This article is machine translated

Show original

Your Airdrop Earning Strategy NOW

1⃣ The market is gradually changing

2⃣ Airdrop monetization strategy

3⃣ What I'm doing now

We hope everyone will ❤ and 🔁 to support @HakResearch

1⃣ The market is gradually changing

✏ Investors have dry eyes looking for investment trends

Surely users participating in the Crypto market from 2021, 2022 to now are starting to look for trends to invest in, if during the period 2021 - 2022 we have many different trends and Money Games. like IDO, DeFi, GameFi, Metaverse, DeFi 2.0, Layer1 or the final trends of the cycle, Move to Earn, we currently do not have such Money Games.

The biggest Money Game in the market at the moment is mainly Memecoin, but most market investors from 2021 until now have eliminated this taste from their investment portfolio because it is too expensive. Risky and easy to lose money. Other trends are unclear, such as AI, Inscription, Bitcoin Ordinals,...

Obviously, at the present time the market does not recognize any trend that can be called a big Money Game like DeFi or GameFi or Move to Earn in the past. And all investors are mostly still waiting or investing according to the news.

✏ The current trend is Airdrop/Retroactive

In the current market context, it cannot be denied that Airdrop/Retroactive is an extremely big trend in the Crypto market. Nowadays, Airdrop not only Vai as a marketing strategy to attract users to know about the project, but also recognizes the project for the early support community, thereby helping users continue to use it. Use and support their products in the long term

✅ Airdrop plays a strategic Vai in attracting users to the project through Airdrop into many different rounds instead of a Liquidity Mining strategy that has become too old and outdated.

✅ Airdrop plays a Vai in marking a project's position compared to its competitors. Usually users believe that projects with more Airdrop will also have better products than their competitors.

✅ Airdrop plays the role of putting power into the hands of those who have used the product, thereby deploying DAO more effectively.

2⃣ Airdrop monetization strategy

✏ Redirect from investing through Airdrop/Retroactive

Realizing the context of the market, I asked myself a question: "The current Crypto market trend is Chia into 2 schools such as Memecoin, AI but it is very difficult to predict, the second school is Airdrop/Retroactive . So why don't I take the money to do Airdrop/Retroactive instead of investing in Token of projects listed on exchanges?".

Not only that, I also see one thing: "Most of the projects I work on are really quality projects, the Airdrop from those projects gives me a position of 0 so why should I sell a position?" equal to 0 to buy another position already xxx on the floor?". Therefore, long-term holding of Airdrop is essentially a way of investing, but the difference is that we have an almost zero position.

That's why I've almost converted about 70% of my investment portfolio to doing Airdrop/Retroactive projects with really good quality.

✏ Circulate cash flow between Airdrop projects

Currently, normal projects will use the Earn Point model to be able to give Airdrop to deserving people, but there is also a lot of competition because everyone knows that project will Airdrop sooner or later. user. Besides, these projects can be classified according to a number of criteria such as:

✅ The project has not been announced, nor has there been any disclosure about the launch date of the Airdrop. The level of certainty about the Airdrop launch time is 0%. These projects can be classified as Tier 3.

✅ The project reveals or predicts the time of Token launch and Airdrop for the community. Or projects that have information disclosed to the outside about the Airdrop launch time. The level of certainty about the Airdrop launch time is 60%. These projects can be classified as Tier 2.

✅ The project announces the official Snapshot time, Token launch, the time here can be a certain period of time such as the end of Quarter 1, the beginning of Quarter 2, the end of April,... The level of certainty about the time Airdrop launch time is 90%. These projects can be classified as Tier 1.

Based on this factor, I will always prioritize cash flow to Tier level projects, which means the majority of cash flow about 70% will lie in Tier 1 projects, 20% will lie in Tier 2 and Tier 2 projects. 10% will be in Tier 3 projects. However, there will be a risk that because Tier 3 projects do not have an exact time to release Token , if the Capital allocation is too little, then when the project launches Airdrop Any sooner will result in a lost opportunity.

The solution I offer for these Tier 3 projects is that I will focus on hitting these projects quickly and strongly to get a Point level of about 7 - 10%, then I will move money from Tier 3 projects to other projects. Tier 2 projects and especially tier 1 projects. I will still allocate 10% to Tier 3 projects to maintain rank or to let rank increase more slowly, or in the case of residual Snapshot projects.

Of course, before getting to this step, you need to select projects. I have some articles about selecting Airdrop projects that everyone can refer to before entering this article here.

✏ If you punch it, it will kill you

For projects in Tier 3, I have usually determined a relatively accurate time (90%) as to when the project will launch the Token and at this time I take advantage of the "let's hit" strategy. I'll die right away". The punch you hit will kill you, demonstrated through some of the following strategies:

✅I will put Capital into Airdrop/Retroactive projects under Tier 3.

