This article is machine translated

Show original

Regarding the story of achieving a 6.7% return in 1.5 hours by utilizing wHLP reward delays and revolving loans:

On February 1st, the market crashed in the early morning, resulting in the liquidation of numerous positions. HLP, as the Hyperliquid treasury, automatically took over and completed the liquidation.

Liquidation profits, market-making spreads, and transaction fees were all added to NAV in real time, causing the value of HLP shares to surge by 7%!

However, I hadn't deposited any funds into the treasury, and it was too late to deposit HLP by the morning.

So, is it still possible to reap this huge return like in the 1011 incident?

The answer is: Yes, bro!

Here's the full recap 👇 The core asset in this instance was wHLP, a wrapper token that enjoys the same underlying HLP rewards as HLP. However, wHLP's price and rewards rely on external oracles or data index updates, which are slower than the official treasury.

After the sharp fluctuations, this delay was amplified, making the reward dilution of wHLP appear lighter and relatively "undervalued."

Similar to the secondary opportunities following the October 11th crash, this time it was the community's Alpha group members who first seized the opportunity: wHLP's data hadn't yet caught up with HLP's actual surge in returns, so the strategy was to quickly buy in and wait for the rewards to synchronize.

Some members also chose to participate on Mint YT, but most ultimately opted for wHLP.

There are two main reasons:

1/ By the time the opportunity was recognized, it was already a bit late; the YT contract entry point had closed.

2/ YT's liquidity is insufficient; with many buyers and high slippage, the actual participation experience is not as good as wHLP.

After buying in, one could simply wait, but ultimately, the intention was to leverage through revolving lending. The main reason is the ratio between HLP and USDT/USDC; even with the risk of leverage, it's still a relatively safe way to amplify returns.

After searching relevant DeFi protocols, it was discovered that Hyperlend supports wHLP collateralized lending, making the path clear.

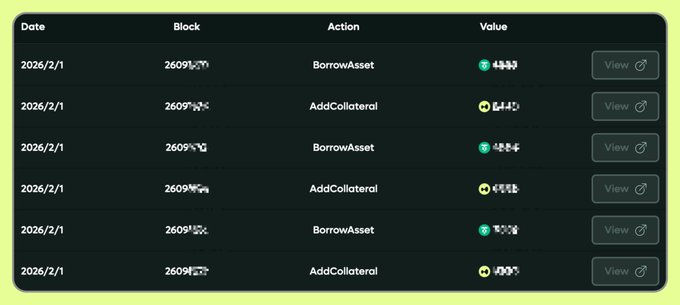

Detailed Operation Process:

1/ Buy wHLP;

2/ Deposit wHLP into Hyperlend as collateral to borrow stablecoins;

3/ Use the borrowed stablecoins to buy wHLP again;

4/ Repeat steps 2 and 3;

5/ After the vault is empty, reverse the operation to close all loans.

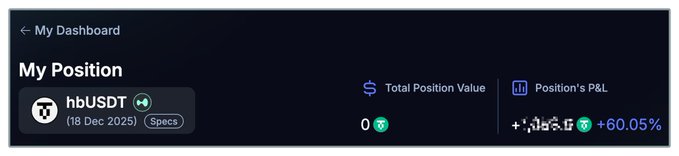

After completing all the above operations, a 6.7% return was achieved (in comparison, simply buying and holding only yielded about 2%).

There was also a surprise: the page initially showed a 5-day waiting period for redemption, but the actual redemption was instantaneous, taking only 1.5 hours from start to finish.

Therefore, the initially estimated 10,000% annualized return actually resulted in a 39,128% annualized return, haha!

During the cycle, because Hyperlend's lending rate was relatively high, there were concerns that the project team might delay distributing rewards and potentially exploit the system, but the result was excellent.

Note: The above is for informational purposes only and does not constitute investment advice. Please conduct your own research! BitHappy, a DeFi enthusiast who got carried away by his friends.

BitHappy

@BitHappy

10-14

危机就是机会,有次生灾害,也同样会有次生机会:24 小时盈利 60% 复盘~

1011 那天因为起晚,没能从危机中抓住大机会,这种遗憾比合约网格爆仓还让我心痛。

不过,当天早上 8 点左右,社区的小伙伴 @gaofeng901224 高老师就在群里分享了大清算后的第一个次生机会。

由于 @HyperliquidX x.com/an_le23998/sta…

I made some money to buy some hype

Okay, I'm Crane~

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content