Author: James Butterfill, Head of Research, Max Shannon, Alex Schmidt Source: medium Translation: Shan Ouba, Jinse Finance

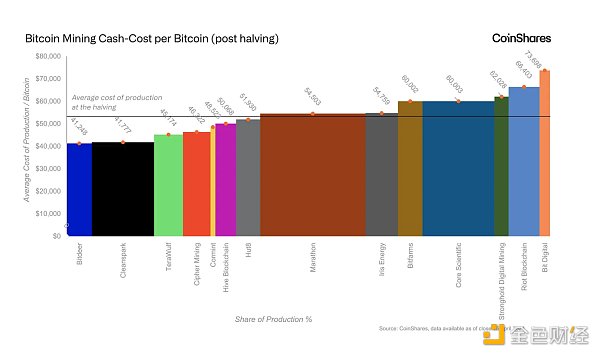

This research article was published to coincide with the 2024 Bitcoin halving and aims to update and inform investors of the risks and opportunities facing the Bitcoin mining industry. We recently updated our data based primarily on reported data from the fourth quarter of 2023. We found that the average production cost per Bitcoin for publicly traded mining companies is currently around $53,000.

In this report, we explore the mining industry and its challenges in more detail. We now use the hash cost method (which more easily accounts for custodial activity) and the cost per bitcoin method to better understand the profitability of the industry.

Summary

We expect energy-secure regions to turn to AI due to its potential for higher revenues, with companies such as BitDigital, Hive and Hut 8 already generating revenues from AI. This trend suggests that Bitcoin mining may increasingly move to stranded energy locations, while AI investments grow in more stable locations. TeraWulf, BitDigital and Core Scientific all currently have AI operations or AI growth plans.

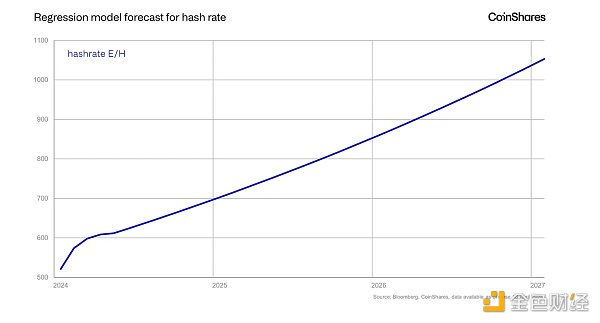

Our model predicts that the hashrate will rise to 700 Exahash by 2025, although after the halving, the hashrate could drop by 10% as miners shut down unprofitable ASICs.

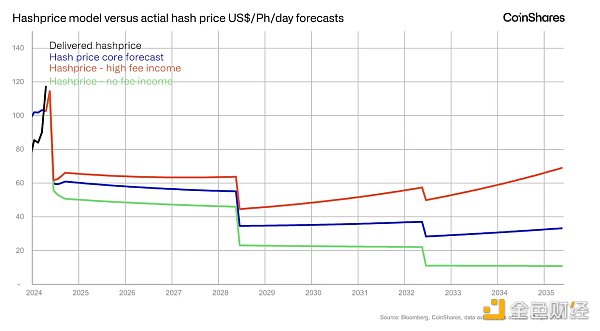

The hash price is expected to drop to $53/Ph/day after the halving in 2024.

As a result of the halving, costs are expected to increase significantly, with electricity and overall production costs nearly doubling. The main mitigation strategies include optimizing energy costs, improving mining efficiency, and ensuring favorable hardware procurement conditions.

Miners are actively managing financial liabilities, with some using excess cash to significantly reduce debt.

Emerging Trends: Is AI Computing a Threat to Bitcoin Mining?

It can indeed be a threat to some data centers. AI computing and Bitcoin mining have very different energy and internet uptime requirements. AI requires extremely high uptime (typically 99% or higher) and complex redundant systems. Downtime in AI often results in large contractual penalties and can delay the resumption of previous processing activities for a long time, limiting its applicability. In contrast, Bitcoin mining does not face these problems. ASICs are the hardware used for Bitcoin mining that can be powered on and off in a matter of minutes and resume hashing immediately. This flexibility makes them ideal for locations with less reliable energy, such as those using renewable energy or stranded gas flaring, where uptime requirements are flexible.

