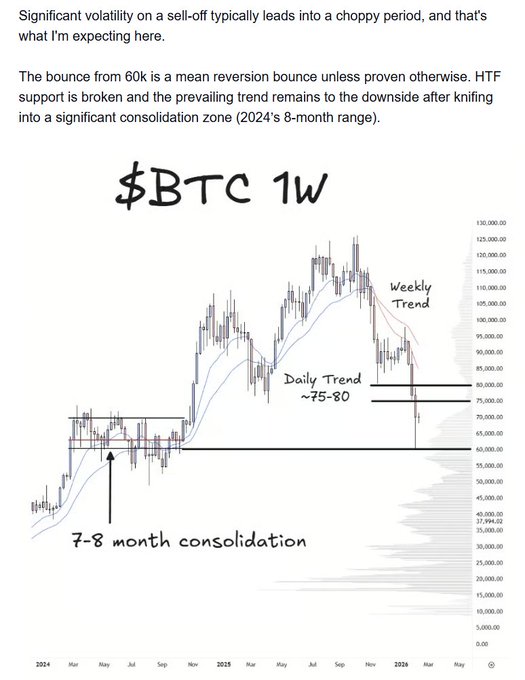

After a violent sell-off, a mean reversion bounce is to be expected.

This magnitude of spike in volatility typically leads to a rotational regime where most tend to chop themselves out getting trigger happy and marrying a biased one-directional thesis without much information.

Letting the market decide where there is excess and what the bracket of the current range is (or not) and will go with the flow.

Excerpt from weekly cookbook - free newsletter published every Monday with Mercury, Magus, Doc and Charlie:

New COOKBOOK out now

Magus — Finally pulled the trigger on this

Doc — 3 ways to buy the bear market lows

Charlie — Anything worth watching?

Stoic — Short-term opportunities

Mercury — What I’m expecting from here

read below 👇

One way of thinking about is that there was a ton of energy released on that sell-off and it takes time for such an imbalance to resolve (markets spend more time ranging).

Conservation of energy -> stored potential energy released into kinetic energy - back to building up potential energy.

The compressed spring was released and it will now just oscillate about the mean and compress once again until there is new information or there is enough positioning built up on one side or another to unravel into.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content