Written by: Jin Jianzhi

Virtual currency is a very embarrassing existence in China. Due to certain regulatory issues, friends who buy and sell virtual currencies in China have various concerns. How to find a trustworthy method of depositing money? How to safely withdraw money without being blocked? How to seek judicial relief after a dispute arises? How to explain the source of one's virtual currency to the public security organs... But in Hong Kong, none of the above is a big problem. Virtual currency is completely a topic "under the sun". There are many ways you can legally buy and sell virtual currencies in Hong Kong.

Virtual currency exchange

As of the date of publication of this article, there are currently two companies that have obtained Hong Kong virtual asset service provider licenses (VASP licenses): Hashkey, OSL, and one company, HKVAX, which has received in-principle approval.

In short, Hashkey and OSL are two licensed exchanges approved by the Hong Kong Securities Regulatory Commission. Users can directly buy and sell virtual currencies on the exchange platform by registering an account, recharging funds, placing orders, and withdrawing funds, without too much effort. Worry about anything happening in the exchange that harms the rights and interests of investors, because every move of the exchange is under the supervision of the China Securities Regulatory Commission, and users can also complain to the China Securities Regulatory Commission at any time and report violations of the exchange.

However, according to the regulatory requirements of the Hong Kong Securities Regulatory Commission, in order to protect the rights and interests of investors, there are also differences in the types of virtual currencies that professional investors and retail investors can purchase. Take Hashkey Exchange as an example. You can choose from 4 types when opening an account on Hashkey: retail investors (commonly known as retail investors), individual professional investors (an investment portfolio of not less than 8 million Hong Kong dollars or the equivalent in foreign currencies), and corporate professional investors ( Investment portfolios with not less than 8 million Hong Kong dollars or the equivalent in foreign currencies or total assets with no less than 40 million Hong Kong dollars or the equivalent in foreign currencies), institutional professional investors, and retail investors can only buy fiat currency trading pairs of mainstream cryptocurrencies such as BTC and ETH. Professional investors can trade with stablecoins and deposit and withdraw all virtual currency pairs on the exchange.

OTC

Virtual currency OTC merchants are institutions or individuals that provide over-the-counter (Over-the-counter) services. OTC trading refers to the buying and selling of cryptocurrencies on platforms or channels other than exchanges, usually involving cash or other fiat currencies. OTC transactions come in the following forms:

Online platform: Connect buyers and sellers through online tools such as websites, social media, and chat software, and provide matching, custody, clearing and other services.

Offline stores: Provide cash-for-cryptocurrency or vice versa services in physical stores, usually without real-name authentication or other compliance requirements.

ATM: A self-service device set up in a public place that allows the purchase or sale of cryptocurrencies with cash or card.

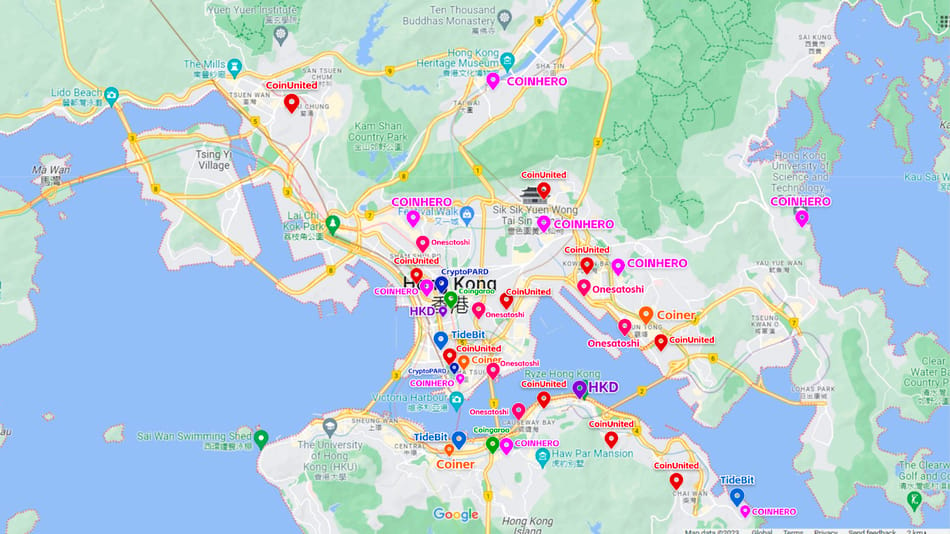

According to rough estimates based on preliminary on-site observations by Hong Kong law enforcement agencies, there are approximately 200 physical virtual asset over-the-counter trading shops (including over-the-counter trading shops operated by ATMs) in operation in Hong Kong, and about 250 active online virtual asset trading shops. Asset buying and selling service provider. According to a Chainalysis investigation, change shops are an important part of over-the-counter cryptocurrency trading, accounting for the majority of the $64 billion in digital assets flowing through Hong Kong as of June.