Our recent mining company management discussions revealed a notable shift, with some miners increasingly turning to AI at their energy-secure sites. While the trend is relatively new, companies such as Hve and Hut 8 are seeing AI revenues account for 3.6% and 2.9% of their revenues, respectively, and others are developing AI projects. We are seeing a preference for AI over Bitcoin mining in these energy-secure regions. Going forward, it is conceivable that Bitcoin mining could become primarily based at stranded energy sites with energy insecurity, particularly where it can financially subsidize such energy projects. Conversely, miners seeking revenue diversification and potentially higher profits could invest in AI, exacerbating this disparity.

AI presents some challenges, notably the need for unique and more expensive infrastructure, which creates barriers to entry for smaller, less capitalized entities. Additionally, as companies hire more AI professionals, employees will need different skills, which can lead to increased costs. Companies such as TeraWulf and Bitdeer are actively expanding capacity. For example, Core Scientific hosts Coreweave under a multi-year contract. Meanwhile, BitDigital plans to double its capacity with the goal of reaching an estimated annual run rate of approximately $100 million.

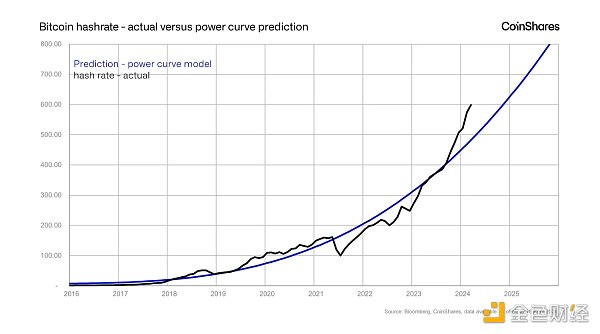

Hash rate modeling

Modeling the overall network hash rate can be done simply, one could assume it follows some form of Moore’s Law, or better yet a power curve of its growth. This could determine what path it will take in the future.

There are several issues with this approach, though. Things may change in the future, especially as the industry matures and becomes more likely to adopt the Verhulst S-curve rather than the power curve due to limited energy resources. It also does not take into account how fees will evolve. So far, fees have been sporadic, but as network usage increases, fees may increase over time.

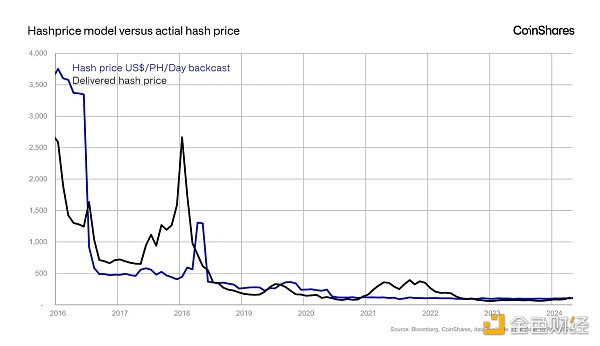

Our goal is to calculate hash price (miner profitability) to make it easier to determine miner profitability, especially since it is difficult to use a per-bitcoin approach when calculating hosting. The components of hash price include issuance, mining fees, hash rate, and price.

Issuance is predictable and hash rate can be modeled. This allows forecasters to adjust their assumptions about price and fees to determine hash price.

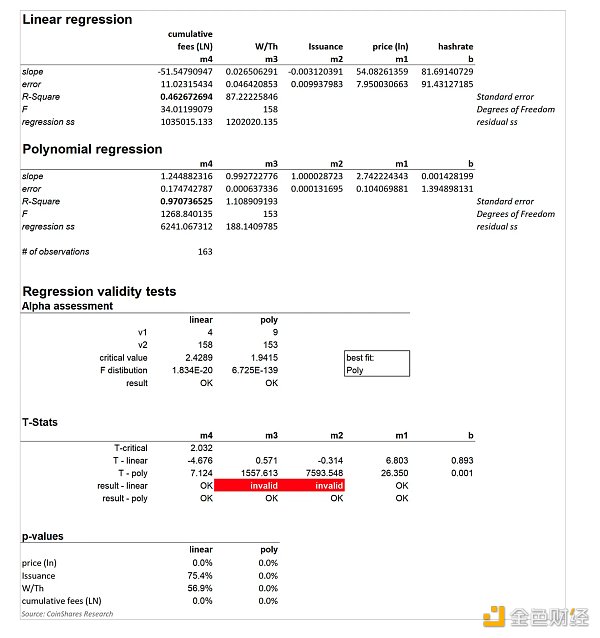

If we are to use regression analysis, modeling hash rate to help calculate hash price is by far the biggest challenge. In our approach, we adhere to the sensitivity principle and only identify those potential inputs to the model that make sense, not because they are incidentally linked to hash rate. Global interest rates are strongly correlated with hash rate. Nonetheless, we do not believe they are closely enough linked to hash power from a sensitivity perspective, as there is a lag in the transmission of lower/higher interest rates to miner acquisitions. We identify four factors to predict hash rate: fees, miner efficiency, issuance, and price.

