Read and download the full report in PDF format.

Overview

Momentum has improved from deeply oversold levels, with the 14- day RSI rebounding toward its lower statistical band, signalling easing sell pressure and tentative buyer engagement. Spot volumes have expanded materially, yet activity remains reactive rather than constructive, reflecting churn following downside repricing instead of decisive accumulation.

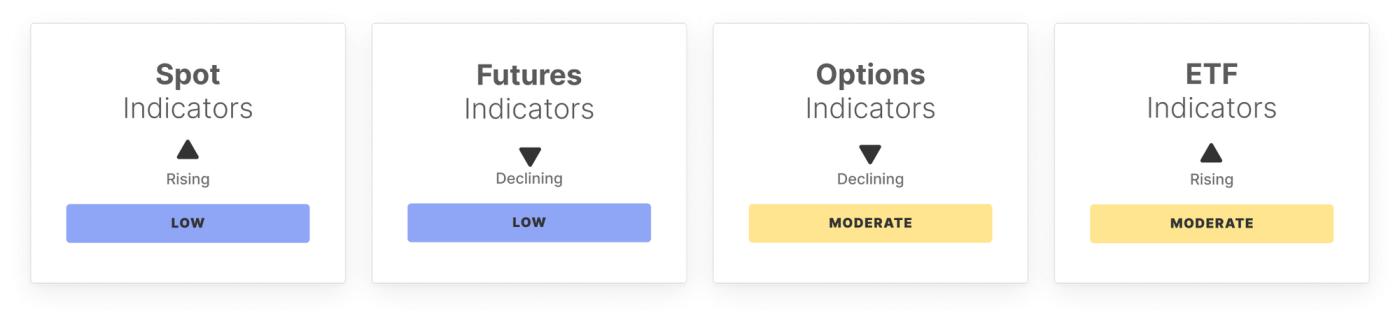

Spot conditions remain defensive, with Spot CVD entrenched in negative territory and confirming persistent sell-side aggression. While ETF outflows have moderated sharply, positioning still reflects caution, even as ETF trading volume has surged. Elevated participation suggests engagement has increased, but sustained demand absorption has yet to materialise.

Derivatives markets continue to lean risk-off. Futures open interest has contracted below its statistical range, signalling broad position unwinding and reduced speculative appetite. Funding has cooled as traders step back from leveraged long exposure. Perpetual CVD has stabilised, but options positioning remains defensive, with lighter open interest, compressed volatility premia, and elevated skew pointing to persistent downside hedging demand

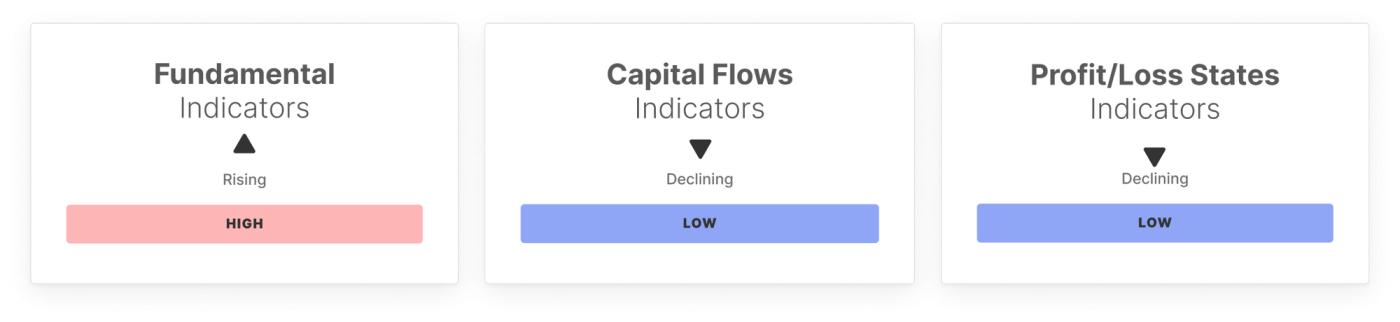

On-chain activity reflects stress transitioning toward stabilisation. Transfer volume has surged above its upper band while fee demand remains steady. Capital flows have turned negative, realised cap growth is contracting, and unrealised losses dominate supply. These conditions align with late-stage correction dynamics where selling pressure may begin to exhaust.

Overall, conditions remain defensive across spot, derivatives, ETFs, and on-chain indicators. Profitability is compressed, capital flows are negative, and hedging demand remains elevated following the downside repricing. While some signals suggest selling pressure may be moderating, a durable recovery likely depends on renewed spot demand capable of stabilising price above recent lows.

Off-Chain Indicators

On-Chain Indicators

🔗 Access the full report in PDF

- Follow us and reach out on X

- Join our Telegram channel

- For on-chain metrics, dashboards, and alerts, visit Glassnode Studio

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

Exchange balances presented are derived from Glassnode’s comprehensive database of address labels, which are amassed through both officially published exchange information and proprietary clustering algorithms. While we strive to ensure the utmost accuracy in representing exchange balances, it is important to note that these figures might not always encapsulate the entirety of an exchange’s reserves, particularly when exchanges refrain from disclosing their official addresses. We urge users to exercise caution and discretion when utilizing these metrics. Glassnode shall not be held responsible for any discrepancies or potential inaccuracies.

Please read our Transparency Notice when using exchange data.