RWA (Real-world assets) refers to the tangible or intangible asset mapping of traditional financial assets on the chain. Specifically, RWA is the digital embodiment of assets in the real world and the rights and interests bound to them.

RWA can be roughly divided into three categories: tangible assets, intangible assets, and financial assets .

The easiest to understand tangible assets include real estate, such as a home or commercial space. In addition, tangible assets can also be watches, records, cars, etc. Tokenizing these assets allows them to obtain better liquidity, and also provides investors with a way to split the originally indivisible real assets, that is, to partially own high-price assets.

Intangible assets include intellectual property rights, patents, copyrights and other various rights and interests. Tokenizing these assets can ensure that the transfer of rights is safe, credible, traceable, and non-tamperable.

Financial assets represent ownership or claims on priced assets, including stocks, bonds, income sharing agreements, etc. By placing tokenized financial assets on the blockchain, both buyers and sellers can more easily access and participate in trading traditional financial assets and products.

The different categories of RWA highlight the unique versatility and scalability of RWA enabled by blockchain technology.

RWA’s unique advantages

Tokenizing real-world assets will reshape traditional investment methods on multiple levels.

A key advantage of RWA is that it can carve up assets such as real estate, allowing investors to partially own high-gross-value assets . This not only lowers the investment threshold for individual investors, but also significantly enhances the trading liquidity of traditional assets.

Creating more investment opportunities is another significant benefit brought by RWA. Based on the decentralized nature of blockchain, RWA can bring traditional investment opportunities to ordinary investors that they would otherwise have difficulty accessing, thereby promoting the diversity and liquidity of investment targets.

In addition, RWA controlled by smart contracts can simplify the workflow in the traditional investment field, speed up settlement time and reduce costs .

On a decentralized platform, traders can trade 24/7, bringing higher liquidity, improving market efficiency, and allowing investors to manage assets more easily.

Finally, the scalability of RWA will also bring innovation in portfolio diversification , providing traders with broader choices beyond traditional financial instruments.

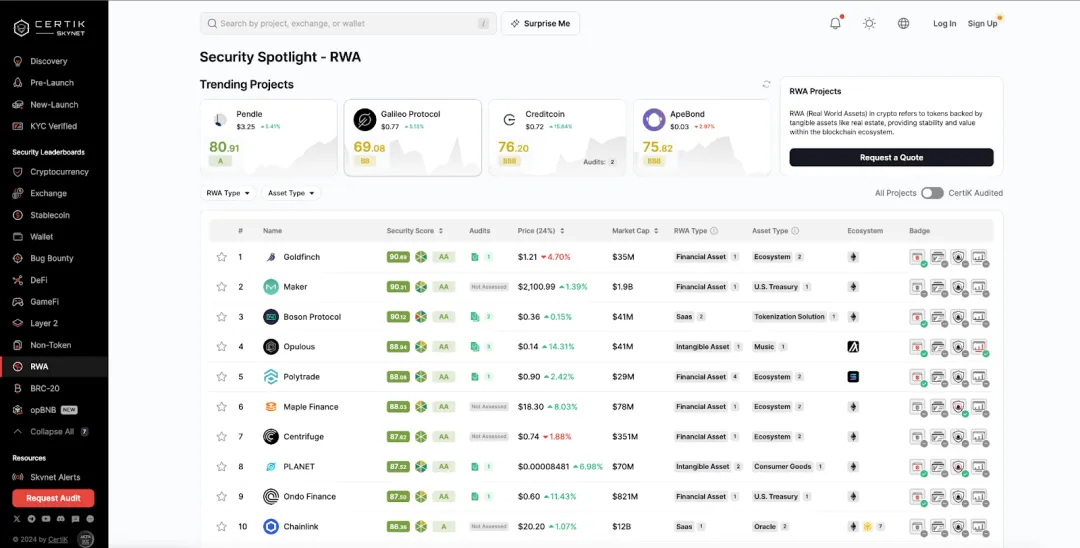

Skynet: One-stop RWA project research

CertiK Skynet has now launched the RWA ranking list , allowing users to understand the detailed information of many RWA platforms in one stop. Users can filter and search according to their hobbies and browse information by content section to achieve quick and effective query and research.

Next, we will take Ondo Finance as an example to introduce how to query the detailed information of related projects through the Skynet RWA ranking list.

