XRP price has fallen below $2, representing a drop of approximately 19% from its peak on January 5, 2026. This decline has caused concern among many investors. However, experts still see several positive signs that could support a price recovery.

This article will analyze the key factors leading to the above conclusion, based on social media data, trading activity, and recent developments from exchanges.

Retail investor sentiment has turned pessimistic amid a price correction.

XRP has just experienced a dramatic shift in market sentiment.

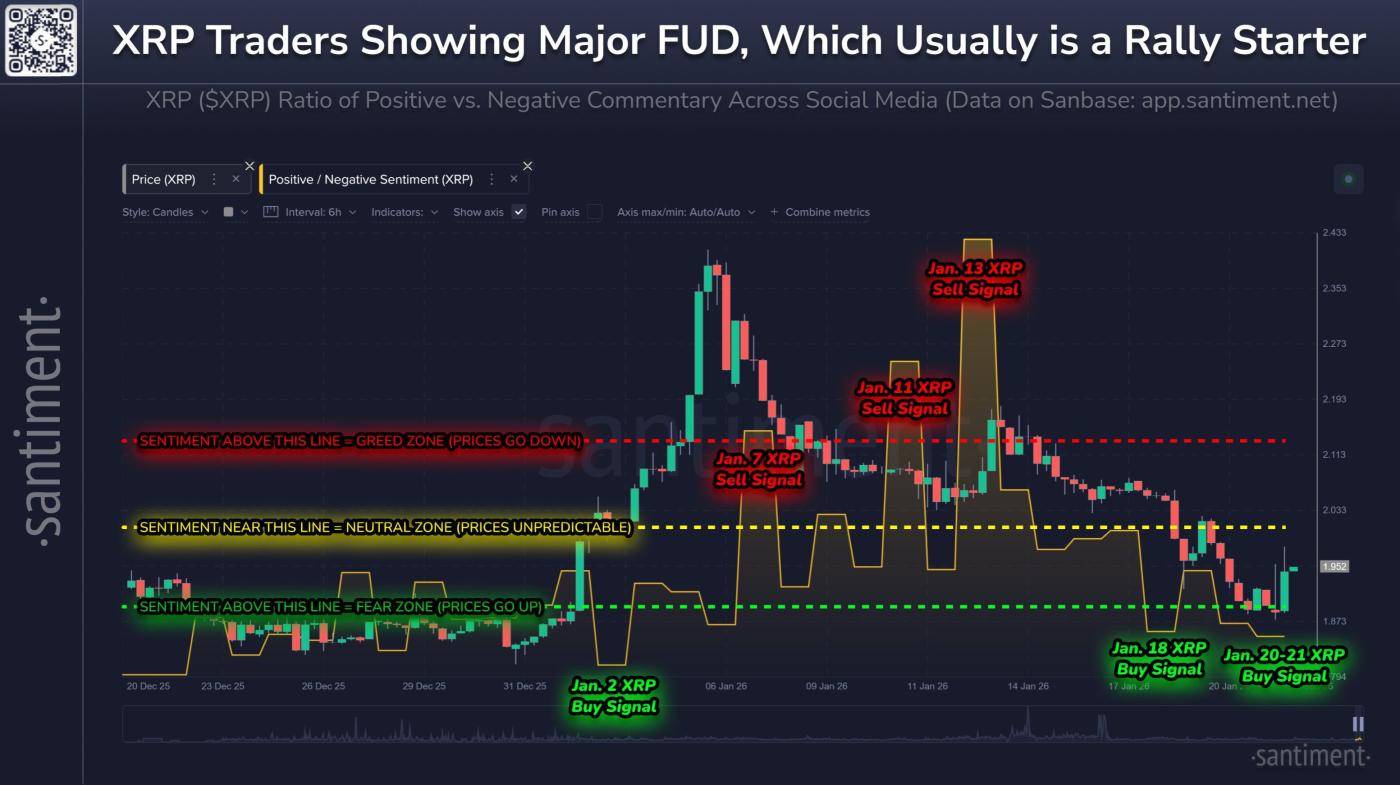

Positive/Negative Sentiment data from the Santiment analytics platform, based on social media discussions, shows that XRP price has now fallen into the "Extreme Fear" zone. Just a week ago, this indicator still showed greedy sentiment.

According to Santiment, in the past, periods of extreme sentiment have often been indicators of potential price reversals. The market tends to move against the expectations of the majority.

XRP Positive/Negative Sentiment Ratio. Source: Santiment

XRP Positive/Negative Sentiment Ratio. Source: Santiment“In the past, periods of high negative commentary have often led to price surges. In fact, prices often move in the opposite direction to the expectations of retail investors,” Santiment reports .

While this is a positive sign, the rapid shift in market sentiment over a short period also reflects the instability and inconsistency of retail investors. This situation typically does not provide a solid impetus for a long-term upward trend.

