- What is zkLink?

- Highlights of zkLink

- Main features of zkLink

- Structure of zkLink

- Multichain zkRollup

- Settlement Layer

- Execution Layer

- Sequencing Layer

- SKIN Layer

- zkLink's ecosystem

- Tokenomics

- Token metrics

- Token versatility

- Token allocation

- Roadmap

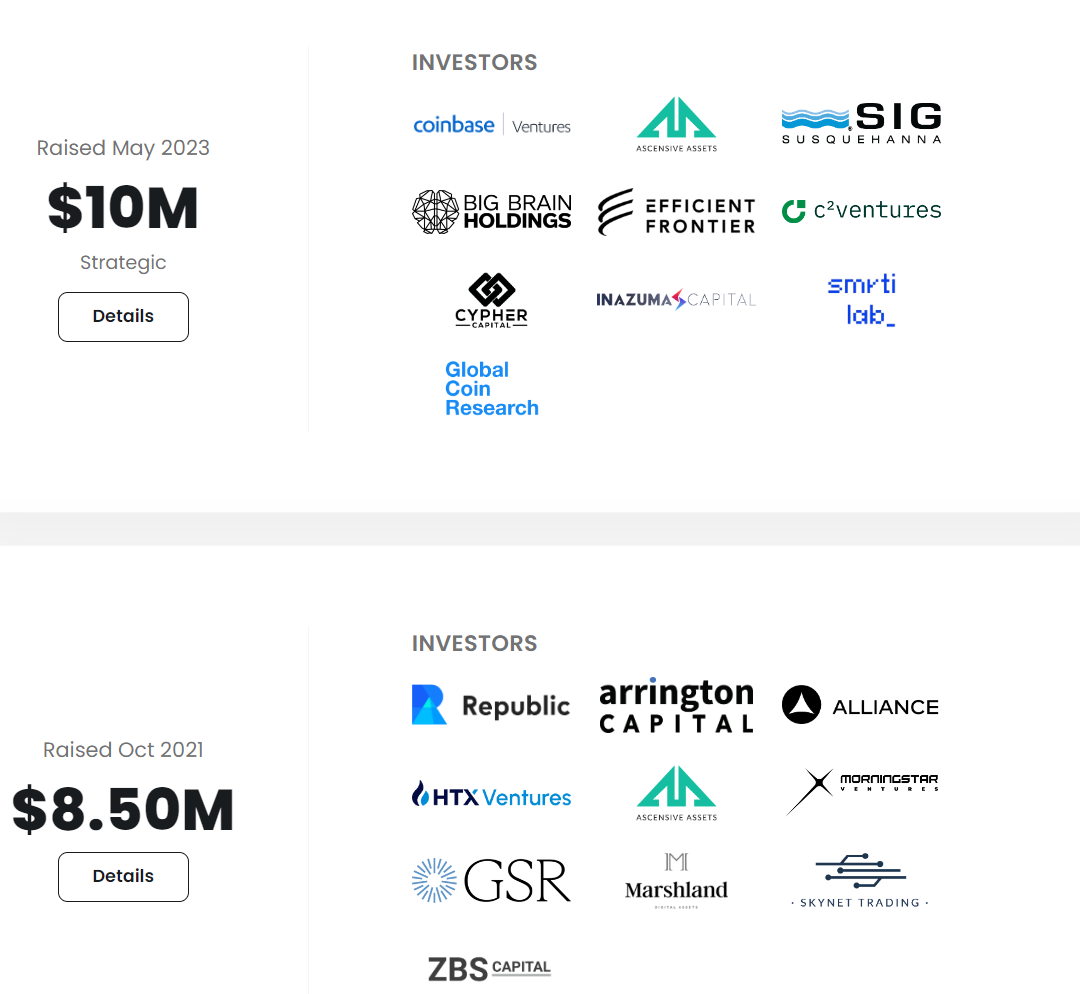

- Partners and investors

- Official information channel

- Conclude

What is zkLink?

zkLink is a Multichain zkRollup Infrastructure project (multi- chain zkRollup infrastructure platform), providing a smooth and secure trading experience on different blockchains.

Using zk-SNARKS technology, zkLink has a solid security system, while also providing API-based solutions for creating decentralized order book-style exchanges (DEXs), Non-Fungible Token marketplaces and other other decentralized applications.

And yet, by connecting different L1 blockchains and L2 networks, zkLink's flexible ZK-Rollup infrastructure also allows developers and traders to leverage synthetic assets and liquidation from different chain , thereby providing a seamless multi- chain trading experience, contributing to creating a more efficient and accessible DeFi ecosystem for everyone.

