Compiled by: Felix, PANews

Original Title: A Must-Read for Beginners: Five Trading Secrets Shared by Experienced Traders

Trader Lin recently shared her trading insights, including technical analysis, risk management, and psychological factors, which are suitable for novice traders or those who frequently suffer losses. Details are as follows.

Go with the flow

Strong upward trends often yield substantial profits. You should always trade with the trend. As the old saying goes, "The trend is your friend." This is absolutely true. Investing is a game of probability. Therefore, you need to maximize your odds of winning.

Buying stocks in an uptrend is like sailing with the wind; everything feels easier. The faster and longer the market rises, the easier the progress. When you're with the wind, even a small push can bring huge gains. That's why everyone feels like a genius in a bull market.

So, how do we identify trends?

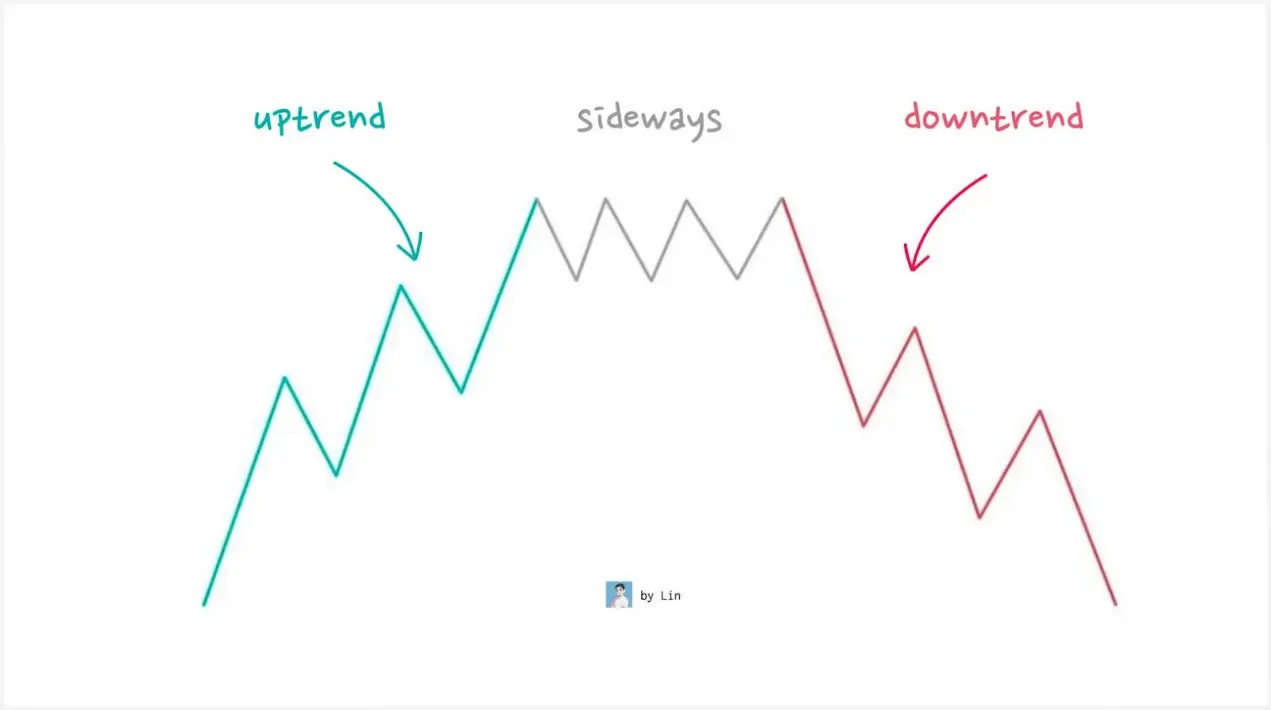

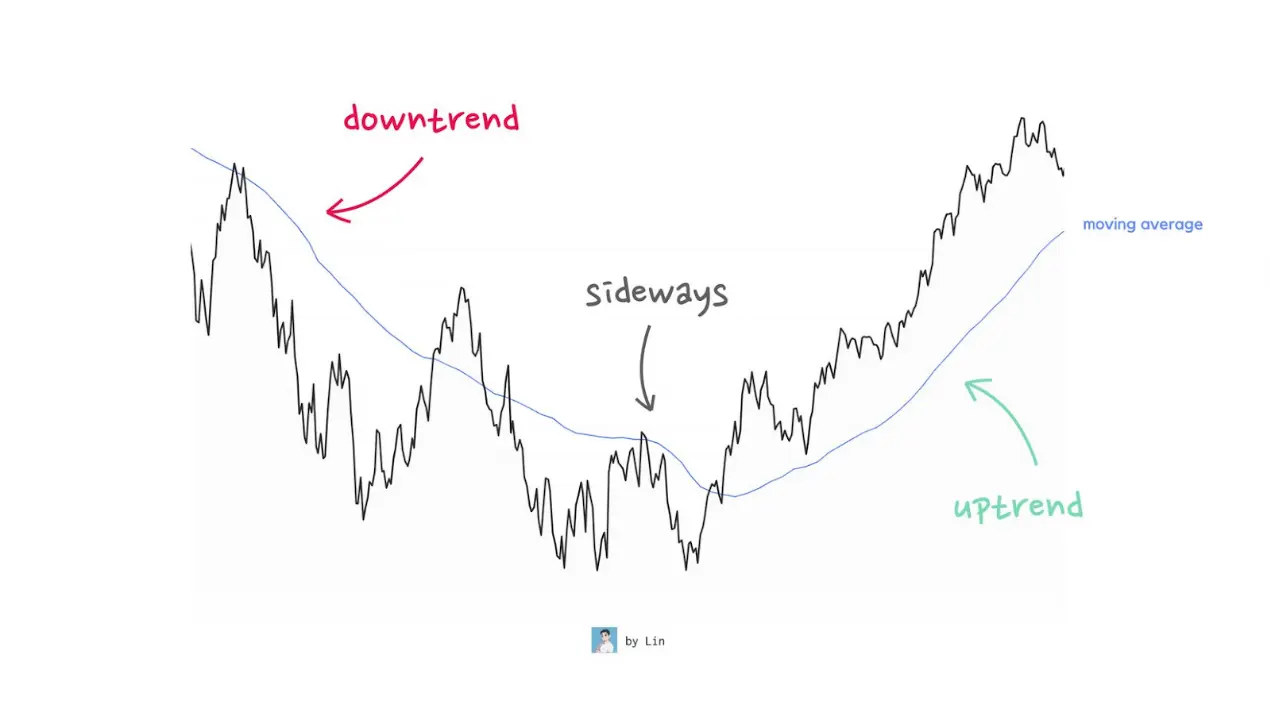

Identifying the direction of a trend typically takes only a few seconds. A trend is simply the overall direction of data points in a time series. Let's look at an upward trend:

First, the chart extends upwards from the bottom left corner.

Secondly, there is a series of higher highs and higher lows.

Of course, the same applies to a downward trend.

To identify these trends, you can also use simple tools such as trend lines or moving averages to help you determine the overall direction.

Importantly, different timeframes exist in the market.

The market may decline in the short term but remain in an upward trend in the long term. Alternatively, the market may perform strongly in the short term but weaken in the long term. You need to choose a timeframe that suits your strategy.

Day traders focus on hours and days, swing traders look at weeks, and long-term investors focus on years. Your profit opportunities are greatest when all timeframes (short-term, medium-term, and long-term) are aligned.

