Bullish on Solana and the Ethereum ecosystem, bearish on RWA and NFT trading

I am bullish on Solana, Ethereum, AI track, LayerZero, and Cosmos ecology. I personally believe that the RWA narrative will slow down in 2024 and bearish on the development of Base. The market share of GMX-style platforms will be centrally limited by market makers. Price book and intent-based DEX replacement.

Bullish Narrative:

1) Solana was already a winner early in the bull market. The huge airdrops for Jito and Pyth are just the beginning, followed by Jupiter, Tensor and Margin.fi;

2) The market has begun to realize the importance of spot ETFs to cryptocurrency capital flows, and it is expected that the same script as Bitcoin will be repeated before the ETH spot ETF is approved in mid-2024;

3) Maturity of the L2 ecosystem;

4) I predict that LayerZero will bring a new trend of full-chain tokens. Account abstraction will allow users to hold assets and transact on their favorite L2 or L1 instead of constantly crossing chains;

5) In 2024, multiple AI projects will enter the top 50 in market capitalization;

6) Despite issues such as confusion in ATOM governance, founder issues, team disagreements, and the lack of real utility of the Cosmos Hub, Tendermint consensus and interoperability are excellent technologies that may ultimately lead to good investments in 2024;

7) Bitcoin block space requirements must increase over time to ensure network security. I’m looking at DEXs, wallet infrastructure, stablecoins, and lending markets for simple DeFi upside;

8) It is expected that there will be native crypto games to attract native and non-native users;

9) The Curve/Frax/Convex ecosystem is booming;

10) Intent-based DEX is 0 to 1 innovation: Symm_IO is off to a great start, even though the founding team is part of the dying Fantom ecosystem.

Bearish Narrative:

1) The RWA narrative slows down: Cryptocurrencies are chasing the same gains that all traditional financial investors are chasing, and I expect demand for this product to wane before it really gains momentum;

2) Bearish on Base: I don’t think it is difficult for Base to attract users, but how to attract teams to build an ecosystem on the chain is difficult;

3) NFT trading volume will not be as high as during the mania period of 2021;

4) Low Bitcoin ETF inflows before the second half of 2024: I don’t expect significant inflows until the third quarter of next year. I think most retail and high-net-worth investors currently invest through individual accounts or private equity funds;

5) GMX style platforms will lose market share to central limit books managed by market makers (e.g. dYdX, Hyperliquid and Vertex) and intent-based DEXs (e.g. Thena, IntentX, Pear Protocol, Based Markets) replaced.

Solana ecological review: What are the layout opportunities?

Solana ecological projects include DeFi, DePIN, AI and other tracks.

DeFi field:

1) Orca: The DEX with the smoothest interaction and the best experience in the SOL ecosystem, with top capital support: Polychain, Coinbase Ventures and Solana Capital;

2) Marinade: A non-custodial liquid staking protocol on SOL. Those who pledge SOL tokens can get mSOL in return. mSOL can freely circulate in the SOL ecosystem and participate in other DeFi applications, such as lending, trading, oracles, etc. It can also be redeemed at any time. The project has no VC and generates cash flow completely spontaneously. Currently, SOL ecological TVL ranks first. But the market value is only 78M;

3) Pyth Network: Faster price update frequency, diversity of data types, and confidence intervals can protect the protocol and users, and can realize cross-chain price feeding. In the future, RWA and cross-chain interoperability will be comparable to LINK.

GameFi field:

1) Aurory: A JRPG-style game that draws on Pokémon, the originator of turn-based combat games;

2) Star Atlas: A space-themed massively multiplayer online game (MMO) that revolves around space exploration, territorial control and political rule;

3) Kineko: An online gambling company with a gambling license and DeFi integration, casino various card games and sports betting. Owning the KNK token entitles you to revenue share and governance rights. At the same time, 33.33% of the casino's profits are used to buy back and destroy KNK tokens.

Depin field:

1) Helium: A pioneer in the DePIN track, its ecological network is the most mature and stronger than other IOT ecosystems. With the support of Helium, its ecological project MOBILE is very popular in North America, with an astonishing growth rate;

2) Helium Mobile: Helium’s 5G business specializes in providing decentralized 5G network infrastructure for mobile networks;

3) Hivemapper: A decentralized map collection application. Contributors can collect data by installing the official driving recorder and earn HONEY as rewards.

