Original author: Bob, BlockBeats

Overview

The decentralized custody protocol and digital asset management platform Safe (formerly Gnosis Safe) was launched in 2018 with the slogan “Unlock Digital Asset Ownership”. The offline team is mainly based in Berlin, Germany, and the Safe Foundation is registered in Zug, Switzerland.

As the name suggests, the digital asset management platform allows users to transfer digital assets (tokens/NFTs) to the smart contract address of a Safe account controlled by an individual/organization. They can then complete various conventional on-chain operations through the many mainstream dApps integrated by Safe, thereby achieving transparent management of assets on the chain.

With the release of Ethereum's ERC-4337 standard, wallet account abstraction (AA) has become a mainstream narrative that may lead the crypto industry to break out of the circle. But what is the magic of Safe that has won the favor and praise of Ethereum co-founder Vitalik Buterin, OpenAI founder Sam Altman and others?

As an infrastructure that integrates multiple attributes such as "smart contract wallet" + "multi-signature wallet" + "account abstraction concept", Safe is also the absolute leader in market share in the field of DAO fund management tools, building a conversion cost moat and a cost advantage moat. Its co-founder Lukas Schor announced the SAFE token economic model at the governance forum as early as August 2022.

Token Economic Model

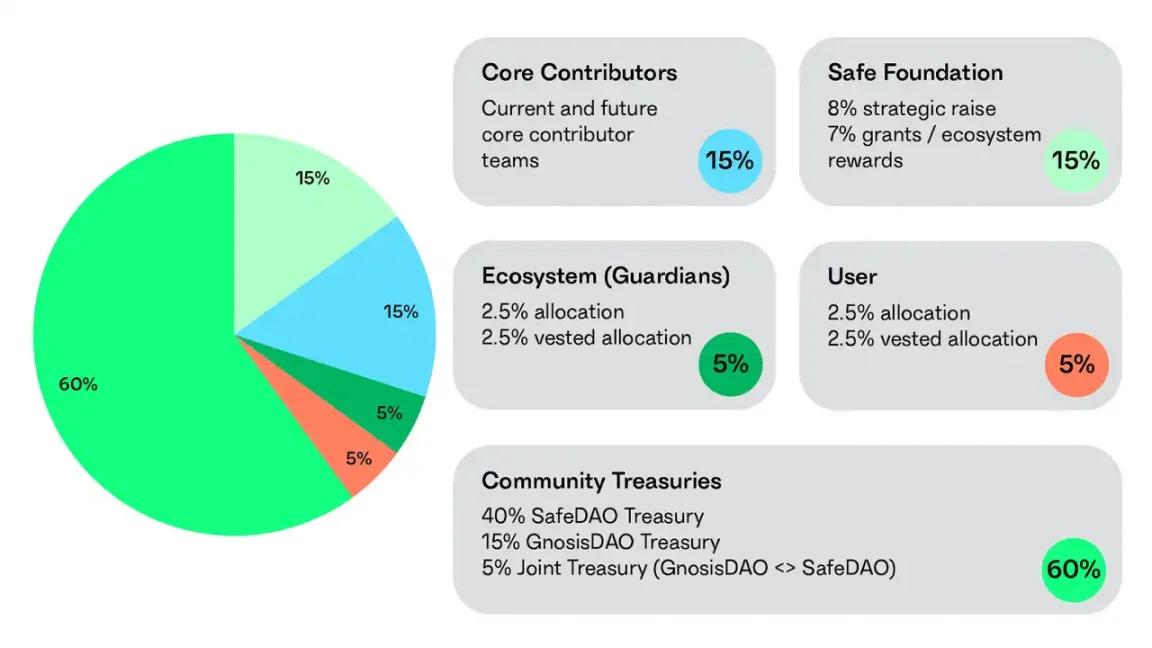

The total amount of SAFE is fixed at 1 billion, minted by the Safe Foundation. Among them:

Users 5% (50 million):

Ecosystem members/Guardians 5% (50 million): 25 million have been allocated, of which 12.5 million have been fully unlocked and the vesting period of 12.5 million is 4 years. The remaining 25 million will be allocated to future guardians.

8% (80 million tokens) for institutional investors: Unlocking will begin on July 8, 2023, with a vesting period of 4 years.