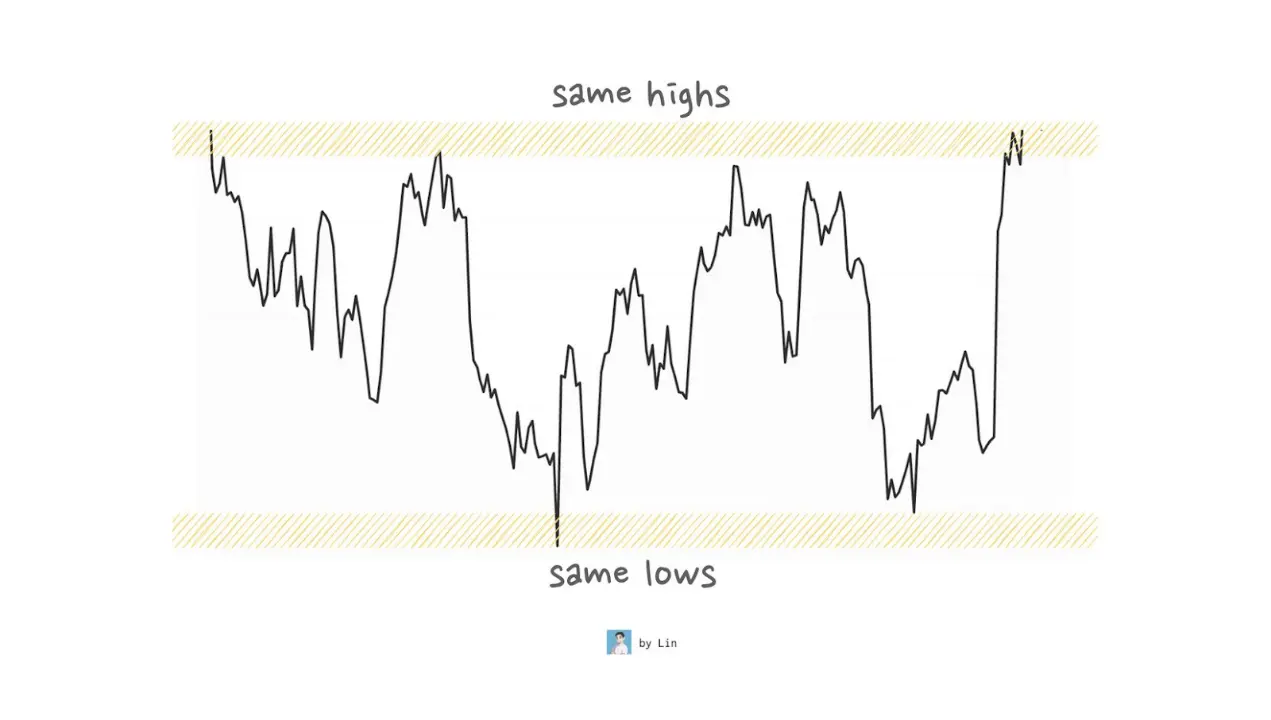

Most of the time, the market lacks a clear trend. Only a small fraction of the time does a clear, strong trend emerge. The rest of the time, the market moves sideways.

For active investors, sideways-moving markets are the most dangerous. They lack clear direction, are extremely volatile, and experience failed breakouts and pullbacks. You'll be repeatedly tossed around. Just when you think the market is about to move in your favor, it hits a wall and reverses course.

Of course, if you have a shorter trading timeframe, you can profit from these fluctuations. But for most people, doing nothing is often the best option in this situation.

But overall, the big money was made during strong upward trends. There are two main reasons for this:

First, stocks in an upward trend tend to continue rising: when a stock is already rising, the probability of it continuing to rise is greater than the probability of it suddenly stopping. Market sentiment is optimistic. Everyone is only focused on the upward movement.

Secondly, there is usually little or no selling pressure from above: this means that most people holding the stock are already in a profit. They are not in a hurry to sell. With fewer sellers, the price is more likely to rise.

However, not all trends are the same. Some trends are slow and steady. Others are fast and steep. The steeper the trend, the stronger it appears. But everything has its advantages and disadvantages.

Stocks that rise rapidly are more vulnerable. When prices rise too quickly, they become overbought. This makes them more susceptible to sharp pullbacks or sudden reversals. So strong trends are powerful, but also require caution.

The goal is to ride the wave while the trend continues, but nothing lasts forever.

Focus on leading sectors

After identifying the overall market trend, it is necessary to find the leading sectors. Their importance is self-evident.

Investing is a game of probability; you want as many factors as possible to work in your favor.

Ask yourself, would you buy stock in a newspaper company today? Probably not. Few people read print newspapers anymore. Everything is online. The market isn't expanding; it's shrinking. Demand is naturally declining. Finding and retaining customers has become harder. Retaining good employees is also harder. Employees are less willing to join an outdated, stagnant industry. These are all natural headwinds.

Now let's look at the opposite situation.

Artificial intelligence is one of the most dynamic industries today. Everyone wants to work in AI. It has a natural appeal. Talent, funding, and attention are all flowing in the same direction, making development much easier.

A leading industry is like the rising tide, capable of supporting all ships. Not everyone benefits equally, but the overall trend is important.

Ideally, the entire industry should be thriving. If all companies except one are performing poorly, it often means that the industry has peaked or is about to decline.

