[2/3]

(Reuters | PANews)

Market Analysis

1. BTC and ETH rebounded from the sharp drop: BTC returned to the $67,000-$69,000 range, and ETH returned to around $2,000. Multiple platform quotes show that BTC rebounded and once stood above/broke through $69,000, while ETH returned to about $1,999-$2,002. The previous intraday low and the rebound range were inconsistent, indicating that volatility is still high.

(CoinDesk | TechFlow | Odaily)

2. Deleveraging continues: The scale of margin calls across the network varies, but all are at historically high levels.

CoinGlass statistics show that approximately $2.242 billion in liquidations occurred in the past 24 hours; CoinAnk statistics show approximately $1.662 billion. The difference stems from the exchange sample and statistical methods used.

(TechFlow | PANews)

3. Trend Research is massively selling/transferring ETH to reduce leverage and repay debts. On-chain monitoring points to continuous selling pressure. Multiple monitoring sources indicate that it is related to leveraged positions on Aave. In the past few hours/15 hours, there have been multiple concentrated transfers to Binance (such as 20,000 ETH, 30,000 ETH, etc.), and there are different estimates that "more than 410,000 ETH have been sold since February 1, with a total loss of about $700 million". Overall, it points to the fact that institutional deleveraging is still underway.

(TechFlow | BlockBeats | PANews)

4. On-chain Fund Flows: BlackRock and Grayscale-related addresses transferred BTC/ETH to Coinbase Prime, sparking discussions about "redemption/rebalancing or potential selling pressure." Monitoring shows that BlackRock-related addresses deposited approximately 3,948 BTC and 5,734 ETH into Coinbase; Grayscale also saw approximately 1,364 BTC transferred into Coinbase Prime. These transfers need to be assessed in conjunction with ETF redemption and market-making processes.

(TechFlow | Odaily)

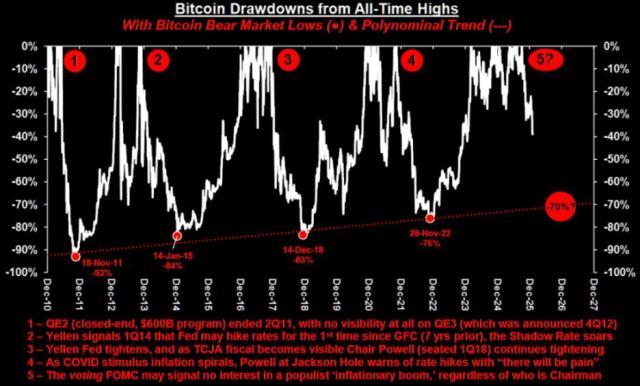

5. Indicators and Institutional Views: Glassnode and CryptoQuant have indicated that the market is currently in a "period of extreme/near the end of a bear market," but a rebound still needs time to be confirmed.

Glassnode stated that BTC's "Yardstick" has hit an all-time low, which historically often corresponds to a narrowing of downside potential. CryptoQuant mentioned that the loss-making BTC supply is close to the level at the end of the last bear market, and some opinions suggest that the lack of a substantial rebound could trigger a chain reaction of forced selling.

(BlockBeats | BlockBeats | PANews)

6. Macroeconomic and Risk Appetite: Michigan consumer confidence rebounded and inflation expectations declined; volatility in safe-haven assets (gold/silver) intensified. The University of Michigan's preliminary February consumer confidence reading was 57.3, higher than expected; the preliminary 1-year inflation expectation reading was 3.5%, lower than expected; during the same period, gold rose to nearly $4,960/ounce, and silver also experienced significant fluctuations, indicating cross-asset deleveraging and linkage risks.

(TechFlow | Odaily | PANews)

━━ Project Updates ━━

1. ENS halts proprietary L2 “Namechain” development: ENSv2 will be directly deployed on the Ethereum mainnet.

ENS stated that the Fusaka upgrade is expected to significantly reduce registration costs after increasing the gas limit, and has opened a public alpha test for the new version of the ENS App/Explorer.

(Foresight News)

2. Ronin: Saigon testnet has completed its migration to Ethereum, and the mainnet is planned to be upgraded to Ethereum L2 in the first half of 2026.

The upgrade window points to Q1–Q2 of 2026, reflecting the convergence of the game chain towards the Ethereum Rollup route.

(BlockBeats | Foresight News)

3. Polymarket's parent company has applied for the "POLY/$POLY" trademark. Executives have confirmed plans to issue native tokens and airdrop the trademarks to cover financial and crypto market software, tokens, and platform services. The timeline for the tokens has not yet been disclosed.

(The Block | Odaily)

4. Relay Protocol completes $17 million Series B funding round: plans to launch "instant cross-chain settlement" Relay Chain.

Archetype and USV led the investment, focusing on cross-chain settlement infrastructure.

(PANews)

5. Strategy discloses it will launch a "Bitcoin security plan" to address quantum uncertainty.

Saylor stated that it will collaborate with the cybersecurity/cryptography/Bitcoin security community to advance the project, viewing it as a long-term engineering challenge rather than an immediate threat.

(CoinDesk | TechFlow)

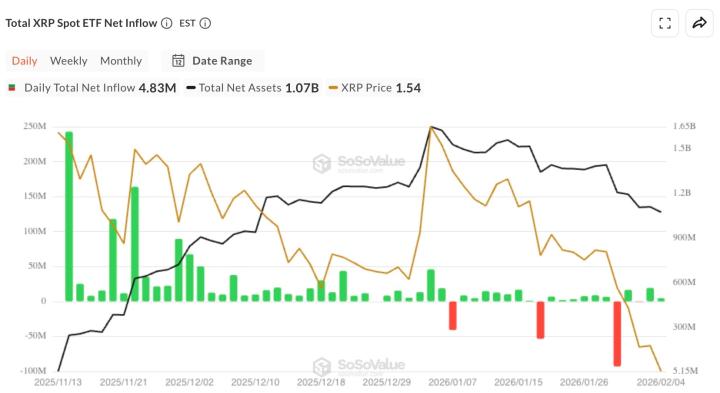

6. Ripple releases XRPL institutional-grade DeFi blueprint: positioned as "regulated real-world finance"

It emphasizes recent upgrades and upcoming features to promote the adaptation of XRPL in institutional scenarios and compliant financial infrastructure.