In the future, zkLink will support innovative DeFi scenarios such as cross-chain farming and financialization of Non-Fungible Token, aiming to build a free marketplace of interoperable and scalable assets in different formats. Capture higher value for users.

Highlights of zkLink

- zk technology with zero security compromise: To maximize product performance and optimize user experience, zkLink has used zk technology. With this technology, only valid transactions are made and cannot be manipulated or tampered with, thus ensuring asset safety.

- Separation of centralized and decentralized authority: With ZK-Rollup, DAO protocols and light oracle network, the project offers a strict security scheme with checks and balances as well as a network of experts and censorship-resistant verifiers.

- Seamless and easy-to-use trading experience: Multiple blockchains are linked together with a liquidation aggregation feature, allowing chain -chain traders to directly tap into multiple liquidation pools and complete their transactions with low slippage and guaranteed ultimate output.

- Fast, secure and easy cross-chain swaps: zkLink is a decentralized and trusted zero-knowledge protocol that connects isolated chain , empowering traders to solve payment problems liquidation and provide multi- chain deployment solutions for Dapp developers.

- A single wallet address: Users on zkLink have a single wallet address for all networks such as Polygon, Starknet, zkSync, Linea, Arbitrum, Optimism, Scroll, Solana... All assets will be unified unified into one wallet such as ETH on Arbitrum network, ETH on Optimism network, ETH on zkSync network... instead of ETH (Arbitrum), ETH (Optimism), ETH (zkSync),... it will be unified into 1 single ETH . Same with other assets.

- Helps developers easily build an App Rollup with customizations on Sequencer, Data Availability, Network Collections, Stetlement,...

Main features of zkLink

- Liquidation Aggregation: The zkLink Aggregation Network merges Stablecoins, ETH , and different multi- chain Token into one unified Token , eliminating cross- chain differences.

- Hyperscaling, maintaining Ethereum-level security: zkLink App Rollups can reach up to 1,000+ TPS and transaction costs under 0.001 USD while maintaining security measures comparable to Ethereum. This drives DeFi growth for traders to new heights.

- Multi-Chain , cross-rollup abstraction: zkLink allows users to deploy with the languages and tools you are familiar with, with access to multiple L1s and L2s. Additionally, trade and manage multi- chain Token on a single user interface without the need for a crosschain asset bridge.

Structure of zkLink

zkLink is composed of 4 layers including:

- Settlement Layer

- Execution Layer

- Sequencing Layer

- SKIN Layer

These layers will be separated to be customizable depending on the developer's needs, because each developer may wish to build a zkRollup specifically designed to suit the industry they are working in, for example. DeFi prioritizes security, Trading, GameFi & Non-Fungible Token require scalability.

.png)

Multichain zkRollup

First, we will come to the concept of Multichain zkRollup. This concept allows rollup contracts not only on one Layer 1 but also on multiple Layer 2 networks at the same time. In the zkLink model, only one chain is chosen as the Primary Chain to perform ZKP (Zero Knowledge Proof) verification, while the other chain only need to play a supporting Vai called Secondary Chain without need to verify ZKP. This factor makes verification on the Primary Chain synonymous with verification of all Secondary Chains.

The operating principle of Multichain zkRollup includes the following basic steps:

- Commit : Sequencer synthesizes all data from Secondary Chain to Primary Chain. on-chain Contract on Primary Chain will verify data from Sequencer using ZK Proof.

- Prove : ZK Proof of Secondary Chains will be proven on Primary Chain by on-chain Contract.

- Synchronize : After proving the authenticity of ZK Proof, data synchronization will take place on both Primary Chain and Secondary Chain.

- Execute: The execution process will be similar to regular zkRollup platforms.

Settlement Layer

Settlement Layer includes:

- zkLink Nexus : zkLink Nexus are Layer 3 where transactions will be resolved and status updated (state commitment) directly on zkRollup platforms such as Starknet, zkSync, Linea, Scroll,... and finally to Ethereum.

- zkLink Origin : zkLink Origin will allow transactions to be settled and status updated on Ethereum, Layer 2 (can be Optimism or Arbitrum) or Layer 1 provided that these platforms must support Zero technology zero-knowledge.

To maintain connectivity between Layer 1 and Ethereum, zkLink introduces Light Oracle Network as a cross- chain messaging solution.

Execution Layer

Here, zkLink introduces TS-zkVM as a highly efficient ZKP execution environment specially designed for projects in the fields of Oderbook, Spot, Derivatives, Non-Fungible Token... Besides, in terms of Data Availability, both zkLink Nexus and zkLink Origin all supports Validium, in addition to DA solutions from third parties such as Celestia, EigenDA, Avail,... to meet the diverse needs of developers.

