Authors: @clairegu1, @MorrisSHYang and Hubble Research Team

Polymarket's trading volume has repeatedly broken records, making it a global liquidity hub for prediction markets. However, for traders, an unavoidable question remains: how much of the hundreds of millions of dollars in trading volume represents the intellectual battles of real people, and how much is a silent battle waged by algorithms? While most retail investors are searching for smart money based on trading volume rankings, they may be walking headlong into a meat grinder of robots.

The Hidden Bot Zone: A Very Small Number of People Create the Vast "Prosperity"

During the full address lookup, Hubble discovered a group of unusual accounts in the "Bot Zone" :

A game for a very small minority : This group of accounts accounts for only 3.7% of the total number of users (approximately 54,000 addresses).

Absolute control : These 3.7% of accounts contributed 37.44% of the total transaction volume across the entire platform.

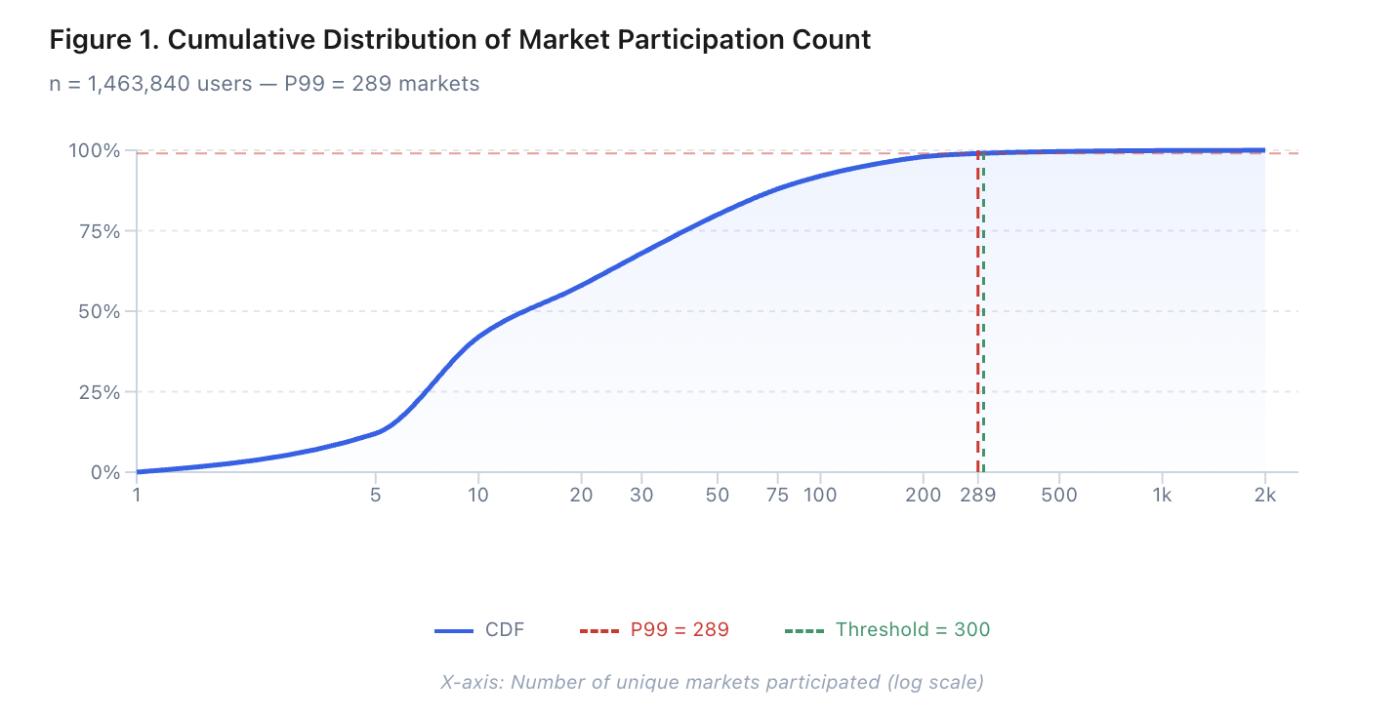

The Lie of Perception : Statistics show that 99% of real users participate in fewer than 289 marketplaces in their lifetime . However, "Bot Zone" accounts typically participate in more than 500 marketplaces .

For traders, this means that nearly 40% of what you see as "market sentiment" is actually just code fluctuations.

If your

Decisions based on trading volume mean you're likely just providing liquidity to a hedging script that has no real strategy (see previous articles:).

How Hubble identifies algorithms

To accurately identify these "machine predators," Hubble developed a filtering logic based on the "XY-axis quadrant analysis method."

