By using wallet tracking technology and studying the on-chain behavior of smart money, we can find systematic transaction paths from zero to millions of dollars.

Written by: @maxxexee

Compiled by: AididiaoJP, Foresight News

People never appreciate what they get for free. But today, I'm giving you my years of hard work, countless sleepless nights, wholehearted dedication, and those secrets I've been longing to know. So make the most of it, and don't be an ordinary person who just wastes opportunities.

beginning

Before you begin, you will need to prepare the following tools, which you can use now:

- Ray Purple Wallet Tracking Bot

- MevX (used for sniping deals)

- Gmgn AI

- DEX Screener

- Personalized music playlists to help you get into the zone.

- Whale Watch by Moby (Remember to turn on push notifications)

Mindset Shaping | Your thoughts determine who you are

placebo effect

When I say "tracking from zero to millions of dollars through your wallet," the protagonist doesn't necessarily have to be me; it could also be you, the reader of this passage.

Science has proven that the placebo effect shows that simply "believing" can trigger real, measurable results—changing your performance, perceptions, and decisions—without any direct external cause. I have witnessed this principle time and again in my life.

We solemnly remind you to take this matter seriously.

If you lack patience, only seek shortcuts, lack conviction, are content with mediocre dreams, are undisciplined, or simply don't believe in yourself—then you shouldn't be here. Go back to those pump-and-dump games on Pump.fun.

I don't trade to survive. I force myself to study systems that will make me a better trader, and the improvement in my survival and quality of life will naturally be the reward that follows.

If you trade purely for money and survival, the immense pressure is likely to break you. But if you understand the system and treat trading as a byproduct of building a better life, your chances of success will be much greater.

There will always be someone who tells you that these strategies are fake, that it's all a scam, and that only insiders can win. This is usually just excuses made by people who lack depth and have low self-esteem.

Listen to me, someone who has tracked/contacted a whale holding over $40 million in GRIFFAIN insider positions; lying would do me no good.

Trading is a game. Wallet tracking is a maze, and every profitable wallet proves that someone has found the exit.

Okay, let's begin.

First Lesson

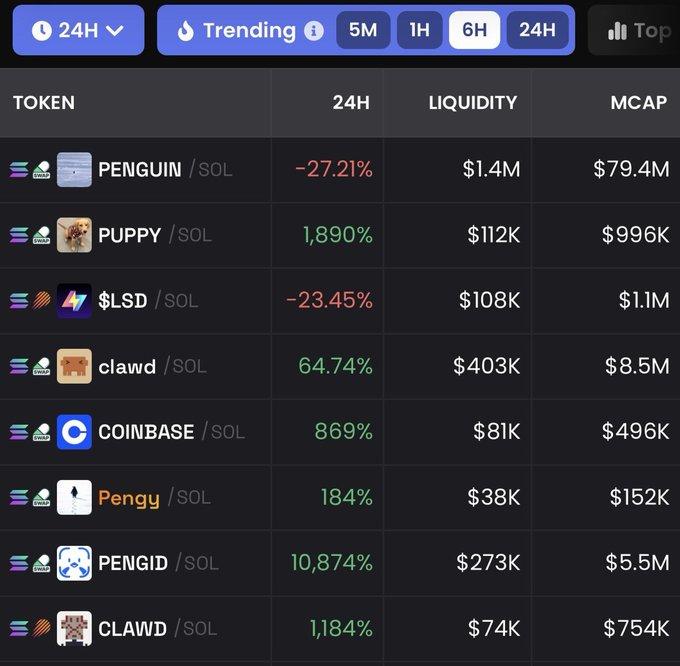

Welcome to this diaper-free "preschool." After the warm-up, your first practical exercise is identifying tokens promoted in an organized manner by KOLs or small groups. These can usually be found on Dex Screener's real-time trending list.

DEX SCREENER: See every move clearly

When checking tokens, I strongly recommend using a computer for the clearest view.

I set the chart to 1-minute candlestick charts and daily trading timeframes.

- A 1-minute candlestick chart can accurately show the time points when buy and sell transactions occur.

- The daily trading timeframe shows the token's complete performance from its issuance: every surge, every drop, and the secret accumulation phase.

I typically keep the candlestick chart period at 1 minute or 5 minutes, while matching the timeframe to the token's "age." If the token was issued 2 days ago, I set it to 2 days; if it was issued 3 days ago, I set it to 3 days. This way, all historical data is readily available and comprehensive.

