Encrypted Breakfast | February 7th

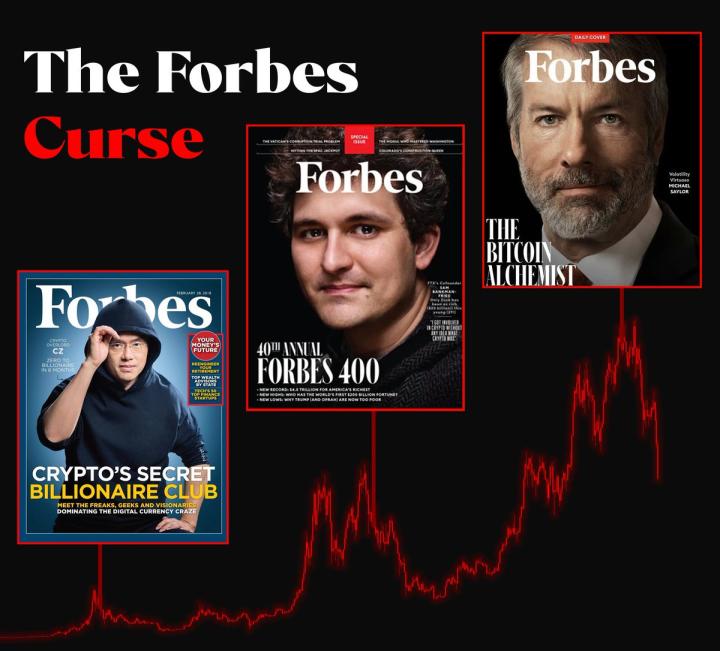

1. Bitcoin plummeted 15.48%, hitting a low of $60,000, marking its largest single-day drop since the FTX crash. This was due to a combination of institutional selling pressure and macroeconomic risk aversion, with the root cause being institutional deleveraging, which led to the continued decline in Bitcoin prices.

PS: Speculation that “the collapse of the IBIT hedge fund triggered a sharp drop in Bitcoin” continues to ferment, and partners of Dragonfly believe that the speculation is quite reasonable.

2. Over $2.5 billion in margin calls occurred across the internet, affecting 570,000 people, with long positions being the primary target. A market rally could only proceed after leverage was cleared out at 3:12 PM.

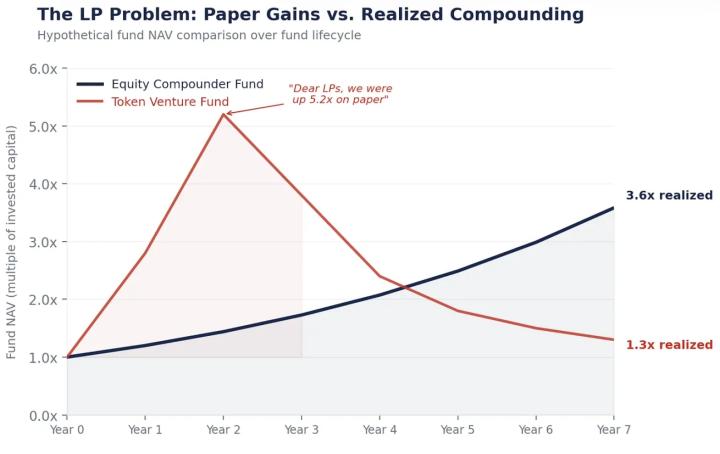

3. MicroStrategy reported a net loss of $12.4 billion in Q4 2025. The CEO stated that even if Bitcoin falls to $8,000, MicroStrategy will not collapse and will only buy more.

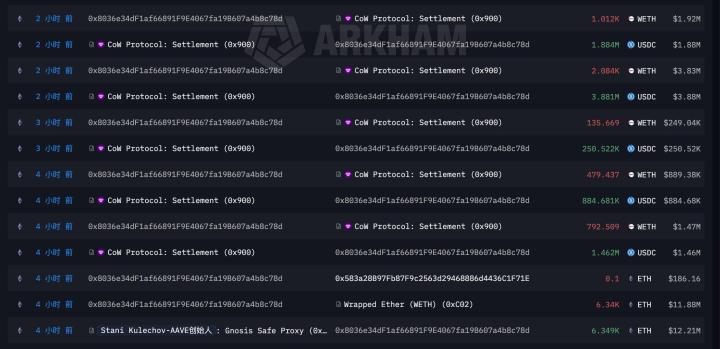

4. Vitalik sold 2,779 ETH (worth $6.22 million) in the past 3 days.

5. Bithumb mistakenly airdropped a large amount of Bitcoin to users, causing a short-term price drop on the platform. The world is a mess.

6. Tether makes a strategic investment of $150 million and integrates XAUT to explore the purchase of physical gold with stablecoins.

7. Pump.fun Acquired the cross-chain transaction terminal Vyper, and will gradually cease service starting February 10.

8. Binance SAFU Fund address has once again increased its holdings/transferred in 3,600 BTC (approximately US$233 million).

9. Hyperliquid ecosystem Perp DEX Trade.xyz: 24-hour trading volume reached a record high of $5.45 billion.

10. Glassnode: Bitcoin valuation has reached an all-time low, indicating that downside potential has been exhausted.

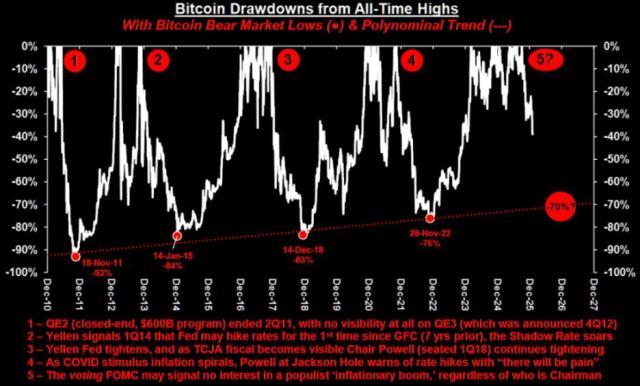

[Bitcoin Market Analysis] The Bitcoin Fear Index has fallen to 6, and the current "extreme fear" sentiment is unprecedented.

This round of decline was caused by institutional investors, so the abnormal decline has brought great panic to everyone. However, this panic also means that the market is close to the bottom.

Bitcoin is currently finding support around $60,000 on the 4-hour chart, and has rebounded by about 20% in the past 24 hours.

There are no ETF markets over the weekend, so the rebound is expected to continue. We'll know next week whether institutions have finished selling. If selling pressure decreases, market confidence will continue to recover.

Bitcoin's revolution in the financial market will not end, and the trend is irreversible. The short-term decline is simply due to increased leverage. Originally, there were no great expectations for this year, but this rare drop has actually increased my confidence in this year's market. The market is not without bear markets, but this bear market has accelerated.

[Risk Warning] Digital assets are highly volatile and carry extremely high risks. Please participate with caution, never go all in, and never use leveraged loans.