The results are encouraging and suggest that, using monthly data since 2011, polynomial regression is the best approach, especially when evaluating alpha estimates (the probability of incorrectly concluding that a relationship exists) and T statistics (how useful each slope coefficient is in estimating hash rate). The p-values are only available for polynomial regression.

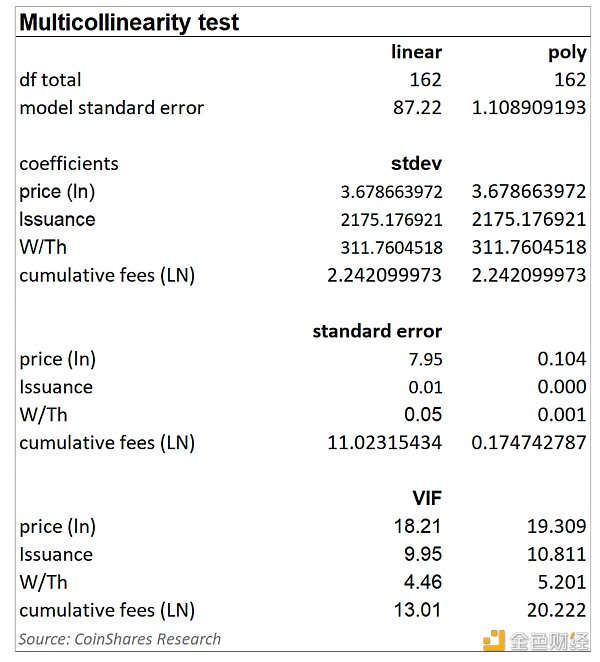

We also tested for multicollinearity, often called autocorrelation. Multicollinearity occurs when multiple variables in the model are highly correlated, meaning they provide overlapping information.

Multicollinearity can obscure which factors are truly influential, compromising the reliability and precision of the model conclusions. Results should be interpreted by looking at the variance inflation factor (VIF), with a VIF of 1 being ideal and an upper limit of 10; we found that both linear and polynomial models had some factors with VIFs above 10.

Although we do not think we should completely abandon the model because of this. In many ways, it is expected that there is a relationship between the various factors, with price affecting hash rate as it affects miners' capital expenditure decisions. It is worth noting that multicollinearity can sometimes be detrimental in regression analysis, but it depends on the context and goals of the model. Since our main goal is model prediction, the presence of multicollinearity is not a significant issue. Even if the independent variables are highly correlated, the model can still make accurate predictions.

Model Output

Interestingly, adjusting the model highlights that rising hashrates depress hash price, which makes sense since more miners/hash power equals less revenue per miner. While rising Bitcoin prices do have a significant impact on hash price in the short term, in the long term, rising Bitcoin prices tend to encourage more people to mine. Therefore, the net effect on hash price tends to be neutral, as reflected in the model.

The model predicts that the hash rate will rise to a record 700 Exahash by early 2025.

Miner fees are a relative mystery at the moment, which we believe is due to the relative immaturity of the fee market. To date, fees have followed price; when bull markets emerge, fees tend to increase in line with increased activity. Although recently, fees generated by ordinal numbers have been far more resilient than many expected and have been a boon to miners, with daily fees sometimes exceeding mining revenue. As Bitcoin matures, it is expected that fees will account for an increasing market share of miner revenue. The model currently emphasizes that rising fees tend to have the most positive impact on hash price.