Of course, no trend lasts forever. Some industry trends can last for decades, while others only last a few days. The key is to grasp the big trends.

The major trend is long-term transformation that is reshaping industries. Examples include railways, the internet, mobile technology, and now artificial intelligence.

The boom-bust cycle refers to a brief peak followed by a sharp decline. Examples include SPACs (Special Purpose Acquisition Companies) and influencer stocks.

Cyclical trends rise and fall with economic fluctuations. Oil and natural gas are a good example, with their prices fluctuating with demand and economic growth.

Buy the "leading stocks" at the market bottom.

Once you've identified the overall trend and the leading industries, you can buy into the leading companies. The reason is simple: most people want the best, which is human nature.

Just look at the sports world. Everyone talks about the World Cup champion or the Olympic gold medalist. News headlines, interviews, sponsors, and history books all focus on the first place. Few people remember who came in second. The winners get all the attention, money, and status.

For a simple example:

Who is the fastest man on Earth? Usain Bolt. Who is the second fastest? Most people don't know. In fact, Bolt isn't much faster than the second-fastest. But nobody really cares about second place. It's all about the best, the fastest, the winner.

The same applies to business and investment. Winners receive the most attention. They attract more clients, talent, and funding. Success is self-reinforcing, making it easier to stay number one.

For a company, this means your product will be compared to others. Employees want to work for the best companies. Investors want to invest in the best, not the second best. This advantage may seem insignificant at first glance, but over time, these small advantages accumulate and eventually have a huge impact. That's why winners keep winning.

Every industry has a market leader:

The smartphone industry is dominated by Apple.

In the search engine field, it's Google.

Large-scale language models are from OpenAI.

The graphics processor is Nvidia.

These industry leaders are far ahead of other companies in the competition.

What makes a market leader? A large and growing market share, rapid revenue and profit growth, a strong brand, continuous innovation, and a top-notch founder (team).

When to buy leading stocks? Buy when the market is in an uptrend and the stock breaks out of its bottom. The reason is simple. Investing is risky, and many things can go wrong. You can't eliminate risk, but you can reduce it.

There are several ways to do this: do thorough research, capitalize on market uptrends, focus on strong companies, and buy at the right time.

Timing is more important than most people realize. Buying at the right time reduces entry risk. It also lets you know clearly when problems might arise. If the stock price falls below your purchase price or a key support level, that's a signal you should exit or cut your losses. A good purchase price helps define your selling price. And having a clear selling price is crucial for managing risk.

Buying a stock when it breaks out of a bottoming pattern is generally less risky. A bottoming pattern is simply a period of sideways movement and consolidation for the stock. It's accumulating energy. When it breaks out, the trend is in your favor. Momentum strengthens. There's less selling pressure above, making it easier for the stock to rise.

You're not guessing; you're reacting to market strength. That's how you increase your odds of winning.

