Encrypted Breakfast | February 8th

1. The Iranian Foreign Minister announced that the second round of Iraqi-Latin American talks will be held in the coming days. He also stated that the possibility of war always exists, and Iran is prepared to prevent war from occurring.

2. Musk: Once solar power generation, robotics manufacturing, chip manufacturing, and AI form a closed loop, traditional currencies will become an obstacle. What really matters will be (power generation) capacity and output, not the US dollar.

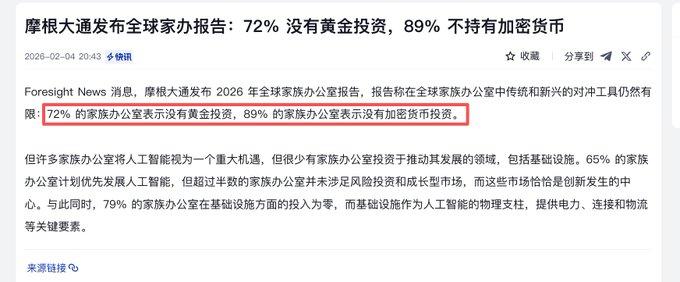

3. Eight Chinese ministries jointly issued new regulations on virtual currencies, clarifying the definition of RWA and requiring overseas tokenization registration.

4. Bithumb exchange mistakenly issued 620,000 bitcoins, of which 99.7% have been recovered, causing brief market panic but which was quickly resolved.

5. Bitcoin whale Garrett Jin deposited 5,000 BTC (worth $351 million) into Binance in two hours yesterday.

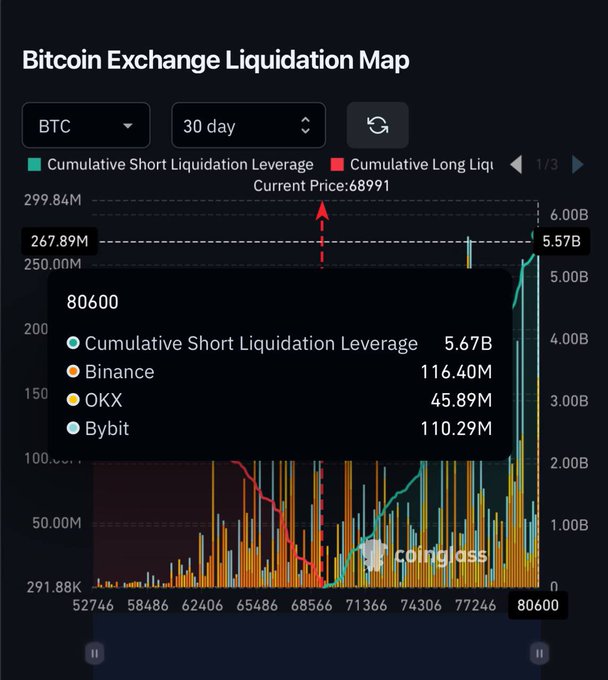

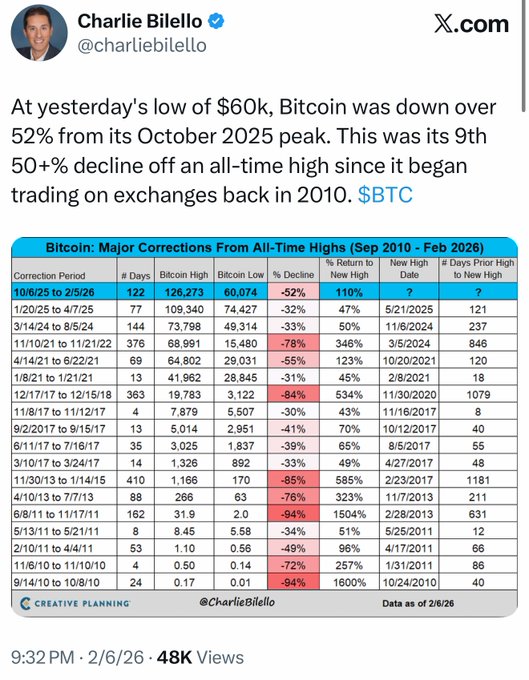

6. Arthur Hayes analyzes the Bitcoin crash as possibly caused by traders using IBIT structured products for hedging. VanEck analyzes five factors contributing to the crypto crash: deleveraging, miner selling, the waning AI hype, quantum computing risks, and the four-year cycle psychology.

7. The founder of Crypto.com acquired the domain name AI.com for $70 million. It's estimated that related AI products are coming soon.

8. ENS Labs abandoned Namechain L2 and moved ENSv2 entirely to the Ethereum mainnet.

9. MegaETH announced that mainnet will launch on February 9th, and that it will use USDM earnings to buy back MEGA tokens.

10. Polymarket applied for the trademarks POLY and $POLY, and partnered with Circle to upgrade to USDC settlement.

11. The White House met with crypto/bank executives to discuss the Clarity Act, focusing on stablecoin yields, which may accelerate regulatory progress.

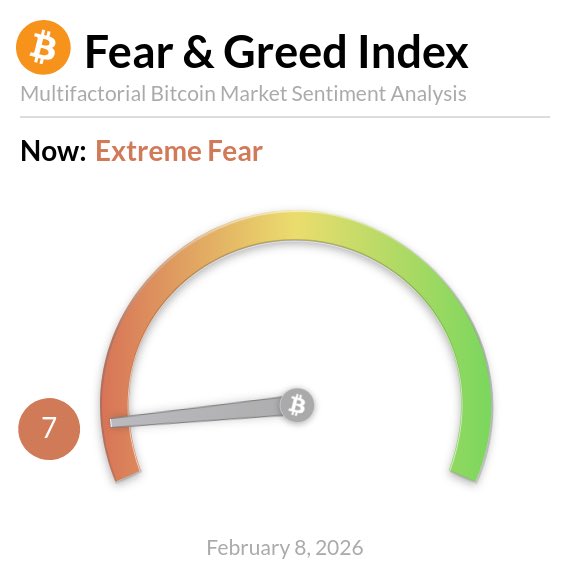

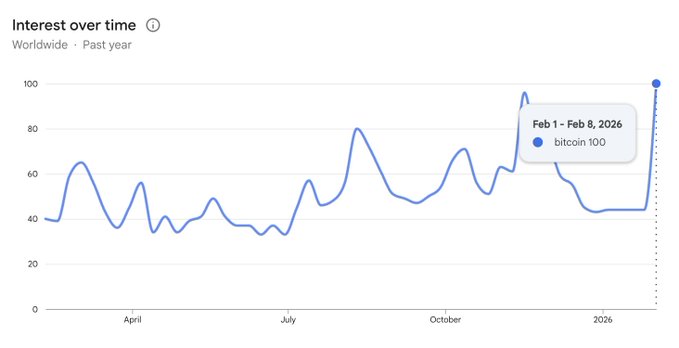

[Bitcoin Market Analysis] Bitcoin has been working hard to recover over the weekend. After such a sharp drop, it takes a long time to recover, so the market is expected to be in a prolonged state. Market confidence may be fully restored once the crypto bill is passed.

Bitcoin is currently fluctuating around $70,000. If there's no further selling pressure at the opening tomorrow, the market should stabilize, followed by a weak correction before rebounding. However, if institutional selling hasn't ended, panic will continue.

Bitcoin is showing a weak rebound on the 4-hour chart. Tomorrow's outcome depends entirely on whether institutions have finished selling off and whether their hedging and other risks have been fully resolved.

[Risk Warning] Digital assets are highly volatile and carry extremely high risks. Please participate with caution, never go all in, and never use leveraged loans.