Omni Network has just been announced by Binance to launch on Binance Launchpool. This is a Layer 1 blockchain project created with the mission of connecting different blockchains.

In addition, the project is also backed by huge investment funds along with a supposedly large Airdrop program.

Let's learn more with Allinstation!

What is Omni Network?

Omni Network (Omni) is a Layer 1 blockchain designed to integrate Ethereum's rollup ecosystem into a unified system by reStaking. This allows developers to build global applications that allow access to all of Ethereum's liquidation sources and users.

The project has also just announced Airdrop to users.

Outstanding features of the project

Resolve the phenomenon of liquidation fragmentation

The Omni Protocol aims to solve Shard challenges by facilitating smooth and compatible communication between different rollups:

- Cross-rollup communication: Omni allows users and applications to interact across different rollups as a single, cohesive network.

- Unified Liquidity Pool: By supporting Cross-rollup transactions, Omni helps liquidation liquidity, improve Capital efficiency and minimize slippage.

- Simplified user experience: Users can enjoy a smooth experience with the ability to move assets or take actions across rollups without complicated or multi-step processes due to leveraging a user-friendly platform with developer.

reStaking mechanism

The project introduces a groundbreaking method of blockchain security through the use of $ETH reStaking . When retaking ETH on Omni Chain, it will help the security of other projects in the Ethereum network benefit.

Omni Network also uses the "Dual Staking" mechanism thanks to Retaking ETH and Stake OMNI, which not only helps the protocol reach the security of the Ethereum Chain but also increases its own security budget due to more and more OMNI Token being Stake..

Compatibility

Compatibility is necessary for any project to achieve uniformity in transactions and information exchange. With Omni Network, the project addresses the need for interoperability by providing a protocol that supports Cross-chain communication, bridging interactions between multiple blockchains.

With this support, developers can easily create multi- chain operated dApps, minimizing connection and transaction complexity.

In particular, thanks to its integration with EigenLayer, Omni Network ensures safe and secure multi- chain transactions.

