Organized by: Chase Blu , Crypto Piggy

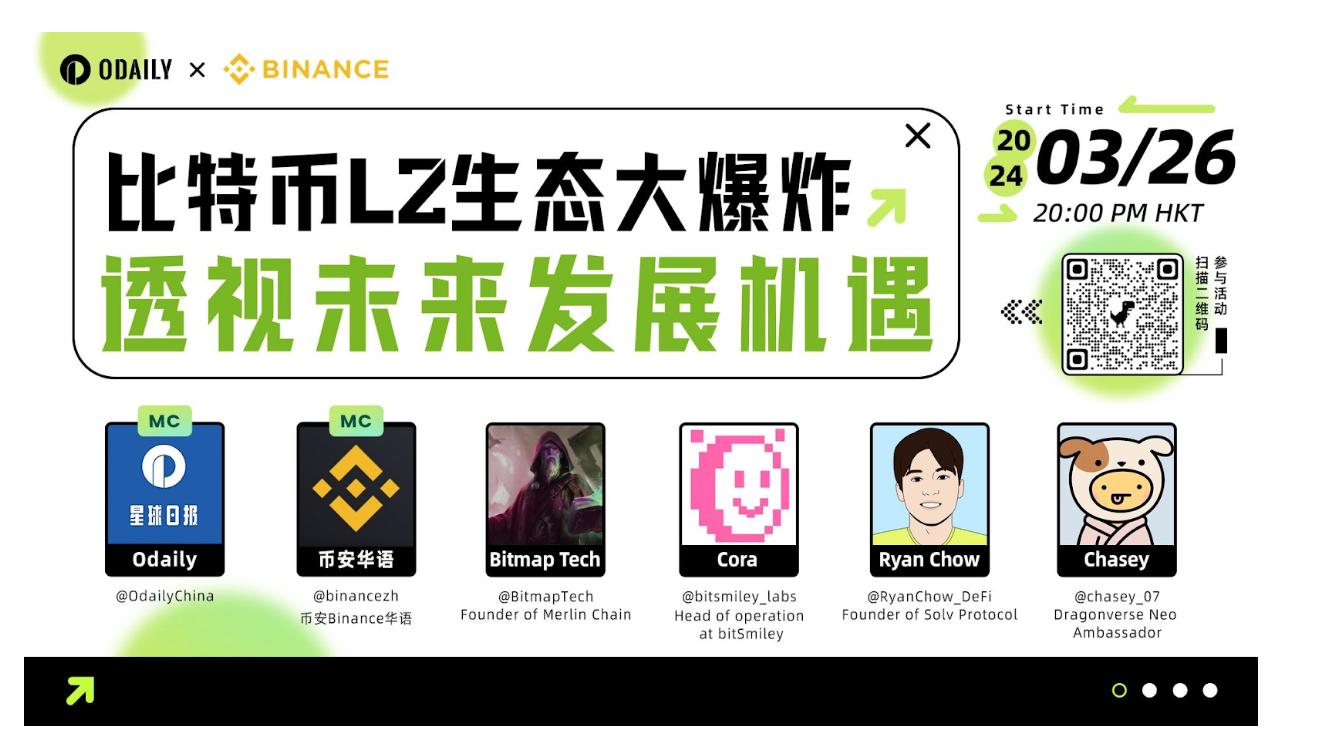

On March 26, Binance Chinese Channel teamed up with Odaily to host a BTC L2-themed Twitter Space. Invite Merlin Chain, the second-layer leader of Bitcoin, and Merlin's ecological projects to talk about the future development opportunities of Bitcoin L2 under the influence of ETF, halving, ecological explosion and many other combined forces.

This article is a review and compilation of the wonderful speeches of the guests in this session.

Hosted by: Binance Chinese Channel, Odaily Odaily

Special guests: Merlin Chain founder Jeff, Dragonverse Neo team, Surf Protocol team, BitSmiley team, Solv Protocol team

Part 1: Review of Merlin Chain founder Jeff’s speech

On the impact of ETF adoption on Bitcoin

About the different scenario applications of Bitcoin L2 and Ethereum L2

Opinions on BTC ecological cooperation (compare L1 and L2)

The most anticipated opportunities on Bitcoin L2 in the second quarter

Part 2: Recent trends in some of Merlin’s leading projects

The ace chain game Dragonverse Neo will launch the token $MDBL this week, and 69% of the shares will use the LBP mechanism for fair launch without access.

