[2/3]

(TechFlow | BlockBeats | PANews | Foresight News | WuBlockchain | TechFlow(Arkham))

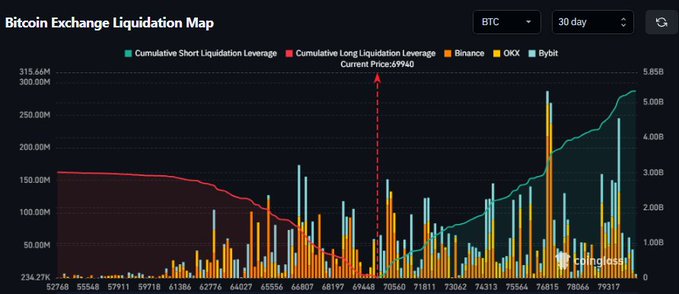

2. BTC/ETH spot prices experienced abnormal fluctuations in the early morning, with a single-minute amplitude exceeding 3% at one point; the Fear & Greed Index remains at "Extreme Fear".

Between 00:05 and 00:17, the price fluctuated by more than 1% per minute multiple times (some exceeding 3%), with a short-term surge in trading volume. Market speculation suggests this may be related to malfunctions in the grid trading strategies of some market makers; the index reached 7 (“Extreme Panic”). Meanwhile, data indicates that ETH 24-hour contract trading volume on Bybit reached $21.58 billion, a year-on-year increase of 354.01%.

(TechFlow | PANews | Foresight News | BlockBeats | Foresight News)

3. Bitwise advisor Jeff Park refuted the rumor of "removal of IBIT options position limits": The IBIT cap remains at 250,000 units. He stated that the rumor is untrue and that the proposed adjustment is to increase the cap for FBTC, ARKB, HODL, and Ethereum ETF from 25,000 units to 250,000 units to achieve fairness. He also believes that the recent selling pressure is more likely from non-directional "paper funds" such as TradeFi risk de-trading and derivatives hedging/market making, which can be verified through OCC data.

(TechFlow | Foresight News | BlockBeats | Odaily)

4. ETH/BTC On-Chain Fund Movements: Suspected institutional purchase of 20,000 ETH; new address withdraws 1,546 BTC; multiple whale purchases/withdrawals of ETH.

On-chain tracking shows that a new wallet, suspected to be BitMine, transferred 20,000 ETH (approximately $41.67 million to $41.98 million) from Kraken; another newly created address withdrew 1,546 BTC (approximately $106.68 million) from Binance. Meanwhile, a whale was observed withdrawing 60,784 ETH (approximately $126 million) from Binance within 30 hours, and another address increased its holdings by 53,544.2 ETH (at an average price of approximately $2,074.4) in 24 hours, accumulating a total of 63,784.8 ETH since February 1st.

(BlockBeats | TechFlow | PANews | Odaily | TechFlow | BlockBeats | Foresight News | TechFlow)

5. Macroeconomic/Interest Rate Expectations (CME): 23.2% probability of a 25bp rate cut by the FOMC in March; 32.5% probability of a cumulative 50bp rate cut throughout the year by the end of 2026.

In addition, the probability of a cumulative interest rate cut of 75 basis points throughout the year is 25.9%; the probability of no further interest rate cuts is 5.4%.

(BlockBeats | Cointelegraph)

6. Bitcoin mining: Difficulty decreased by 11.16% to 125.86T, the largest single decrease since the summer of 2021. Block height 935,424, difficulty decreased by 11.16%; the average hashrate over the past 7 days is 990.08 EH/s, and the total hashrate has decreased by about 20% over the past month.

(BlockBeats | Foresight News | Odaily)

7. Institutions and Opinions: Coinbase CEO emphasizes long-term bullishness; CoinDesk believes the pullback is more like a "sharp but short-lived" correction; Arthur Hayes opposes "conspiracy theories".

Brian Armstrong stated that the sharp fluctuations do not change his long-term view and believes that crypto is rapidly "eating up the financial services industry." CoinDesk analysts believe that BTC's nearly 50% pullback from its highs is more like a historically "sharp but short-lived" correction, possibly related to misinterpreting Fed signals, margin calls, and profit-taking. Arthur Hayes stated that the recent crash was not a secret conspiracy, and that derivatives do not create volatility but only amplify it in both directions, and that the lack of government bailouts will help clear excessive leverage more quickly.

(BlockBeats | Odaily | PANews | TechFlow | BlockBeats)

8. Forward Industries (FWDI) announced it will increase its stake in SOL "without leverage or debt" and plans to integrate other SOL financial companies.