author | Cointelegraph

Compile | Wu Blockchain blockchain this article was published in 2023, some information is already outdated

Some experts believe that miners will always be crucial to the Bitcoin ecosystem even after the last batch of Bitcoins are mined.

Satoshi Nakamoto mined the Genesis Block on January 3, 2009, minting the first 50 bitcoins in history and launching a multi-billion dollar industry centered on crypto mining . However, due to the limited supply of Bitcoin, the fate of miners after the last batch of Bitcoins is unclear.

Bitcoins are generated through mining, a process that involves computer hardware solving complex math problems and verifying transactions on the blockchain network. For their efforts, miners are rewarded with a predetermined number of bitcoins for each block of transactions.

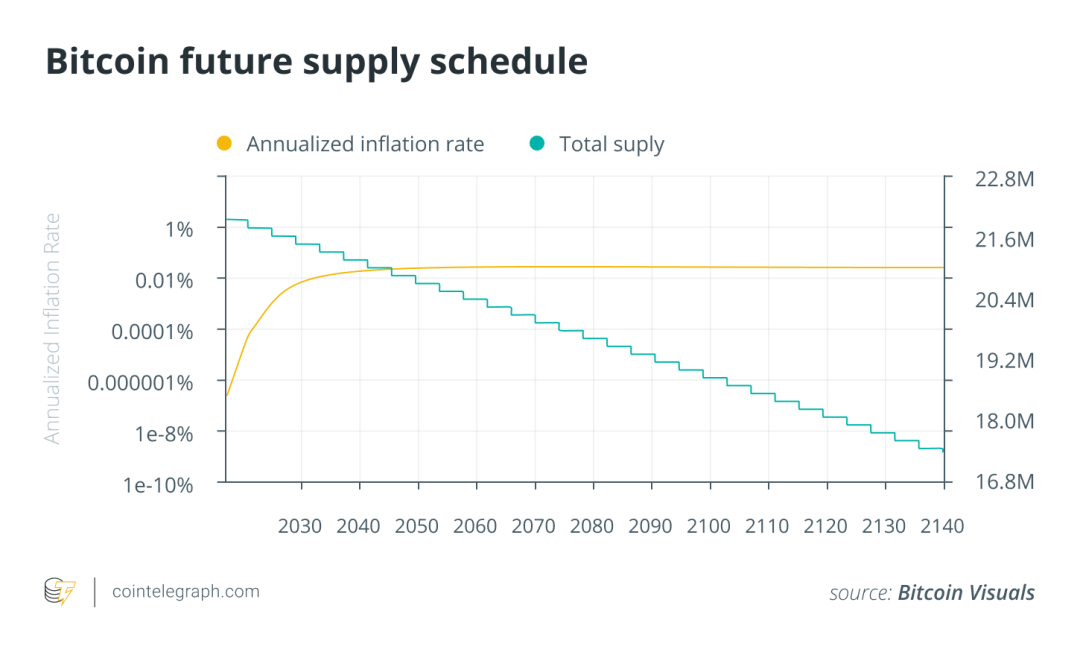

According to the Blockchain Council, more than 19 million Bitcoins have been awarded to miners as block rewards, while according to Satoshi Nakamoto’s white paper, only 21 million Bitcoins are available. Once this cap is reached, miners will no longer be rewarded for validating transactions.

In an interview with Cointelegraph , Nick Hansen , founder and CEO of Bitcoin mining firm Luxor Mining, said that although block rewards have disappeared, miners will continue to play a key role in validating and recording blockchain transactions, but the way they are compensated will evolve.

Currently, successfully validating a new block on the blockchain rewards miners with 3.125 bitcoins, which is about $203,125 according to Coingecko (data has changed). Miners also receive transaction fees.

