This week, our newsletter covers Consensys’ standoff with the SEC, new edits to the Bitcoin BIP repository, and the IRS’ new 1099 draft for digital assets.

Consensys joins fight against SEC

Consensys has filed a lawsuit against the SEC, accusing it of "illegally usurping the power of Ethereum." In a lawsuit filed on Thursday in the U.S. District Court for the Northern District of Texas, Consensys challenged the SEC's practice of regulating Ethereum as a security. According to the lawsuit, Consensys received a Wells notice from the SEC on April 10, which indicated that the SEC was preparing charges against its MetaMask wallet, claiming that the wallet acted as an unlicensed broker that facilitated securities transactions through exchange and pledge products.

In a blog post, Consensys founder Joe Lubin explained the two main reasons for filing a lawsuit against the SEC: first, the SEC "should not be allowed to arbitrarily expand its jurisdiction to cover regulating the future of the Internet"; second, "the SEC's reckless behavior has caused confusion for developers, market participants, institutions, and countries who are building or managing critical systems on the Ethereum platform." Lubin also emphasized that Consensys' position is clear: (i) Ether is not and should not be considered a security, and (ii) wallet software that allows people to buy, sell, and transfer Ether, such as MetaMask, is not a securities broker.

Joining the fight against the SEC’s over-regulation of cryptocurrencies is Consensys, an Ethereum-centric company dedicated to protecting the broader Ethereum ecosystem. Consensys not only supports MetaMask, the most popular cryptocurrency wallet, but also offers products such as Infura and Truffle (API and development tool kits), Besu and Teku (Ethereum clients), and Linea (emerging ZK rollup protocol). However, based on the filing, it appears that the SEC is currently targeting only the MetaMask Swaps and MetaMask Stake products. If the SEC’s expected charges are based on these MetaMask products, then the charges may be at least partially dismissed - on March 27, a federal judge dismissed the SEC’s allegations against Coinbase that the exchange acted as an unregistered broker through its Coinbase Wallet, although the judge did allow the SEC to proceed with its lawsuit against Coinbase’s staking program (see our previous newsletter for more details). Assuming that the MetaMask and Coinbase Wallets operate similarly and the two companies’ respective staking programs are similar, we think it is reasonable to treat any potential lawsuit against Consensys in a similar manner to Coinbase.

Regardless, Consensys is an important part of the Ethereum ecosystem, so any legal developments could have ramifications for the broader crypto industry. As a result of Consensys’ latest lawsuit, or any active related litigation between cryptocurrency companies and the SEC, a federal judge could soon declare whether Ethereum is a security. — Charles Yu

Bitcoin community adds five new BIP editors

The Bitcoin developer community recently appointed five new contributors as editors of Bitcoin Improvement Proposals (BIPs). For background, a BIP is a formal proposal for an upgrade to the Bitcoin protocol. These new members, including Bryan “Kanzure” Bishop, Jon Atack, Mark “Murch” Erhardt, Olaoluwa “Roasbeef”, and Ruben Somsen, now play a vital role in the BIP process. Their responsibilities include reviewing drafts of proposed BIPs, providing feedback to BIP authors, and deciding whether to assign a formal number to the BIP. Once a BIP has sufficient technical documentation, the BIP editors merge the corresponding pull request into Bitcoin’s Github BIP repository. The expansion of the BIP editor team marks a significant change from the past, when Luke-Jr, a well-known but controversial Bitcoin Core developer, had the sole power to merge BIPs into the repository. Bitcoin’s Github BIP repository serves as the primary database for tracking all pending Bitcoin upgrades.

The addition of five new BIP editors marks the first time in Bitcoin’s history that more than one core contributor has served as a BIP editor. Veteran Bitcoin Core developer Ava Chow led the nomination process to select the five new BIP editors.

Our take:

The cadence of Bitcoin protocol upgrades is slower than other blockchains due to the meticulous due diligence process conducted by the developer community. For example, the recent Taproot upgrade, which was activated in November 2021, underwent three years of rigorous developer review before activation. This long due diligence is partially attributed to the limited number of BIP editors authorized to merge pull requests to Bitcoin's Github BIP repository. Prior to the recent addition of new BIP editors, designating one person as the only BIP editor caused a bottleneck in the BIP process for many years. As a result, assigning numbers to promising BIPs has been a major obstacle for BIP authors.

Improving the efficiency of the BIP due diligence process while maintaining quality control is an important step forward for the Bitcoin developer ecosystem. Recently, one of the five new BIP editors assigned BIP numbers to two high-profile opcodes, OP_CAT and OP_TXHASH, namely BIP-347 and BIP-346. Although assigning a number to a BIP and including it in the GitHub BIP repository does not mean a guaranteed activation path, this step helps increase the visibility and attention of the BIP. In addition, the assignment of a BIP number sends a signal to the developer community that the BIP has passed the initial due diligence stage. Overall, the addition of these five talented Bitcoin Core contributors with a rich GitHub commit history will inevitably bring greater efficiency and clarity to the entire BIP process.

