Coinbase is the largest cryptocurrency service provider in the United States. Although its stock price faced some turbulence last year due to regulatory crackdowns, as the overall cryptocurrency market has recovered, ETF applicants such as BlackRock have chosen to sign "supervision agreements" with Coinbase. Sharing Agreement", Coinbase stock price rose more than 300% in 2023.

Table of contents

ToggleCoinbase shares drop nearly 20% in New Year

However, after entering 2024, Coinbase's stock price did not continue this momentum. Instead, due to the violent fluctuations in Bitcoin prices, it fell nearly 20% from the annual high of $187 at the end of 2023.

Ark Investment sells Coinbase stock

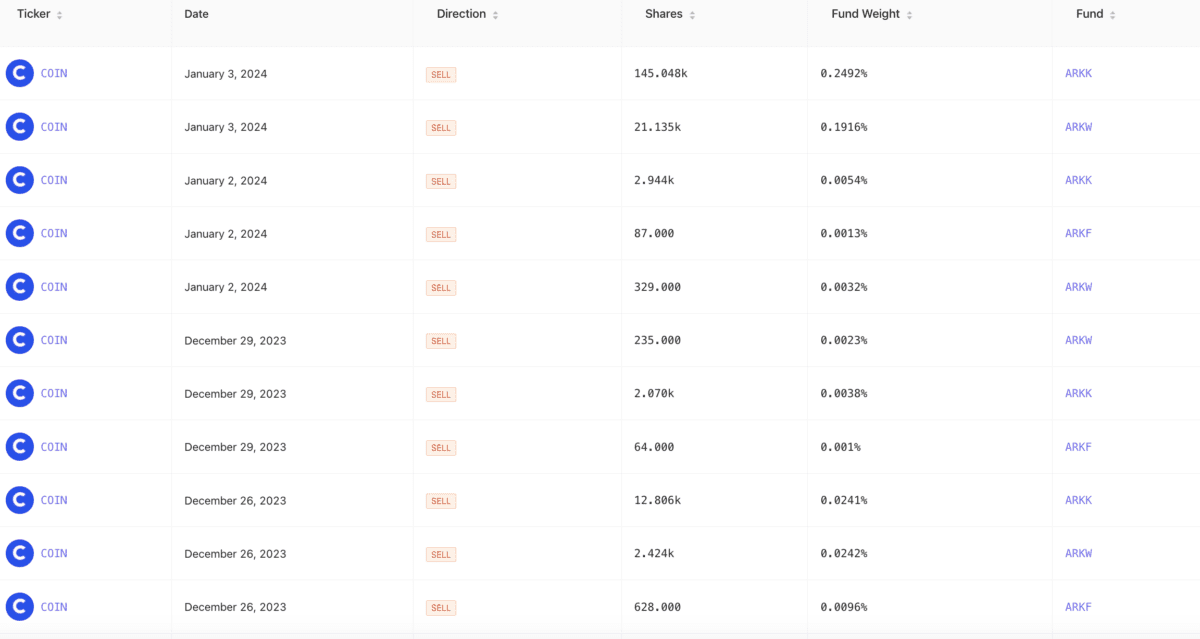

It is worth mentioning that, as one of the institutions that applied for a Bitcoin spot ETF, Ark Invest is one of the major institutions that has aggressively sold Coinbase’s stock price in recent weeks. According to data from Cathie's ARK, Ark Investment sold an additional 166,183 Coinbase shares yesterday, worth $25.3 million.