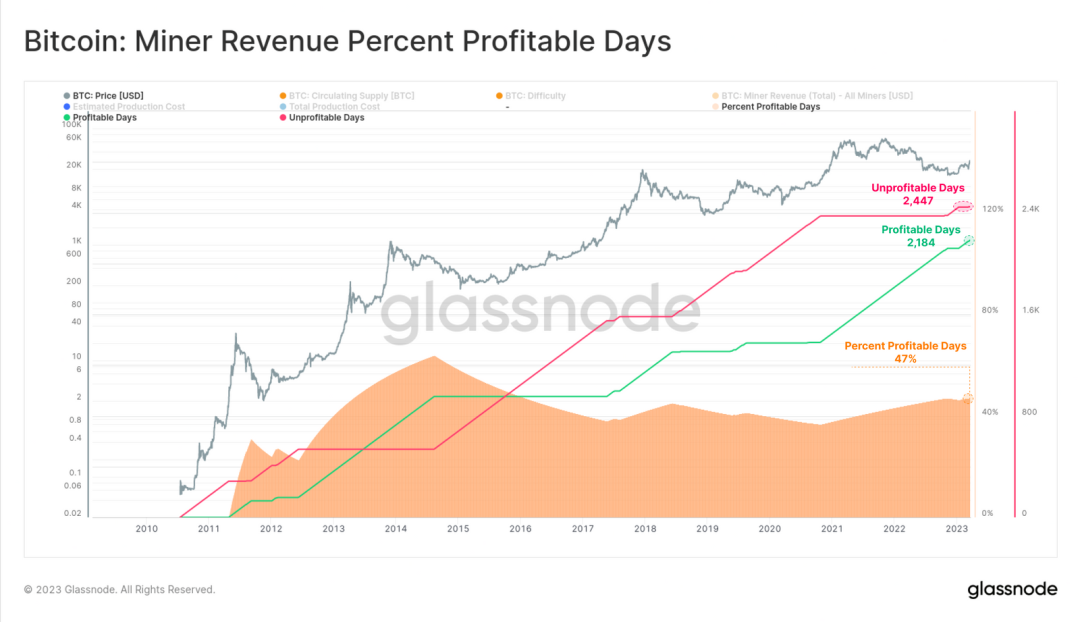

Transaction fees and block rewards have earned miners more than $50 billion since 2010, according to calculations shared by on-chain analytics firm Glassnode in a May 1 tweet.

Hansen believes that transaction fees will eventually become the main incentive for miners to continue mining after the last bitcoin is mined.

“That’s why as transaction fees grow in importance in the bitcoin mining economy, it becomes even more critical to understand transaction fee dynamics and predict their future,” he said, adding:

“So it’s important to see fees increase over time, like the recent Bitcoin ordinals help.”

However, given that current miners may not be alive by the time the last Bitcoin block reward is mined, this transition may still take years.

Waiting for an answer takes a long time

According to Hansen, based on the rate at which blocks are discovered and the halving process that occurs approximately every four years (or every 210,000 transaction blocks), the last Bitcoin will most likely be mined around 2140.

