The Ethereum flywheel is ready: a game of chess, a two-way journey with the BTC&Sol ecosystem

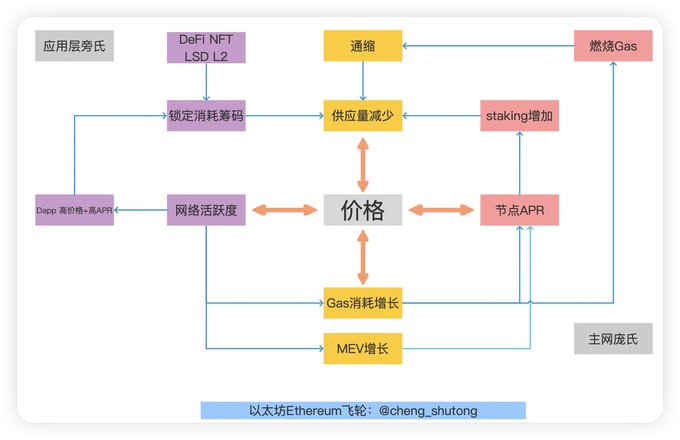

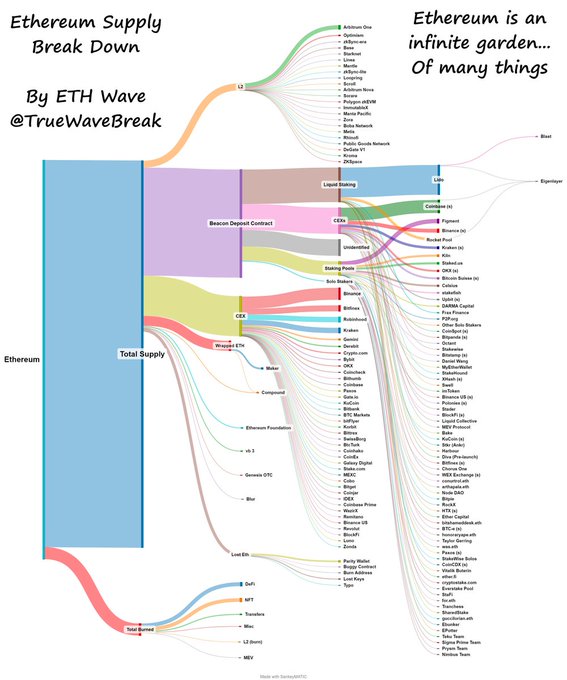

Figure 1 - Ethereum is a chess game, and the end point of the chess game is lock-up and deflation; in the past, every major upgrade ostensibly served expansion, but on the surface it was to reduce market floating chips and artificially create deflation. Most people only know that Bitcoin has Halving, but Ethereum has actually experienced several production cuts; as shown in the figure, block rewards are reduced with difficulty bombs, POS transfers, etc., and market floating chips are reduced by increasing the gas limit, burning gas, staking, etc.; Ethereum Foundation He is a "market management master" who can always guide prices at key nodes.

Figure 2 - The Paris upgrade in September 22, from Merge-Pow to PoS, was a watershed in this game of chess. Previously, the Ethereum Foundation could actively control this economic machine through the above upgrade, but after Merge, it lost the weapon of active control. , we can only increase consumption and reduce selling pressure with the help of upper-layer applications, such as LDO, Blur+Blast, Eigenlayer, DeFi, etc.; PoS has caused Ethereum to lose the last hand in regulating the economy, and the upcoming Cancun upgrade will lose its ecological and But the loss of dominance does not mean the end of this reflexive flywheel.

Figure 3 - This is a "decentralization" that trades time for space. Price is just the transmission medium of this game, thus forming a standard Ponzi model; price, network activity, fee burning, Gas, MEV, Node staking, mining rewards, and "Dragon Balls" have formed a network transmission mechanism. Superimposing upper-layer applications has created multiple highly reflexive flywheels. The singularity is not far away; and, the closer to the "power center" The more projects can obtain alpha beyond the parent, such as currency and asset issuance rights, economic control rights, ecological development rights, governance rights, etc., the cake is naturally equivalent to the plunder of rights;

In December 2020, Ethereum locked 1/4 of the chips through DeFi, and in conjunction with the PoS beacon chain staking, the ETH/BTC exchange rate began to continue to rise within two quarters; the current node staking/circulation ratio ≈25%, and the upper flywheel applied TVL /Circulation ratio ≈ 10%. The two may overlap, but more than 1/3 of Ethereum chips are locked in disguise. The small details of the application layer-TVL and ETH-staking in the past year have decreased and increased, indicating more short-term staking shifts. Long-term staking, and the current downward trend of short-term staking has ended, and the growth of long-term staking continues. The key factors of the application layer flywheel, gas, MEV, DeFi and staking APR, have begun to rise. Subsequent prices will greatly enhance the reflexivity of this flywheel;

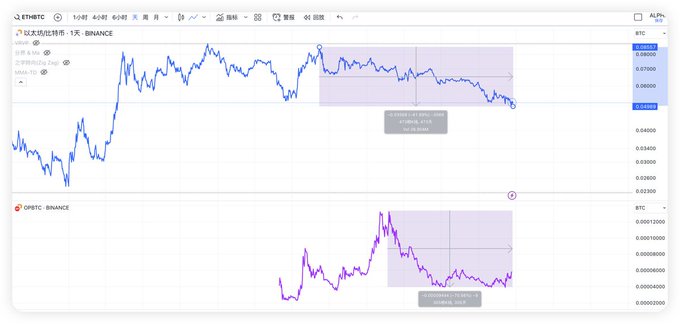

Figure 4 - The price comparison effect has begun to emerge, and the fundamentals are still strong; the narrative aspect has been greatly destroyed in the past six months due to the front and back attacks of Solana and the BTC ecosystem. The double destruction of the narrative aspect and the fundamental aspect is the collapse of value. If the narrative aspect is weak, But the fundamentals remain the same, but the price has been impacted. It coincides with the high valuations of L2 and LSD projects after their launch. Controversial views also make them relatively cost-effective; Figure ETH/BTC exchange rate pair and application layer typical OP/ETH exchange rate equivalence creates opportunities for non-consensus and consensus to coalesce again

If you think of Ethereum as a bureau or game, you will know that the circulation disk is locked to a certain proportion, and the powerful reflexivity after the rotation of this flywheel is just short of a tipping point; of course, this is not to underestimate the Bitcoin and Solana ecology, on the contrary This is a two-way rush. The boost of the Ethereum ecosystem will increase the valuation space of the Bitcoin and Solana ecosystems. Solana and the Bitcoin ecosystem are like a catfish, stirring up the Ethereum ecosystem to continue to be full of vitality; obviously , most people in the bear market have developed the inertial thinking of PVP on the market and hold an either/or view, but the incremental market in the bull market will be tolerant enough, sooner or later.