- Ondo Finance’s Skynet profile page

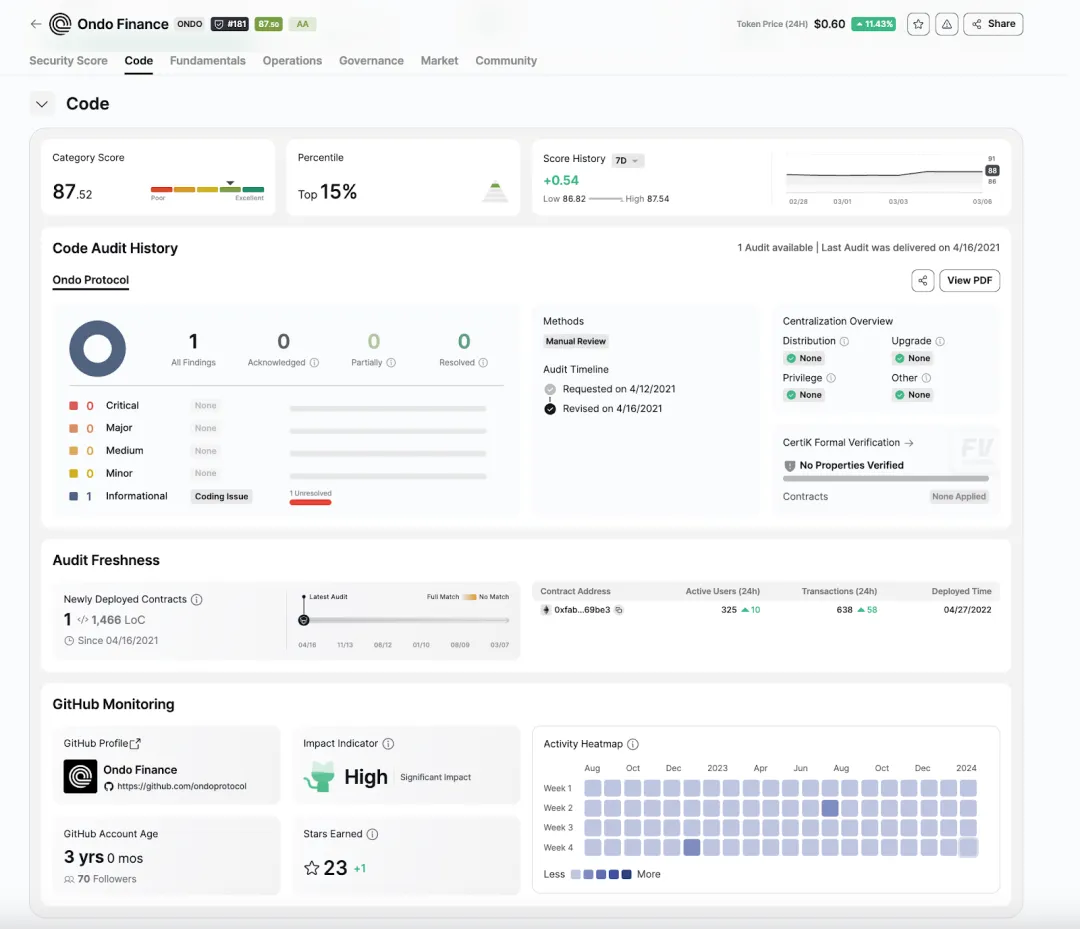

Each project's Skynet profile page is composed of six security primitives: code, foundation, operations, governance, market, and community. A project's performance in these six areas will determine its overall safety score:

- code

This section includes CertiK’s audit results, focusing on any centralization risks related to distribution, upgrades, permissions, or others. Ondo Finance has not raised any red flags and has only one unresolved informational risk. GitHub monitoring shows that Ondo Finance's development rating is "high", indicating that its development activities are relatively active.

- basic

This section shows the project's KYC status, maturity and the location of active users (Ondo Finance currently does not use CertiK or third-party platform KYC services). This section also shows how long the project has been online and provides an analysis of the geographical distribution of users. Compared to other projects on Skynet, Ondo Finance’s maturity is considered “medium” (3 years of development).

- operations

This section evaluates the security protection measures taken by the project, including the bug bounty program and security testing of the project website. Ondo Finance currently conducts a bug bounty program through a third-party platform, and the "historical event record" indicates that no security incidents have occurred in the project in the past 90 days.

- governance

This part evaluates the centralization risk of project governance from aspects including "contract uncertainty", "owner privileges" and "transaction constraints". The status of "passed" or "needs attention" will be clearly marked with symbols on the page to help users quickly identify risks. Currently, the project has risks that require attention in two areas: owner permissions and transaction restrictions.

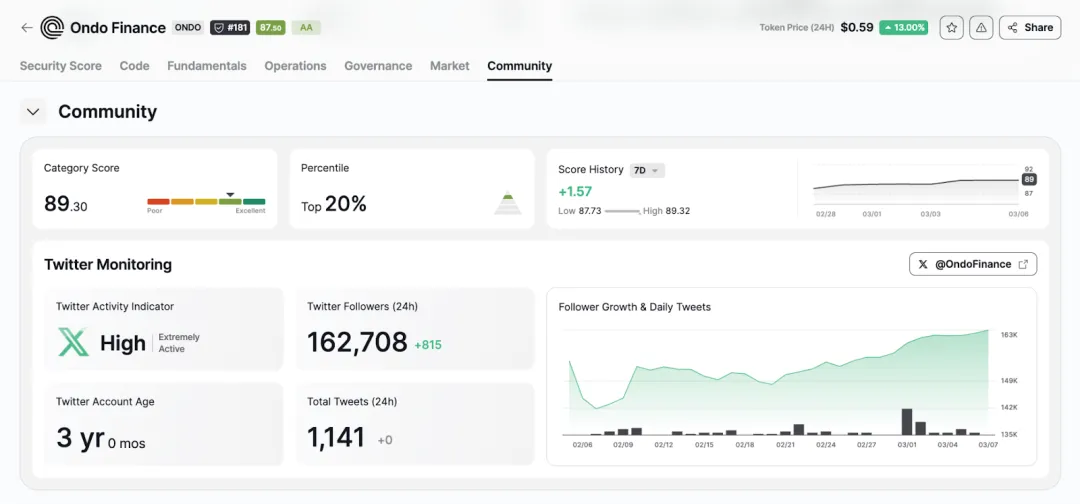

- Community

This section obtains data from the project's official social platform, measures the activity of the project and the community, and displays the project's social media participation and influence.

RWA goes into the real world

The tokenization of real-world assets is an important opportunity for the large-scale implementation of blockchain technology . It also provides opportunities for continuous improvement and development for traditional industries and Web3.0. Skynet will continue to be optimized to provide Web3.0 and RWA researchers with more convenient and in-depth project research data and security analysis.

Copy the following link to your browser or click "Read the original text" at the end of the article to immediately go to the Skynet RWA rankings: https://skynet.certik.com/leaderboards/rwa