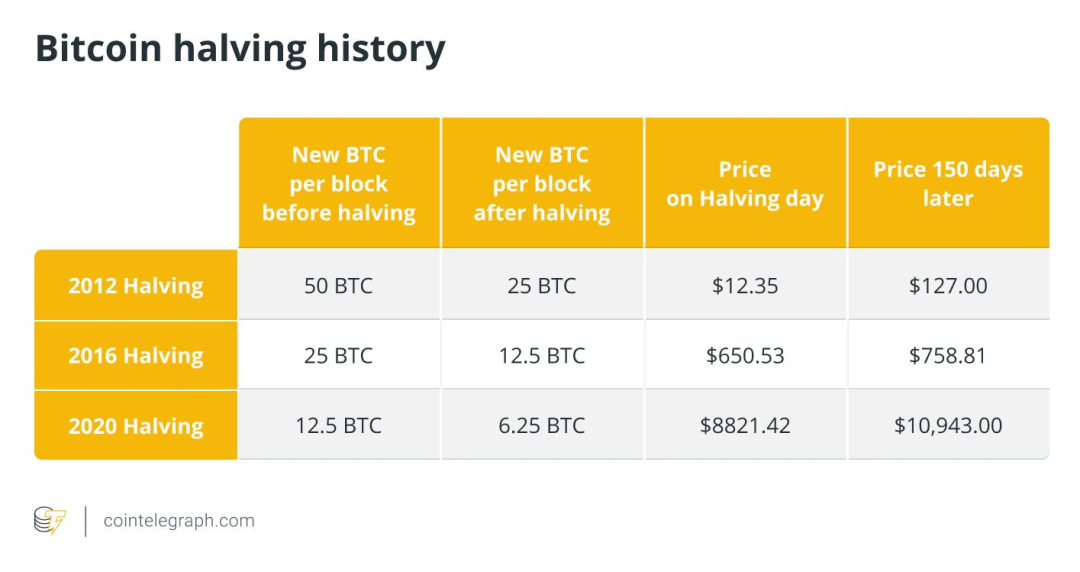

The Bitcoin halving is a scheduled reduction in the rewards received by miners, with the latest to occur in April 2024. This will reduce the reward per block to 3.125 bitcoins.

In theory, by limiting the supply of Bitcoin, the value of each coin should increase as demand increases and supply is fixed.

Hansen said the price of Bitcoin in 2140 will depend on unpredictable factors such as market demand, the regulatory environment, technological advances and macroeconomic factors.

“All the bitcoins in circulation may create scarcity, but whether that scarcity translates into price appreciation depends on market dynamics,” he said.

“As we look toward a future where all bitcoins are mined, it’s important to remember that Bitcoin was designed with this end in mind. The gradual reduction of block rewards and the shift to transaction fees are intrinsic properties of the protocol, and they represent an elegant solution to ensuring the continued security and viability of the network,” Hansen added.

Jaran Mellerud, research analyst at Hashrate Index, told Cointelegraph that as Bitcoin adoption and usage grows, transaction fees will increase significantly and become a major source of revenue for mining companies.

Mellerud said that by the time the last bitcoin is issued, the block subsidy will be so small that it will not have a significant impact on the bitcoin supply.

“Due to the huge demand for block space relative to the scarce block space supply, transaction fees must rise substantially in a future scenario of heavy Bitcoin usage,” he said, adding:

“If you don’t believe that transaction fees will be high enough in the future to justify mining, then you don’t really believe in Bitcoin.”

By the time the last Bitcoin is mined, Mellerud believes its value will not be measured in U.S. dollars or other fiat currencies.

He speculates that by then, the fiat currency system will have long collapsed, and Bitcoin may become the successor and the standard unit of account around the world.

“In this context, the only valid way to measure Bitcoin’s purchasing power is to look at how much energy one Bitcoin or one Satoshi can buy,” Mellerud said.

“Just like we now measure the purchasing power of the dollar in terms of energy, like barrels of oil,” he added.

