Author: Nancy, PANews

As deployment costs and development difficulties continue to decrease, launching chains seems to have become the "mainstream approach" for current crypto projects. In this article, PANews takes stock of the 28 crypto projects that have officially announced the launch of chains in 2024, and organizes and analyzes the types of chain launches, online status, technical solutions, and impacts.

L2 and L3 are the main directions, divided into two major schools: general chain and application chain

Compared with the past, which required strong technical strength, sufficient capital reserves and a lot of time, many "one-click chain launch" tools such as OP Stack, Arbitrum, Polygon CDK and Zk Stack have led to the wave of chain launch. As the chain launch arms race kicked off, various companies have entered the market to seize the opportunity.

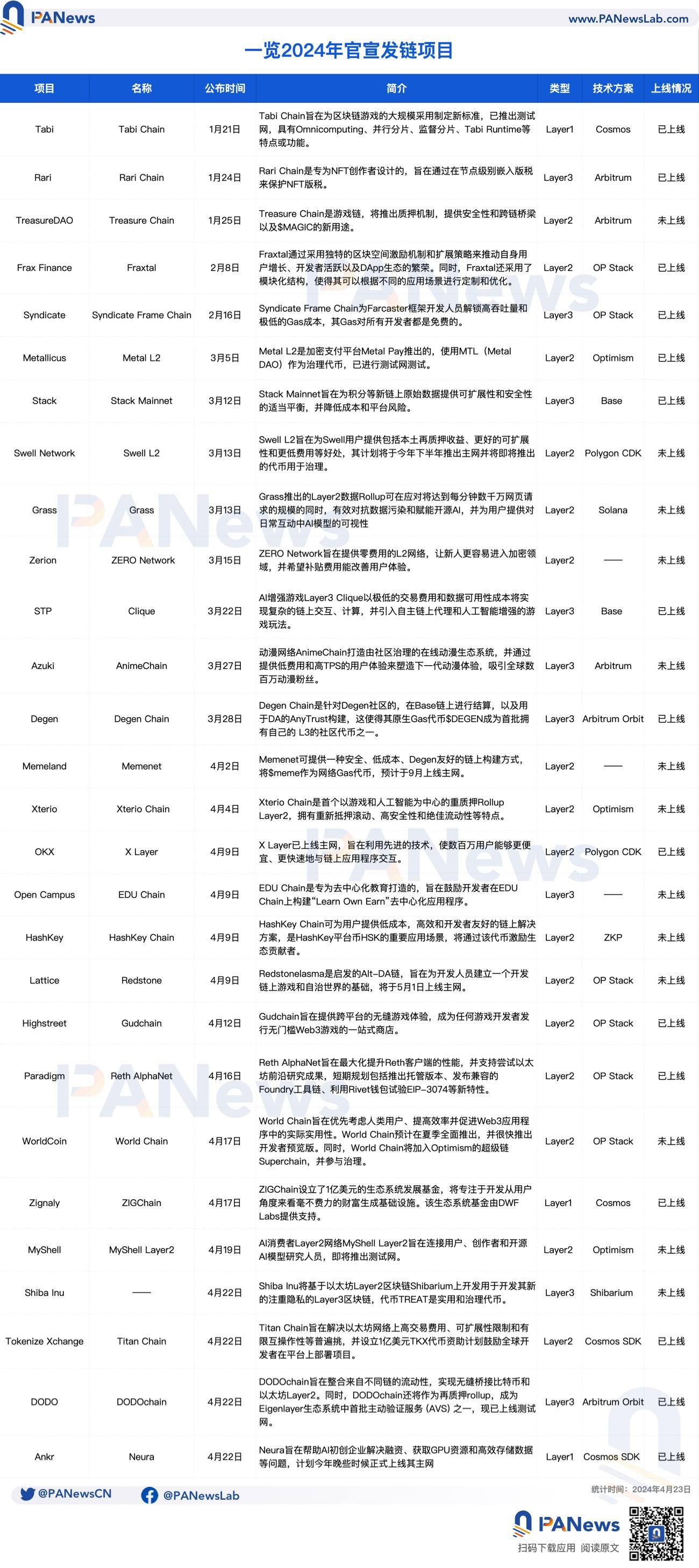

According to incomplete statistics from PANews, from the beginning of 2024 to the present, 28 crypto projects have joined the chain issuance camp. These projects come from many tracks such as games, NFT, AI, DEPIN, exchanges, investment institutions and wallets.

From the timeline point of view, 23 projects were announced in March and April this year, accounting for as high as 82.1%. It can be seen that the market chain launch phenomenon mainly seizes the bull market window period and becomes increasingly inward-looking; from the type point of view, compared with Layer 1, 25 chains in the market are Layer 2 and Layer 3, especially Layer 2 is more favored by projects, accounting for 57.1% of the total number.

At the same time, in terms of the launch status and technical solutions of each chain, nearly half of the projects have been launched on the test network or mainnet, and many are expected to be officially launched this year. Among the many development plans, OP Stack, Arbitrum, Cosmos and Polygon CDK are the mainstream solutions, with 20 projects adopting these solutions.

From a functional point of view, these chains are roughly divided into two types: general chains and application chains. Among them, general chains are not limited to specific application scenarios and can support different types of businesses, including Fraxtal, Syndicate Frame Chain, ZERO Network, X Layer and HashKey Chain, which focus on multiple advantages such as EVM equivalence, performance optimization, low fees and incentive mechanisms.

