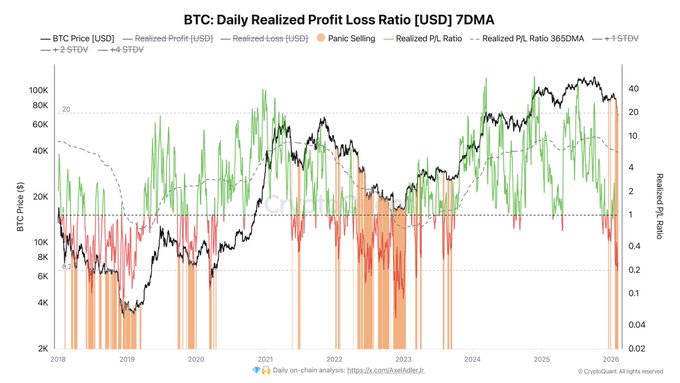

🔴 Realized losses continue to heavily dominate the market, suggesting that many investors bought near the recent tops. We are even seeing some DATs, who bought at much higher levels, choosing to sell their BTC. BTC is not for everyone… 💥 Today, the realized profit to loss ratio stands at 0.25, meaning that for every $1 of realized profit, $4 of losses are being realized at the same time, which is significant. The 7 day moving average of this ratio is now reaching bear market levels. For comparison, the annual average ratio sits at 6.33, indicating that profit taking remains largely dominant over the long term. We are still far from a bear market level where this ratio ends up dropping below 1. 💡 Remember that this happens after the end of the bear market, because since it is a yearly average, there is inertia in the data. 👉 Today, realized profits are slightly exceeding losses which had not happened for several weeks. These phases of panic selling or capitulation can persist, especially when the market enters a bear trend. For the market to recover, this purge of weak hands needs to run its course, and investors need to return to holding unrealized profits, which would encourage them to hold rather than sell.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share