[1/3]

[Crypto and Traditional Finance News Roundup] 2026-02-07 16:00 (Beijing Time)

━━ Important News ━━

1. The China Securities Regulatory Commission (CSRC) issued and implemented the "Regulatory Guidelines for the Issuance of Asset-Backed Securities Tokens (RWA) by Domestic Assets Overseas". The CSRC issued the "Regulatory Guidelines for the Issuance of Asset-Backed Securities Tokens (RWA) by Domestic Assets Overseas" (〔2026〕No. 1) and it came into effect immediately. The guidelines implement strict supervision and a filing system for "issuing tokenized equity certificates (ABS-like tokens) overseas with domestic assets/cash flow as support". The guidelines require domestic filing entities to submit a filing report and a complete set of overseas issuance materials, and list various prohibited situations such as those involving national security, major criminal offenses, major ownership disputes, and negative lists.

(BlockBeats)

2. The US CFTC reissued an employee letter: limited revisions to the definition of "payment stablecoins," including the National Trust Bank.

The CFTC’s Market Participation Division reissued Employee Letter No. 25-40 with limited revisions, clarifying that the “national trust bank” can be an approved issuer of payment stablecoins, thus avoiding its exclusion by definition.

(Foresight News)

3. The White House will hold another discussion on "stablecoin yields" on February 10. It is expected that the first meeting between banks and industry organizations will be held at the staff level, but it is also expected that bank representatives and industry trade/association groups will attend together for the first time, with the topic focusing on "stablecoin yields".

(BlockBeats | Foresight News | Odaily | TechFlow TechFlow)

4. South Korean company Bithumb mistakenly "airdropped/transferred" 620,000 BTC, claiming to have recovered 99.7% and has restricted trading and withdrawals.

Bithumb disclosed that due to an internal operational error, a total of 620,000 BTC (approximately 2.95% of the total BTC supply) was mistakenly recorded/transferred to 695 customers. Trading and withdrawals were restricted for 35 minutes after the erroneous payment occurred. The company stated that no funds were transferred to external addresses and that 618,212 BTC (99.7%) has been recovered, along with approximately 93% of the 1,788 BTC equivalent that had already been sold. The incident has sparked controversy regarding "ghost balances/internal control vulnerabilities" at centralized exchanges, and South Korean regulators have reportedly intervened.

(BlockBeats | Odaily | TechFlow TechFlow | velo.xyz | BlockBeats)

5. The U.S. Office of the Comptroller of the Currency (OCC) has approved Erebor Bank's application for a nationwide banking license. The bank reportedly intends to provide services to technology companies in the AI, crypto, defense, and manufacturing sectors, as well as related high-net-worth individuals.

(TechFlow | Foresight News)

6. Arweave (AR) Network Anomaly: No new blocks produced for more than 24 hours. Block explorer data shows that Arweave has not produced any blocks for more than 24 hours, with the last block height being approximately #1,851,686 (11:18:15 Beijing time on February 6).

(BlockBeats | Foresight News | TechFlow | ViewBlock)

7. On-chain monitoring: Trend Research nearly liquidated its ETH holdings and significantly reduced leverage, with estimated cumulative losses of approximately $747 million. Monitoring shows that Trend Research (owned by Yilihua) previously withdrew approximately 792,500 ETH from Binance (at an average price of approximately $3,267), and subsequently deposited back approximately 772,900 ETH at an average price of approximately $2,326, leaving only approximately 21,300 ETH on-chain; the estimated cumulative loss is approximately $747 million. Its lending positions have also decreased to only 2, with total debt of approximately $25 million (health coefficient approximately 1.38–1.58). Further monitoring indicates an address association with the entity labeled "BTC OG/Agent Garrett Jin".

(Foresight News | BlockBeats | Odaily | Foresight News)

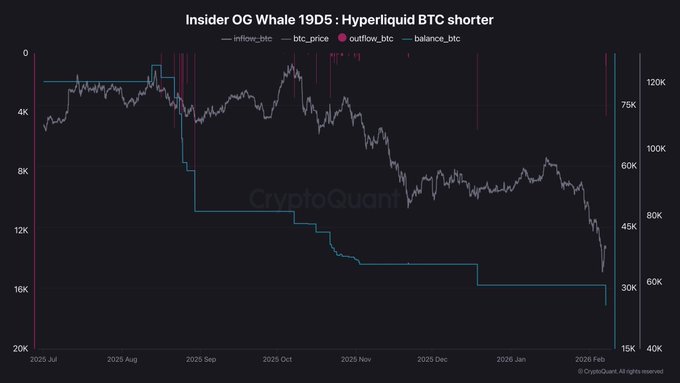

8. Institutional and On-Chain Fund Movements: BTC whale transferred funds to Binance; Circle issued 1.5 billion USDC on Solana in 9 hours.

On-chain monitoring indicates that "BTC OG/related whale" transferred 5,000 BTC to Binance in a short period of time, and another address deposited 1,599 BTC in 2 hours; at the same time, Circle issued 1.5 billion USDC on the Solana chain in 9 hours, and the cumulative issuance on the Solana chain since 2026 is approximately US$14.75 billion.

(BlockBeats | Foresight News | BlockBeats | BlockBeats | TechFlow TechFlow)

9. ETF Updates: BTC spot ETF saw net inflows of $330.7 million; ETH spot ETF saw net outflows of $21.3 million; 21Shares submitted an application for an Ondo (ONDO) ETF. The US BTC spot ETF saw net inflows of approximately $330.7 million yesterday (with IBIT contributing the most), while the ETH spot ETF saw a net outflow of approximately $21.3 million yesterday. Bloomberg ETF analysts and media information indicate that 21Shares has submitted relevant applications/documents for an Ondo (ONDO) ETF.