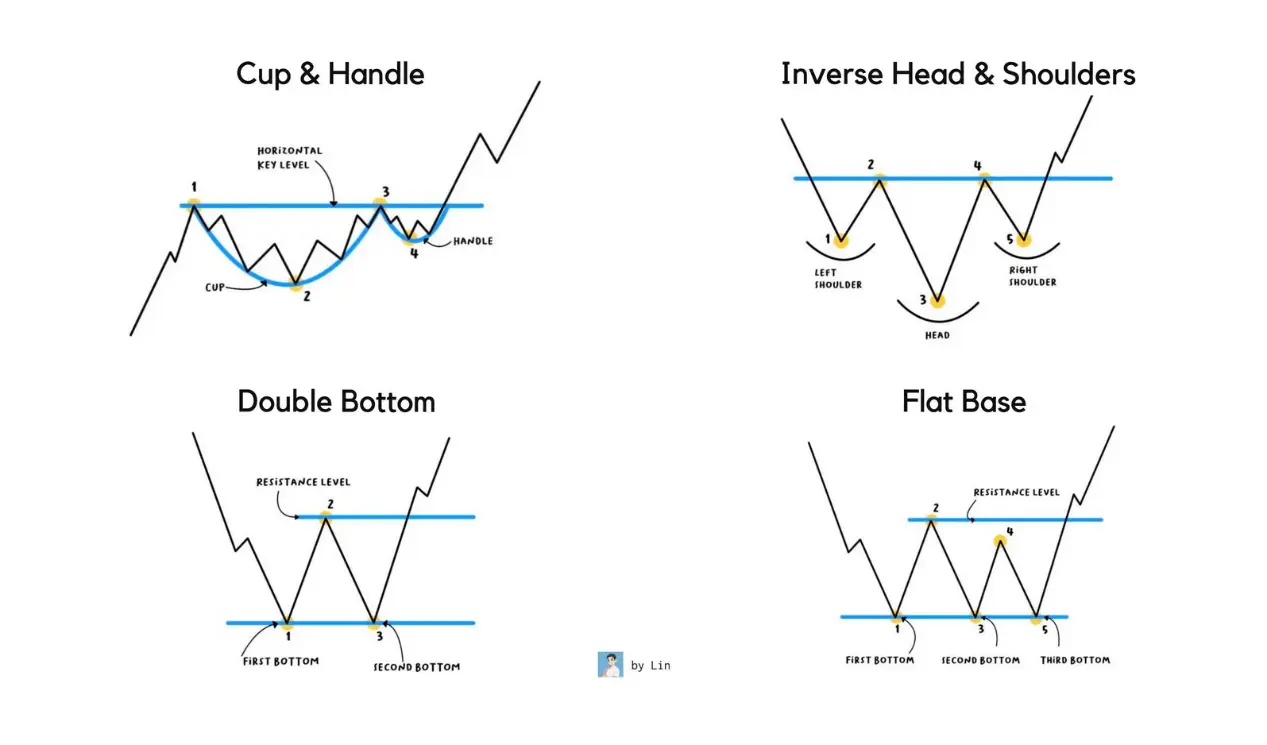

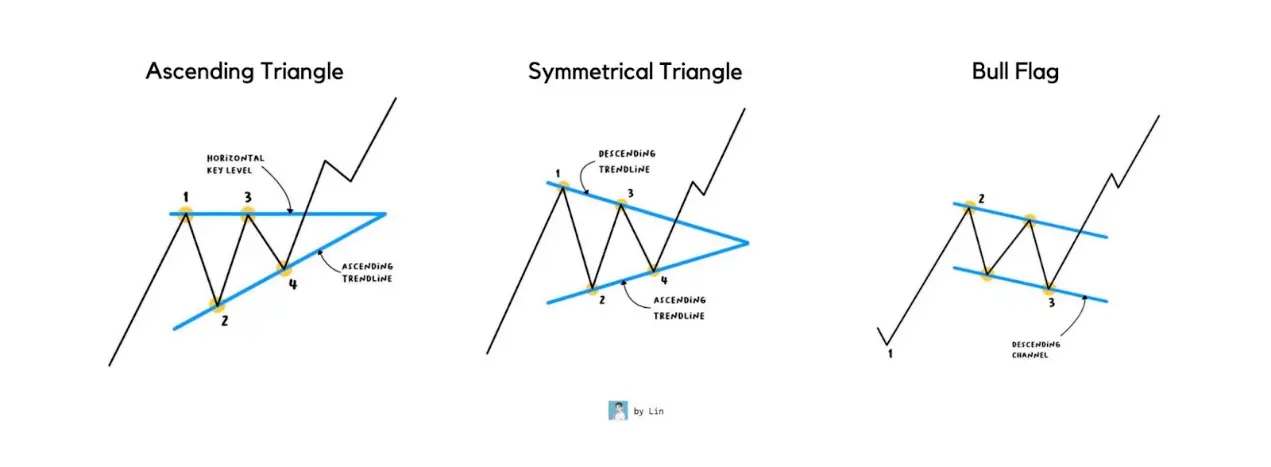

There are several different types of bottom formations. Some of the most common formations include:

Cup handle shape

flat bottom

Double Botto pattern

Reverse head and shoulders pattern

These patterns typically appear at the beginning of a new wave of market movements or trends.

When a stock price rises and then stagnates, these bottoming patterns are called continuation patterns. The most common continuation patterns are the flag and the triangle.