The "Diagonal Law" for Real People

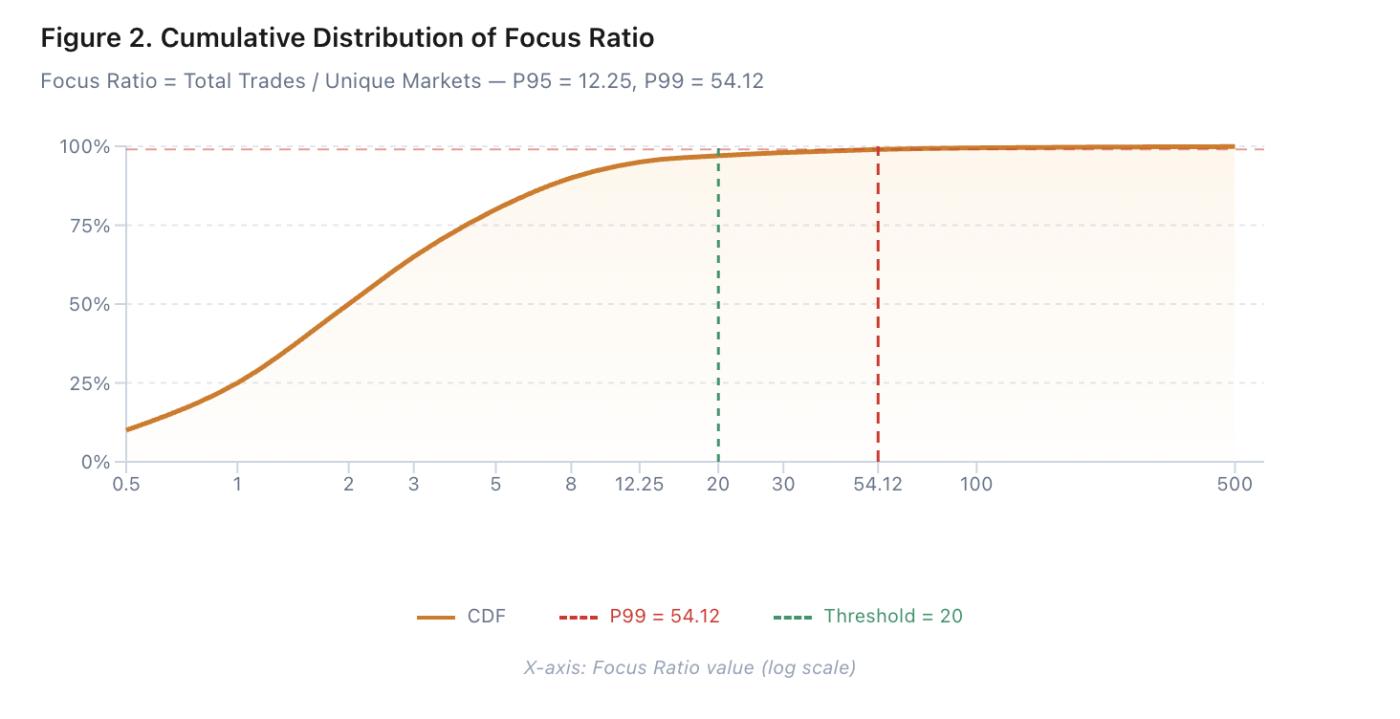

For real users, the number of markets participated in and the total number of transactions show a positive logarithmic linear relationship. As the number of markets studied increases, the number of transactions increases moderately, and the Focus Ratio (total number of transactions / number of markets participated in) remains within a reasonable range of 2 to 10 .

Judgment Criteria : Data shows that 95% of users have a Focus Ratio below 12.25 .

The "marginal distribution" of robots

The robots will break this linear relationship and be distributed along the edges of the coordinate axes:

Vertical anomalies (deep-cultivation type) : A very small number of markets, but an extremely high volume of transactions. These addresses are typically market maker scripts, with a Focus Ratio peaking at 39,394 .

Abnormal Horizons (Distribution Type) : Numerous markets, but very few transactions per market. These addresses are often frequented by arbitrageurs or bulk traders.

Our research team found that true "prediction masters" typically specialize in a specific field.

Those self-proclaimed "all-around gurus" who repeatedly jump between hundreds of markets often base their strategies on arbitrage based on odds discrepancies, rather than genuine insight into the outcomes of events. Following such signals makes it difficult to learn true game theory logic.

Holding duration is the only truth.

In addition to static counts, we identified the essence of the bot's "fast cash flow" by tracking the Inventory Curve :

HFT/MEV Bot : Average holding time < 60 seconds . Only bots can complete a full risk hedging loop in tens of seconds.

Grid Bot/Market Maker : Holding time is less than 10 minutes .

Real traders : Active traders typically hold positions for more than 1 hour , while trend holders hold them for more than 1 day .

This shows that algorithms can simulate transaction frequency, but it is difficult to simulate the "hesitation" and "determination" of real people.

Signals with a holding period of less than 10 minutes are basically noise, because they are not predictions of the outcome, but rather the harvesting of volatility.

Summary: Polymarket's Survival Principles

Based on the true distribution behind the 1.46 million addresses, we have summarized three core principles for copy traders:

Trading volume does not equal consensus, and liquidity does not equal profit : 37% of the market's trading volume is simply "algorithms dancing." If you follow a market with high volume, you may not be entering a hot sector, but rather a "meat grinder" of high-frequency trading bots.

"All-rounders" are more likely "assembly line workers" : statistics have already provided the answer—humans cannot simultaneously engage in deep gaming across 300 topics. True smart money often focuses on a few specific areas.

Time is the only true gold standard for identifying real people : algorithms can simulate transaction frequency, but it's difficult to simulate a real person's "time exposure." The real value signals are often hidden in addresses that are willing to take on more than one hour of risk exposure.

PolyHub: Born for "Signal Dehydration"

In the current market environment, blindly following Polymarket's original signals is dangerous. To address this pain point, we built the tool PolyHub .

Our aim is to help traders see through algorithmic noise and find the "real wisdom" that truly grasps the trends.

If you're interested in cutting through the market fog and identifying real smart money, you're welcome to join our exploration program:

Follow @PolyHub to get the latest in-depth data analysis and algorithm model updates on the prediction market.

Interactive participation : Like/retweet the original post and comment "Waitlist" to reserve your first PolyHub beta test slot.