With the rapid development of the digital economy, artificial intelligence is undoubtedly one of the most innovative and promising fields today. Many AI entrepreneurs and programmers have devoted themselves to it, full of enthusiasm and technological dreams. However, seemingly innovative business models may also harbor many unnoticed legal risks.

This case will delve into the legal risks that AI entrepreneurs, programmers, and technical teams may face when engaging in fintech, quantitative trading, and other fields, using Shanghai's first case of illegal stock recommendations using an "AI stock trading robot," and will offer compliance advice.

I. This article is written by lawyer Shao Shiwei.

1. Shanghai's first case of illegal operation of AI stock trading software: Company controller sentenced to seven years and nine months in prison.

Case Summary:

Without approval from the relevant authorities, Company S operated the "XunDong Quant" online platform to promote its stock trading products, such as "Range Arbitrage" and "DIY Stock Trading Robot," to clients, and provided them with securities consulting services, including stock buying and selling opportunities and recommendations for specific stocks. The total profit amounted to over RMB 30 million [i].

After trials in two courts, Zhong, the actual controller of Company S, was sentenced to seven years and nine months in prison.

2. Is it illegal to sell AI robot stock trading software?

In this case, Mr. Zhong, the owner of the technology company, believes [ii]:

The self-developed DIY stock trading robot helps clients select and buy desired stocks based on their own plans. According to Zhong, the buying strategies are all determined by the clients; the software merely performs data analysis and does not recommend stocks. Therefore, the company does not require any specific qualifications.

However, this view was not adopted by the court. Many AI industry practitioners, including programmers, may hold similar views:

AI-powered stock trading software is merely an information filtering tool, not investment advice. The software automatically captures and processes publicly available market data (such as fund flows and trading volume) to help users improve their information processing efficiency. The final decision-making power rests entirely with the user, which is fundamentally different from "stock recommendations" that provide specific buy/sell advice and promise returns. Therefore, they believe that this type of software constitutes a "neutral information technology service," not an "illegal securities investment consulting business," and should not constitute illegal securities business operations as defined in Article 225 of the Criminal Law.

In this perspective, "factors" (such as capital flows and sector movements) and "range arbitrage" models are calculated and presented based on publicly available, objective data . The software merely simplifies the information processing and does not make subjective "value judgments" or "investment decisions." Users trade according to their own settings, and the software only executes automatically when conditions are triggered. It is a tool-based execution of user-initiated decisions, not a company making decisions on behalf of the user.

If using data analysis and automation technology alone constitutes a crime, then all AI software or financial data terminals on the market that provide similar information filtering and quantitative tools (such as certain functions of Tonghuashun and Eastmoney) could also be deemed to be operating illegally , which is clearly unreasonable.

So why was the business conducted by Company S deemed a crime of illegal business operations?

3. Why the court determined that the company constituted the crime of illegal business operations: A breakdown of Company S's business model

Judging from Company S's business model, the actual situation went far beyond simply selling AI stock trading software. The company not only provided strategies such as "range arbitrage," but also offered different tiers of membership services for its stock trading robot software, with VIP memberships priced at 8,800 yuan and 28,800 yuan respectively. Through these membership services, Company S charged customers "interface usage service fees," which were essentially fees for "illegally accessing brokerage trading channels," ultimately accumulating profits of over 3 million yuan.

Specifically, members paying 8800 yuan will receive services such as "range arbitrage." "Range arbitrage" refers to the software analyzing stock price fluctuations over several days, calculating reference values, and recommending stock buying and selling opportunities to clients, or directly providing trading strategies to help them with quantitative investment. If clients are not satisfied with the software's preset algorithms and trading strategies, they can obtain further analysis and recommendations from customer service.

Members in the 28,800 yuan tier can set their own investment "tracks" and capital allocation plans based on the data, models, and parameters provided by the company. Once the preset conditions are triggered, the software will automatically help the client execute buy and sell operations.

Therefore, the reason why Company S is guilty of illegal business operations is as follows:

The 8800 yuan service essentially provides clients with specific investment advice—recommending stock buying and selling opportunities, offering strategic trading strategies, and having customer service analyze and recommend based on experience. This service directly aims to "tell clients what to buy and when to buy," and its core is providing investment advice, which completely goes beyond the scope of information intermediaries.