Sequencing Layer

The Sequencing Layer is an important component in the aggregation system, mainly responsible for receiving user transactions, sequencing the transactions, and wrapping them into batches. These batches are then committed to the Settlement Layer.

DA Layer

Both zkLink Nexus and zkLink Origin by default support the main chain as a DA Layer.

zkLink's ecosystem

The zkLink ecosystem continues to grow with dApps across many different categories such as: Order Book DEXs, Non-Fungible Token Marketplaces, gaming, RWA derivatives...

Currently, there are 3 projects running on testnet/mainnet using zkLink infrastructure:

- ZKEX : is the first omni-chain Order Book DEX that offers unlimited spot and Derivative Spot Trading similar to CEX. ZKEX simplifies multi- chain trading by providing a simple, accessible Order Book for secure cross chain trading, eliminating the need for croschain bridges and wrapped Token.

- zkJump : is a ZK-secured crosschain bridge for native assets that eliminates intermediary or wrapped Token . Leveraging zkLink's infrastructure, users can seamlessly connect multi- chain Token in a unified user interface, saving users clicks, time and costs.

- Openworld : Operating as a decentralized exchange, Openworld enables multi-asset trading (cryptocurrencies, stocks, bonds, forex & cmdty) by anyone, anywhere, anytime any. OpenWorld uses zkLink to solve challenges related to trading efficiency and liquidation Shard .

Additionally, the protocol also integrates with industry solutions such as major developer tools, crosschain messaging protocols, wallets, Oracles, decentralized identities, modular DAs, shared sequencers, etc.

Tokenomics

Token metrics

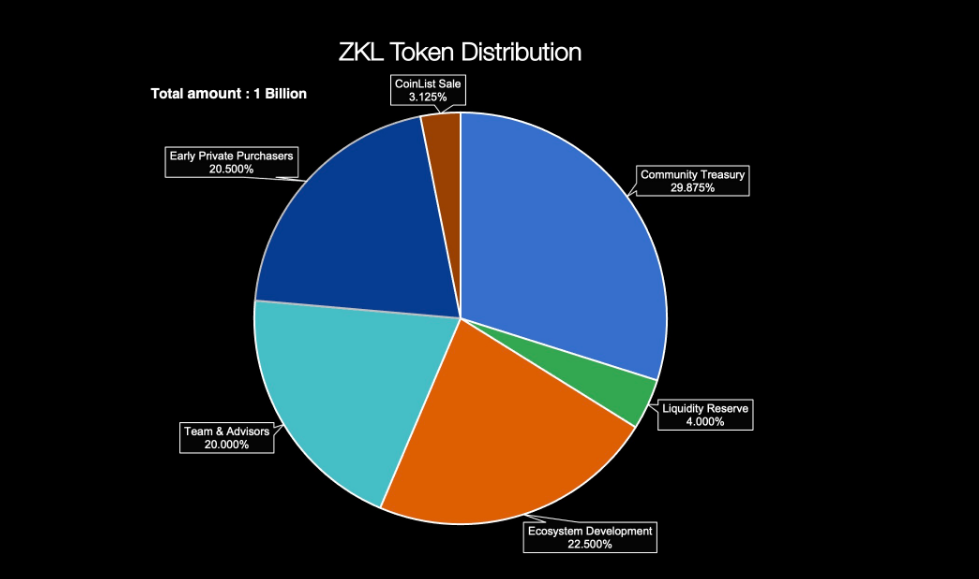

- Token name: zkLink

- Tickets: ZKL

- Total supply: 1,000,000,000 ZKL

- Stardard: ERC20

Currently, Coinlist is opening the Token Sale zkLink (ZKL). You can find out detailed information and how to participate here!

