This bear market is behaving at a completely different pace than previous ones.

Bitcoin has fallen 50% from its high, but the S&P 500 has only retreated less than 3% from its all-time high.

How unusual is this? Let's take a look back at history.

December 2018: Bear Market Bottom

BTC retreated 84% from its high, while the S&P 500 retreated 20% from its high, just hitting the threshold of a bear market. The panic selling on Christmas Eve was the most panicked moment since 2009.

November 2022 Bear Market Bottom

BTC has retreated 78% from its high. At that time, the S&P 500 retreated 25% from its high, marking its worst year since 2008.

Have you noticed the pattern?

In the two previous Bitcoin bear markets, the S&P 500 had already fallen by 20-25%, reaching a relatively low point in the long term. But this time, Bitcoin has already halved in value, while the S&P 500 has only retraced 3% from its recent high.

This level of deviation has never occurred before in history.

If you look closely at Bitcoin's chart, you'll notice something very strange. Since October of last year, Bitcoin seems to have lost its magic.

When US stocks rise, BTC doesn't follow. When US stocks dip slightly, BTC plummets.

So what exactly happened in October? Looking back, there were two major events.

First: The 1011 Incident

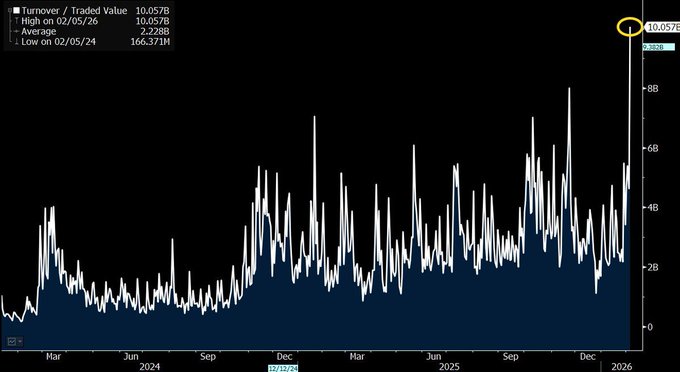

On October 10th, Trump announced a 100% tariff on China. The cryptocurrency market saw a $19 billion liquidation overnight, with 1.6 million accounts liquidated. BTC plummeted from $120,000 to $100,000. This was the largest single-day liquidation in cryptocurrency history.

Second: In the "Double Zhi Case," Chen Zhi and Qian Zhimin were arrested almost simultaneously. The US government confiscated 127,271 BTC from Chen Zhi. The British government seized 61,000 BTC from Qian Zhimin. In total, nearly 190,000 Bitcoins were deposited into government cold wallets.

What does 190,000 units mean?

In July 2024, the German government sold 50,000 BTC, which drove the price of BTC down from 70,000 to 50,000 within three weeks.

The total amount involved in this Shuangzhi case is nearly four times that of Germany. Given the precedent of Germany's cryptocurrency sell-off, the potential selling pressure of these 190,000 BTC is a ticking time bomb hanging over the market.

The Huione exchange behind Chen Zhi was crucial to the liquidity of the entire crypto market. When this empire was taken down, it was equivalent to a huge liquidity provider in the altcoin market suddenly disappearing.

The fact that Memecoin's total market capitalization halved from $80 billion to $47 billion after 10/11, and has not recovered to this day, is a microcosm of this event.

Over the past few months, we have generally heard the following sentiment: Bitcoin's market capitalization is already very large, and with the existence of ETFs, volatility will be relatively low, so the pullback in the bear market should not be as severe as in the past.

But now it seems that the impact of 1011 and the Shuangzhi case may be greater than we imagined.

So, back to the original question: Has it bottomed out? Is it time to buy the dips?

I don't know. But I do know one thing.

If history has any reference value, the bottom for Bitcoin usually doesn't appear until the US stock market also acknowledges its mistake.

Right now, the US stock market is still in the party.

The music hasn't stopped.