IRS Releases Draft Tax Forms for Crypto Brokers

On Friday, April 19, the Internal Revenue Service (IRS) released a preliminary draft of Form 1099-DA (Digital Asset Gains from Broker-Dealing Transactions). The form, as its name suggests, is primarily intended for brokers to report gains from the sale and trading of digital assets and basic information about them. Last August, the IRS, along with the Treasury Department, released an exhaustive 282-page document laying out its understanding of the expanded duties and responsibilities imposed by President Biden’s Infrastructure Act and detailing the form. Under these proposed rules, a broker is defined as a person or entity that can identify a customer and that provides services to help customers sell digital assets. The August guidance made it clear that this would affect centralized cryptocurrency exchanges, custodians, and wallets. But it’s still unclear how these guidelines would apply to non-custodial versions of services and other types of decentralized applications, such as non-fungible token (NFT) trading platforms and blockchain explorers. For a deeper look at the IRS’ new broker rules, see our August report. The IRS states that digital asset brokers will need to collect “know your customer” information from all U.S. users and include Form 1099-DA in their annual tax filings.

The 1099-DA form collects basic information about the filer, including name, address, Social Security number, and specifically focuses on the nature of the brokerage business. The form provides filers with five options to indicate their brokerage type, including:

- Kiosk Operator

- Digital Asset Payment Processor

- Custodial Wallet Providers

- Non-custodial wallet providers

- other

At the bottom of the form, filers must also include the transaction ID or hash and on-chain account address of all digital asset transactions facilitated by the broker. In addition, filers must also report the "number of units" transferred in the transaction and details of any "accrued market discounts" or "disallowed wash sale losses" that affect transaction costs and gains. The draft version is marked with the 2025 tax year at the top, which may indicate that the IRS is seeking to finalize the broker reporting rules by the end of this year. The IRS is currently accepting comments and feedback on the draft 1099-DA form. Some crypto industry advocates have publicly opposed the draft, pointing out that it could have adverse effects on the privacy and accessibility of crypto users. Earlier this year, a bipartisan group of nine members of Congress also expressed opposition to the IRS's proposed rules on tax reporting requirements for digital asset brokers.

Our take:

The good news is that the proposed broker-dealer reporting rules have not yet been finalized and are still subject to change. The bad news is that the IRS does not seem to be fully listening to the concerns of cryptocurrency industry advocates and legal experts. The IRS's proposed ruling received more than 40,000 comments during the public comment period between August 2023 and November 2023. Many institutions such as Galaxy Research, Coin Center, and A16z objected to the overly broad definition of brokers, arguing that it would cause major setbacks for brokers and users and developers of blockchain-based services, and could trigger a large-scale migration of specific decentralized finance (DeFi) services outside the United States.

Despite the resistance, the IRS appears to be moving forward with its proposed rules for digital asset brokers. The draft 1099-DA form released confirms industry concerns that the definition of a broker could include non-custodial digital asset wallets and most DeFi applications. The inclusion of “non-custodial wallet providers” as a type of digital asset broker recognized by the IRS suggests that those “other” types of digital asset services that facilitate the sale or exchange of digital assets, regardless of whether they are operated by a centralized entity or function primarily through self-executing (smart contract) code, will be subject to the same rules.

If Form 1099-DA and the proposed broker-dealer reporting rules are finalized in their current form, DeFi developers, as well as other types of open-source software developers in the crypto industry, will need to consider the implementation of these rules and consider one of three options:

- Comply with and implement KYC measures and annual reporting via Form 1099-DA;

- Blocking US users and prohibiting the use of US IP addresses on the website front end may not be feasible at the smart contract level;

- Full decentralization, giving up application upgradability, front-end, and fee decisions, makes it impossible for a service or its creators to know (let alone report) the identity of its users.

Likewise, the good news is that the IRS’s proposed rules for digital asset brokers have not yet been finalized, and the early release of the draft 1099-DA form opens a new comment period, which industry stakeholders can use as an opportunity to once again voice their concerns. Given the broad impact these rules could have on the crypto industry, any opportunity, no matter how small it may seem, should not be ignored.

