Note: The original text comes from @riyuexiaochu’s Twitter threads.

Summary of recent important funding situations

1) Stablecoins continue to be issued, with an additional issuance of 2.3 billion US dollars in the past 10 days. However, the total market value is still 20 billion US dollars away from the last bull market.

2) BTC and ETH continue to flow out of exchanges, with a net outflow of 12,000 BTC in the past 10 days and a cumulative net outflow of 200,000 since January.

3) Binance and OK have seen a net inflow of 2.3 billion stablecoins in the past 10 days, which coincides with the increase in issuance.

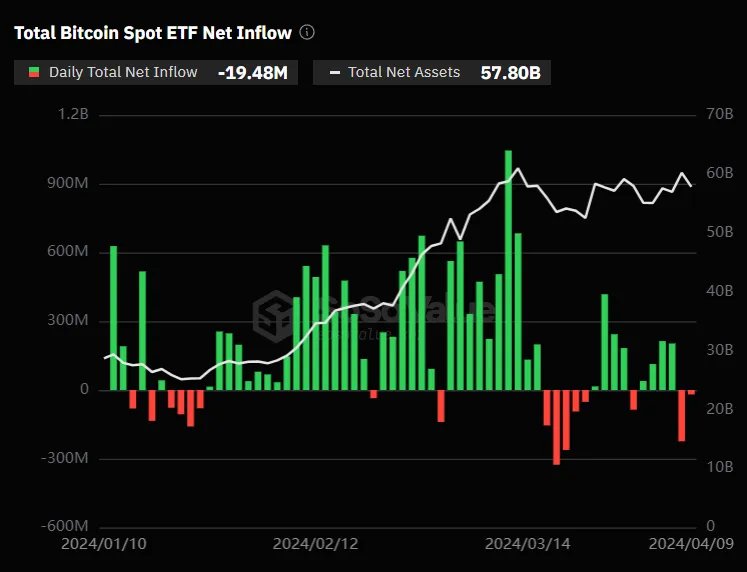

4) The net inflow of BTC ETF has slowed down significantly. After April, the daily net inflow was around US$200 million, compared with an average net inflow of US$600 million in March.

2 Stablecoin total market value

Since April, the total market value of stablecoins has been continuously increasing. The total market value of stablecoins has increased from 143.2 billion US dollars to 145.5 billion US dollars, an increase of 2.3 billion US dollars. For mainstream stablecoins, USDT has increased from 104.4 billion US dollars to 107.1 billion US dollars, an increase of 2.7 billion US dollars. USDC has decreased from 32.5 billion US dollars to 32.2 billion US dollars, a decrease of 300 million US dollars.

Since April, the total market value of stablecoins has been continuously increasing. The total market value of stablecoins has increased from 143.2 billion US dollars to 145.5 billion US dollars, an increase of 2.3 billion US dollars. For mainstream stablecoins, USDT has increased from 104.4 billion US dollars to 107.1 billion US dollars, an increase of 2.7 billion US dollars. USDC has decreased from 32.5 billion US dollars to 32.2 billion US dollars, a decrease of 300 million US dollars.

Although the total market value of stablecoins has been hitting new highs recently, it still has not reached the height of the last bull market. In March 2022, the total market value of stablecoins peaked at $163.3 billion, and there is still a gap of about $20 billion.

3. Stablecoin stocks on mainstream exchanges

Regarding the stock of stablecoins in Binance and OK exchanges, Binance increased by 2.2 billion USD and OK increased by about 100 million USD.

Regarding the stock of stablecoins in Binance and OK exchanges, Binance increased by 2.2 billion USD and OK increased by about 100 million USD.

For Binance, USDT stock increased from $23.6 billion to $25.4 billion, with a net inflow of $1.8 billion. USDC decreased from $1.5 billion to $1.2 billion, with a net outflow of $300 million. FDUSD increased from $2 billion to $2.8 billion, with a net inflow of $800 million.

For OK, USDT increased from 5.75 billion to 5.81 billion, with a net inflow of 60 million US dollars.

The two exchanges had a net inflow of $2.3 billion in stablecoins. Coincidentally, the total market value of stablecoins also increased by $2.3 billion. Of course, it is impossible for the additional issuance to directly enter the exchange. But it can explain the entry of funds.

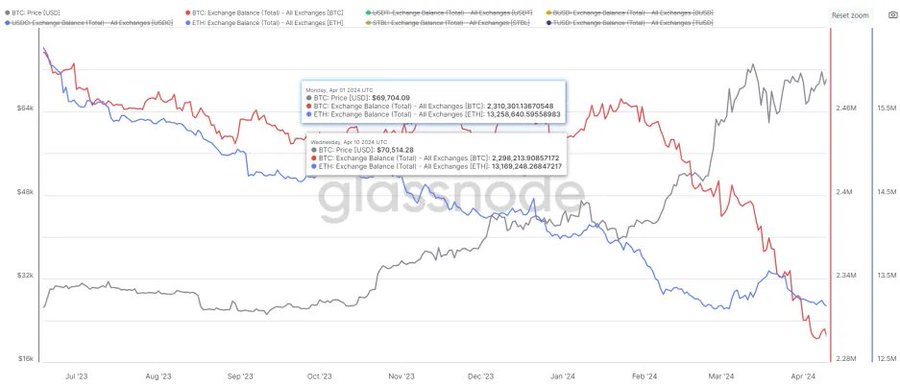

4 BTC/ETH stocks on exchanges

BTC and ETH continue to flow out of exchanges.

Since April, BTC in exchanges has dropped from 2.31 million to 2.298 million, with a net outflow of 12,000. ETH has dropped from 13.25 million to 13.16 million, with a net outflow of 70,000 ETH. From a larger time perspective, BTC has been continuously outflowing since January, with a net outflow of 200,000.

5 BTC ETF situation

The ETF fund situation of BTC has obviously cooled down since April compared with February and March. There have been two net outflows since April. Even during the period of net inflow, the daily net inflow was only 200 million US dollars. In comparison, the daily net inflow in March was around 600 million US dollars, which is a significant cooling.

The ETF fund situation of BTC has obviously cooled down since April compared with February and March. There have been two net outflows since April. Even during the period of net inflow, the daily net inflow was only 200 million US dollars. In comparison, the daily net inflow in March was around 600 million US dollars, which is a significant cooling.