Token versatility

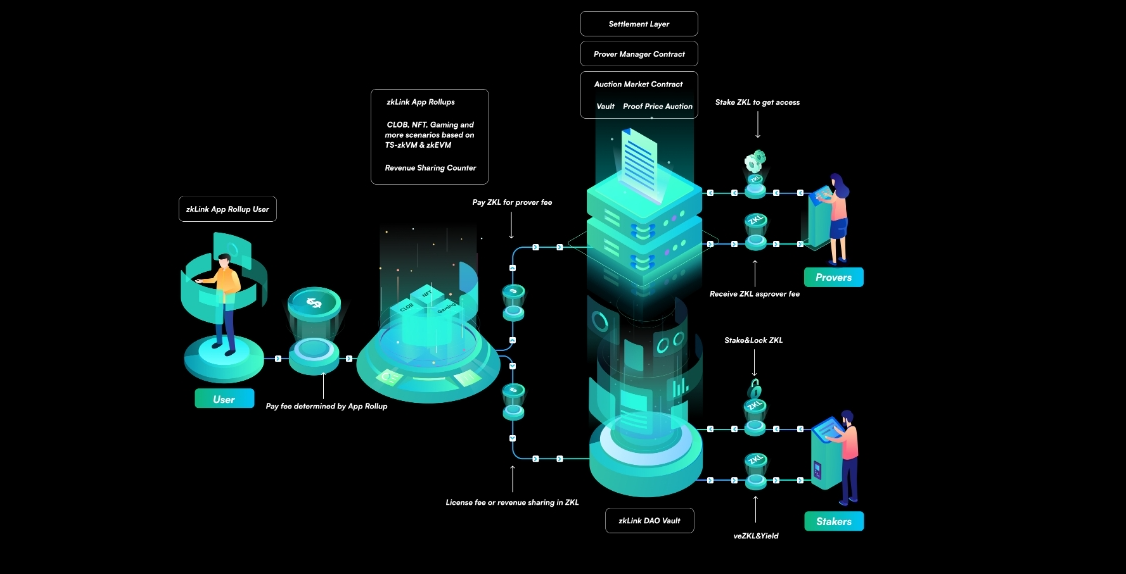

Operation model of ZKL Token .

ZKL is zkLink's native Token , used in the following cases:

- Payment: ZKL acts as the main payment Token for the zero-knowledge proof generation service provided by provers. In the zkLink App Rollup infrastructure solution, ZKL is the payment Token for DApps that access the zkLink service and pay for the use of the network's block space.

- Governance: ZKL is the Governance Token for the zkLink protocol. ZKL holders have the ability to participate in the governance of protocol development by initiating and voting on proposals.

- Reward: Reward Validator Stake ZKL.

- Perks: ZKL holders have access to exclusive features of dApps in the ecosystem, such as discounted trading fees and exclusive Non-Fungible Token minting opportunities. Specific privileges are managed by the zkLink DAO and backed by eco dApps through the DAO Vault to cover initial license fees.

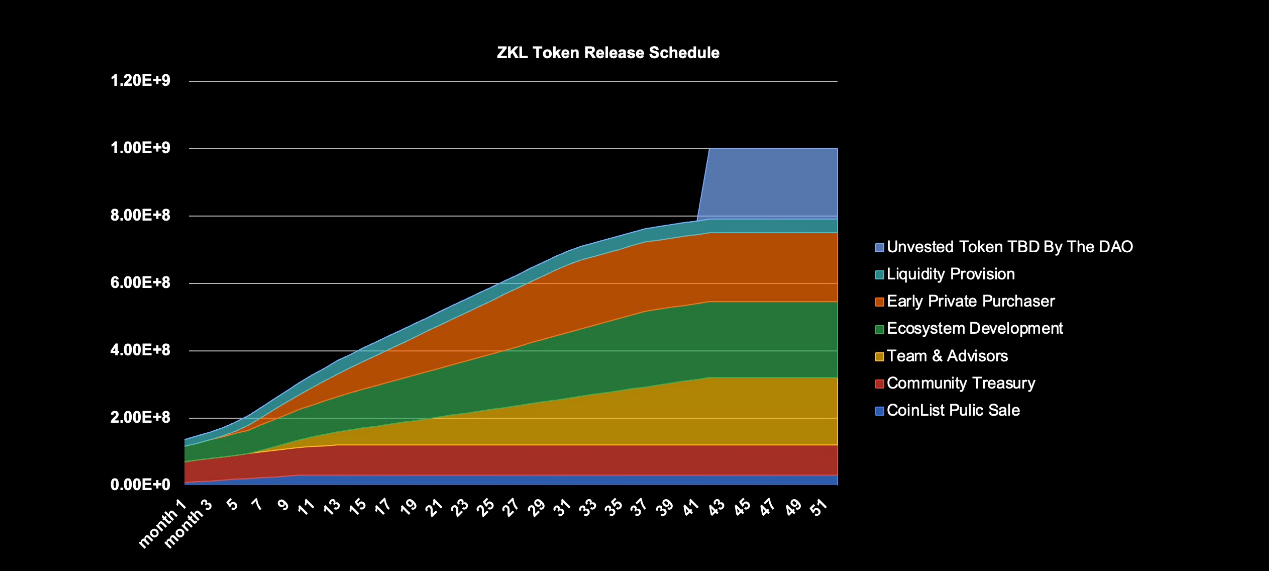

=> In short, the ZKL Token secures the decentralization of the protocol in the long term. At the same time, encourage active community participation to provide the necessary computational resources to create zero-knowledge proofs and maintain network operations. In particular, the total supply of ZKL is limited to 1,000,000,000 ZKL Token and maintains a non-inflationary model.