In most offline stores and ATMs of OTC merchants, KYC is generally not required. The transaction is a simple payment of money with one hand and virtual currency with the other. It only takes a few minutes to complete, which provides cryptocurrency users with convenience, flexibility, and The private transaction method is especially popular among mainland users.

It is worth mentioning that on February 2, 2024, the Secretary for Financial Services and the Treasury of Hong Kong, Hui Ching-yu, said that the Hong Kong government believes that it is necessary to bring OTC under supervision. It will become safer for users to buy and sell virtual currencies through OTC. Any illegal behavior of OTC can also be complained and reported directly to the regulatory authorities.

(Image source TokenInsight)

Brokerage firm

A-share investors must be familiar with the process of opening accounts on the Shenzhen Stock Exchange and Shanghai Stock Exchange through major securities firms to trade stocks. Similarly, buying and selling virtual currencies in Hong Kong can also be done through brokers. In fact, more and more Hong Kong securities firms are also developing cryptocurrency business, including: Futu Securities, Tiger Brokers, Victory Securities, Interactive Brokers, Nanhua Securities, Longbridge Securities, Fuqiang Securities, and Quam Securities wait.

Among them, Victory Securities, a Hong Kong-listed company and an established Hong Kong securities firm, has been approved by the Hong Kong Securities Regulatory Commission to provide virtual asset trading and consulting services to retail investors . In short, traditional brokerage users can buy and sell virtual currencies through the brokerage platform. According to an interview with Chen Peiquan, executive director of Victory Securities, Victory Securities will soon launch an APP that “combines the trading experience of traditional finance, such as stocks and bonds, with the trading experience of virtual currency, allowing customers to configure all the required financial instruments on a single platform. assets". That is to say, stock trading and currency trading will be seamlessly connected.

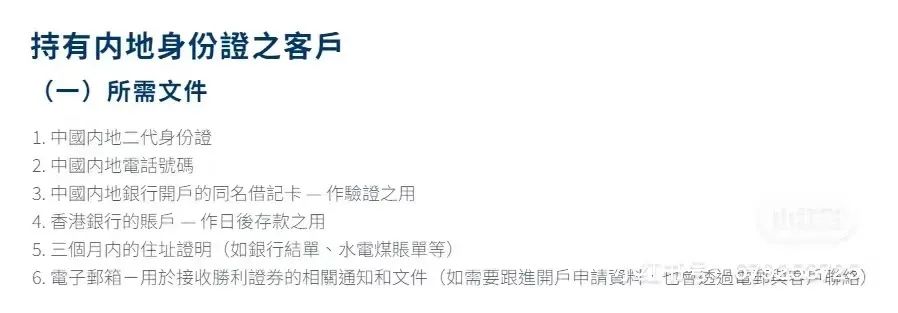

According to the official website of Victory Securities, mainland residents only need to provide the following information to open an account at Victory Securities. The not-so-easy ones are a Hong Kong bank account and proof of overseas address within 3 months. After opening an account, you can buy and sell mainstream virtual currencies with fiat currencies through brokers.

(Picture source: Victory Securities official website)

When authenticating your name, you need to pay attention to distinguishing between visitors and registered users. For tourists, real-name authentication is not required, but for users who post, real-name authentication is required. It should be noted that decentralized wallets cannot be equated with real-name authentication, because decentralized wallets are also anonymous. Therefore, if users are required to use a decentralized wallet to log in or bind, they also need to provide other valid identity certificates, such as mobile phone number, email address, ID card, etc. to complete the real-name authentication requirements .

summary

As the legal status of virtual assets is recognized in more and more countries and regions, the legal participation channels and methods for virtual asset investors are gradually enriched. I hope that the summary of this article can provide reference and suggestions for relevant friends. It needs to be reminded that as a Chinese citizen, you should still abide by the relevant management regulations of the mainland during the entry and exit of assets. If you have further consultation on virtual currency compliance allocation, you can contact Lawyer Mankiw.