AI field:

1) Render Network: distributed GPU rendering computing power network;

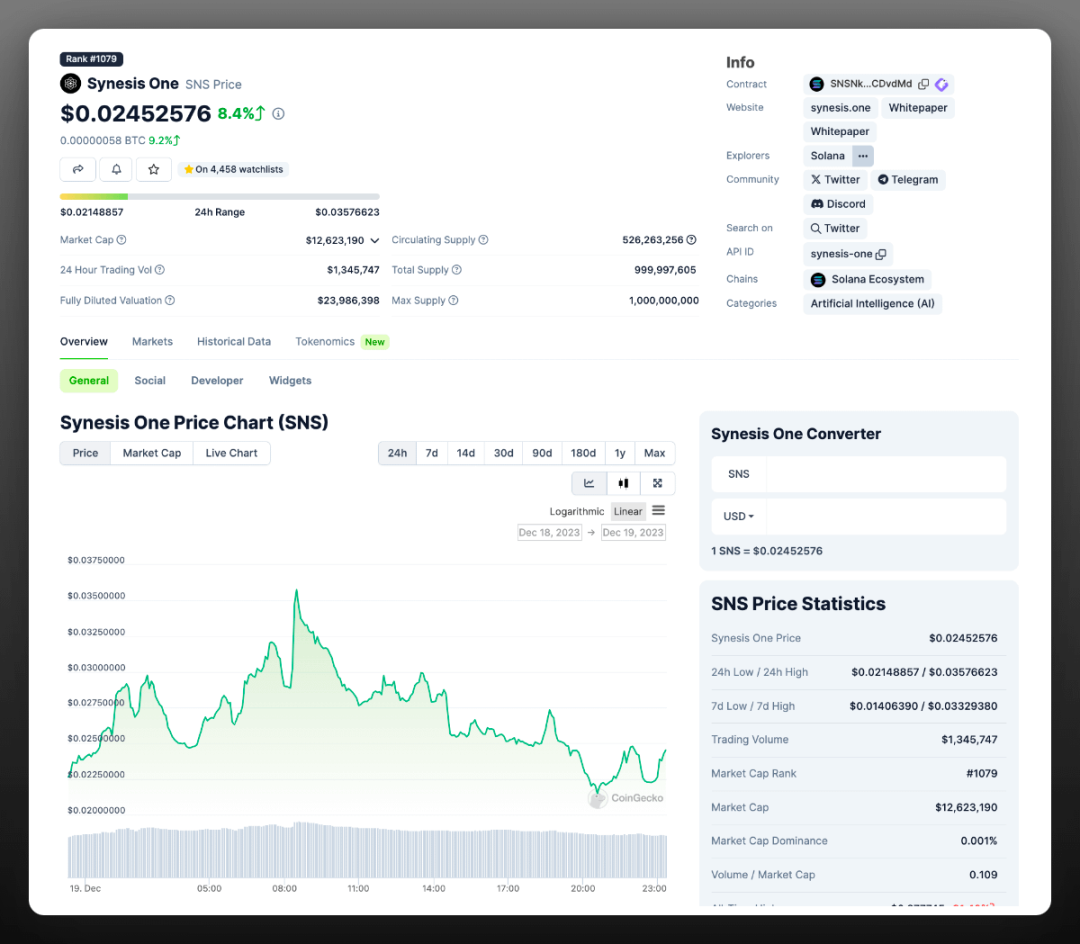

2) Synesis One: The world's first AI crowdsourcing Train2Earn platform, anyone can train AI and receive rewards for it. The platform creates a level playing field for global artificial intelligence companies through the X2Earn model, no matter where they are located;

3) Nosana CI: A distributed GPU network protocol that allows anyone to rent computing power, thereby reducing costs; solving the problem of GPU shortage in the market, making it easier for individuals and enterprises to obtain necessary computing power and getting rid of the constraints of high hardware costs.

Finally, there are still many things that have not been written in, such as specific opportunities and specific decisions. These things often cannot be summarized in one article.