A recent survey of over 5,700 Bitcoin (BTC) owners revealed a clear disconnect between belief and action in the cryptocurrency space. While nearly 80% of participants supported the expansion of crypto applications, 55% stated that they rarely or never used the digital asset for daily payments.

This widening gap shows that the industry's biggest challenge today is no longer a matter of perception or ideological support, but a different obstacle altogether.

Most crypto users support its adoption, but rarely spend money on it: Why?

The survey from Gomining received responses from users in a variety of regions. The largest proportions were in Europe (45.7%) and North America (40.1%).

Participants also had diverse experiences, roughly evenly Chia between those new to crypto and retail investors with many years of experience in the market.

This distribution suggests that limitations on spending with crypto are not concentrated in a specific region or user group. The survey found that paying with crypto remains a rather "niche" practice within the retail investor community.

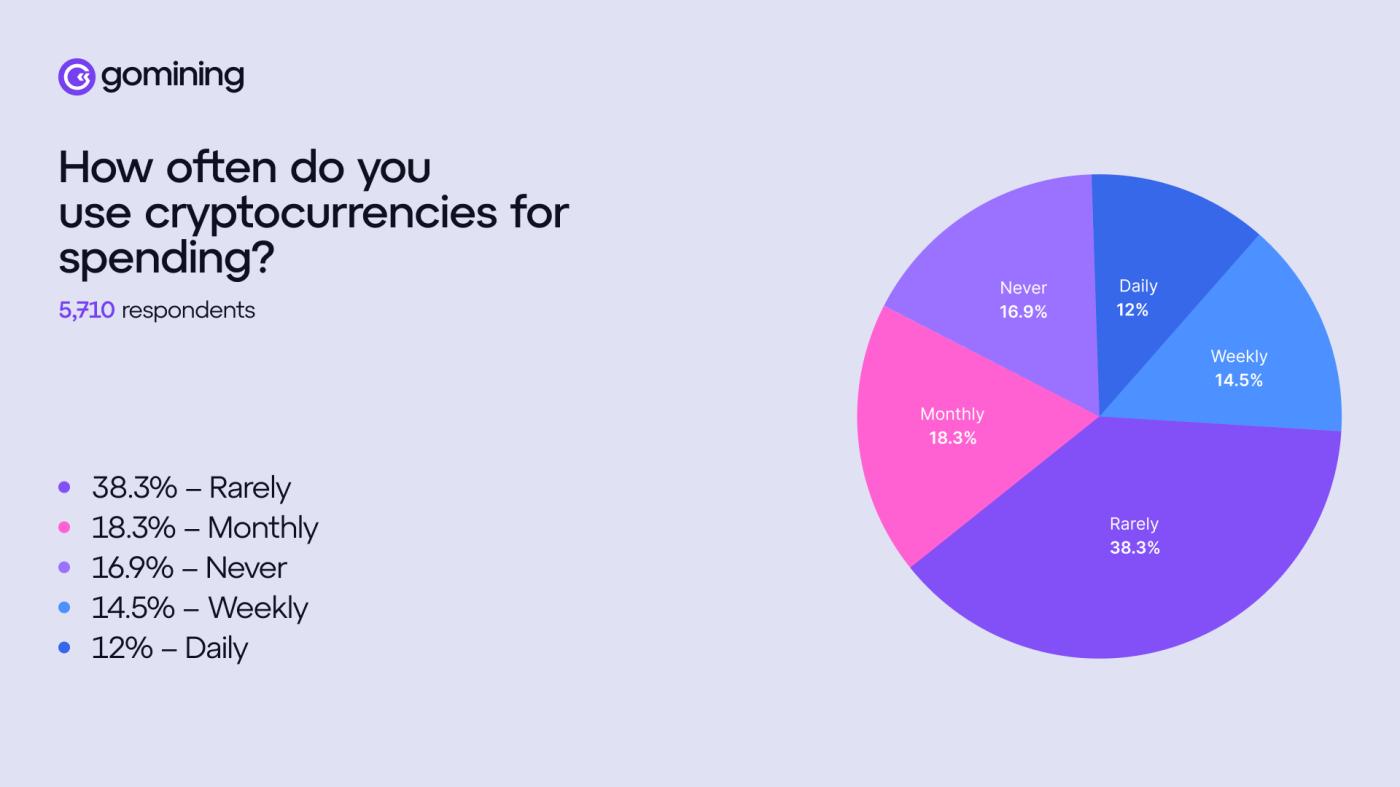

Only 12% of those surveyed use crypto for daily payments. This number increased slightly to 14.5% for weekly payments and 18.3% for monthly payments. However, the majority still indicated that they rarely or never use crypto for spending.