Surf Protocol, a derivatives protocol selected into the Binance MVB Accelerator Program, will soon receive a series of updates including mainnet launch, new product launch, airdrops, incentives, cooperation, etc.

Over-collateralized stablecoin project BitSmiley will soon launch Bit Universe to build an ecosystem around bitusd.

Solv Protocol, a lending project invested by Binance Labs, launches BTC liquidity strategy derivative SolvBTC

Part 1: Review of Merlin Chain founder Jeff’s speech

Jeff: On the impact of ETF adoption on Bitcoin

The impact of ETFs on the market is two-fold. First, the ETFs passed this year have triggered massive inflows, fueling a "perpetual bull market" vibe. It is generally believed that the large amount of funds in ETFs can reduce the volatility of the crypto and avoid violent rises and falls. This shows that this bull market has indeed begun. Second, ETFs bring Bitcoin into the public eye. Cryptocurrencies used to be taboo and speculation for most people in the past. But the passage of the ETF forces them to face up to this matter.

Overall, active post-investment support and institutional participation will indeed make volatility less dramatic. As the number of participants increases, the number of Bitcoin holdings increases, which is beneficial to the entire Bitcoin ecosystem. It is precisely at this time that the innovation and enthusiasm of the Bitcoin ecosystem are unprecedented, and the adoption of ETF coincides with the time point, which can actually form a synergy. It remains to be seen whether a permanent bull market with less volatility will emerge as expected.

Jeff: Regarding the different application scenarios of Bitcoin L2 and Ethereum L2

In addition to DeFi and other aspects, Merlin also focuses on a different point: the combination on the content chain.

First, the concept of composition on the content chain began with the inscription wave. Different from Ethereum and other chains that mainly put contracts, tokens and hashes on the chain, Bitcoin allows people to experience the composability brought by content on the chain through the popularity of inscriptions. For example, the formation of the BRC 20 token is to put Json files on the chain. Combined with specially formatted indexes. Starting from such a small Jason document, it started a whole wave of inscriptions that cannot be said to be magnificent, but can be said to be very magical.

Second, the combination on the content chain is censorship-resistant and regulatory-resistant. Although the popularity of inscriptions seems to have declined nowadays, we are still very concerned about the form of uploading content to the chain, combining it, and then indexing it, because the content obtained cannot be tampered with, which makes it censorship-resistant.

Third, the combination on the content chain is convenient for secondary innovation. Now, whether we are talking about AI, games, or the combination of some other content, in fact, it is very suitable to do it through the form of inscriptions. For example, after the entire game is engraved on the chain, someone else can use certain modules in the game to quickly produce a new game. Or for example, after we engraved the forum on the chain in the form of inscriptions, all the replies and interactions of everyone in the forum were also immutable on the chain. Therefore, the entire chain and time will record everything that happens. I think this matter is still very different, at least it has not appeared in the Ethereum ecosystem before.

Jeff: Opinions on BTC ecological cooperation (compare L1 and L2)

BTC L2 brings new investment and innovation opportunities and improves the reusability of assets, while retaining the unique core culture of the Bitcoin ecosystem.

The upgrades of Bitcoin Layer 2 compared to Layer 1:

Liquidity combination: The liquidity combination of BTC L2 is actually not available on L1. For example, the certificate tokens generated by the Solv protocol can be used in other protocols.

On-chain arbitrage opportunities: For example, in different dexes, you can do LP and long in this dex, and at the same time, you can short in another exchange. There are many opportunities for arbitrage on various chains.

Asset reusability: User-generated assets such as NFTs and game tokens can be reused in lending, trading and other scenarios.

But it also retains the characteristics of Layer 1:

Build for community: This is the unique culture of the Bitcoin ecosystem, which refers to empowering other ecologies, communities and projects. For example, Merlin's IDO supports MEME tokens on the chain, such as voya and huhu, unlike traditional IDO platforms that only support stablecoins, Bitcoin or Ethereum. Bitcoin culture encourages mutual assistance between assets and communities. The faster you understand this culture, the more opportunities there will be for cooperation between projects. For example, fair launch naturally involves the distribution of assets, through what applications, what channels to distribute, and what assets to distribute based on, which is different from the past Ethereum's high-control and low-circulation approach.