The 28,800 yuan service, by combining data and models provided by the company, directly executes trades on behalf of the client. The software's automated execution function essentially acts as a trading channel and instruction execution mechanism, which is the core of a brokerage firm's business.

The combination of these two factors allowed Company S to bypass the role of a licensed securities firm and directly complete the core securities trading and investment consulting business that should have been carried out by licensed institutions such as securities companies and investment consulting firms.

4. Compliance Boundaries of AI Stock Trading Software: Criteria for Distinguishing Between Criminal and Non-Criminal Activities

Based on the above cases, does this mean that selling AI stock trading software without obtaining the required licenses and permits, such as the "Securities and Futures Business License" and the "Securities Investment Fund Sales Business Qualification," is itself a prohibited activity by law? Of course not.

In practice, the core of the controversy lies not in whether AI was used or quantitative analysis was performed, but in whether the final output of the product and service is data and tools, or "investment advice and trade execution." In other words, whether it has moved beyond the boundaries of neutral technical services and securities investment consulting or securities business operations.

Based on Company S's business model, a comparison can be made from the following three aspects:

1. Functional output level:

Company S's services, including the "range arbitrage" model and customer service recommendations, provide clear instructions on "when to buy or sell which stock." This completes the transition from "what it is" (data facts) to "how to do it" (investment decision-making), which is the essence of investment consulting.

According to Article 1 of the "Interim Provisions on Strengthening the Supervision of Securities Investment Consulting Business Using 'Stock Recommendation Software' (Second Revision in 2020)", software products, software tools or terminal equipment that have the function of summarizing securities information or statistically analyzing historical data of securities investment products, but do not have the function of "providing investment analysis opinions, predicting price trends, product selection suggestions, and actual buying and selling suggestions for specific securities investment products", do not belong to "stock recommendation software".

Therefore, if an AI tool only provides objective data displays such as securities information summaries, historical data statistics, fund flows, or sector anomalies, without providing specific analysis opinions, trend predictions, stock selection suggestions, or buy/sell recommendations for specific securities, it is closer to a neutral information tool.

2. Business Logic Level:

Company S's business model involves charging high, tiered membership fees, based on the premise of "providing profitable investment advice and convenient trading." From the user's perspective, they are paying for "who can quickly make money for me." Essentially, this involves selling investment consulting and trading access services.

In contrast, if a product is sold as a one-time software sale or charged through a data subscription fee, its main value lies in the information tool itself, and it does not use "profitability" as its core selling point. This is usually closer to the business logic of technology services or information services.

3. Operational closed-loop level:

Company S's services, especially the 28,800 yuan tier, allow users to set conditions, and the software automatically completes the entire process from decision triggering to order execution. This has partially replaced the roles of investors and brokers.

In contrast, if a product only provides analytical tools and users still need to make their own judgments and place orders, and the decision-making and execution processes are not completed by the platform, then its overall risk boundary is relatively controllable.

5. The use of "cutting-edge technology" led to multiple charges being combined.

The reason why Company S's software can quickly help customers conduct automated stock trading is that it purchased a plug-in program from a "hacker" named Han, who developed the plug-in program, wrote it into its own program, and deployed and ran it on the company's server. This allowed Company S's account to bypass the relevant technical protection measures of Tongdaxin software (the market data terminal provider), call its trading channel, illegally access the securities company's server, and conduct automated stock trading, thereby charging customers for interface usage services.

As a result, Han was sentenced to three years in prison for providing programs for intruding into computer information systems. Zhong, the actual controller of Company S, and Kong, the company's technical director, were both convicted of multiple crimes, including illegal business operations and copyright infringement.