Chart of the Week

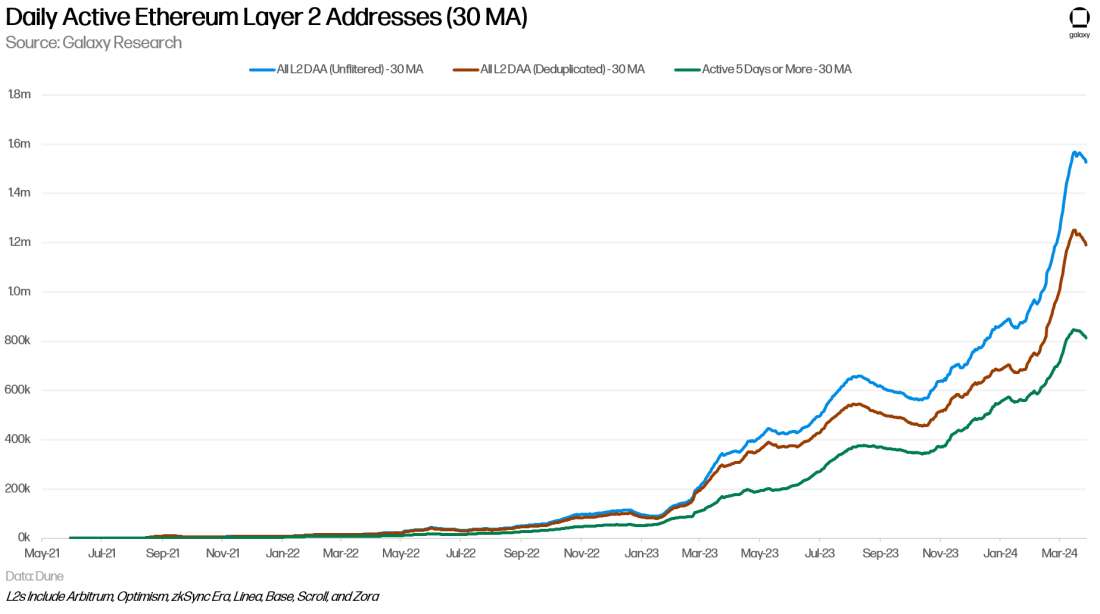

Last week, we noticed a record high percentage of addresses using multiple Layer 2 (L2) addresses per day, suggesting that the observed unfiltered daily active address data in L2 is inflated. The chart below further identifies the number of daily active addresses that have been active for the past five days or more. This pool of addresses is less mercenary and more representative of the core set of active L2 addresses.

Using the 30-day moving average (MA), there are 814,320 daily active addresses that have transacted for more than five days in their lifetime. In comparison, there are 11,900 deduplicated daily active addresses and 15,300 unfiltered daily active addresses (as of April 25, 2024) across the seven observed L2s. This highlights that 68% of deduplicated daily active addresses and 53% of the commonly cited unfiltered daily active addresses are more active.

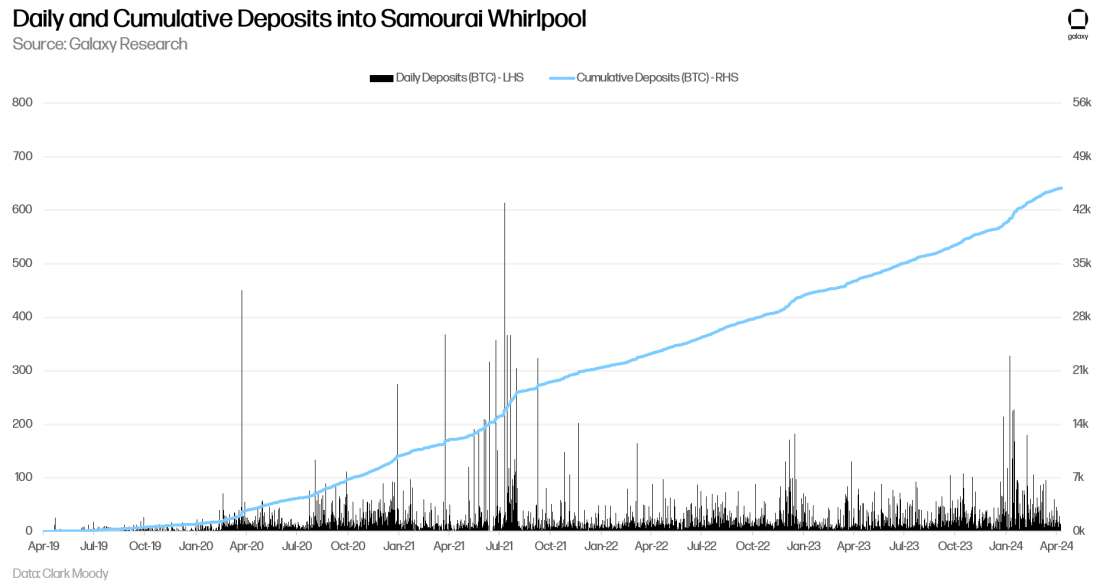

In addition, the founder of Bitcoin mixing service Samourai was charged this week with crimes including money laundering and unauthorized fund transfer. During its operation, the service received deposits worth 44,900 BTC, a total of $2.87 billion based on the market value of Bitcoin at $64,000, involving 79,700 individual transactions. The service accepted its first deposit in April 2019. (Data source: Clark Moody).

Other News

- Stripe has enabled USDC payments since this summer

- ViaBTC’s “epic satellite” from the fourth Bitcoin halving sold for 33.3 BTC (about $2.13 million)

- Worldcoin development team looks to partner with PayPal and OpenAI

- Franklin Templeton Launches Peer-to-Peer Transfers for its On-Chain U.S. Government Money Fund

- CryptoPunk sold for 4,000 ETH (about $12.41 million), becoming the sixth most expensive cryptocurrency in history

- Bitcoin mining difficulty rises for the first time since halving amid rune fee surge

- EU anti-money laundering bill finally passes vote

- Renzo’s ezETH drops 18.3% after Binance announces REZ token economics

- Samourai Wallet founder arrested by DOJ on federal money laundering charges