volume of various DEXs in DefiLlma, the sum of the transaction volumes of Raydium, Orca, Lifinity, Phoenix, OpenBook, Mango Markets, Drift, and Saber on Solana in the past 24 hours was US$1.55 billion. The trading volume of perpetual contracts such as Drift should not be calculated here. The spot trading volume of Drift is calculated as US$7.6 million, but the trading volume of SOL-PERP is US$43 million.

The combined transaction volume of Uniswap, Curve, Balancer, PancakeSwap, DODO, Tokenlon, Maverick, and Sushi in Ethereum is US$1.18 billion. It can be explained that on November 21, the trading volume of DEX on Solana was indeed higher than that of Ethereum. It should also be noted that the transaction volume on Ethereum is mainly concentrated in Uniswap (USD 940 million), followed by Curve (USD 140 million), and the rest of the transaction volume is only about USD 20 million or lower.

Another indicator that has begun to be mentioned recently, DEX trading volume/TVL, can reflect the utilization rate of funds. Raydium and Orca are 4.81 and 2.87 respectively, Uniswap, Curve, and Balancer are 0.26, 0.09, and 0.042 respectively. Liquidity providers currently provide liquidity mainly to obtain income from transaction fees. This shows that with the same principal, the income from providing liquidity on Solana is much higher than that on Ethereum, and subsequent funds may further enter the Solana ecosystem.

Decentralized Lending

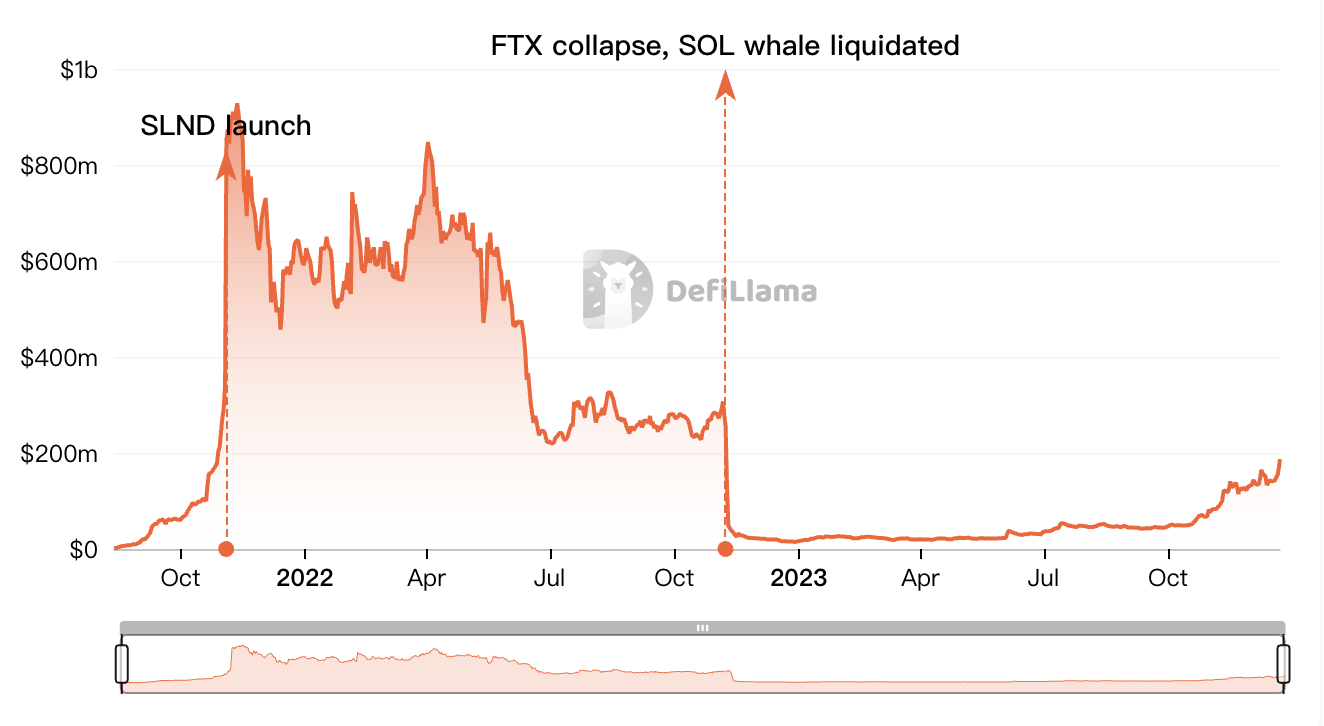

The decentralized lending track has undergone major changes. Among the lending protocols that used to have large amounts of funds, only Solend is still at the forefront, but it has also been surpassed by newcomers. TVL is also crucial to the lending agreement, representing how much remaining funds (deposits - borrowings) there are in the agreement. More remaining funds means more deposits.