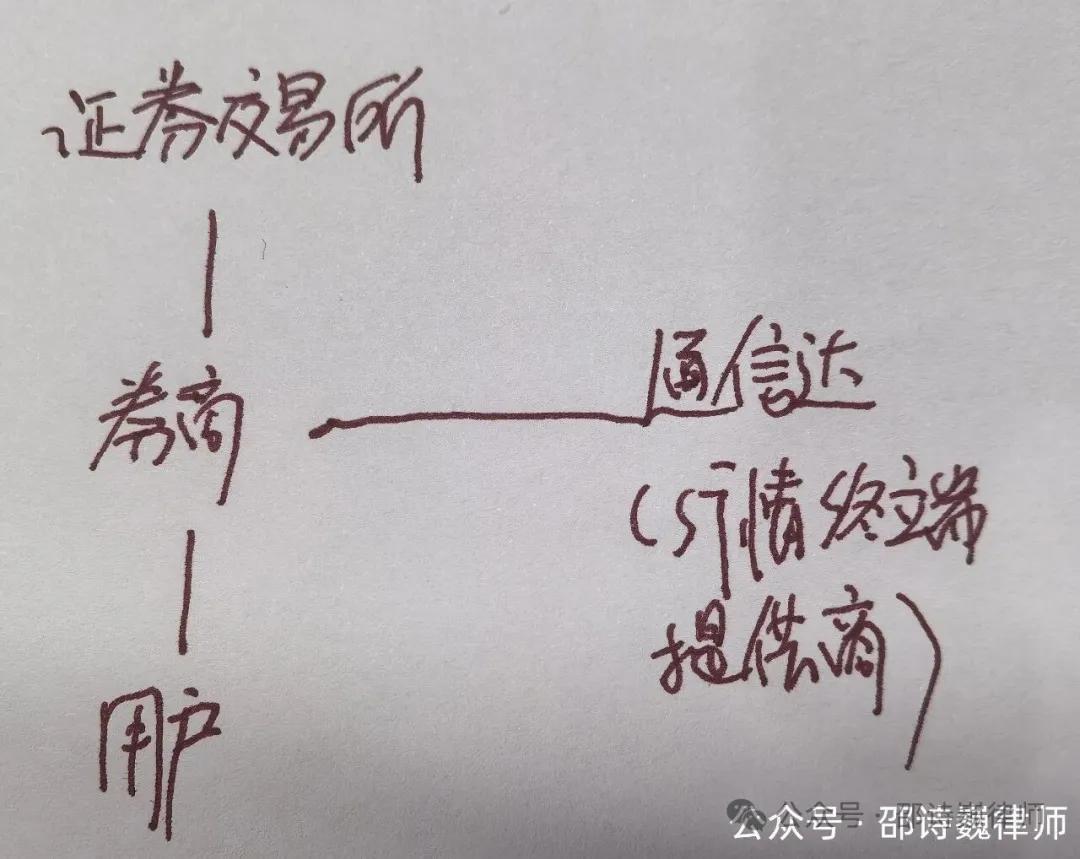

The reason is that, under the compliance framework, the basic structure of securities trading should be:

(Personally, I still prefer the most primitive way of drawing.)

The stock exchange is responsible for trading rules and matching mechanisms. Brokerages, as the sole legal operating entities, establish client relationships with investors, who then participate in securities trading through them. Market data and trading terminal service providers, such as Tongxinda, provide technical tools to brokerages and investors; they themselves neither participate in securities business operations nor establish securities service relationships with investors.

