How will MegaETH's KPI plan and Cap's stable airdrop rebuild market trust?

Written by: David Hoffman

Compiled by: AididiaoJP, Foresight News

There is a problem with "good tokens" in the crypto space because most tokens are worthless.

From a legal and strategic perspective, most teams do not treat their tokens as equity. Because teams have historically lacked the level of importance they place on tokens compared to equity companies, this reality has been reflected in token prices.

Today I want to share two data points that make me optimistic about the prospects of token economics in 2026 and beyond:

- MegaETH's KPI Plan

- Cap's "Stable Airdrop"

Make token supply conditional

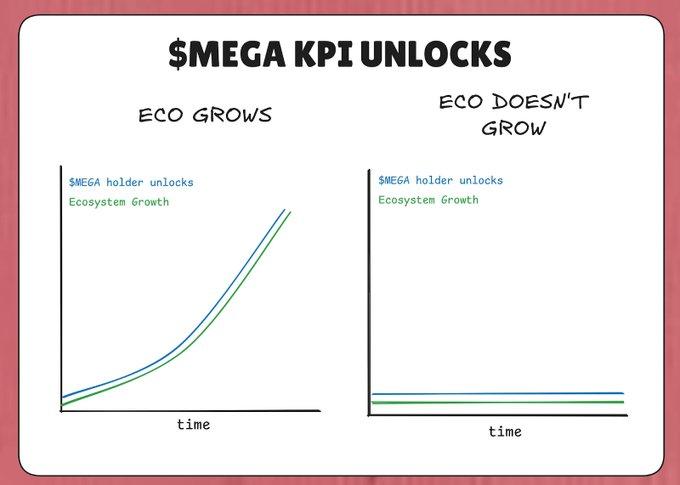

MegaETH has locked 53% of the total supply of MEGA tokens in a "KPI program." The core idea is that these tokens will not be unlocked if MegaETH fails to meet its key performance indicators (KPIs).

This means that during a bear market where the ecosystem stagnates, there won't be a large influx of new tokens into the market, diluting existing holders. MEGA tokens will only be gradually released when the MegaETH ecosystem truly grows (as defined by KPIs).

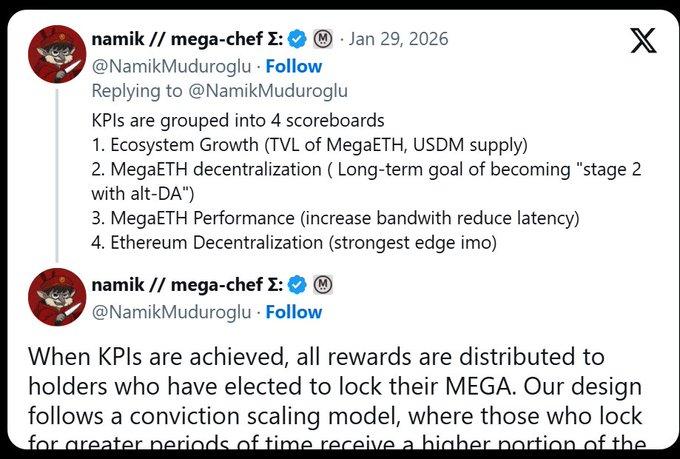

The KPI plan is divided into four aspects:

- Ecosystem growth (total locked value, USDM supply)

- MegaETH Decentralization Process (Progress in the L2Beat Phase Roadmap)

- MegaETH Performance (IBRL)

- Ethereum's degree of decentralization

In theory, as MegaETH gradually achieves its KPI targets, its ecosystem value should also increase accordingly, thereby mitigating the negative impact of token dilution on market prices.

This strategy is reminiscent of Tesla's "results-oriented" compensation plan for Elon Musk: In 2018, Tesla granted Musk stock incentives, which unlocked in stages, provided that Tesla simultaneously achieved tiered growth targets in both market capitalization and revenue. Musk could only receive corresponding equity returns when the company's value increased.

MegaETH attempts to introduce a similar logic into its token economics: the "issuance" of tokens is not inevitable, but rather an interest that the protocol can only "earn" after making real progress on meaningful metrics.

However, unlike Musk's compensation package, Namik's KPI targets do not include the market capitalization of the MEGA token, perhaps for legal reasons. But as a public market investor in MEGA, I naturally pay close attention to this metric.

Who receives the newly issued tokens is also crucial.

Another noteworthy detail of this KPI plan is: who will receive these MEGA tokens when they are unlocked?

According to Namik's tweet, the unlocked MEGA will be distributed to users who have staked their tokens in the lock-up contract.

Users who stake larger amounts and have longer lock-up periods will be eligible to receive 53% of the MEGA tokens that enter the market.

The underlying logic is straightforward: the newly issued tokens will be given to those who already hold MEGA and are willing to hold them for the long term or even increase their holdings, as they are the least likely to sell.

Trade-offs and potential risks

This design also carries some risks, and there are historical precedents of similar mechanisms causing problems. See Cobie's article for a case analysis: "The Failure of ApeCoin and its Staking Mechanism".

If you are pessimistic about tokens or a skeptic in the crypto space, this "bond of interest" may be exactly what you're worried about.

However, the same article also points out that "staking mechanisms should serve the long-term goals of the ecosystem."

Linking token issuance to KPIs that reflect the ecosystem's real growth is far healthier than the "unconditional issuance" staking mechanism of the 2020–2022 yield farming era. During that period, tokens were continuously issued regardless of whether the protocol made any real progress, leading to value dilution.

Overall, MEGA's issuance mechanism has the following characteristics:

- The amount of new issuance is limited by the actual growth of the ecosystem;

- The newly issued tokens flowed to long-term holders who were least likely to sell.

This does not guarantee that the price of MEGA will rise—the market has its own operating rules. However, this mechanism is indeed a meaningful and sincere attempt to improve the "ineffective issuance" problem that is prevalent in the current cryptocurrency field.

Treat tokens like equity.

In the past, many teams have distributed tokens arbitrarily within their ecosystems: airdrops, farming rewards, grant programs... If a token truly has long-term value, a team would not distribute it so carelessly.

Because the team issues tokens as if they were worthless governance credentials, the market also regards them as worthless governance credentials.

A similar philosophy is reflected in MegaETH's attitude towards listing on exchanges. When Binance listed MEGA futures (a move often seen as an exchange pressuring projects to release tokens), MegaETH maintained restraint and a strategic approach.

Hopefully, more teams will design token distribution mechanisms more carefully in the future. Only when teams begin to value their tokens will the market respond in kind.

Cap's "Stable Airdrop"

Stablecoin protocol Cap has launched a new distribution mechanism – the "Stablecoin Airdrop". Unlike traditional airdrops, Cap does not directly distribute its governance token CAP, but instead distributes its native stablecoin cUSD to users participating in the protocol's token farming program.

This approach rewards ecosystem participants with real value, fulfilling the "social contract" between the project and its users. Users who deposit USDC into the Cap protocol bear the risks of smart contracts and the opportunity cost of their funds; the stable airdrop is a reasonable compensation for their contributions.

For users who genuinely want CAP tokens, Cap conducts token sales through the CCA (Community Contribution Activity) on Uniswap. Participants need to invest real money to become actual investors in the project.

Screening long-term holders

The combination of "stable airdrops + token sales" aims to filter out users who are truly willing to hold for the long term. Traditional CAP airdrops are likely to attract short-term arbitrageurs, leading to a rapid sell-off of tokens. Requiring users to invest funds through subscriptions ensures that CAP flows to those willing to take risks for future potential—those who are more likely to hold for the long term.

This design increases CAP's chances of success by building a holder community that is highly aligned with the protocol's long-term vision, in stark contrast to past airdrop mechanisms that attracted short-term speculators.

Token design is maturing.

Protocol providers are becoming more sophisticated and cautious in their token distribution mechanisms. MegaETH and Cap are no longer using a "wide net" approach to token distribution, but are instead precisely targeting specific groups.

"Optimizing for maximum distribution" is a thing of the past—perhaps a legacy of regulatory pressure. Today, more teams are starting to "optimize for holder quality," focusing on building a solid and loyal base of token holders.

We hope that more new projects in 2026 will learn from these strategies and continue to innovate, so that the "quality token problem" will no longer be a problem, and ultimately only truly high-quality tokens will remain.