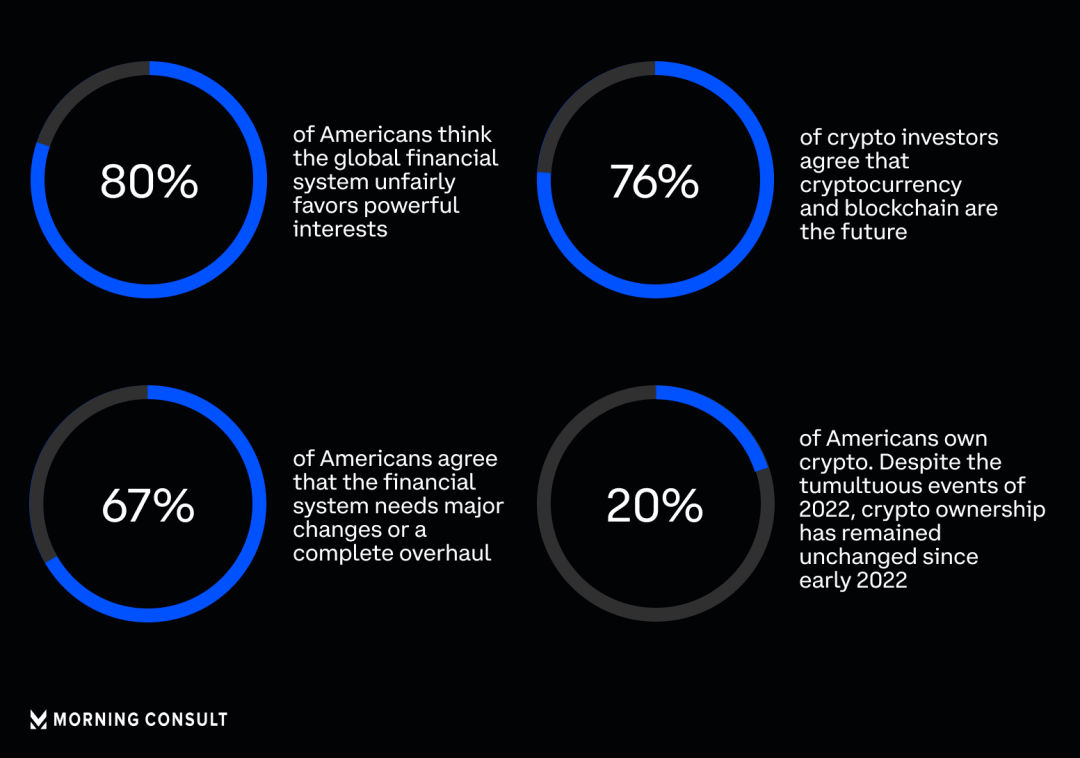

The collapse of the fiat currency system has long been predicted, and this prediction is mainly due to the many problems faced by the traditional financial system. Just in March 2023, Silicon Valley Bank collapsed due to a liquidity crisis, followed by Signature Bank and Silvergate Bank.

Ahead of the March 2023 banking crisis, a February survey conducted by business intelligence firm Morning Consult for cryptocurrency exchange Coinbase found that most respondents were already frustrated with the global financial system.

Most respondents are disappointed with the global financial system and hope for change. Source: Morning Consult

Bitcoin may be different in 120 years

Pat White, co-founder and CEO of Bitwave, told Cointelegraph in an interview that miners will remain a key part of the ecosystem, but not all will survive and some will shut down in the face of increasing costs.

According to a March 24 report from Glassnode, miners have experienced a long period of unprofitability since 2010, with only 47% of trading days being profitable.

Miners have been experiencing a long period of unprofitability. Source: Glassnode

“I think we could see some miners shut down, or resort to other manipulative techniques to drive up fees,” White said, adding: “But I also envision that this could happen before the last bitcoin is mined, as the last few halvings brought the block reward down to the satoshi level.”

However, White also said that “a lot can happen in 120 years” and that Bitcoin could change radically over the next century.