BlockBeats Note: On July 12, 2022, Gnosis Safe announced the completion of a US$100 million strategic financing, led by 1kx and participated by Tiger Global and others.

Safe Foundation 7% (70 million): vesting period is 4 years.

15% (150 million tokens) for core team members: vesting period is 4 years.

GnosisDAO Treasury 15% (150 million): vesting period is 4 years, starting on May 1, 2022.

SafeDAO Treasury 40% (400 million): vesting period is 8 years.

GnosisDAO & SafeDAO joint treasury 5% (50 million): fully unlocked.

Note: There are 59 clearly marked DAOs/organizations in the top 100 addresses of Safe airdrops

During the initial opening of Safe for users to claim airdrops, a total of 11,635 addresses out of 43,575 eligible addresses actively claimed their SAFE airdrops. Afterwards, the Safe DAO governance community voted to redistribute half of the unclaimed airdrops (i.e., more than 16.1 million tokens) to the addresses of previous claimants in proportion. The claimants will be able to claim a total of approximately 190.45% of the SAFE tokens in the initial airdrop plan.

Ecosystem Overview

The ecosystem built on Safe is booming, and multiple projects have completed financing of over 10 million US dollars. As the underlying protocol/framework on which "mini-programs" of projects can be installed and built, Safe's open source project code library is also giving back to the Web3 community and building a network effect moat.

Safe Ecosystem Map (2023) Source: Safe

Multis, a crypto startup built on Safe, announced in February 2022 that it had completed a $7 million financing round, led by Sequoia Capital, with participation from Y Combinator, Coinbase Ventures, MakerDAO and others.

Coinshift, a Web3 infrastructure startup powered by Safe, announced in May 2022 that it had completed a $17 million Series A funding round, led by Tiger Global and participated by Sequoia India and others.

Utopia, a DAO salary payment system built on Safe, announced in June 2022 that it had completed a $23 million Series A financing round, led by Paradigm, with participation from Circle Ventures, Coinbase Ventures, and others. Subsequently, Utopia announced that it would shut down its services on November 6, 2023. The announcement emphasized that this action does not mean closing the company, but abandoning existing products and existing directions.

"Fat protocol, thin application".

The protocol can both create and capture most of the value driven by the applications built on it. Value returns to the Safe protocol, and the ecological flywheel develops in a healthy way.

Vitalik Buterin, the choice of OpenAI CEO

Ethereum founder Vitalik Buterin strongly advocates multi-signature wallets

When talking about multi-signature wallets, readers can only or first think of Safe, which means that Safe has built an intangible asset (brand) moat.

Forbes reported on May 12, 2021 that Vitalik Buterin transferred the vast majority of his personal Ethereum holdings, more than 325,000 ETH (worth more than $1.3 billion at the time), to a new wallet address generated through Gnosis Safe.

BlockBeats previously reported that Vitalik Buterin has repeatedly recommended the use of multi-signature wallets:

1. On August 15, 2022, he said, "Hardware wallets are overrated. Most people should store most of their tokens in a multi-signature (5 participants) and ensure that the majority of the keys are held by trusted family and friends.";

2. On November 16, 2022, he said, "I prefer social recovery and multi-signature wallets to hardware wallets, paper records, etc.";

3. On March 17, 2023, it was stated that “multi-signature wallets (such as Gnosis Safe) are a simple and secure way to store funds. Self-custody is very important, and both individuals and the Ethereum Foundation use multi-signature wallets to store most funds.”

Source: Vitalik Reddit

Sam Altman's crypto project Worldcoin's ecological wallet "World App" integrates Safe

When World App was launched, it only integrated Safe, Uniswap, ENS, Circle, MoonPay and Ramp Network. From this, we can perhaps see the purest account abstraction/crypto wallet in the mind of OpenAI CEO Sam Altman.

Source: Worldcoin

Conclusion

The most popular title of Safe is “multi-signature wallet”. Safe Co-founder said that in fact, Safe is not just a “multi-signature wallet”, the most accurate definition is actually a composable smart account framework; it is a fully programmable smart account that can be used to cover any type of use case or user group through plug-ins.

At the same time, as the first entrant in the new infrastructure track, Safe has no optional targets that can be compared with the reference market value (MC)/fully diluted valuation (FDV), which brings broad imagination space to stakeholders such as ecosystem builders and participants.