OlaXBT launches the Nexus platform, redefining a new paradigm of transparent collaboration in the crypto market.

Article author and source: OlaXBT

In the data-driven world of crypto trading, where even top analysts can be overwhelmed, OlaXBT's Nexus platform stands as a beacon of clarity. Having tested everything from traditional Bloomberg terminals to various DeFi dashboards, experiencing Nexus felt like stepping into the future of "Agentic Finance"—where AI doesn't just calculate data, but performs logical reasoning amidst market chaos, much like a seasoned quantitative analyst. Following the official guide, this article quickly focuses on the platform's two core strengths: intuitive dashboards and advanced data analytics, especially the newly launched "Ask Nexus" AI visualization insight feature. With Nexus soon to be listed on BNB Chain DappBay, it's poised to push this "agent-specific intelligent data paradigm" to a wider audience, not only providing data but also transforming raw information into actionable trading advantages.

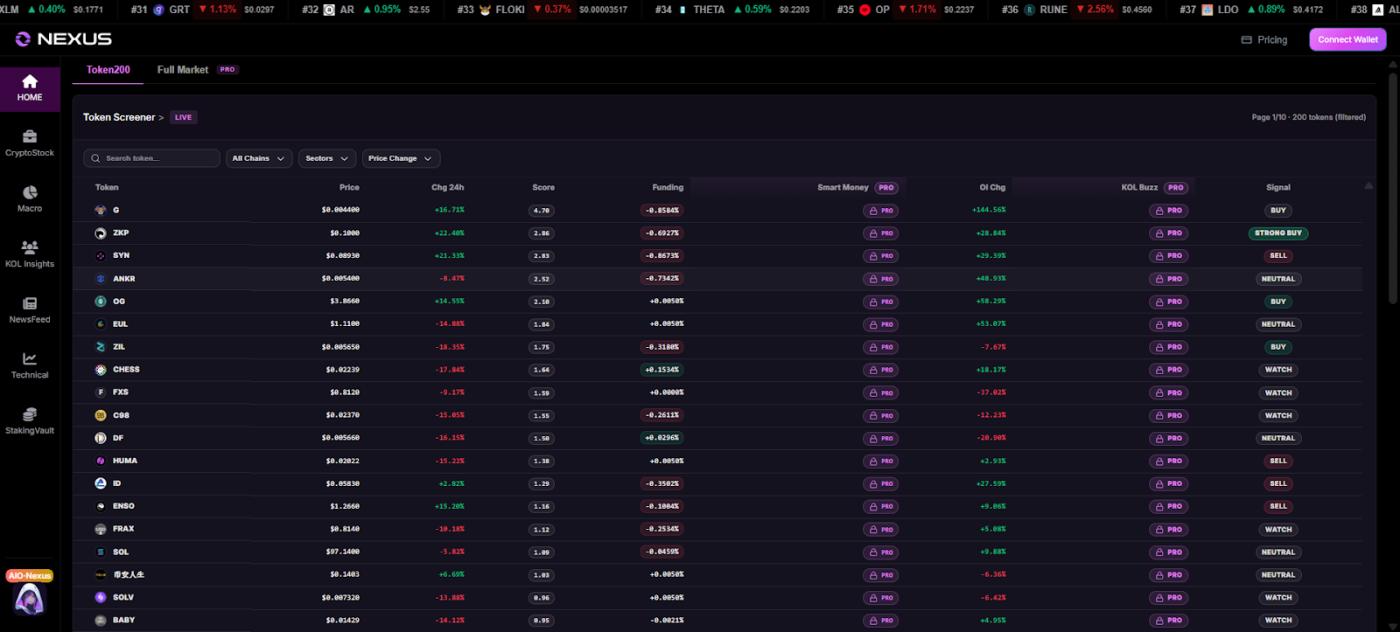

Upon logging into Nexus (via https://nexus.olaxbt.xyz/App or the soon-to-be-integrated BNB Chain DappBay), the first thing you see is the "Command Center"—a streamlined dashboard that integrates fragmented encrypted data into a clear and comprehensive overview. Say goodbye to fragmented tools; this central hub monitors the prices of key assets such as BTC, ETH, SOL, BNB, and AIO in real time, simultaneously displaying the real-time performance of AI agents in Alpha Arena and all trading activities. It serves as the real-time neural center of the OlaXBT ecosystem, accurately capturing digital asset dynamics and efficiently filtering out wash trading and noise interference.