A negative funding rate indicates a potential reversal pattern.

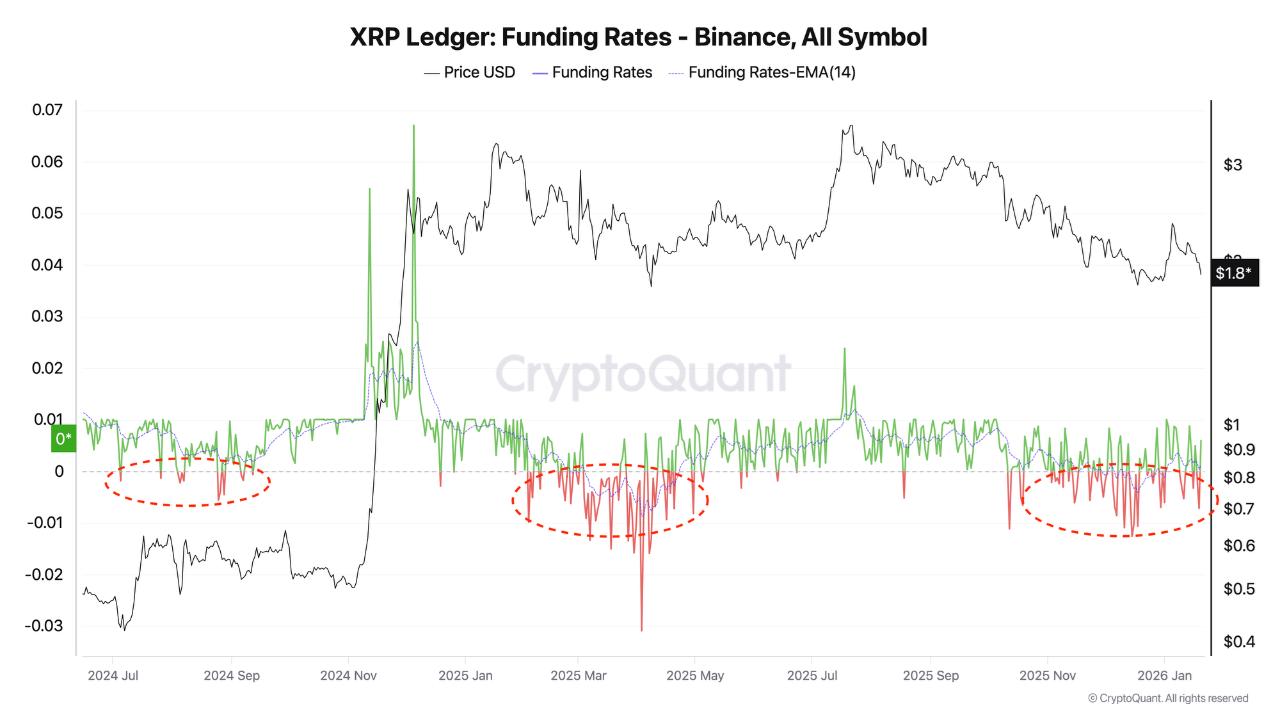

Market data also reveals another potential signal of a potential reversal. An expert at CryptoQuant has discovered negative funding rates on perpetual Futures Contract , reflecting an overaccumulation of Short positions.

Funding rates are the periodic payments between Longing and Short positions in the perpetual Futures Contract market. A negative rate means Short investors have to pay a fee to Longing buyers. Historically, such cases often occur before XRP price rallies.

XRP Funding Rate. Source: CryptoQuant .

XRP Funding Rate. Source: CryptoQuant .Data from CryptoQuant shows that this pattern has appeared twice since 2024—during the August–September 2024 period and April 2025. In both instances, negative funding rates preceded significant price surges.

“History shows that markets often move against the lagging consensus of the majority. The accumulation of Short positions creates short-term selling pressure, but also builds up potential buying power. If the price starts to rise, these positions can be liquidated, creating stronger upward momentum,” explains expert Darkfost from CryptoQuant.

Binance lists the XRP/RLUSD trading pair, boosting volume.

Another piece of good news boosting XRP 's prospects comes from exchanges. On January 21, 2026, Binance announced the listing of a new trading pair , XRP/RLUSD.

Ripple CEO Brad Garlinghouse expressed optimism about this development. Trading RLUSD Token on Binance allows the stablecoin to reach more new users . This move will strengthen the XRP Ledger ecosystem and indirectly support the upward trend of XRP price.

Listing the trading pair also opens up additional liquidation channels for both XRP and RLUSD. In the long term, if market conditions are favorable, improved liquidation will help reduce price volatility, deepen the market, and attract more new Capital flows.

BeInCrypto's technical analysis also shows a bullish divergence signal when the XRP price falls below $2 . This is also one of the bases supporting the possibility of a short-term recovery.