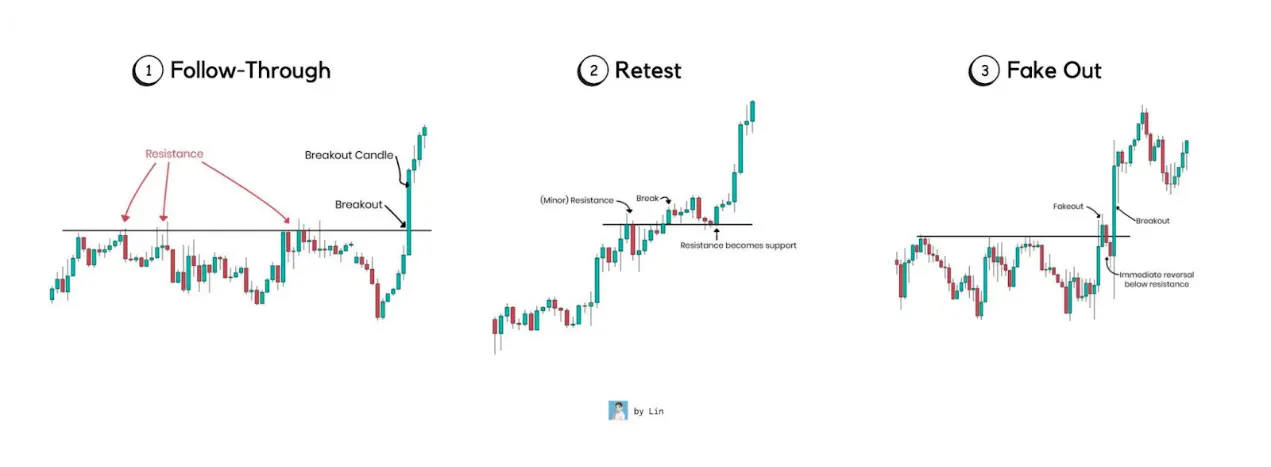

In addition, you can control risk. When the stock price breaks through, the following three scenarios may occur:

The stock price continued to rise.

The stock price pulled back and retested the breakout area.

The stock price failed to break through resistance, and early buyers are now trapped.

Breakthroughs don't always work. The failure rate can be high. You need to be prepared to make mistakes frequently.

Most breakouts fail because of market weakness, the stock not being a true leader, or large institutions selling off. This is why risk management is so important.

You must always prepare for the worst. You must limit downside risk and set a clear stop-loss point.

Accepting losses is hard; nobody likes admitting they're wrong. But refusing to cut small losses can turn small problems into big ones. Most big losses start as small ones. They grow bigger because people hesitate, hoping to exit at breakeven.

Remember this: if the stock price rebounds, you can buy it back at any time.

Protecting your downside risk is crucial to staying in the game. That's why taking control of your winnings is so important.

Here's another tip: pay attention to trading volume.

Breakouts with high trading volume are stronger and less likely to fail. High volume indicates that large investors are buying in, and these large investors leave traces.

Big players find it difficult to hide their actions. They can't buy all their positions at once; they need to accumulate gradually.

Keep your profitable stocks rising.

Fundamentally, the essence of investing is that profits must exceed losses. Everything else is unimportant. This is something many investors overlook.

They believe success comes from finding cheap stocks or chasing the hottest stocks. Price-to-earnings ratios, moving averages, competitive advantages, and business models are just pieces of the puzzle. All of these can help. But none of them alone guarantee success.

What really matters is:

How much money can you make when you make the right judgment?

How much money will you lose if you make a wrong judgment?

This applies equally to day traders and long-term investors. The only real difference between them is the time frame. The principle is the same.

The most important lesson here is: you will make mistakes, and you will make a lot of mistakes.

Investing is a game of probability. Even if you believe it can't fall any further because it's cheap, or you believe it will definitely rise because all the fundamentals are improving, you can still make mistakes.

A good rule of thumb is to assume that you have a maximum accuracy rate of 50%.

Consider that Michael Jordan missed roughly half of his shots. Yet he's still considered the greatest player of all time. You don't need to be right every time to reap huge rewards.

This can happen even when the market is doing well.

When the market is down, things get even worse. Sometimes your accuracy rate is only 30%. That's normal.

Mistakes are not failures. They are part of the process. Once you accept this, everything changes. Your focus shifts from striving for correctness to managing results.

