This article is machine translated

Show original

0205 Options - The market no longer believes a short-term rebound to above $85K is possible.

Let's look at today's Bitcoin options data.

Key points:

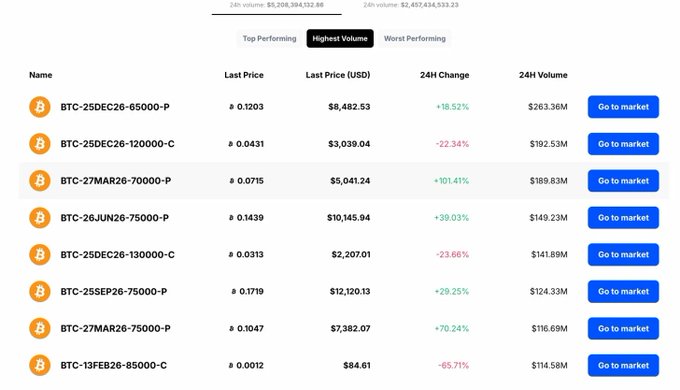

- Today's high-volume options were Puts, indicating severe risk aversion, with some even reaching $60K. The market believes that a return to $70K is unlikely by March 26th, followed by $75K at the end of June, $75K at the end of September, and $65K at the end of December...

- Bullish investors are liquidating their positions. Short-term Calls at $85K are almost zero (13FEB26-85000-C). The number of people believing a return to $85K by mid-February has significantly decreased, leading to a severe sell-off of these options.

- Institutional consensus downside range: $65,000 - $75,000. The largest volume Puts were concentrated at 25DEC26-65000-P ($263M), indicating that some are positioning for a potential BTC price to reach $65K before the end of the year. This actually aligns with the bottoming pattern of the "medium-to-long-term grid" strategy currently being established.

Although a drop below 70K is indeed quite bearish for the overall market,

the increased trading volume may indicate that short-term panic is nearing its peak.

alvin617.eth

@Alvin0617

02-04

$BTC 大盤跌麻到 74K ... 昨晚直播已經有所徵兆?

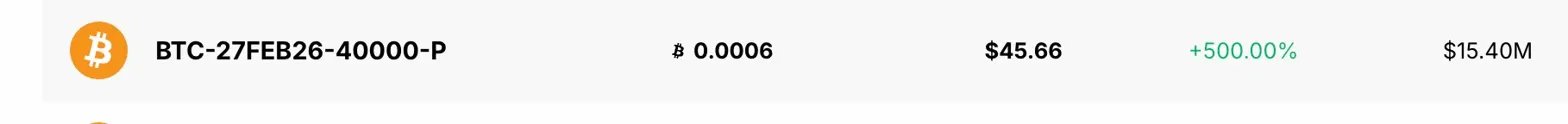

期權市場已經有人開始預期 $BTC 跌破 40K 而買彩票

因為成本超級便宜,可以用來賭上百倍的回報

在 Deribit 上面的 Top Performing 榜上看到了極恐怖的 40K 保護單,出現了 500% 的漲幅

說明「有人正在大量購買「BTC 在 2 月底前跌到 $40K」的保險 x.com/Alvin0617/stat…

source :

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content