What is the truth behind Epstein's case? Let's examine Patrick Boyle's conspiracy theory: This isn't a simple 'sex scandal,' but a textbook example of the failure of elite power, money, and the system.

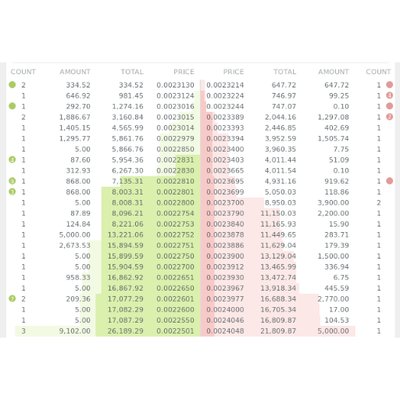

1. Epstein, a college dropout with no formal financial background, amassed hundreds of millions of dollars? The source was almost entirely through Les Wexner (owner of Victoria's Secret) entrusting him with real estate, airplanes, and a private island—this isn't financial advisory; it's clearly a shadow banking/money laundering channel.

2. After the DOJ released 3 million pages of documents (plus photos/videos) in 2026, the official narrative collapsed—no complete client list, no clear blackmail video, no hard intelligence evidence, yet the layers of red-acted descriptions and 'co-conspirators' were not investigated.

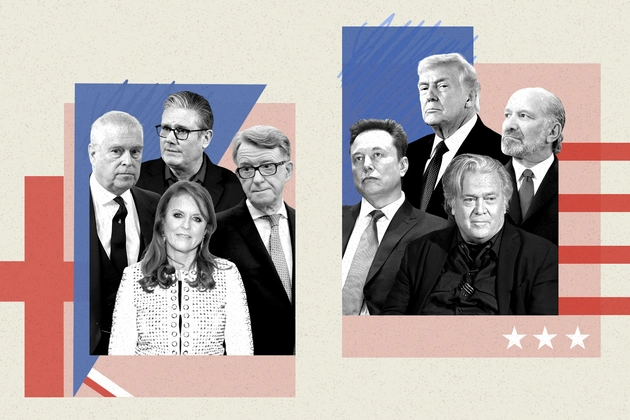

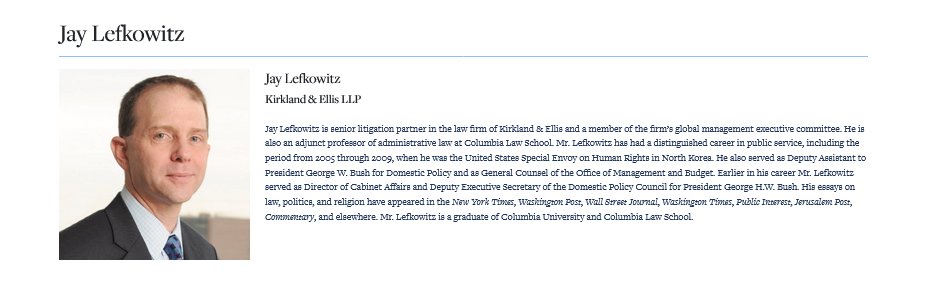

3. Ghislaine Maxwell's 2003 birthday book (238 pages, leather-bound) is even darker: handwritten letters from political and business figures/grotesque children's themes/sexual innuendo, far exceeding 'embarrassment,' resembling a pledge of loyalty or a blood oath. 4. The 2008 Acosta sweet deal ('He's intelligence, don't touch him') + Maxwell's father Mossad's background led Boyle to imply that Epstein was at least an intelligence broker/asset.

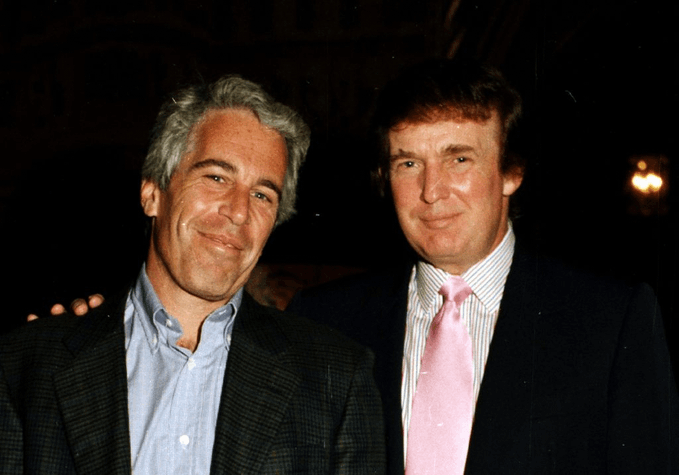

5. Documents expose a two-tiered justice system: ordinary people were convicted long ago, while elites only had their 'connections' exposed (Clinton's 26 flights, Gates' multiple meetings, old photos of Trump). Even more ironically, Boyle's analysis video was demonetized by YouTube (yellow label/soft censorship), proving that touching the truth is punished by the algorithm.

Conclusion? The Epstein case is a product of the system: a network of mutual guarantees among the powerful + regulatory capture + institutional failure. Unclear source of funds + layers of cover-up + intensified censorship = a perfect closed loop.

This is not a conspiracy theory, but financial reality.