Token allocation

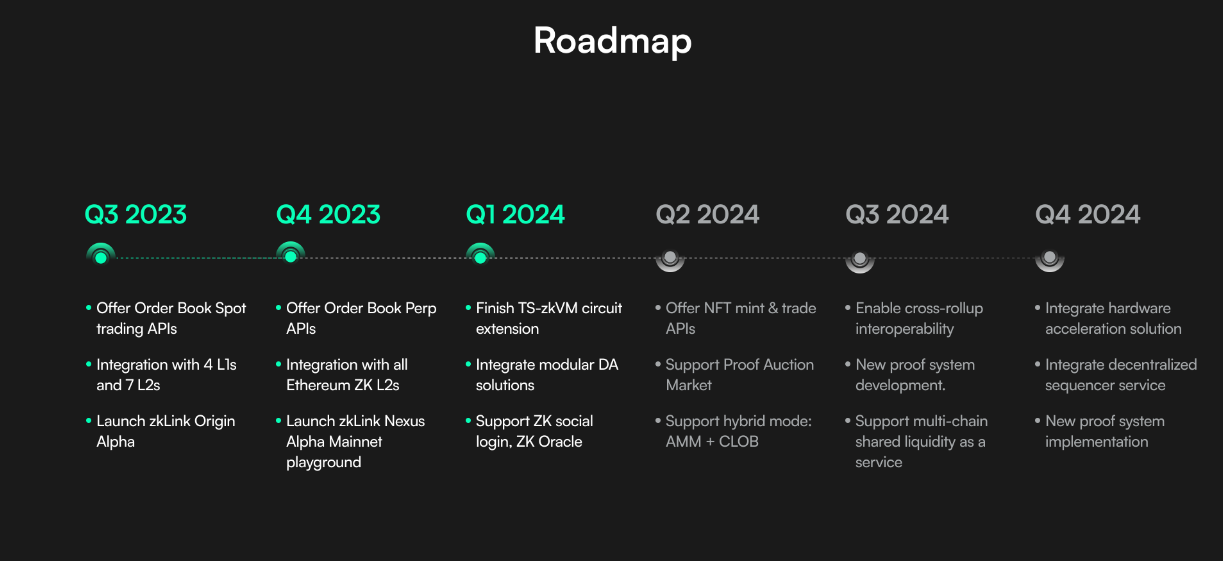

Roadmap

zkLink's development roadmap in 2024 is Chia into 4 stages:

- Q1/2024: Integrate more DA solutions and support ZK Social Login and ZK Oracle solutions.

- Q2/2024: Supports AMM + CLOB and Proof Auction Market models.

- Q3/2024: Develop a new proof system, allowing cross-chain interaction.

- Q4/2024: Integrate Decentralized Sequencer services, deploy new proof systems, and integrate solutions for hardware acceleration.

Partners and investors

September 22, 2021: zkLink successfully raised 8.5 million USD in a Seed Capital round led by Republic Crypto, with the participation of Houbi Ventures, GSR Ventures, Arrington XRP capital, Skynet Tradung, ZBS Capital...

May 4, 2023: zkLink continues to receive $10 million in funding from Coinbase Ventures , Cypher Capital, Big Brain Holdings...

Official information channel

- Website: https://zk.link/

- Twitter: https://twitter.com/zkLink_Official

- Discord: https://discord.gg/zklink

- Telegram: https://t.me/zklinkorg

Conclude

With the continuous development of the entire crypto market, new products, new upgrades or new breakthroughs in all industries are also continuously "introduced". However, development always comes with challenges that give projects headaches, typically such as liquidation Shard , multichain deployment challenges, high costs, security issues... Therefore, zkLink was born to solve the above challenges of blockchain interoperability and standardization.

In particular, as a comprehensive solution for developers who want to build a Layer 2 or even a Layer 3 according to their own needs, zkLink is striving to bring smooth technology experiences to users, thereby transforming DeFi becomes a common home that anyone can access.

VIC Crypto compiled

Related news:

Archway (ARCH) suddenly opened trading on DEX Osmosis before Coinlist paid the Token

Archway (ARCH) suddenly opened trading on DEX Osmosis before Coinlist paid the Token