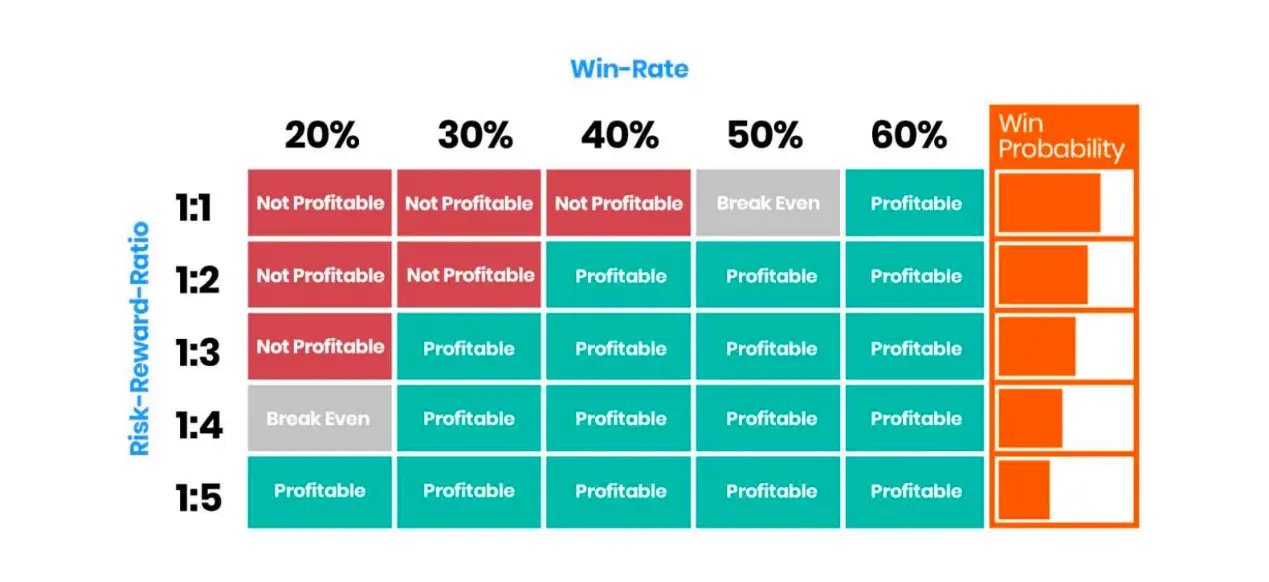

This simple table clearly illustrates this point.

It illustrates the relationship between win rate and risk-reward ratio. Let's say your win rate is only 30%. In this case, your profits must be more than twice your losses to break even. To truly profit, profits should be around three times your losses. At this point, your strategy starts to work.

The goal is to incorporate failure into your strategy.

A 50% win rate sounds good, but it's unrealistic in the long run. Markets change, and situations can worsen. That's why your strategy needs to work even in adverse environments.

Starting with a 30% win rate and a 3:1 risk-reward ratio is a good starting point. You can adjust it later. But if you don't know where to begin, start here.

So, what does this mean in practice?

Many investors believe that buy and hold means never selling. This is only half true. You should buy and hold profitable stocks, not losing stocks.

You can never predict how much a profitable stock will rise. Sometimes it's 10%, sometimes 20%, and in rare cases, it could even reach 100% or higher. Of course, if your investment logic fails, or the fundamentals or technicals deteriorate, you'll definitely want to cut your losses. But you should try to hold onto profitable stocks as long as possible.

To know when to cut your losses, you need to calculate your average returns. Assuming your average return is around 30%, then to maintain a 3:1 risk-reward ratio, your average loss should be around 10%.

There are many ways to do this. You can adjust your position size, or sell in stages, such as selling at -5%, -10%, and -15%. On average, if you sell one-third each time, your loss will still remain around 10%.

The specific method is not important; what matters is the principle. Large profits require paying the price of many small losses. Small losses can protect you from disaster.

Quick stop loss

Once you've bought a stock, the only thing you can truly control is when to exit.

You can't control how much it will rise, when it will rise, or even whether it will rise at all. The only real choice you can make is how much loss you are willing to accept.

Sometimes bad things happen: a company releases a terrible earnings report, bad news comes out, and the stock price gaps down overnight. Even if you do everything right, you can still suffer a major blow. It's part of the game. You can't completely avoid it.