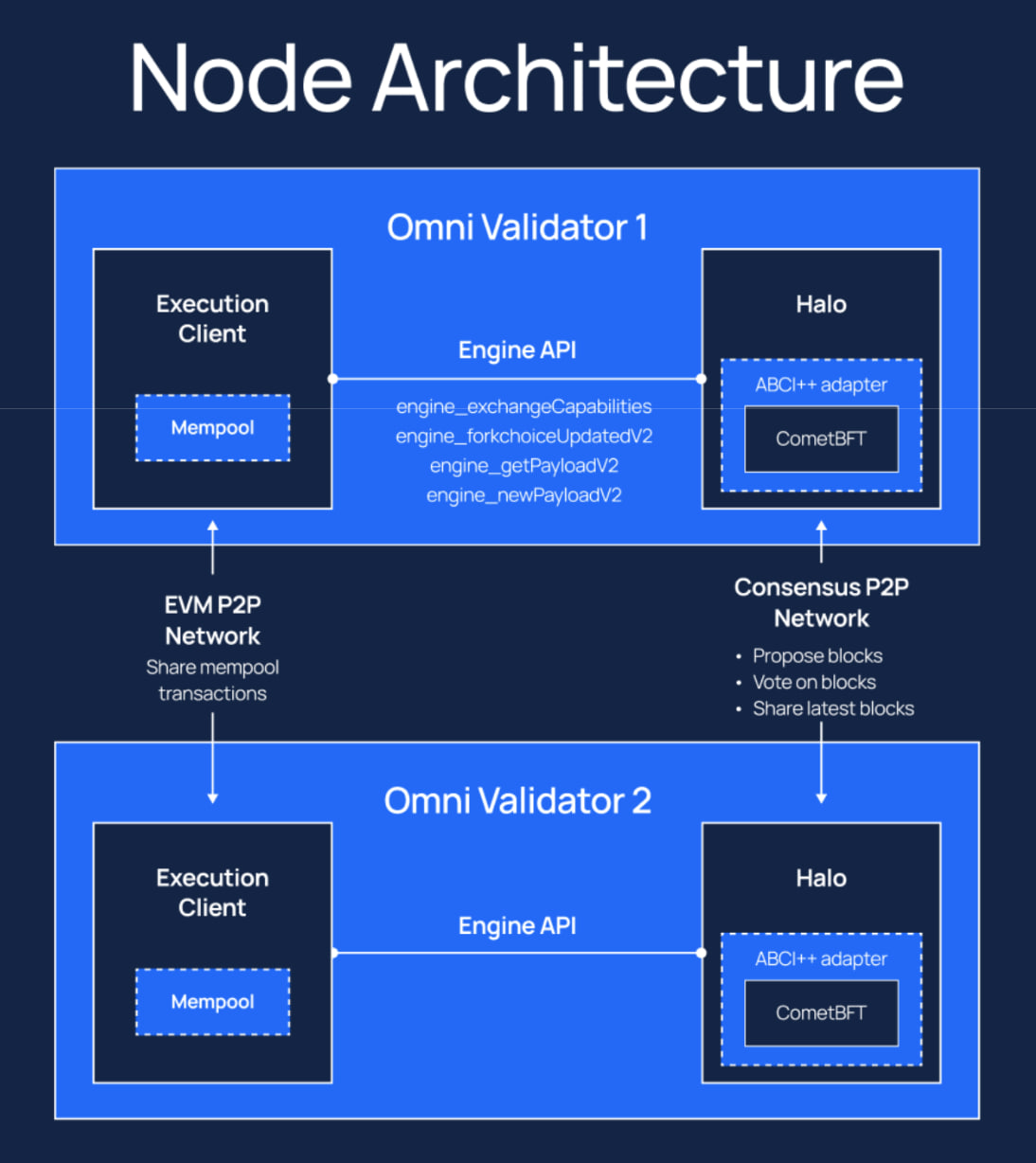

CometBFT

CometBFT is a Byzantine Fault Tolerant (BFT) consensus mechanism designed to ensure network consensus in a distributed system, even in the presence of faulty or malicious nodes.

Its flexibility and efficiency are the ideal choice for Omni, whose goal is to provide a reliable Cross-rollup and Cross-chain communication service.

=> Developers can build dApps on Cross-chain without compromising performance and security.

Dual-Chain Architecture

Omni introduces a groundbreaking approach to blockchain architecture, designed to enhance performance and scalability without compromising security.

Omni's architecture is Chia into two main layers: Consensus Layer and Execution Layer. This two- chain structure allows Omni to efficiently process transactions and manage global state across multiple networks.

=> The use of Modular blockchain structure turns Omni Network into a name that both maintains the security of ETH reStaking and improves transaction processing speed and cost thanks to the layered workload.

Information about Token

Token metrics

- Token Name: Omni Network Token.

- Ticker: OMNI

- Blockchain: Ethereum.

- Token Standard: ERC-20.

- Contract: Updating…

- Token type: Utility & Governance.

- Total supply: 100,000,000 OMNI

- Circulating supply: 10,391,492 OMNI (110.39% of total supply)

Allocation of Token

- Private Sale Investors: 20.06%

- Public Launch Allocation: 5.77%

- Binance Launchpool: 3.5%

- Team: 25.25%

- Advisors: 3.25%

- Ecosystem Fund: 29.50%

- Community Fund: 12.67%

Token payment schedule

Currently, the project has not announced specific information about the Token, we will get the information provided by Binance Research !

Token utility

OMNI can be used to do:

- Gas Price for transactions between Omni EVM and Cross-chain applications.

- Governance: decentralize the network through Staking and governance voting.

- Create a gas market for Cross-chain transactions

- Staking to secure the system

Roadmap

Q2/24:

- Integrates Liquid Staking and Eigenlayer protocols as “Moderator”

- Launch mainnet

- TGE

- Deploy a portion of the $11 billion committed to deploy Omni-secured xERC20

Q3/24:

- Launch “global applications” (NGAs) on Omni EVM

- Deploy smart contract multi-rollup to expand applications

- Launched Typescript frontend library to support application development

Q4/24:

- Expand Omni Network to integrate Data Availability systems such as EigenDA or Celestia

- Enhance network rollup capabilities

- Welcome MPC providers to provide services to organizations wanting to access rollups on Ethereum

Team

- Co-Founder/CEO - Austin King: he majored in Computer Science at Harvard, developed InterLedger Network (processing more than 10 billion transactions), sold the company to Ripple and is CEO of Omni Labs

- Co-Founder/CTO – Tyler Tarsi: he majored in Applied Mathematics, Computer Science and Economics at Harvard. He has experience in building machine learning infrastructure for quantitative trading systems.

Investors & partners

Investors

Omni Network raised 18 million USD on March 26, 2023. This Capital round has the participation of large funds such as Pantera Capital, The Spartan Group, Hashed Fund, Jump Crypto and Two Sigma Ventures.

Partner

Omni Network's partners include big names, especially EigenLayer, which plays an important Vai in the platform's ETH reStaking strategy.

Identify

Omni Network is a Layer 1 blockchain designed to integrate Ethereum's rollup ecosystem and solve the problem of liquidation fragmentation. The project uses the reStaking mechanism $ETH and Dual-Chain architecture for increased security and performance. A notable point is the support from large investors such as Pantera Capital, The Spartan Group, Hashed Fund, Jump Crypto and Two Sigma Ventures, with 18 million USD raised.

The recent listing of Binance Launchpool makes the attraction of the reStaking segment even stronger

Frequently asked questions

What is the project's official information channel?

Where to join Omni Network's Testnet?

- Visit this link: Omni Omega Testnet | Omni Docs

summary

Allinstation answered your question about what Omni Network is and provided information surrounding the project. Let's learn and evaluate together to make the wisest investment decisions. Wish you luck!!!