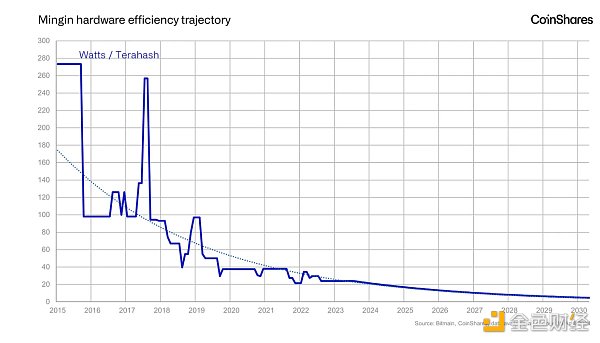

Predicting hash price requires making assumptions about 4 input variables. Issuance is highly predictable, while the efficiency of mining hardware (W/Th) is likely to follow a fairly simple exponential decline, reaching 10W/Th by 2028.

Using a modest assumption of 1.2% price growth and 1% fee growth per month, we see that the hash price could be $60/Ph/day after the 2024 halving, and drop to $35/Ph/day after the 2028 halving.

These growth assumptions would equate to an average monthly Bitcoin price of $86,000 by the end of 2025, with fees at the 80th percentile relative to historical levels. We have also incorporated some outliers, one of which is that fee revenue falls to zero; this would have a direct impact on the hash price, which would be well below the core post-halving scenario ($48.5/Ph/day) by the end of 2025. The second scenario (where we assume a 1.5% monthly growth rate in fee revenue) would push the hash price to $64/Ph/day by the end of 2025. Both scenarios show how important fee revenue is to miners.

The halving means that some hashrate will need to be shut down, particularly affecting companies with higher Bitcoin production costs, which are most at risk. While this will not necessarily lead to company closures, it could result in a reduction in their mining activity. The most significant pain points are expected to occur during the halving as mining hardware improves efficiency. However, as newer, more efficient ASICs enter the market, profit margins should recover. This quest for efficiency will encourage a shift to stranded and renewable energy sources with the lowest energy costs, ultimately making the industry more environmentally sustainable.

Miner profitability after halving

Summary:

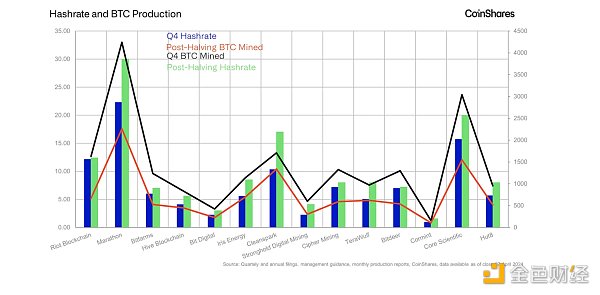

In Q4, we analyzed 106 self-mined Exahash (EH/s) from 13 public miners and 1 private miner, which accounted for about 20% of the global hashrate based on the Q4 network average of 501 EH/s. After the halving, our coverage remains around 20% or 140 EH/s.

The network hash rate is expected to drop by about 10%, from 636 EH/s to about 575 EH/s (based on a rolling 2016 block basis, approximately every two weeks).

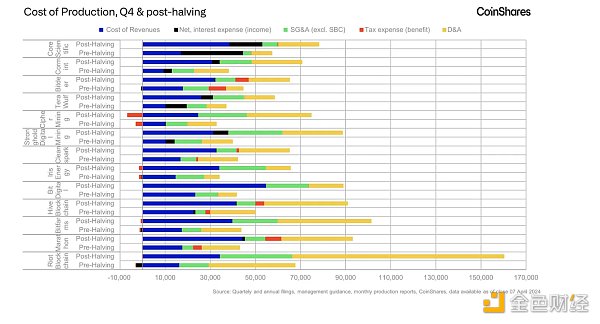

The weighted average production electricity cost in the fourth quarter was approximately $16,300 per Bitcoin and is expected to increase to approximately $34,900 after the halving.

Weighted average cash production costs for the fourth quarter were approximately $29,500; after halving, they are expected to be approximately $53,000.

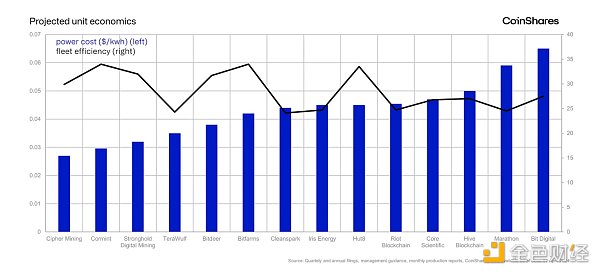

After halving, the weighted average costs of electricity, fleet efficiency, and utilized capacity will be $0.046/kWh, 26.7J/TH, and 922 million kWh, respectively.

