This article is machine translated

Show original

History doesn't repeat itself, but human greed always seems to rhyme.

1️⃣ 1979-1980: The most spectacular bull market for precious metals, with gold soaring from $200 to $850 and silver from $6 to $50. The macroeconomic scenario was an oil crisis plus hyperinflation.

Result? Two months after peaking, gold halved, and silver fell by two-thirds, followed by a 20-year freeze.

2️⃣ 2010-2011: After the subprime crisis, liquidity clearly drove gold to $1921, and silver once again challenged the $50 mark. The scenario changed to a post-subprime crisis monetary easing frenzy.

Result? Gold retreated 45%, silver plummeted 70%, and then entered years of gradual decline and sideways trading.

3️⃣ 2024-2026: This time it's different? The story is much more compelling now: global central banks are buying up stocks, de-dollarization is underway, silver is a necessity in industry… Central bank support has become the last vestige of faith for this generation of bulls.

It does look a bit like 1980. The shape is similar, and even the US-Iran conflict is somewhat similar.

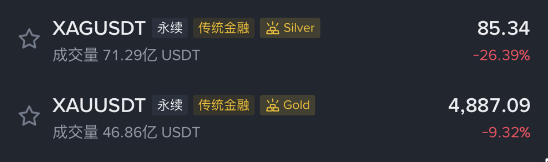

The slaughter has already begun today.

Such a large drop in one day is truly historic.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content