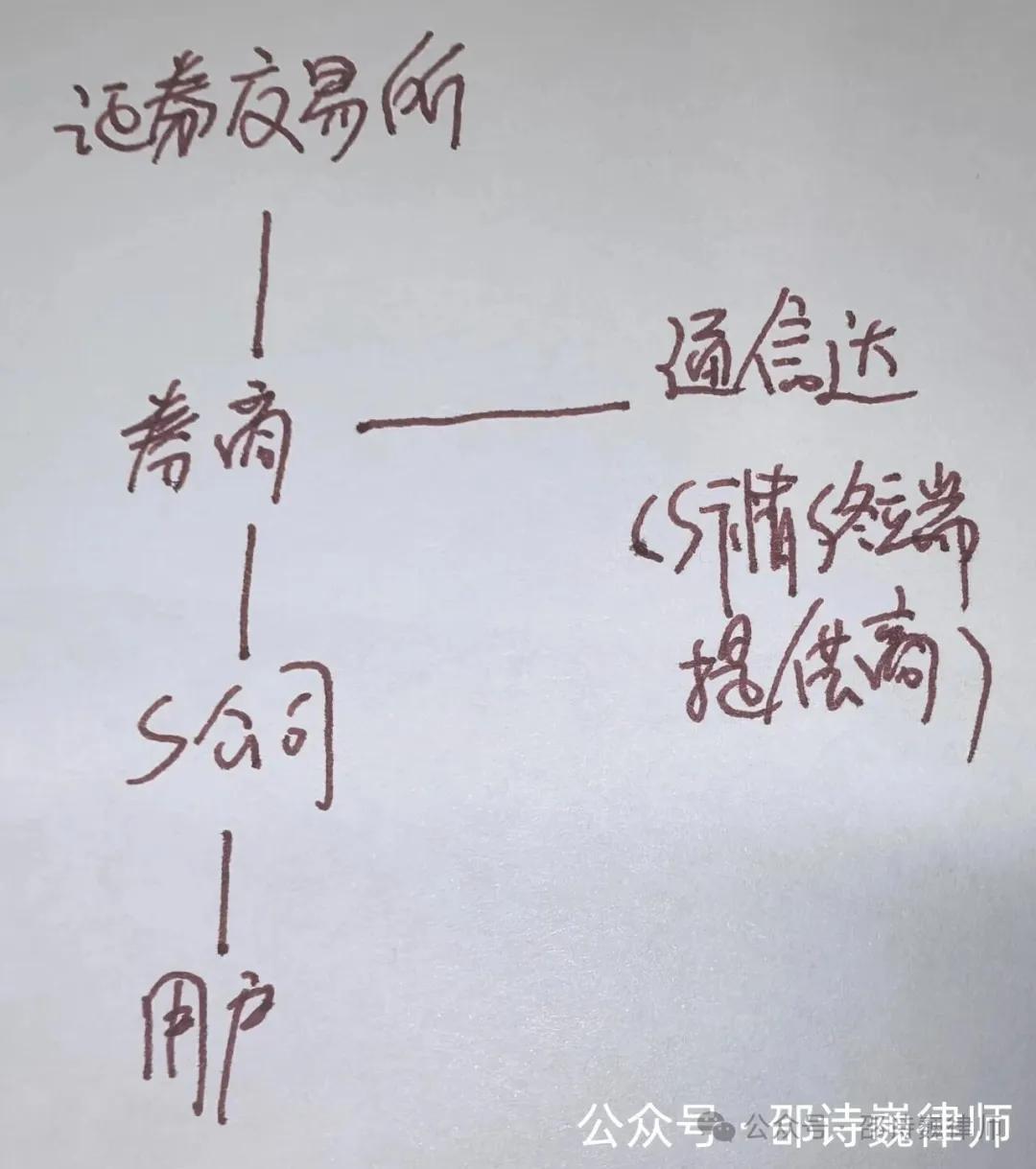

However, in this case, due to the involvement of Company S, the structure evolved into:

Investors first establish a transaction relationship with Company S, purchasing products and services such as so-called "range arbitrage" and "stock trading robots." Company S then illegally accesses brokerage trading channels by cracking the communication interface program and bypassing normal technical protection measures, completing automated trading operations and profiting by continuously charging investors for these services.

Under this structure, securities firms and telecommunications companies are neither the organizers nor the beneficiaries of the business, but rather passively become "exploited objects" in its technological path. The entity that truly builds the business model, controls the transaction path, forms a closed loop of charges, and profits from it is always Company S itself.

6. Risk warnings for AI entrepreneurs and programmers:

This case, in which a tech company was sentenced for "AI stock trading software," essentially exposes the gray areas in compliance with regulations for a large number of AI startups, quantitative trading products, and fintech tools.

For AI entrepreneurs, company leaders, technical partners, programmers, and even product managers, if you are currently working in or planning to enter this field, it is advisable to carefully evaluate your products and business models to ensure that they do not cross the regulatory boundaries of securities business and avoid being misjudged as investment consulting or operating a securities business in disguise.