The use of cryptocurrency as a payment method. Source: Gomining

The use of cryptocurrency as a payment method. Source: GominingSpending behavior reveals which sectors crypto performs best as a payment Vai . Digital products account for the highest percentage at 47%, followed by games at 37.7% and e-commerce shopping at 35.7%.

This indicates that users have been actively consuming crypto on digital platforms that readily support crypto payments. Outside of this environment, crypto payments have decreased significantly.

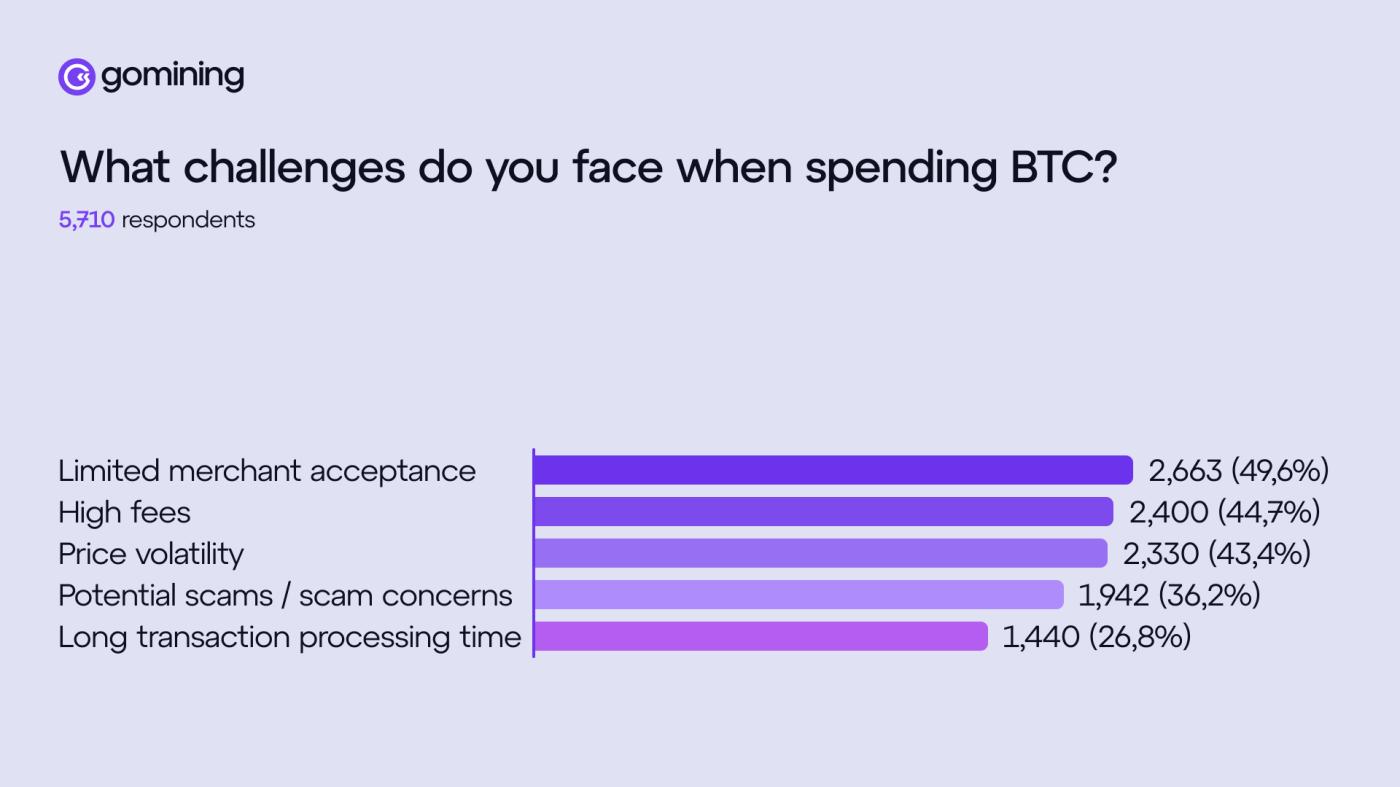

The survey results also revealed that infrastructure-related obstacles remain the biggest barrier to spending on crypto. Respondents cited the main reasons as: few places accepting crypto payments (49.6%), high fees (44.7%), and high price volatility (43.4%). Notably, 36.2% of users were also concerned about fraud.