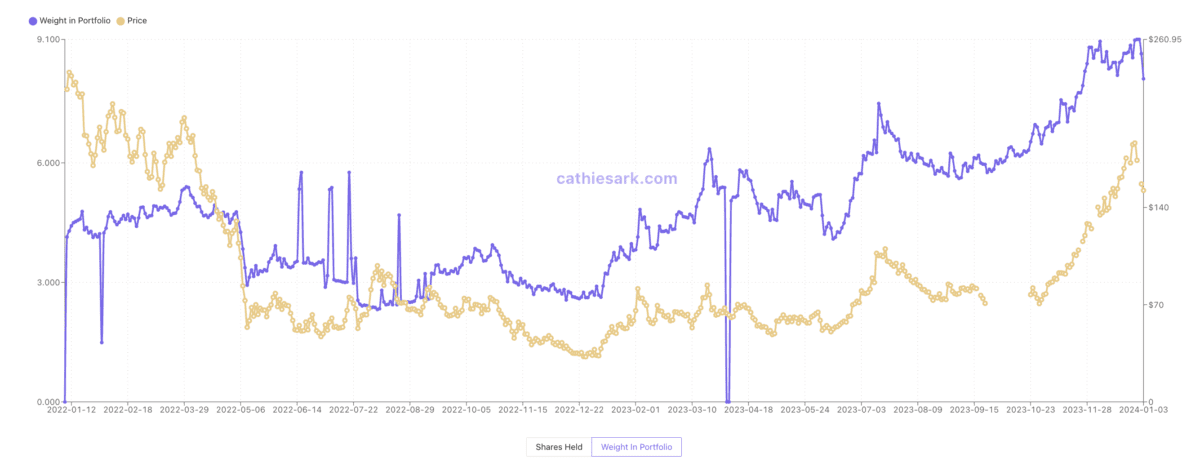

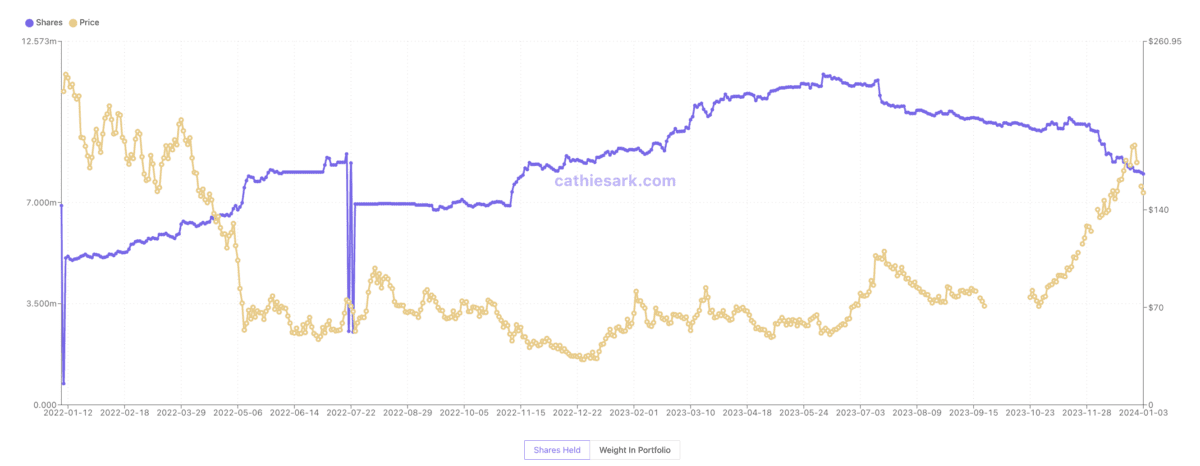

Over the past few weeks, Ark Investment has sold a total of $200 million in Coinbase shares. As you can see from the chart below, Ark Investment’s Coinbase stock position shows a clear downward trend, but does this mean that Ark Investment is bearish on Coinbase’s future performance?

Is Ark Investment bearish on the market outlook?

In fact, judging from Ark Investment’s Coinbase “stock holdings ratio”, Coinbase’s holding ratio has not declined significantly, which may mean that Ark Investment may be selling Coinbase stocks just because they are adjusting the fund’s portfolio weight. "Rebalancing" is a routine operation that "active" funds should have.