Once again, back on duty to cover the indirect BTC ownership of the world's largest sovereign wealth fund, Norway's Oil Fund.

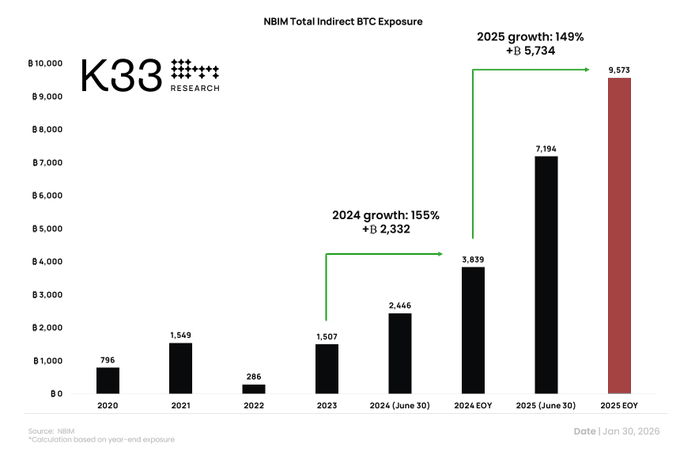

While BTC price action has been horrendous for a while, NBIM's indirect BTC exposure marches higher. It grew by 149% in 2025 to 9,573 BTC.

Per our observations, NBIM does not hold exposure in any digital asset treasury company focused on other cryptocurrencies such as BitMine.

My motivation for monitoring NBIM’s indirect BTC exposure is to highlight how BTC is finding its way into any well-diversified portfolio, deliberate or not.

While short-term price action sucks, the growth trend highlights the strong underlying institutional adoption of BTC.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content