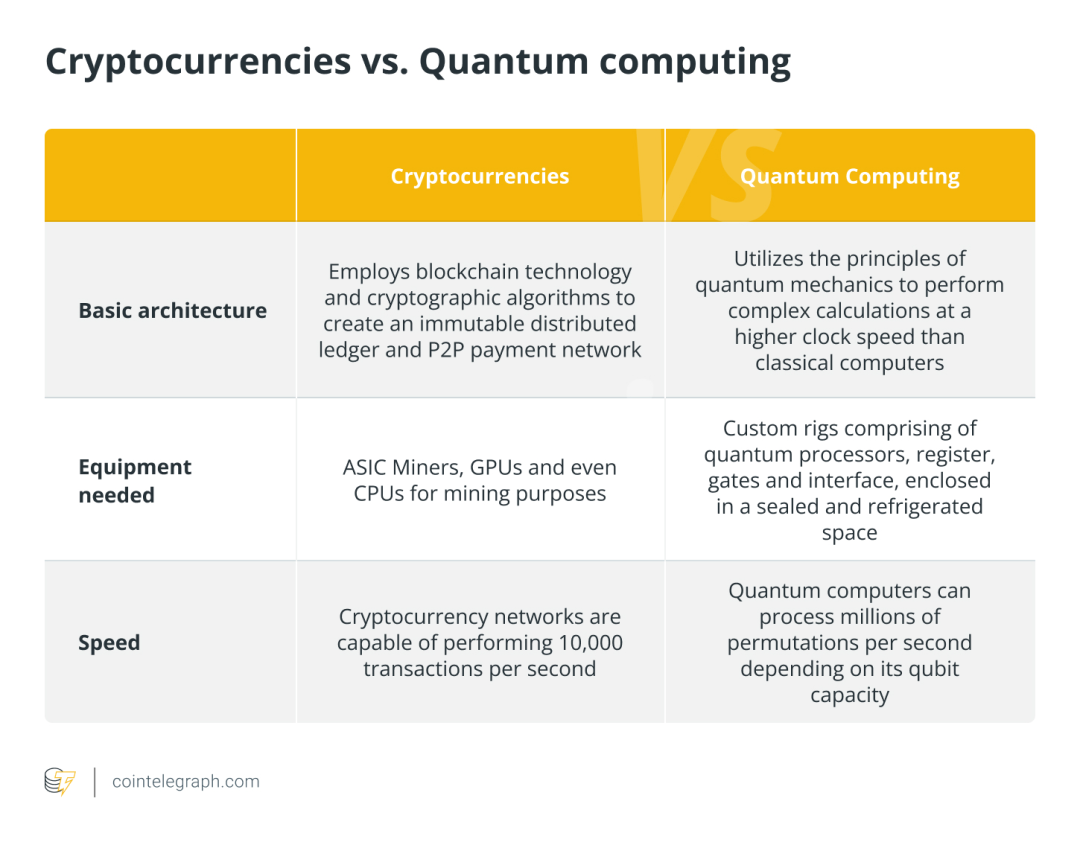

White believes that by 2140, quantum computers may have cracked bitcoin’s core encryption, although he says engineers working on it have long known it is not quantum-safe.

“People don’t need to panic about this quantum security issue. Bitcoin is going to need a massive overhaul at the cryptographic level between now and 2140,” he said.

“By then, the bitcoin developer community will be able to assess whether we are truly moving towards a network based on transaction fees, or whether additional bitcoin mining is needed to secure the network,” White added.

White further speculated that while Satoshi Nakamoto’s white paper states that Bitcoin supply is capped at 21 million BTC and that this is the most solid provision, by 2140, none of us may still be alive to enforce this provision.

He believes that cryptocurrency comes down to coding and consensus; if the community decides that transaction fee incentives are not enough to keep the network secure, future miners could theoretically extend BTC’s hard cap beyond 21 million.

What effect this might have on the price is unclear, but regardless, White believes that Bitcoin’s price will stabilize at some point where global inflation is reflected, and that major price moves will occur within the next 120 years if one or more countries are serious about adopting it as their reserve currency.

In that case, he said it would be “likely independent of Bitcoin’s mining progress” and would be the most certain moment to push up BTC prices.

“We can’t even imagine the things that could affect Bitcoin — obviously there are wars and energy crises — but what if we really are a multi-planet race by then, and we have to extend block production times to support solar-system-scale communication speeds?” White said.

“I’ve always thought it’s important to focus on the hardest problems we see today and do what we can to solve them. That might mean solving payments or digital ownership or banking the unbanked — those are the problems that need to be focused on now,” he added.

Original link: