Monero (XMR ) has just reached a new all-time high of $598. Monero 's market Capital has surpassed $10 billion for the first time. Many analysts remain optimistic about XMR 's growth potential and believe this trend is only just beginning.

Veteran trader Peter Brandt also expressed optimism when comparing the price volatility of XMR to that of silver.

Could Monero become the "silver" of the crypto market?

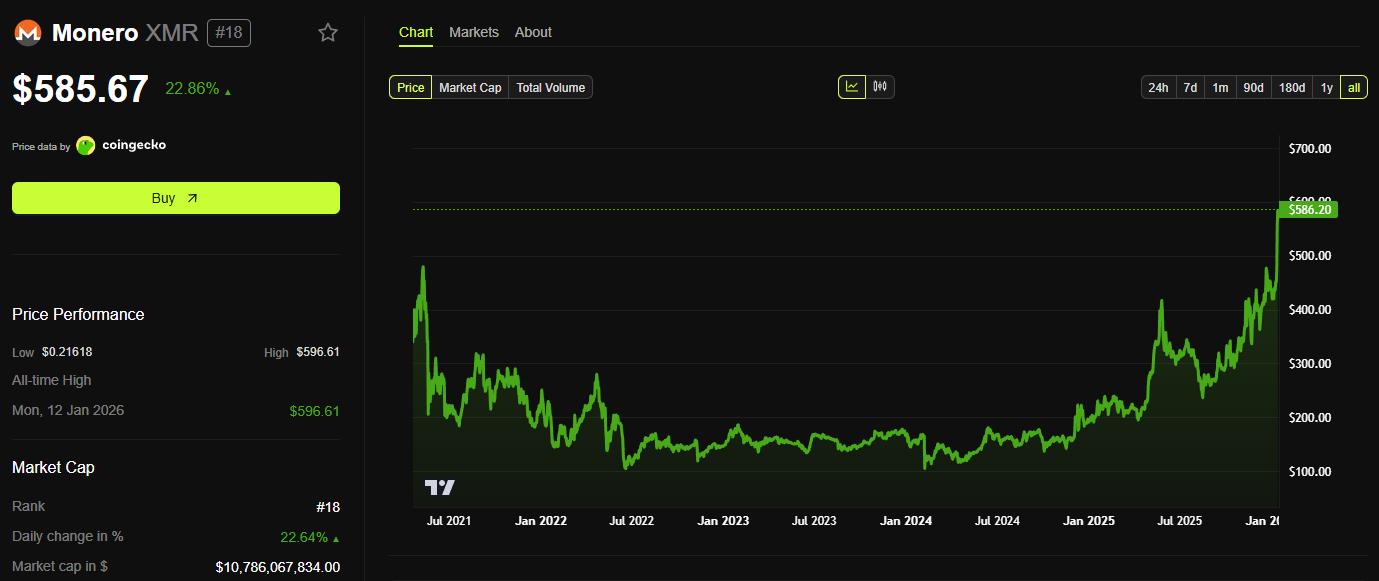

On January 12, 2024, price data from BeInCrypto showed that Monero (XMR) had increased by more than 30% since the previous Saturday. XMR was trading above $585, and its market Capital had exceeded $10.7 billion.

Monero (XMR) price performance. Source: BeInCrypto

Monero (XMR) price performance. Source: BeInCryptoVolume also surged to over $300 million, the highest level in the past month. As a result, XMR surpassed the previous cycle's peak ($515). Many analysts believe the upward trend could continue.

“The price continues to rise very strongly. XMR is breaking through many resistance levels with almost no correction. The price structure is heavily skewed towards an uptrend. Buyers are consistently entering whenever the price dips slightly, and there are still no clear signs of distribution,” according to Chia by 0xMarioNawfal.

Peter Brandt compared the price volatility of XMR to the historic breakout of silver. He observed the monthly chart of XMR and the quarterly chart of silver.

Both currencies had two major peaks that formed a long-term resistance line. Silver then broke through this resistance line and formed a very strong bullish candle, also known as a "god candle".

As usual, Brandt did not provide a specific price target for XMR. However, this comparison implies that if XMR breaks through the resistance line on the monthly chart, a similar "god candle" could very well appear.

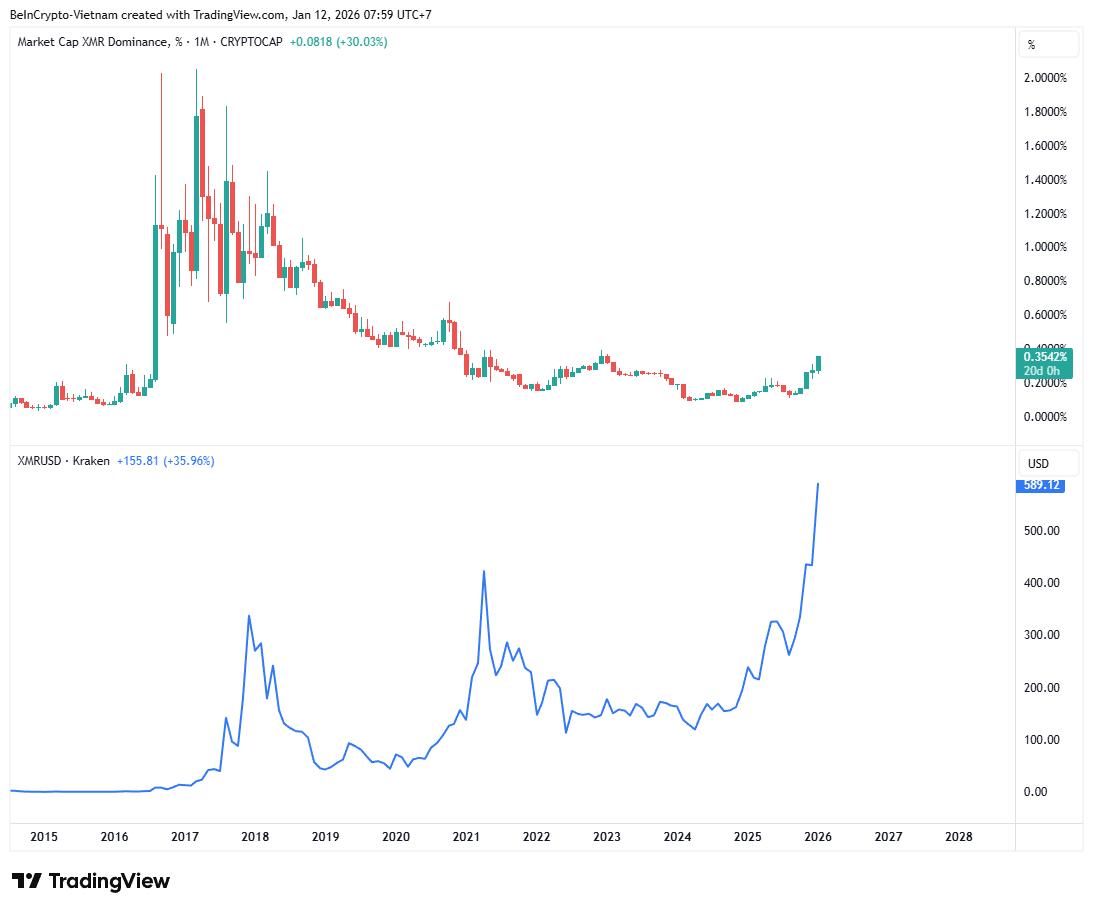

XMR dominance also reached its highest level since 2023. This index represents the proportion of XMR in the total crypto market Capital .

XMR price and XMR Dominance. Source: TradingView

XMR price and XMR Dominance. Source: TradingViewXMR price has reached an all-time high, but dominance remains relatively low. This combination suggests significant upside potential. Money may shift from other altcoins to XMR.

Monero could attract attention amid geopolitical tensions.

There are several reasons why Monero could outperform in 2026. A recent report by BeInCrypto highlighted at least three key drivers . These include increased security demand due to stricter tax controls, coupled with a shift in investor confidence following the disappointing performance of the Zcash team .

Geopolitical tensions could also be a major boost for XMR.

Tether recently froze over $182 million USDT across five TRON wallets linked to illicit financial activities. According to a report published by TRM Labs, the USDT on TRON was used in financial transactions related to Iran's Islamic Revolutionary Guard Corps (IRGC). Over $1 billion was transacted through companies in the UK.

Iran has also used more than $2 billion in cryptocurrency to fund proxy forces and circumvent sanctions.

When non-privacy stablecoins or altcoins are tracked and easily frozen, funds tend to flow to safer channels. In that context, Monero has the potential to become a preferred choice .