✅ I will do all activities with the highest Volume to earn the highest amount of Points.

For these projects, my goal does not stop at 7 - 10%, but my goal is much higher than that, which is the Top 1 - 2% of the Leaderboard. This is not the end, I will XEM with this amount of Volume, how my rank growth rate will be, whether when the time comes for the project to Chia about Snapshot or the end of the Season, I will have Whether you have reached the required rank or not, then continue to take action on adjusting cash flow accordingly.

Normally, if the project announces an expected completion time of A, then I will try to achieve the desired rank of A - 7 days (ie one week in advance, to eliminate unnecessary uncertainties). . My expectations will not stop at earning 2 - 3K for a project, but the target number must be 5 - 10 times that.

Finding cash flow is also extremely important, some ways to have more cash flow in the Crypto market include:

✅ Own idle cash flow, inside & outside the market.

✅ All idle assets such as Bitcoin, Ethereum,... must be put into Lending to borrow the necessary assets for the Airdrop/Retroactive race.

✅ Asset management.

3⃣ What I'm doing now

✏ Successful trade-offs

One of the bets I have traded relatively successfully recently is probably http:/Ether.fi and Pendle. After studying Pendle 's operating model, I found that 1 ETH can be exchanged for 23 YT eETH, which means I only have 1 ETH initially, but when converted into 23 YT eETH, I have the same rights as someone who is currently using Pendle. holds 23 ETH. Besides, I have some additional information such as:

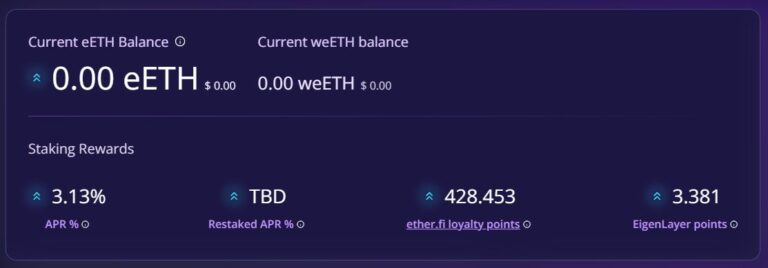

✅ A friend I know deposited about 1-2 ETH on http:/Ether.fi from the early days and now they have about more than 200K Ether Points => My goal must be 400K Ether Points (because I bet quickly and shorten when I sell out YT ETH , I won't increase my Points any more so I have to have more Points much better than them).

✅ According to some sources, I know that http:/Ether.fi It is expected that the Token will be released by the end of the fund in January 2024 => The project belongs to the Tier 3 segment, if you bet, you will invest a large amount of Capital .

And I put in somewhere about 1.5 ETH to buy about 32 YT eETH, within 7 days I ended the journey and earned:

✅ Loss of about $650 due to YT eETH interest rate decreasing and ETH price increasing

✅ Earn 400k Ether Points

✅ Earn 3k Eigen Points

Actually at that time I wanted to farm about 600 - 800K Points http:/Ether.fi but at that time http:/Ether.fi revealed about the Token launch in the near future, so I was worried that if the Snapshot was completed, Ether Points would have no value, causing users to rush to sell YT eETH, so I decided to sell, but there was a problem. The number that happened was http:/Ether.fi Chia that there will be 5% left for the second Airdrop , thereby causing YT eETH to increase strongly again (but since it is a variable, it cannot be calculated).

At the end of this bet, I earned about 450 ETHFI, then I continued to apply the strategy of maybe the project would give "theft Airdrop " and in fact it happened exactly like that, I claimed it nearly 2 minutes earlier than before. When the project was announced, my claim fee was relatively low and I sold it on DEX for $6 instead of waiting to bring it to CEX.

For future Liquid reStaking projects, I will also determine to implement this campaign in a similar way. Waiting for Alpha Leak information about the Token launch, I will apply the strategy of buying YT to bet. quick and concise. At the present time, I do not participate in YT of Puffer Finance or Renzo Protocol because there are too many risks, especially risks related to FOMO.

✏ The bets I'm making and my expectations for position changes

Along with the above strategies, I also currently Chia Airdrop bets into different Tiers from which there are different ways to allocate Capital such as:

✅ Tier 1: Puffer Finance, Rio Network, Renzo Protocol, zkSync, Scroll, Taiko, Hyperlane, LayerZero, Jupiter Exchange, Magic Eden, Phantom, Meteora, Drift Protocol,...

✅ Tier 2: Tensor, Marginfi, EigenLayer, Ethena,...

✅ Tier 3: Parcl - RWA platform, Zeta Markets - Perp DEX platform, Kamino Finance - Lending Protocol platform, Kelp DAO, http:/IO.net,...

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content