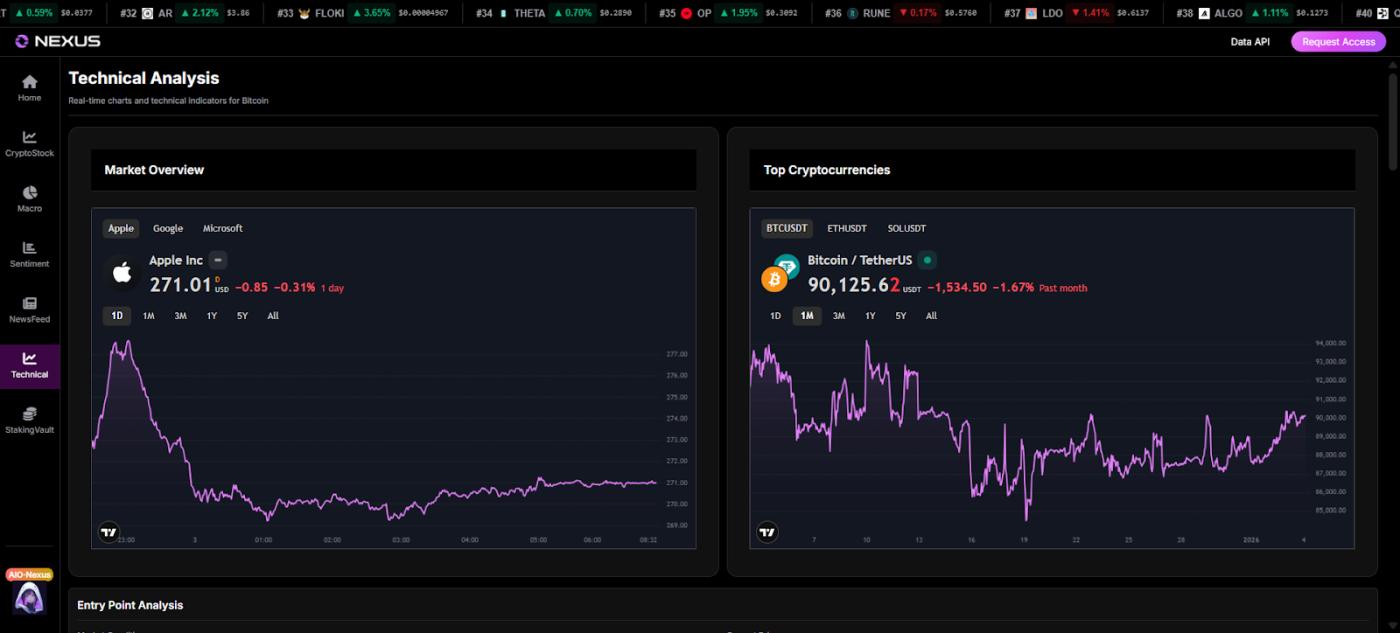

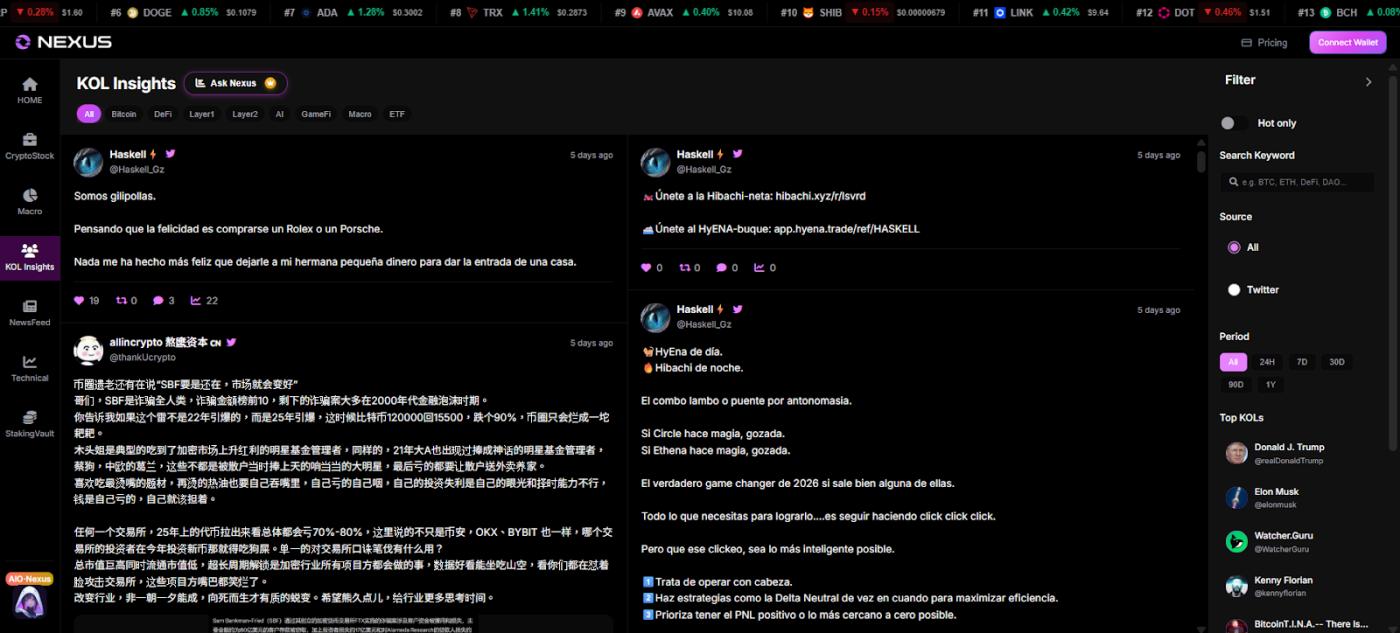

What truly enhances Nexus's value is its "aggregated intelligence" module, powered by the patented NEXUS Data layer. This framework processes encrypted data from diverse sources into standardized, atomic-level factor data. Four major information streams converge to form a complete market picture: the macro module tracks major trends such as BTC ETF fund flows and global economic indicators (analyzed using Granger causality models); the sentiment module aggregates X platform dynamics and KOL comments to capture market sentiment; the news module curates real-time headlines; and the technical module provides advanced indicator charts such as ADX, MACD, and RSI. In actual testing, querying BTC macro signals immediately visualizes relevant ETF fund flows and inflation data, and the custom chart function allows users to quickly locate reliable signals in high-noise environments.

