On April 23, according to the official announcement, Binance launched the 53rd phase of the new coin mining project, using BNB and FDUSD to mine Renzo (REZ). There is a small episode here. The native token of Renzo was originally called EZ, but it was renamed REZ a few hours after the Binance mining announcement was released. According to official rules, Renzo Season 1 incentives will end on April 26, and users who sell their ezETH holdings before this date may not be eligible for airdrops. Users can claim REZ on May 2 through the official claim website.

Related reading: " Analysis of Binance's latest project Renzo: Token economic model and valuation expectations "

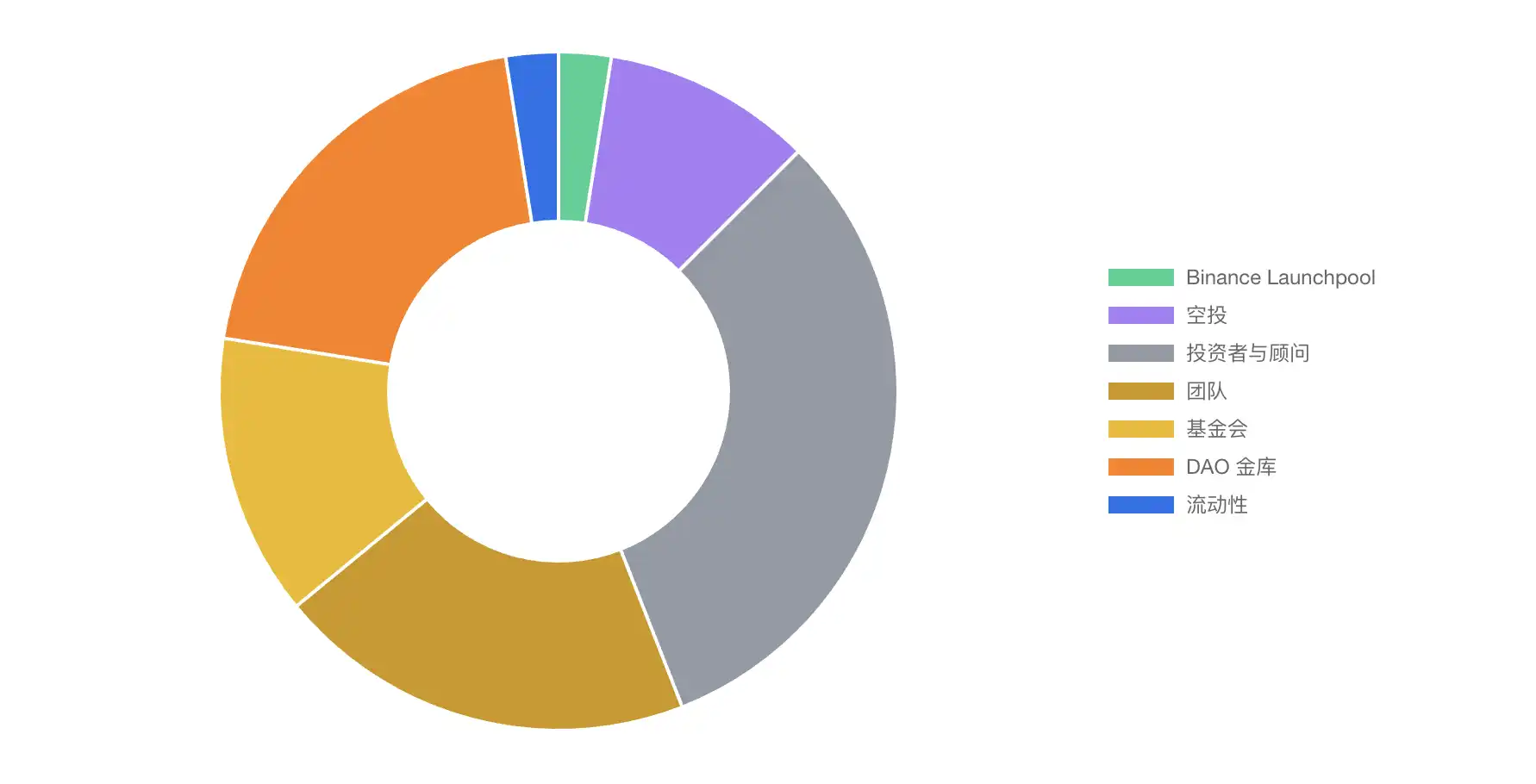

But last night, Renzo's token economics caused controversy. The total number of REZ tokens is 10 billion, and the initial circulation is 1,050,000,000 REZ, which is 10.50% of the maximum supply. The specific distribution mechanism is:

Investors and advisors will receive 31.56%;

· The team will be allocated 20.00%;

The DAO Treasury will be allocated 20.00%;

The foundation will allocate 13.44%;

· Airdrop will allocate 10.00%;

Binance Launchpool will allocate 2.50%;

2.50% will be allocated to the liquidity budget;

In the first version of the announcement released by Renzo, the token distribution pie chart is as follows. It is obvious that the person who drew the chart did not learn mathematics well. He drew the two 2.5% shares to be almost the same as 20%, while the bottom "half" is 62%. The community bluntly said that this is "chart crime, no different from token economics fraud."

Subsequently, Renzo officially deleted the announcement, but has not yet updated the new token distribution. But what makes the market even more angry is that Renzo's token distribution is not satisfactory. Crypto KOL @WazzCrypto forwarded the original announcement and said, "It is a complete joke to brag about the "decentralization of the protocol" and only airdrop 5%. 70% of the supply is still in the hands of insiders."

Some people even jokingly updated the token distribution pie chart for Renzo. "Almost all the tokens are prepared for the team. This is one of the most manipulated token economics in history." Social media is full of dissatisfaction with Renzo's token distribution.

In addition, Renzo's dramatic events include the fact that earlier today, due to insufficient liquidity and large-scale selling, Renzo LRT token ezETH fell sharply to $688 in the short term. As of press time, the EZETH/WETH liquidity pool is only $3.2 million, and EZETH is quoted at $3,148.58 on Uniswap's Ethereum mainnet.

During the unpegging period, a whale used 2,400 ETH to buy 2,499ezETH, worth $6.98 million, and made a net profit of 99 ETH. This unpegging incident also made the community aware of the risks of LRT. DeFi composable leverage protocol Gearbox stated that some users were liquidated due to the unpegging of ezETH.

According to Nancen data, in the past 24 hours, the contract addresses marked as Morpho: Morpho Blue and Zircuit: LST Staking Pool have outflowed 5,806 and 6,010 ezETH respectively.

This series of events has led to the community's negative attitude towards Renzo's airdrop. As the EigenLayer mainnet is gradually launched, related LRT projects have begun to accelerate the pace of token launches, but it will take time to observe how the market will perform in the future.

Welcome to BlockBeats the BlockBeats official community:

Telegram subscription group: https://t.me/theblockbeats

Telegram group: https://t.me/BlockBeats_App

Twitter Official Account: https://twitter.com/BlockBeatsAsia