Solend TVL peaked at $910 million and is currently at $187 million, equivalent to 20.5% of the high. Solend encountered Waterloo in November 2022 when FTX collapsed, and TVL fell by 90% from US$280 million at the beginning of the month. The remaining established lending protocols performed even worse, with Port Finance’s TVL falling from a maximum of $260 million to $5.7 million; Larix’s TVL falling from $360 million to $4.81 million; Apricot Finance’s TVL falling from $350 million to $2.5 million. Ten thousand U.S. dollars.

A number of new competitors have also emerged on this track. The TVLs of marginfi and Kamino are US$348 million and US$204 million respectively, and have grown rapidly recently. None of them have yet issued governance tokens, and both have launched a points system where points can be earned for deposits and borrowings. Under the wealth-creating effect of airdrops such as Pyth and Jito, funds continue to pour in, and various LSTs can also be supported, and liquidity staking projects may give these funds additional incentives.

revenue aggregator

The income aggregator track has almost been falsified. Since Solana does not require high handling fees like Ethereum, investing through the income aggregator can automatically reinvest, avoiding the handling fees of personal operations.

Sunny, the most famous project on this track on Solana, had a TVL of US$3.4 billion at its highest and is currently only US$4.02 million. Sunny is usually used in conjunction with Saber. The developer behind the two projects was revealed to be the same person. This developer forged 11 identities to develop different projects, increasing Solana's TVL by billions of dollars.

In addition to pure aggregate mining functions, some revenue aggregators also provide lending and leveraged mining functions, but due to the reduction in mining revenue, the performance of these projects has also been poor. Francium's TVL fell from $430 million to $20.89 million, and Tulip's TVL fell from $1.07 billion to $21.41 million.

Perpetual contract

Compared with various perpetual contract projects on Ethereum Layer 2, Solana’s performance on this track is not particularly good.

At present, Drift is the most comprehensive in this field. Drift mainly adopts an order book trading model similar to dYdX, and can use up to 20 times leverage. Currently, the project’s TVL has reached a new high of $105 million, and the SOL-PERP transaction volume in the past 24 hours was $43 million. The project also has spot leverage trading.

Mango is an old project on the track, and its TVL dropped from its peak of $210 million to $10.47 million. It was attacked in a market-manipulating manner by a hacker who was later prosecuted and arrested. Mango mainly uses lending and leveraged trading, which requires borrowing funds and then trading through Jupiter. Now Mango has also added a new trading method for perpetual contracts. SOL-PERP only had a trading volume of US$520,000 in the past 24 hours.

Another contender on this track is Jupiter’s JLP, which is a model similar to the GMX V1. JLP’s capital limit is set at $23 million, and SOL-PERP trading volume in the past 24 hours was $101 million, even more than Drift.

Decentralized Stablecoin

Solana has never had an outstanding project in decentralized stablecoins from beginning to end.

UXD Protocol is a representative. It once completed 1D0 with a valuation of nearly US$2 billion, but its TVL was only US$42 million at its highest and is currently US$11.19 million. It initially hedged SOL collateral in a delta-neutral manner, but has now also moved to minting 1:1 with USDC.

There were also two stablecoin projects that used over-collateralization for minting, but they also declined. Parrot Protocol’s TVL is as high as $476 million and is currently $8.61 million; Hubble’s TVL is as high as $39.83 million and is currently $8.06 million.

summary

This article discusses the development status of various DeFi projects on Solana. Liquidity staking projects have led the growth of Solana TVL. Various LSTs can also be used in other projects and receive incentives; the liquidity in DEX is compared with that on Ethereum. The gap is far, but the transaction volume sometimes exceeds that of DEX on Ethereum. Behind this is the extremely high capital efficiency of DEX on Solana, which may further attract funds for Solana; newcomers in the field of decentralized lending, marginfi and Kamino The performance is outstanding, and there are expectations for airdrops; Drift and JLP in the perpetual contract are growing; however, there are no outstanding projects in the income aggregator and stablecoin fields.