For example, X Layer, built by crypto exchage OKX based on Polygon CDK, is a general-purpose chain that aims to use advanced technology to enable millions of users to interact with on-chain applications more cheaply and quickly. It is now online on the mainnet. Since its launch on the testnet in November last year, X Layer has launched more than 170 DApps, and more applications will be launched soon; Fraxtal, launched by Frax Finance, is also a scalable general-purpose computing chain. It promotes its own user growth, developer activity and the prosperity of the DApp ecosystem by adopting a unique block space incentive mechanism and expansion strategy, and adopts a modular structure that can be customized and optimized according to different application scenarios.

The application chain is an infrastructure customized for different usage scenarios, especially those that cannot meet the growth needs of high-frequency application scenarios due to many issues such as performance, fees, throughput and privacy. Typical representatives include Tabi Chain, Rari Chain, Treasure Chain, AnimeChain, Degen Chain, Memenet and Neura, which are launched for games, NFT, AI and MEME.

For example, Web3 education platform Open Campus announced that its Layer3 product EDU Chain is designed for decentralized education and aims to encourage developers to build "Learn Own Earn" decentralized applications on EDU Chain; 9GAG's NFT project Memeland announced this month that it will launch Memenet, a Layer2 network built specifically for the MEME economy, which can provide a safe, low-cost, Degen-friendly on-chain construction method and is expected to be launched on the mainnet in September; Tabi Chain is a blockchain designed specifically for games and compatible with EVM. It aims to set new standards for the large-scale adoption of blockchain games. It has launched a test network with features or functions such as Omnicomputing, parallel sharding, supervised sharding, and Tabi Runtime; Gudchain is a custom chain developed by the metaverse platform Highstreet specifically for games. It aims to create an interoperable metaverse, provide a seamless cross-platform gaming experience, and become a one-stop shop for any game developer to publish barrier-free Web3 games. It is about to release its first Fair Launch and support staking $HIGH.

Of course, as OP Stack and Arbitrum launch more efficient chain-launching tools and continue to advance open source plans, multi-chain competition is bound to intensify, and falsified old chains will be eliminated by new chains that are more competitive in the market.

Multi-faceted empowerment under the chain narrative

For each project, chain issuance has different degrees of driving effect in expanding its own narrative power, breaking the business bottleneck caused by performance, and enhancing brand value and influence.

On the one hand, chain issuance has become a "traffic password" for business expansion, asset activation, user competition and even brand transformation and upgrading. Take the stablecoin protocol Frax Finance as an example. Due to the limited market competitiveness of its own stablecoin business, the project began to explore multiple product suites, including the modular Layer 2 blockchain Fraxtal built on OP Stack launched in February this year, which promotes its own user growth, developer activity and the prosperity of the DApp ecosystem by adopting a unique block space incentive mechanism and expansion strategy; for example, the blue-chip NFT project Azuki, after a series of NFTs collapsed across the board and its reputation opened high and fell, joined hands with Arbitrum Foundation and Weeb3 Foundation at the end of March this year to launch the Arbitrum-based animation network AnimeChain to create an online animation ecosystem governed by the community, and to shape the next generation of animation experience by providing a low-cost and high-TPS user experience, attracting millions of anime fans around the world.

On the other hand, due to performance limitations, high on-chain fees, and other difficulties such as poor user experience and limited development, many projects are using chain issuance to achieve a better and smoother user experience and lay a better foundation for ecological growth and prosperity, such as Treasure Chain, World Chain, Syndicate Frame Chain, Stack Mainnet, Grass, Clique, Reth AlphaNet and Titan Chain. For example, Sam Altman's crypto project Worldcoin is based on the Ethereum Layer2 network World Chain built on OP Stack. In fact, Worldcoin has seen rapid growth in user volume since its launch, and currently has more than 10 million users, but it faces the problem of blockchain often being congested due to robot activities, and the current L1 and L2 are unlikely to improve the network inefficiency and high costs in the short term. The launch of World Chain can integrate robot review into its DNA, while greatly increasing capacity and having low-cost advantages. It also supports interactions with other super chain members, thereby helping its vision of "allowing billions of users to enter the crypto market";

In addition, many projects have also played a certain role in promoting the value and influence of projects after issuing chains, such as Swell L2, Shiba Inu, ZIGChain and Grass. For example, Swell Network, which has not yet issued tokens, announced in March this year the launch of Swell L2, a Layer 2 rollup project based on Polygon CDK. It is planned to go online in the second half of this year and use the upcoming tokens for governance. At the same time, Swell has also opened the Pre-Launch deposit entrance of the L2 network. Users can obtain multiple potential benefits by depositing ETH and various LST and LRT, including Swell's own tokens and airdrop rewards from major projects on Swell Layer2. Affected by this, Swell Network has shown strong money-making power in the short term. Half a month after its launch, the total deposit volume of its L2 has exceeded 300 million US dollars, which also shows the market's imagination of the value of Swell Network; for example, the DePIN project Grass, which is also a non-coin project, also launched a Layer 2 data Rollup based on Solana in March this year, which can effectively combat data pollution and empower open source AI while dealing with the scale of tens of millions of web page requests per minute, and provide users with visibility of AI models in daily interactions. According to the information released by conte, a contributor to the Grass community not long ago, Grass still has 1.8 million real users after removing 7.5 million fake accounts.

Overall, the “out-of-the-box” chain-launching tools have improved the convenience and feasibility of public chain development, and to a certain extent can promote the emergence of more innovative use cases and bring prosperity to the ecosystem.

However, too many players will enter the market, which will easily lead to aesthetic fatigue in the market, thus causing the real high-quality projects to be buried. And if the market focuses on the narrative of launching chains and "reinventing the wheel", it will also greatly disperse the market liquidity, and the phenomenon of public chains "idling" due to lack of ecology and users will be aggravated. After all, the premise of building enough and wide "roads" is that there are enough "cars" to use them.