Better cold start methods: Bitcoin’s assets and communities have many ways to cooperate. Whoever leverages these best will get the most traffic early on. For example, if a new project comes to Merlin to develop, we suggest that early cold start in the Bitcoin ecosystem can quickly accumulate millions of wallet interactions within a week. This is all achieved through cooperation between communities. I hope developers can understand this and quickly increase traffic.

Jeff: The most anticipated opportunity on Bitcoin L2 in the second quarter

Don't pay attention to the key nodes that you are particularly looking forward to. Because I feel that every market change is not due to a specific thing, or that real innovation slowly emerges through continuous builds. For example, today's various guests in our ecosystem, including bitsmiley, surf, solv and Longzhu, have spent a lot of time testing, accumulating users, developing new features, fixing bugs, and continuing testing. It is this kind of constant exploration day after day, year after year, including I believe that many teams today are making this kind of small transformation. Today we all think that one thing is right, but tomorrow it may be proven false. At this time, you can only go back on the road, correct this thing again, and then make a new innovation.

Now whether it is the approval of ETFs or the halving every four years, including the enthusiasm of the entire capital market, it actually indicates that the market will be relatively active this year. In such a very good environment, I still hope that more developers can continue to iterate their products, so that users can experience the most innovative and fun experience after they are launched online. In the end, I hope everyone can reap their own happiness and reap huge benefits.

Part 2: Latest trends in Merlin’s leading projects

Web3 Genshin Impact, Merlin Ace Chain Game Dragonverse Neo

Dragonverse Neo is a 3D open world deployed in Merlin. It was launched by the MOBOX team, the leader of Binance chain games. The game style is similar to Genshin Impact and the quality is very beautiful. The market value of the BRC 420 Dragon Ball that was previously launched for free and fairly has quadrupled.

Dragonverse Neo’s native token $MDBL will be used as a golden shovel in the ecosystem to dig out a series of gold mines including $eMDBL, Merlin token $MERL and so on through applications such as passive interest generation, game gold mining, and game L3 nodes. $MDBL will initially use 69% for fair launch, and the remaining 31% will be continuously released as ecological rewards. The team does not have a reserved share and must also participate in the fair launch to receive tokens.

The fair launch time of $MBDL is expected to be within this week, adopting the form of LBP (dynamic price, free choice by users, no entry threshold). The launch only supports M-BTC, and you need to prepare a small amount of BTC as GAS except for the first time.

Surf Protocol, a derivatives protocol selected for the Binance MVB Accelerator Program

Surf Protocol is one of the Binance MVB Accelerator Program projects. It has received investment from well-known institutions such as ABCDE. It is also the first native derivatives project of Merlin Chain. It has designed many product mechanisms to adapt to the BTC ecosystem (LP single asset provides liquidity nature, satoshi-based margin model, fund reuse of LP certificates, pre-market market for unreleased projects, etc.), it is quite innovative.

Surf Protocol will have a lot of activities going on throughout Q2. There will be new things every week, including mainnet launch, new product launch, airdrops, incentives, cooperation, etc.

BitSmiley, a stable currency known as Bitcoin’s MakerDAO + Compound

BitSmiley is known as the "MakerDAO + Compound" of the Bitcoin ecosystem. Its over-collateralization mechanism has leverage attributes, thereby improving the fund utilization rate of the Bitcoin ecosystem.

BitSmiley is about to launch Bit Universe and build an ecosystem around its native stable ratio bitUSD. The first to be launched is the native stablecoin AMM bitCow to enrich bitUSD usage scenarios. bitCow completely eliminates free losses in the transaction process and simplifies the user's asset management process through mechanisms such as dual LP tokens.

The upcoming V1 version will focus on launching trading functions that support Bitcoin's native stablecoins; the V2 version will focus on implementing a more advanced automated centralized liquidity AMM solution to improve the fund usage efficiency of Bitcoin's native assets.

Solv Protocol, a lending project invested by Binance Labs

Merlin ecological lending track project, invested by Binance Labs. Provides native yields through decentralized asset management infrastructure for $BTC, $ETH and stablecoins.

Solv Protocol recently launched the BTC liquidity strategy derivative SolvBTC, which uses a multi-strategy framework to obtain BTC native income for BTC holders, including market making strategies, delta neutral funding interest rate strategies, cross-exchange arbitrage, etc., which can make BTC holdings One can earn additional BTC or increase Satoshi while maintaining exposure to BTC.