The methodology is roughly consistent with the post-halving report for Q3 2023 , but with slight adjustments:

Interest expense includes only interest on debt and excludes lease payments and other finance charges, where possible. In the fourth quarter, interest from Hive and Stronghold did not offset interest income.

Whenever possible, use valuation allowances to calculate taxes to determine income tax expense and benefits.

Depreciation and amortization (D&A) is allocated to wholly owned machines whenever possible.

The projected hash rate (and market share) is based on our estimate of powered-on hash rate using monthly production reports rather than company management forecasts. This is expressed as a percentage of our estimated 575 network EH/s after the halving, reflecting a 10% drop from the current global hash rate of 636 EH/s.

Interest expense represents the sum of the principal amount outstanding, amortized where possible through the second quarter of 2024, multiplied by the periodic interest rate. It is not offset by interest income.

D&A takes into account Q4 D&A plus the annualized change in incentivized hashrate quarter-over-quarter multiplied by the industry average machine cost of $15/TH.

We do not forecast stock-based compensation after the halving because it relies on forecasting volatile stock prices.

The hash cost analysis for Q4 is from the quarterly earnings report. We calculate the "total" hash cost converted to $/kWh by adding the electricity cost, SG&A, D&A, income tax expense (income), interest expense (income), and SBC expense items and then dividing by the utilized capacity (utilized kWh). To convert to hash cost ($/PH/day), the $/kWh figure is multiplied by each miner's respective efficiency and 24 (the number of hours in a day). The "profit" shown for each hash price is the revenue after the "total" hash cost is deducted from the hash price.

The projected post-halving hashrate is based on previous estimates from monthly production reports and press releases. Due to stagnant or lack of month-over-month growth, some miners may not be able to achieve their publicly stated goals. Riot, Bitfarms, and Bitdeer are expected to be the worst offenders. As a result, they may see the most significant decline in Bitcoin production after the halving. For example, Riot expects to reach over 21EH/s by the second quarter of 2024; however, their hashrate has remained at 12.4EH/s since November 2023. Similarly, Bitfarms expects to reach 12EH/s by the second quarter of 2024, but has remained at 6.5EH/s since December 2023. Bitdeer's hashrate has fallen from a three-month high of 7.2EH/s to 6.7EHs in the last four months since December 2023.

The main goal of miners is to achieve the lowest $/kWh and W/T (lowest energy cost and best efficiency). The strategy aims to minimize electricity consumption while maximizing Bitcoin production, thereby expanding gross profit margins. In addition, as the cost of hashrate decreases ($ per Petahash per day), miners become more resilient to lower hashrate prices (network revenue per Petahash per day, including block rewards and fees, while adjusting for difficulty).

Our depreciation and amortization methodology is standardized, albeit arguably crude. The $15/TH assumption for incremental hashrate is machine-specific and excludes infrastructure costs. Infrastructure build-out costs vary widely across the industry, often in the hundreds of thousands of dollars per MW. Excluding these from the D&A calculation may result in lower total D&A costs than other miners. This is particularly important as teams may “paint” their P&L with “losses on sales” that are often masked in “special items” when legacy fleets are sold for less than their book value upon subsequent upgrades. The figures depicted may underestimate the true D&A costs per Bitcoin, especially in the second half of 2024 as hashrate growth and option exercises become active over the past few months. In turn, Cormint’s management team has indicated that it is deploying air-cooled infrastructure at approximately $110,000 per MVA and purchasing machines at less than $3/TH. At $15/TH, Cormint’s D&A expense per Bitcoin is considered high. While our methodology is intended to provide a general overview, it is critical to recognize nuances.

