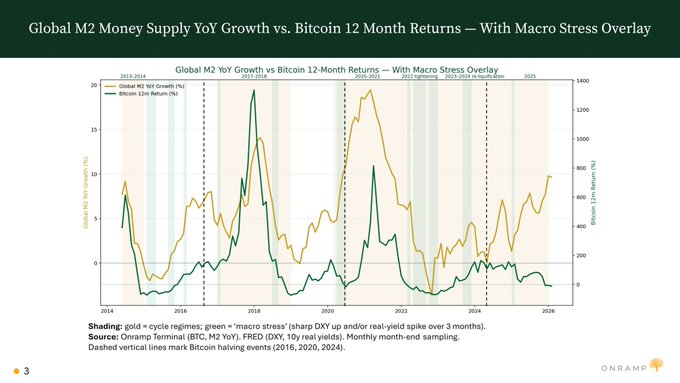

As @brian_armstrong articulated in Davos last week, bitcoin is a check and balance on central bank irresponsibility or in his words, ‘healthy competition’ for fiat. Fiat is printed infinitely. There will only ever be 21M BTC. The expansion of unbacked monetary units drives the price appreciation of sound monies over time, when denominated in the expanding unit (USD). Gold’s run to all-time highs tells this story. Central banks have been aggressively stacking gold for years, an admission that the fiat monetary system is cracking. As @RayDalio put it, sovereigns don’t want to own each other’s debt anymore. This really accelerated post the seizure of Russia’s UST reserves. Bitcoin is the same thesis with more asymmetry, and thus more upside. Gold’s market cap is now ~$35T, while bitcoin’s is still under ~$2T. Both respond to the same macro forces, but bitcoin is far less widely understood as sound money today. There’s typically a lag between liquidity expansion and BTC repricing (see chart below), but the logic is straightforward: bitcoin gets repriced higher against infinitely expanding money. Gold is proving the thesis right now, bitcoin is up next.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content