Performance analysis using EPSTEIN as an example

Step 2: Interpreting the Charts

After setting the filter criteria, we began to observe the tokens. I mainly focused on two types:

- New token pairs: Track wallets that bought and held tokens at their initial offering. These are high-risk, high-volatility pairs, but also potentially high-return ones.

- Rally/Second Launch/Early Bird Trading: Track wallets that buy old coins that have gone to zero or bottomed out (possibly insiders or those who preemptively positioned themselves for an event) and sell at the high point.

Today, we'll focus on option 2, which I believe is a safer bet based on past experience. Often, KOLs or insiders will shake out hesitant retail investors through a shakeout, accumulate enough shares, and then drive the price sky-high, leaving you behind and continuing to be scammed on Pump.fun.

By observing the EPSTEIN chart, we can identify 3-4 key support and resistance levels, which are where large-scale buying and selling occur.

- Support level - Buy signal, rally, green candlestick pattern

- Resistance level - Sell, sell-off, red candlestick

Your tracking should start from the absolute bottom, near the resistance zone before the support or buy area. Why? Because this represents a token that is "dead," abandoned, and has completely bottomed out.

When someone intervenes in this position, it's never random. They either have inside information, have heard rumors, or are preemptively planning an event you have no idea about.

I know things you don't.

Real-world case study: The movement of smart money

Look at EPSTEIN: its market capitalization soared to $1 million on its first day of listing, then plummeted to $100,000, just like your ex dumped you… Don't be sad, that's just how the market is. High risk, high volatility, which is why I said before not to touch new coins, wait until you have more experience.

After the crash, it consolidated around a market value of $100,000, slowly accumulating shares to rise to $400,000-$500,000, and finally surged to $3.3 million.

Was it insider manipulation? Was it smart money? Maybe. But that doesn't matter. What matters is that some wallets bought in at the bottom $100,000 range, held until $500,000 (our key watchpoint), and then watched it soar to a market capitalization of $3.3 million. Well done.

This is an 8-fold return, which isn't amazing, but it's a real profit.

Some people are always chasing the next "miracle coin" that turns 5,000 into 1 million. Remember, quality is far more important than quantity.

I'd rather invest $100,000 in a high-probability 2.5x opportunity and make a steady profit than invest $100,000 in an uncertain 10x opportunity and lose it all.

Your task

We've now identified the key area of interest—the region where buyers accumulated significant positions before the price surge. The next task is to identify the wallets that bought in that area.

This is a tough job, because you might experience eye strain, headaches, or even auditory hallucinations. I suggest you get up and walk around every now and then to take a break.

I love using Dex Screener because it provides comprehensive information: wallet entry time, trading volume, market capitalization, etc., giving you enough depth for analysis.

According to Dex Screener, the main buying activity occurred around 2:15 AM on February 1st, with a market value of approximately $600,000 (note that time zones may differ).

Now you know the time and general details of the event. Next:

Set filter criteria:

- The date is set to the specific date the event occurs (e.g., February 2nd).

- The time window is set before and after the event (e.g., 2:10-2:30).

- Add an extra 20-30 minutes of overlap time to ensure complete coverage.

- The transaction type was filtered as "buy only".

Analyze buy transactions

After filtering, you need to hover over each transaction to view it. This is tedious and stressful, but it's like a miner digging for gold. By hovering over each transaction, you can see: who bought it, how much they spent, when they bought it, and what their final return was.

For example, a wallet starting with "26o" bought in for $415 and eventually sold for a 5.6x return. This is insignificant compared to the large transactions we track, but it's still worth noting. It can't be directly classified as insider trading or smart money, but it's worth adding to our watchlist.

Repeat this process, recording wallet addresses in a notepad, organizing your observations, and carefully studying the patterns. Over time, the noise will subside, and the truly important trends will naturally emerge.

Step 3: Utilize "Unrealized Gains"

This strategy is particularly suitable for new coins or tokens that are slowly accumulating momentum, and I like to approach it from a psychological perspective. Unrealized gains refer to profits that have not yet been realized on paper, which holders choose not to sell because they expect the asset to appreciate further.

Operating steps:

- Find a new cryptocurrency pair with a moderate market capitalization (e.g., $200,000, $500,000, or $1 million).

- Look for currency pairs that have been available for 30 minutes to 1 hour (or longer).