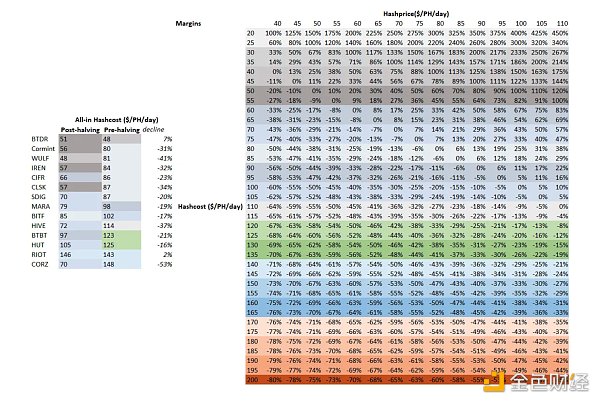

The table above illustrates the profits these businesses could realize based on their hash costs and the network hash price. If the hash price halves and drops to about $53/PH/day, below the October 2023 low, our analysis suggests Bitdeer is the lowest cost miner pre- and post-halving, and could generate a pre- and post-halving net profit of about 11%. Cormint could net a loss of about 5%, while TeraWulf and Bitdeer could net about 15% and 4%, respectively. The weighted average projected (based on projected hash rate) cash and all-in hash costs are $44/PH/day and $77/PH/day, respectively, and the weighted average cash and all-in profit margins are 24% and -28%, respectively, for the industry post-halving.

Compared to hash price, the hash cost measure is one of the better ways to understand the overall cost structure and profitability of a business. There are still some challenges: 1) it does not take into account different business models that focus on energy strategies, such as Riot, or diversified revenue sources and their profitability, such as Bit Digital; 2) the effectiveness of the measure may vary between businesses that adopt different power strategies.

Bit Digital has received notice to double its high performance computing (HPC) capacity (which they intend to accept under certain terms and conditions). As a result, its HPC revenues could double to an annualized run rate of ~$100 million with a very attractive gross margin of ~90%. In our analysis, Riot’s power credits account for 35% of total costs (excluding curtailments) and are not deducted for their total energy costs. This approach applies to all miners, as our goal is to find their true total power costs. In addition, its lower uptime (76%) also reduces the kWh it uses, so its hashing cost appears high. We believe that once Riot replaces the seemingly faulty machines with new machine orders, their operational issues should be resolved, resulting in higher uptime, higher efficiency, and lower hashing costs. Further out, the validity of the hashing cost metric may vary between businesses with different power strategies. Miners with power purchase agreements (PPAs) can monetize the difference between the high power price and the price they would otherwise mine (assuming that price, i.e., the Bitcoin opportunity value, is itself higher than their PPA price), thereby reducing their net power costs. Those operating in real-time electricity markets without PPAs cannot monetize, only avoid revenues and costs (gross margins remain stable). Reduce the net cost of electricity. Those operating in real-time electricity markets without PPAs cannot monetize, only avoid revenues and costs (gross margins remain stable). Reduce the net cost of electricity. Those operating in real-time electricity markets without PPAs cannot monetize, only avoid revenues and costs (gross margins remain stable).

The structure of bitcoin mining forces miners to reduce costs over time by finding cheaper energy and investing in more efficient equipment. However, miners have also been agreeing to option contracts for the right to exercise purchase orders for machines. Given the large size and long duration of these options, and given that companies have learned from previous bull runs and limited capital expenditures on machines, economies of scale have quietly entered the negotiations. CleanSpark signed a purchase agreement in January to buy 60,000 Bitmain Antminer S21s at $14/TH/s, with an option to buy an additional 100,000 at the same price. Iris purchased an additional 1 EH/s of Bitmain Antminer T21, while obtaining an option to purchase up to 9.1 EH/s, which can be exercised in the second half of this year at a fixed price of $14/TH/s.

Miners have also been paying down debt to reduce interest expenses. TeraWulf used excess cash flow to pay down $70 million of debt in the past six months. Argo reduced its outstanding balance to $14 million as of the end of February after selling its Mirabel facility in Quebec for $6.1 million, with $4 million of proceeds used to repay debt to Galaxy Digital. However, Argo still has an additional $40 million of outstanding senior notes with an interest rate of 8.75%. Greenidge also completed the sale of its South Carolina bitcoin mining farm to NYDIG, settling the remaining $21 million of secured debt owed to the bitcoin asset manager.

In summary, the analysis shows that Bitcoin miners face a challenging situation post-halving, with production costs increasing significantly, mainly due to the halving of block rewards despite miners reducing their overall cost structure. Companies such as Riot, Bitfarms, and Bitdeer are not expected to achieve the hashrate growth forecast for the second quarter, which will affect their production and cost efficiency. Despite these challenges, the report identifies strategies that miners are using to reduce costs and improve profits, such as obtaining cheaper energy, improving fleet efficiency, negotiating favorable terms for equipment purchases, and reducing financial debt to maintain a stronger balance sheet.

Overall, Bitdeer, Cormint, TeraWulf, and Iren are most likely to survive the halving, while Riot and Hut 8 face significant challenges.