Holding onto losing stocks is dangerous. The longer you hold them, the greater the potential losses. The goal is to exit as early as possible while still allowing the stock sufficient room for normal fluctuations. Stocks go up and down every day. You shouldn't sell just because of a small dip.

Yes, sometimes stock prices gap down, triggering your stop-loss order, and then rebound. This does happen. However, the last thing you want is for the stock price to fall, you wait for it to rebound before exiting, but it continues to fall.

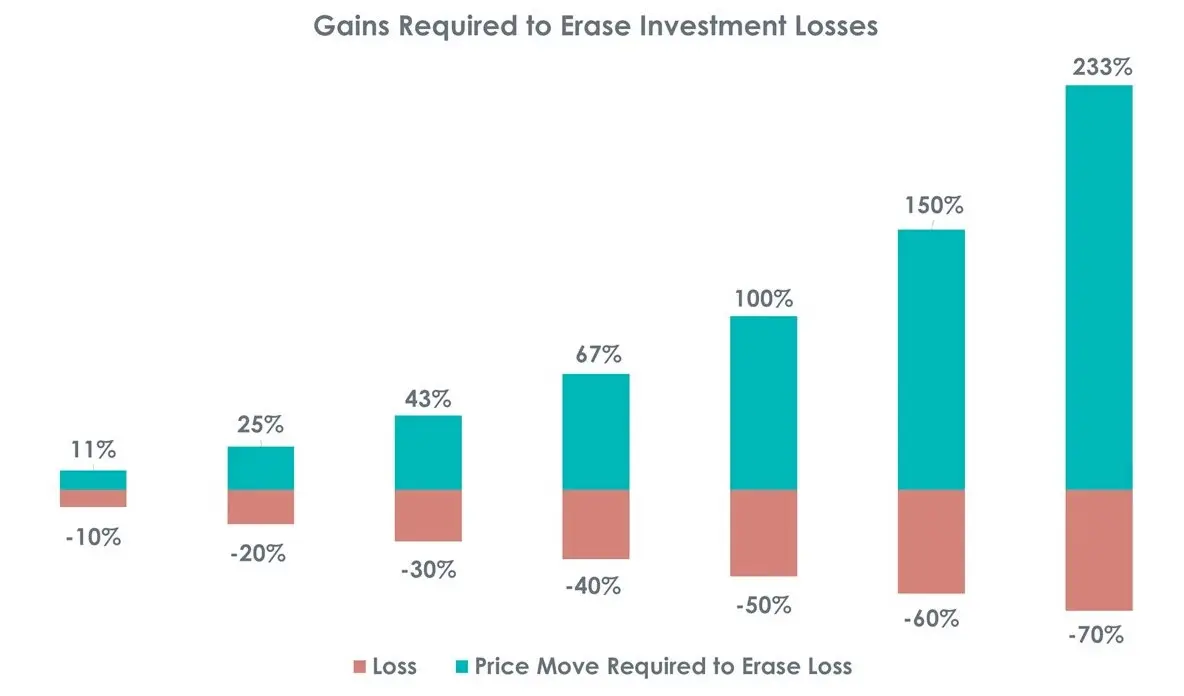

Every great loss begins with a small one. And the greater the loss, the harder it is to recover.

A 10% loss requires an 11% gain to break even.

A 20% loss requires a 25% gain.

A 50% loss requires a 100% gain.

That's why protecting against downside risks is so important.

Stopping losses is difficult. As long as you hold a position, there's still hope. Hopefully, it will recover. Hopefully, you're right in the end. Hopefully, you won't look foolish.

It's painful to suffer losses. It's painful to admit mistakes.

Research shows that people need twice the gain to make up for a loss. In other words, the pain of a loss is twice that of a gain.

Because as long as the position remains open, the loss isn't finalized. There's still a chance for a rebound. There's still a chance to prove you right. But once you sell, the loss becomes real, and the mistake becomes permanent. But you need to accept the loss; it's part of the process.

No one can be right all the time. Investing is always fraught with uncertainty. Investing is not about striving for perfection, but about making more money than you lose over a period of time.

Cut your losses as early as possible. Holding a losing position usually means something went wrong, such as poor timing, incorrect stock selection, or an unfavorable market environment.

Furthermore, there is opportunity cost. If funds incur losses, they cannot be used for other investments. These funds could have been used more effectively in other areas. Learning to cut losses quickly is one of the most important skills in investing.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush