This article is machine translated

Show original

1/ Are whale really the "culprits behind market crashes"? A new report from the Federal Reserve Bank of Philadelphia offers a counterintuitive answer.

This is a hard-hitting working paper published by the Federal Reserve Bank of Philadelphia: "Beneath the Crypto Currents".

They delved into on-chain microdata in an attempt to understand what role on-chain whale(Whales) play when the market experiences wild fluctuations.

We always believe that the crash was caused by malicious selling by whale. Every time there is a major market upheaval, we habitually attribute it to "market manipulation by big players."

The conclusion is somewhat disheartening: This report from the Federal Reserve Bank of Philadelphia tells you, in the coldest terms of the blockchain, that whale are not creating chaos; the market's volatility largely stems from retail investors' own emotions, which they are simply taking advantage of.

2/ The real source of volatility: the herding effect of retail investors. This is probably the most mind-blowing data in the report.

We often assume that whale are making big moves, causing dramatic fluctuations in the K-line chart. But the Fed's quantitative analysis has overturned this assumption.

The truth is: most of the volatility comes precisely from the collective resonance of Minnows (retail investors).

Why? The data provides support from three dimensions:

First, the "herding" of retail investors: Data shows that retail investors' trading behavior is highly correlated. When emotions run high, millions of small accounts, like a pre-programmed algorithm, simultaneously crowd towards the same exit.

This sudden burst of one-sided order flow can quickly drain the liquidity of the order book, causing a sharp increase in price slippage. This is the essence of volatility. Second, regarding the "consumers" and "providers" of liquidity, the paper distinguishes between two roles: Takers and Makers.

In extreme market conditions, retail investors are almost all takers. They panic and sell at market price regardless of cost, consuming the thickness of the order book. But what are whale doing? Data shows that changes in whale' net holdings have a significant negative correlation with price movements.

When prices run down, whale' wallets are net buyers; when prices run up, whale' wallets are net sellers. Third, what if there were no whale? This is a brutal question.

Without whale placing buy orders below to absorb panic selling from retail investors, the price wouldn't have corrected by 20%; instead, it would have experienced a liquidity crunch, instantly dropping to zero. Therefore, whale aren't creating the storm; they are the "shock absorbers" within it. However, the cost of this shock-absorbing service (the spread) is extremely high. It's the irrationality of retail investors that creates opportunities for prices to deviate from their anchor points, while whale are simply the arbitrageurs responsible for bringing prices back to rationality.

3/ The Real Logic of Harvesting: Liquidity Market Making – This is the most covert yet legal "robbery" in the entire game.

The Federal Reserve's data reveals an extremely stable pattern: whale don't need to manipulate candlestick charts; they only need to do one thing: provide counterparties. When retail investors panic and sell off: buy orders in the order book are instantly withdrawn, liquidity is depleted, and everyone is scrambling to escape the market. At this time, only whale dare to buy at the bottom. What they buy isn't the coin, but your urgent need to "get out immediately." When retail investors frantically chase the rise: everyone goes all-in at market price, afraid of miss the pump. At this time, whale dump their holdings on you at the top. What they sell isn't the coin, but your fantasy of "instant wealth." The logic behind this is cruel:

1. The Premium of Immediacy: Retail investors are willing to pay extremely high slippage and spreads to satisfy their immediate emotional needs (whether fear or greed). This is the "liquidity premium."

The whale is like a pawnshop: it takes your family heirloom at a low price when you desperately need money, and sells it back to you at a high price when you want to redeem it.

2. Mean Reversion: Why are whale willing to catch falling knives? Because data tells them that retail investor sentiment is temporary; prices will eventually revert to their intrinsic value. They accumulate large amounts of inventory when you're at your most desperate, and then simply wait patiently for your emotions to calm down and for the price to undergo a mean reversion.

In other words, the Alpha they earned was essentially a monetization of time. The blood-stained chips you lost didn't disappear; they simply shifted from the "impatient hands" to the "patient hands."

This is the truth about the harvest.

It's not a conspiracy, it's human nature.

4/ The Real Risk: Early Bird and Information Gap If the "market-making behavior" of whale could still be explained as a market lubricant, then this discovery is a complete "lower-dimensional attack."

The Federal Reserve's data revealed a chilling time lag: the Lead-Lag Relationship.

1. Stealth Accumulation: We often assume that everyone rushes in after positive news, but on-chain footprints show that whale' net flow had already shown a significant peak before the major price run-up occurred. Note that it's "before," not "during," and definitely not "after."

This means that while retail investors are still staring blankly at the market or still agonizing over the previous negative news, whale have already quietly completed their position building. They are not predicting the future; they are "realizing" some kind of information that we cannot see.

2. The Fate of Retail Investors as "Suckers": In contrast, retail investors' behavior is severely lagging. Data shows that the buying peak of minnows often occurs after the price has already skyrocketed. This is a cruel closed loop: whale use their information advantage to ambush on the left side when the good news is realized, the price rises and retail investors see the K-line turn green, then on the right side, the whale conveniently dump their shares on retail investors, completing their harvest.

3. The essence of Alpha: This proves that whale in this market earn not only liquidity premiums but also money from information asymmetry. They are not betting on coin toss; they have seen the cards. It is hard for retail investors to admit this, but they must admit it: You are playing a game against a group of opponents who have "full map vision".

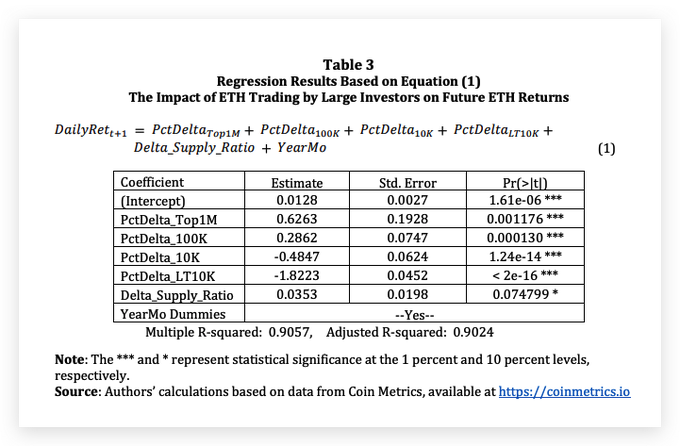

The regression coefficients in the table are positive and significant (marked with an asterisk). This statistically demonstrates that today's whale buying flow can significantly predict price increases tomorrow/next week. This is supporting evidence of "early bird" buying.

5/ The Final Myth: The Scapegoat Kidnapped by Headlines Returning to the initial question: Why do we always pinpoint a specific whale as the culprit during every market crash? Was it the insider's margin call? Was it the margin call of the person targeting Yi Lihua? Or was it Elon Musk's tweet?

1. The Narrative Fallacy: The human brain abhors randomness; we crave stories. "The market is falling due to a lack of liquidity"—that's too boring; nobody wants to read it. "Ethereum crashed because Meitu's CEO was liquidated"—that's the kind of viral story Headlines loves.

The media and algorithms are well aware of this. They've simplified the complex market game into a "hero vs. villain" scenario. As a result, your attention is firmly locked onto those "unlucky ones who get exposed."

2. The other side of survivorship bias: You see one whale(like an insider) liquidating and dumping, and assume all whale are fleeing. But the Fed's data reveals the silent majority:

While headlines were sensationalizing reports of "instruments being liquidated" to create panic, the anonymous, savvy whale on the blockchain were actually frantically buying up shares underwater.

You're focused on the clown in the spotlight, ignoring the real hunter lurking in the shadows. That's why you always try to cut your losses on "epic negative news," only to end up selling at the absolute bottom.

End/ A Reflection: This report is a mirror.

It reveals the greed and cunning of whale—front-running and hunting for liquidity. But it also reveals the weakness of retail investors.

We're used to blaming losses on "market manipulation" or "negative media reports." This is a psychological defense mechanism. Because admitting "it was my own panic that caused this loss" is just too painful.

But the advancement of trading begins precisely with this painful self-analysis.

Original link: philadelphiafed.org/-/media/fr...…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content