Author: Raoul Pal

Compiled by: Jia Huan, ChainCatcher

I'd like to share some thoughts I had while writing GMI (Global Macro Investor) this weekend, which will help boost your confidence. Sit down, pour yourself a drink or a cup of coffee… I usually leave this to GMI and Pro Macro subscribers, but I know you all need to calm your nerves…

The Trap of Mainstream Narrative

The grand narrative is: Bitcoin and cryptocurrencies are completely broken. The cycle is over. Everything's messed up, and we don't deserve good things. It's decoupled from other assets; it's CZ's fault, BlackRock's fault, it's anyone's fault. This is undoubtedly a tempting narrative trap…especially when we see prices damnably plummeting every single day…

But yesterday, a hedge fund client of GMI sent me a short note asking whether he should buy SaaS stocks that seem cheap because of discounts, or whether, as the current narrative suggests, Claude Code (an AI programming tool) has killed SaaS.

I've decided to dig deeper...

What I discovered destroys the narrative about BTC, and it also destroys the narrative about SaaS. SaaS and BTC are following the exact same chart.

UBS SaaS Index vs BTC

This means there's another factor at play that we've all overlooked...

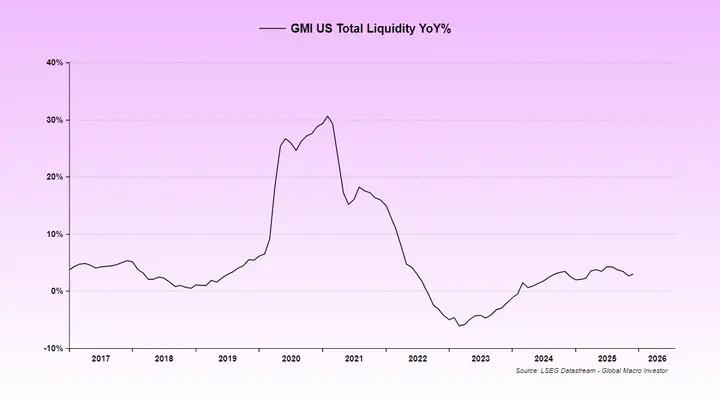

This factor is that due to the two government shutdowns and problems with the US financial "pipeline" (the reverse repurchase facility was essentially exhausted by 2024), US liquidity has been consistently suppressed. Therefore, the TGA (Treasury General Account) rebuilding in July and August was not offset by monetary measures. The result was a liquidity crunch…

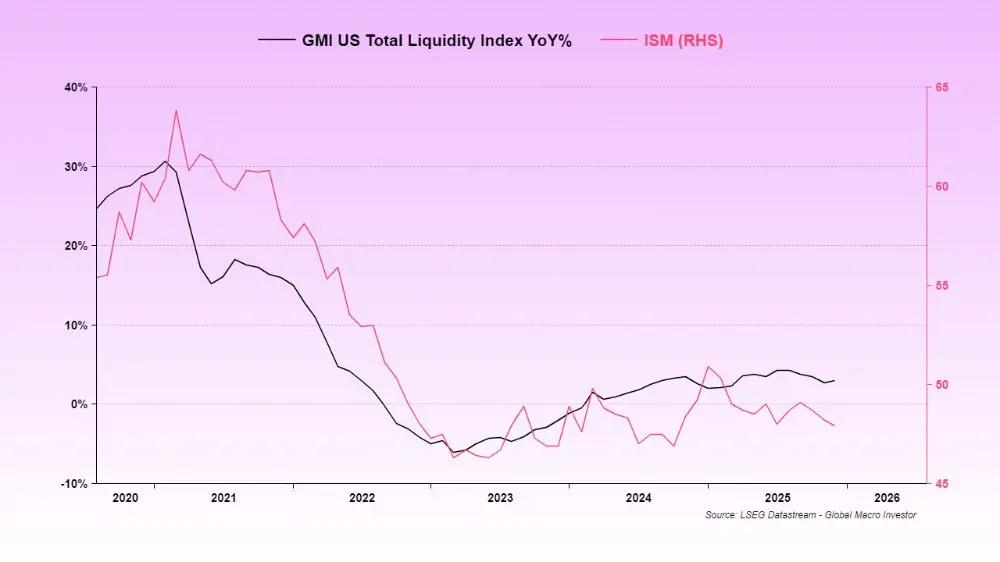

This persistently low liquidity is precisely why the ISM (Institute for Supply Management) index is so low...

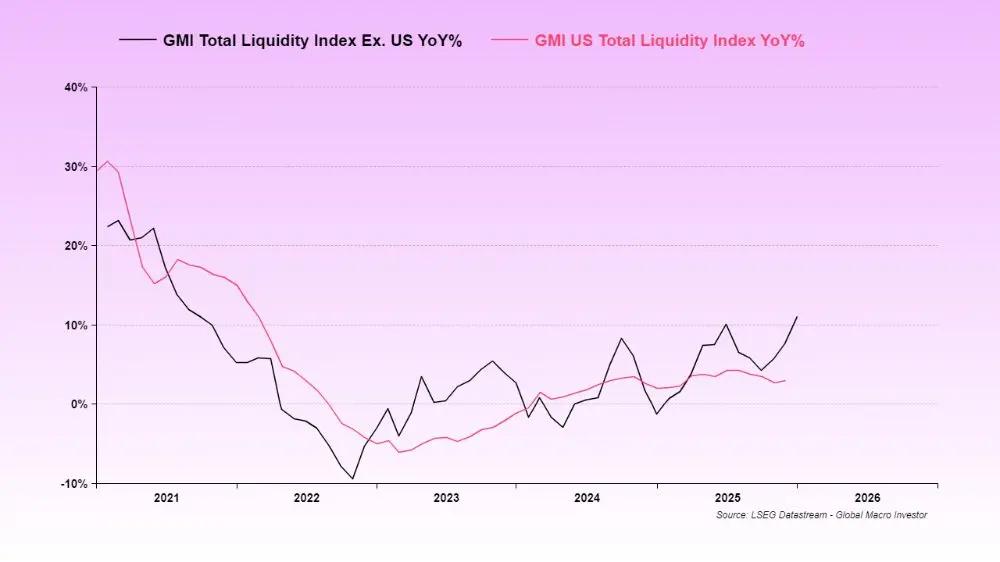

We typically use global total liquidity because it has the highest correlation with BTC and the NDX (Nasdaq 100 index) over the long term, but at this stage, US total liquidity appears to be dominant, as the US is a key provider of global liquidity. In this cycle, global total liquidity is leading US total liquidity, and a rebound is imminent (as is the case with the ISM).

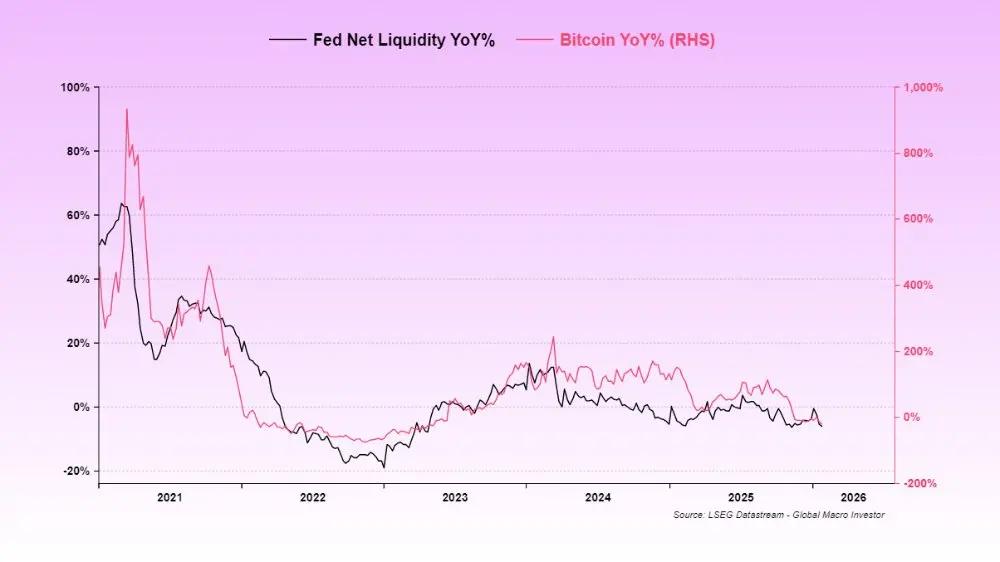

This is what's affecting SaaS and BTC... Both are among the longest-lived assets and have been discounted due to the temporary withdrawal of liquidity. The rise in gold essentially absorbed all the marginal liquidity that should have flowed into BTC and SaaS. There wasn't enough liquidity to support all of these assets, so the riskiest assets were hit.

Now, the US government is shut down again… once more. The Treasury Department hedged this by not using TGA at all after the last shutdown, and actually increased the TGA balance (which led to further liquidity outflows).

This is the “liquidity vacuum” we are currently facing, which has led to brutal price movements. Our beloved cryptocurrencies currently lack liquidity support.

However, signs indicate that this shutdown will be resolved this week, marking the final liquidity hurdle to be cleared. I've mentioned the risks of this shutdown several times. It will soon be in the rearview mirror, and we can proceed with anticipation of the impending flood of liquidity—adjustments to eSLR (supplementary leverage ratio), partial releases of TGA, fiscal stimulus, interest rate cuts, and more. It's all for the midterm elections… In these full-cycle trades, time often trumps price.

Yes, prices may be driven down drastically, but with time and the evolution of the cycle, everything will resolve itself, and the disagreements will close. That's why I advocate patience!

Things take time to evolve, and staring at every fluctuation in your profit and loss statement will only affect your mental health, not your investment portfolio.

Misinterpretation of the Federal Reserve

Regarding the topic of interest rate cuts, there's another circulating false narrative that Kevin Warsh is a hawk. This is utter bullshit. These comments largely originate from 18 years ago.

Warsh's job and his mission is to run the Greenspan-era script. Trump has said this, and so has Bessent (the Treasury Secretary nominee). It's too long to elaborate here, but the gist is: lower interest rates, let the economy overheat, and assume that AI-driven productivity gains will suppress core CPI. Just like in the 1995-2000 era.

He doesn't like the balance sheet, but the system has reached its reserve limits, so it's likely he won't change course. He can't change course, or he'll blow up the lending market.

Warsh will cut rates, and nothing else. He will give Trump and Bessent the runway to manage liquidity through banks. Mirran will likely force a broad reduction in the eSLR to accelerate this process.

If you don't believe me... then believe Druck (referring to Stanley Druckenmiller).

Stanley Druckenmiller is also betting on looser policies.

I know how hard it is to listen to a bullish narrative when things feel this bleak. Our Sui position feels like a pile of dog shit, and we don't know what or whom to believe anymore. First of all, we've been through this many times before. When BTC drops 30%, smaller tokens drop 70%. But if they're high-quality, they recover much faster.

Our misjudgment

Our misjudgment in GMI was failing to see that US liquidity is the current driver, whereas typically global liquidity dominates throughout the cycle. But it's now clear that the "code of everything" is still at work... There's no decoupling. It's just a confluence of events—reverse repo exhaustion > TGA rebuild > shutdown > gold price surge > shutdown—that we couldn't predict, or we missed the impact of anyway.

But that's almost over. Finally. Soon we can get back to normal business.

We can't possibly get every single change right, but we now have a better understanding, and we remain a huge bull on 2026 because we know the Trump/Bessent/Warsh script.

They told us repeatedly...

All we have to do is listen and be patient. Time is the key, not price .

If you're not a full-cycle investor and don't have that kind of risk tolerance, that's perfectly fine. We all have our own styles, but Julien and I aren't swing traders either—we're terrible at it (we don't really care about the ups and downs within a cycle)—but our proven and documented full-cycle investing performance over the past 21 years is one of the best ever. (Warning—we can also be wrong. 2009 is a stunningly bad example!)

Now is not the time to give up... Good luck, and may we have a damn epic 2026!

The mobile cavalry is coming.

Welcome to the official ChainCatcher community

Telegram subscription: https://t.me/chaincatcher ;

Official Twitter account: https://x.com/ChainCatcher_