- Check if the trading volume is reasonably matched with the market capitalization. Unusually high or chaotic trading volume usually means that the token has been overhyped and there is heavy selling pressure, so avoid it.

- If the token meets the criteria, go to the "Top Traders" section, switch to the Unrealized Profits view, and then hover over it to view the holders. This will give you insights into who is holding the token, how much they are holding, and their mindset—silent signals that most people overlook.

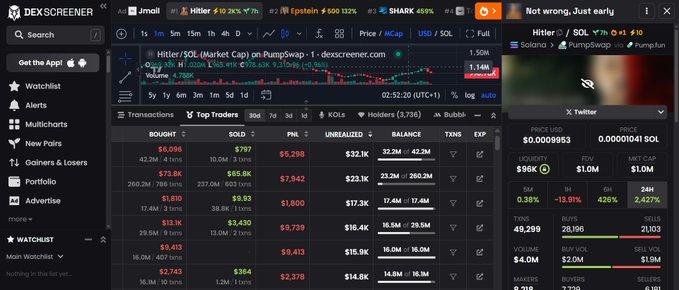

Take Hitler as an example

This chart looks very tempting, full of crazy buying and holding records, but believe me, there is often more to it than meets the eye.

We repeated the same process, carefully recording wallet addresses and unusual activity. For example, someone bought only $50 on Hitler, yet it showed $6,000 in unrealized profits—why haven't they sold? What do they know? It's very interesting.

The only way to find the answers is to treat them as signals and advantages, and quietly build your own observation archive.

Learn to eliminate wishful thinking from your strategies. Not everyone holding onto unrealized gains is smart money; some are simply aimlessly and recklessly holding on without a plan. Don't mistake blind hope for unwavering conviction.

Step 4: MOBY's Whale Observation

This is a highly insightful tool specifically designed to track whale activity and the flow of funds between different tokens.

Usage recommendations:

Follow some reliable whale tracking accounts, turn on push notifications, and then patiently observe for 1-2 weeks. Don't be impatient; the pattern won't appear on the first day.

My operating procedure:

I scan every token that Whale Watch alerts me to, especially those with a realistic market capitalization (usually below $1 million). I look at each one, observing its price action, market performance, and background.

For each token, I would ask myself:

- Why did the whale buy it?

- Does its story or narrative hold water?

- Who had already bought before the whale made their move?

- After the whale made their purchases, who followed suit?

- How did this token perform afterward?

If you record these questions every day, patterns will gradually emerge. It takes time, but it will definitely happen.

I've noticed a pattern (I hesitated to share it): some whale wallets act as "attention containers".

Their goal isn't necessarily to position themselves in advance, but rather to generate attention and FOMO (fear of missing out). Typically, a small group of insider wallets will quietly enter the market first. Then, whale will quickly follow suit, driving up trading volume and market attention.

The same logic applies to the perpetual contract market on centralized exchanges (CEXs). When a large-cap token is listed, such as PENGUIN (for example), several small wallets will quietly build positions beforehand to conceal their activity or create disruption. Once the positions are in place, whale enter the market, causing a surge in trading volume, and the long positions in perpetual contracts begin to profit. The real profits don't necessarily lie in the spot market, but rather in the opportunities created by spot market volatility for other markets (such as contracts).

What finally made me understand something was this:

Why do whale always buy tokens that have already risen in price? Older tokens, tokens nearing their all-time highs, and tokens with already high market capitalizations that are unlikely to double in value again.

Until I realized that price appreciation wasn't the only way to make a profit.

Your job as a trader is to discover vulnerabilities, flawed systems, or hidden mechanisms and exploit them. If you can track down wallets that consistently buy before whale act, you can position yourself in advance, set up your long positions, manage leverage, and make the system work for you. Once you identify this pattern, you can even preemptively buy the next token that whale might target.

This is just one of many perspectives.

I'll stop here.

Either question everything, or become just another ordinary member of the masses.

Wallet Tracking List

This is the final and most important step in the whole process. This checklist will tell you whether you've found a gold mine or just a pile of junk that you've wasted months of time on.