Barriers to using Bitcoin for payments. Source: Gomining

Barriers to using Bitcoin for payments. Source: GominingMark Zalan, CEO of Gomining, Chia with BeInCrypto that if using crypto requires too many complex operations , such as choosing a network, calculating transaction fees, monitoring price fluctuations, or being difficult to undo mistakes, then most users will XEM it as just a fun trial experience and not choose it regularly.

“For the average consumer, true ‘practicality’ begins when crypto becomes ‘invisible,’ integrated into familiar shopping environments, offers clearly competitive costs, fast processing, easy reconciliation, and supports common expectations like billing and complaint handling. To win over this user group, crypto payments should be as simple and reliable as tapping a bank card,” he commented.

The CEO argued that the gap wasn't necessarily a matter of "not being widely available," but simply that the product wasn't truly practical for everyday life.

"People may be ideologically supportive of crypto, but they still choose bank cards or e-wallets because these options are widely accepted and very convenient. Our survey also shows that: many people are interested but don't use them frequently because there are few places that accept them, the costs are unpredictable, and price fluctuations create a sense of anxiety," he said.

Zalan also noted that while there are many Token on the market, this does not necessarily mean users will find it more convenient in their daily lives, as most Token do not solve minor "problems."

Real benefits only emerge when crypto offers clear advantages, such as cross-border value transfer, fast transaction processing, or ease of feature programming. Therefore, the industry is increasingly focusing on developing payment systems and connecting with other platforms rather than expecting users to control and "own" dozens of different assets.

Bitcoin payments face user expectations driven by self-interest.

Additionally, the survey explored what truly motivates users to choose crypto payments over traditional methods. Security and privacy were the two most emphasized factors, accounting for 46.4% of respondents. This was followed by offers and promotions at 45.4%.

For Bitcoin payments, user preferences are also very clear. 62.6% want lower fees. Motivations such as rewards or cashback come in second with 55.2%, and the number of places that accept the payment ranks third with 51.4%.

Nearly half of participants indicated they expect to receive interest or rewards with each payment. This suggests that reward-based expectations are deeply ingrained in users' spending habits.

Survey data reveals a significant shift in perceptions of Bitcoin. While many still identify themselves as small-scale, long-term investors, interest in mining models, profit-generating products, and hashrate Tokenize is growing. The purpose of owning Bitcoin is therefore geared towards seeking value appreciation rather than simply storing it in a wallet.

From this perspective, crypto payments become an opportunity to increase accumulated wealth. Zalan argues that incentives are a common mechanism in the payments industry .

He explained that the traditional system also applies incentive structures for consumers and issuers, helping merchants ensure more transparent payments.

“Waiting for crypto payments to explode without ‘worth switching’ incentives is unlikely. Incentives help us realize where the real bottleneck lies: if the experience were already cheaper, faster, and widely accepted, incentives wouldn’t matter anymore. Currently, incentives help users offset the cost of switching habits and building experiences while the ecosystem is still evolving, processing refunds, supporting service expectations, and making payments simpler and smoother,” the CEO Chia .

Can Bitcoin be both a means of payment and a store of value?

Survey participants also Chia the reasons they would consider using Bitcoin in the future. Daily expenses topped the list at 69.4%. This was followed by gaming and digital entertainment at 47.3%, and purchasing high-value or luxury items at 42.9%.

From a user's perspective, Bitcoin is not limited to a few specific use cases but is increasingly XEM as a practical option for everyday payments . However, this also raises an important question: If Bitcoin truly becomes an everyday payment method, will its Vai as a store of value be strengthened or undermined?

Zalan believes that if Bitcoin becomes more widely used in payments, its Vai as a store of value will become even stronger. He says that an asset being XEM a store of value is a result of social and market consensus.

It is determined by liquidation, reliable tradability, and the extent to which the asset is integrated into real-world financial systems. According to him,

"The more people who can use Bitcoin (whether through layers like Lightning or cards), the more Bitcoin resembles a sustainable monetary asset with strong demand and stable supporting infrastructure."

He emphasized that concerns about Bitcoin's Vai being "diluted" often stem from confusing spending with a loss of confidence in the asset. In developed financial systems, long-term holdings and everyday spending can coexist if the payment platform operates smoothly and without disruption.

Looking ahead to 2026, Zalan suggests a more realistic scenario where Bitcoin Vai as a reserve asset and is used for settlement, while user-friendly payment layers handle the payment processing. This allows people to transact easily without having to worry about technical issues like blocks, fees, or confirmation times.