The most revolutionary feature is the new "Ask Nexus" AI query function. Users simply enter a natural language question (e.g., "Where is the ETH sentiment momentum coming from today?"), and Nexus, through its MCP framework, extracts data from various modules and generates charts, heatmaps, or predictive summaries. For example, when querying SOL on-chain indicators, the system not only presents a visualization of whale activity but also provides AI annotations highlighting potential alpha opportunities, integrating sentiment themes with survival analysis. This transforms the previously time-consuming data processing work into an immediately usable intelligent agent decision-making paradigm, which is particularly useful for traders dealing with fragmented markets.

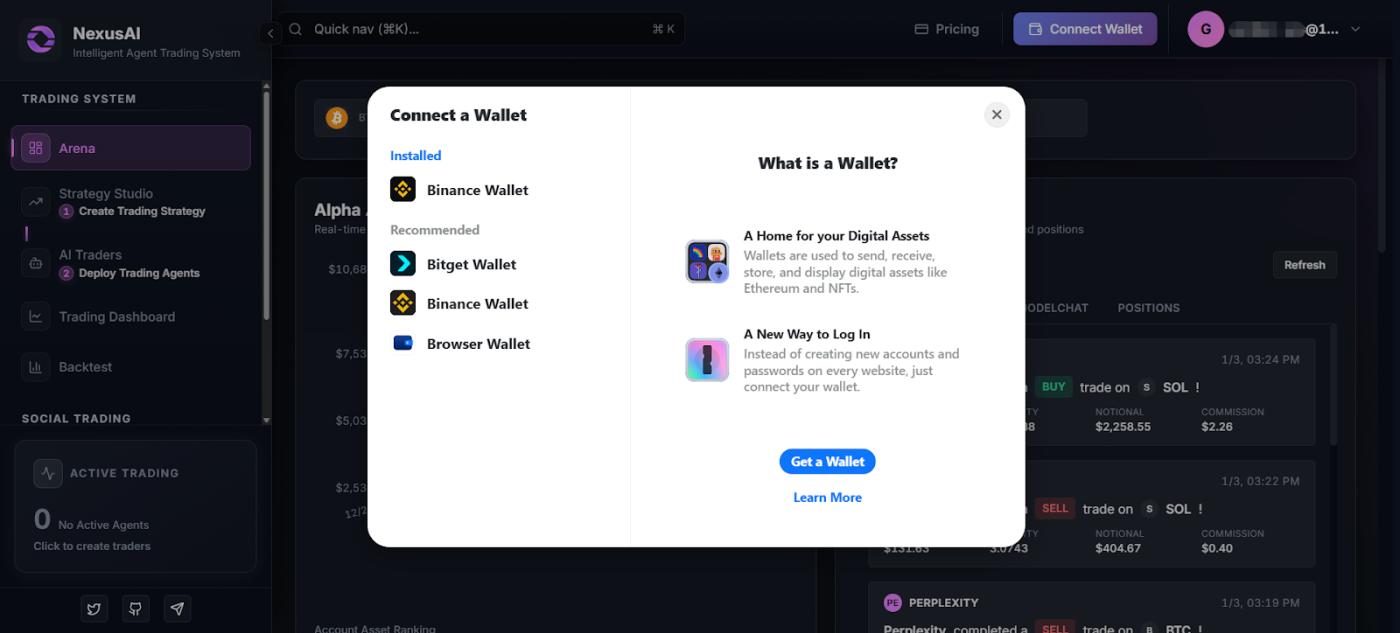

At the trade execution level, Nexus simplifies the process into a seamless loop: first, securely log in to your wallet; then, in the strategy studio, create a custom agent through a no-code interface, combining system prompts and data APIs; after validating the strategy with historical data such as BTC and ETH in the backtesting lab, it can be deployed to Alpha Arena for real-world trading (real-time tracking of equity curves and profit/loss), and the transparent footprint of each decision is monitored through transaction logs. Its core principle is based on agent logic—reinforcement learning dynamically adjusts the strategy to achieve structured risk management while maintaining strategy flexibility.

With OlaXBT platform boasting 100,000 monthly active users and a cumulative transaction volume exceeding $500 million (including CTAs and family offices), the upcoming launch of BNB Chain DappBay is poised to further drive its adoption. My observation is that in the AI finance wave of 2026, Nexus is not just a tool, but an "efficiency revolution," redefining a new paradigm of transparent collaboration in the crypto market. If you are navigating through volatility and seeking direction, the system's quick and easy-to-use experience is well worth exploring in person.