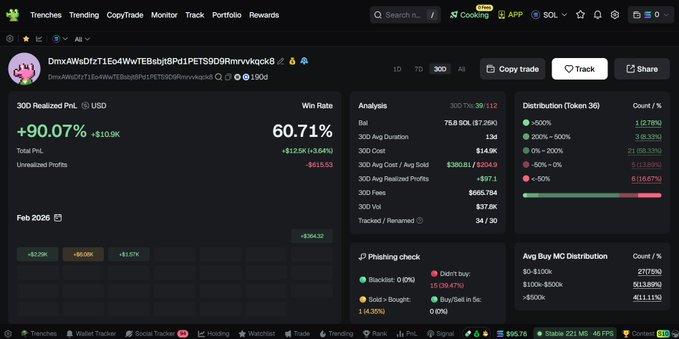

I used GMGN AI for the final analysis.

Paste your wallet address into GMGN and carefully check the following:

- Holding time

- Win rate (please use with caution)

- Average purchase market capitalization distribution – In what market capitalization range do they typically enter the market?

- Transaction and transfer records (more important than most people think)

- How many people are tracking the same wallet?

The Trap of "False Win Rates"

As I delved deeper into wallet tracking, I realized a crucial point: looking at win rates alone is almost meaningless; it's just surface-level data.

I've seen wallets with a win rate of only 20% or even lower, yet they consistently participate in organized price manipulation. Their modus operandi is to buy in with one wallet, then transfer the tokens to other wallets to sell. This is why you sometimes see wallets with sell records but no buy records on the Dex Screener.

Once, I tracked a wallet with an extremely poor win rate. It bought a token when its market capitalization was around $100,000, then transferred most of the tokens out, leaving only a small portion. On the surface, it seemed like it was stuck with the investment. But in reality, within 30 minutes, the token's market capitalization surged to $9 million. A few hours later, the price plummeted, while the tokens in its original wallet remained untouched.

If I hadn't looked closely at the transaction records, I would have assumed he had lost money. But what I couldn't see was that he sold the tokens through another wallet, concealing any signs of profit.

This is the difference between "seeing" and "truly seeing".

This game rewards curiosity and wisdom, not shortcuts. Don't just look at the surface; dig deeper, track behavior, and find the patterns yourself.

The advantage lies in the "dirty and tiring work" that most people are unwilling to do.

Case Analysis

Here's a wallet that seems to have a good win rate. As you can see from the image, it has a solid holding period, with most of its purchased tokens valued between $10,000 and $100,000, and a few exceeding $500,000. This entry point seems reasonable.

Important points to note:

- Average holding time is crucial here, more so than most people realize. A longer holding time demonstrates patience and intent, indicating that the wallet wasn't built to attract copycats or for rapid price dumping.

- Trading and holding analysis gives you the opportunity to observe the types of tokens they buy, their behavior during fluctuations, and whether their entry points coincide with the accumulation phase of major players.

- I also closely monitor how many people are tracking the same wallet. If there are too many trackers, I usually avoid it. This is because its value has been "diluted"—too many eyes watching, too many copycats, almost always distort entry timing and destroy the original upward structure.

Copy trading introduces a lot of market noise. People enter the market without understanding the context, easily panicking prematurely, overusing leverage, and starting to "farm" tokens instead of letting them develop naturally. This behavior completely destroys organized trading and clean price movements.

That's why I don't follow the crowd; I only study behavioral patterns.

Don't be a follower; be a detective.

Just having this mindset gives you a head start.

What to do and what not to do

- What you shouldn't do: Don't immediately follow suit and buy in after seeing insiders make purchases. Observe first and wait for a clear entry signal.

- What to do: Before investing funds, be sure to observe price behavior and market performance.

- If you discover a highly profitable wallet, don't share it publicly. Once its advantages are widely known, they become ineffective.

- Never pay someone to buy a so-called "winning wallet" address. The person selling it to you is either penniless, making up a story, or trying to scam you.

- Never buy more than the insider. That's greed, not conviction.

- Do not sell cross margin at once to take profits. You should plan to take profits in stages.

- Once you've identified a quality wallet, activate it on the wallet tracking bot and wait for transaction alerts.

- If you're as prepared and lucky as I am, you might eventually catch one of those amazing opportunities to turn 5,000 into 500,000. Such opportunities do exist, but they usually come from precise targeting of newly issued tokens.

Conclusion

This guide is now complete.

The next time you envy those "Degen" traders who drive luxury cars and live extravagant lives, remember: they know things you don't and have put in unseen effort.

If you've read this far, I wish you discipline and a fruitful journey in your wallet-tracking endeavors.