⭐️ Want to experience DeFi in the Sui ecosystem? (Part 2)

: Magma Finance, Why Sui Pools Are Risky

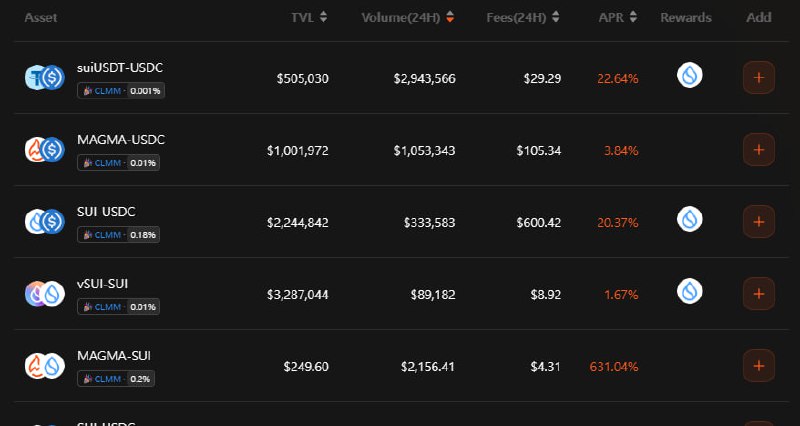

In fact, the stable pools described above don't pose significant risks, except for unpegging.

However, if altcoins are included as underlying assets, the situation changes. Especially if a pool like Magma only supports V3 pools.

——

❓ V3 stands for

🟠Concentrated Liquidity Pool.

🟠V2 provides full liquidity range ($0 to infinity). For example, $ETH Even at $2,000, liquidity is distributed evenly between $100 and $10,000 -> most capital is "unused"

🟠Conversely, V3 allows you to concentrate liquidity at your desired price range, allowing you to earn more fees with the same capital.

🟠All Mamga pools use only the V3 method (no V2).

——

⚠️ What are the disadvantages of V3 pools? 🟠 Range-dependent characteristics lead to impermanent loss (IL)

-> Profit is '0' when the price deviates from the range

🟠 This requires active time management

🟠 Profit loss (opportunity cost loss) incurred when the price deviates upwards, capital loss incurred when the price deviates downwards, etc...

🟠 Unlike V2, loss hedging is impossible.

——

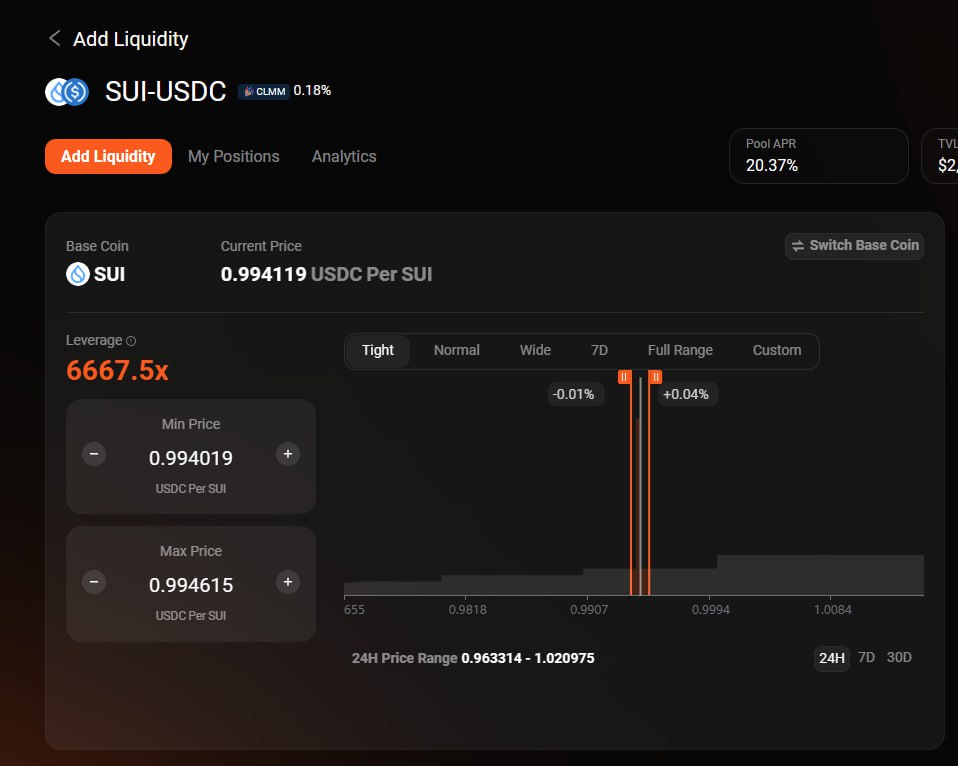

💧 Using Sui - USDC as an example...

🟠 Let's say you open a Sui - USDC pool and then open a V3 pool with a -5% downward range and a 5% upward range. (Sui and USDC are invested in equal amounts.)

🟠 If Sui falls by 5%, all USDC held will be converted to Sui. (Downward deviation)

🟠 If Sui rises by 5%, all Sui held will be converted to USDC. (Upward Breakout)

🟠Even after an upward breakout, the opportunity cost gained from an additional 5% or more increase in Sui during an uptrend is lost.

🟠Even after a downward breakout, if the Sui falls below the spot value invested (all USDC is converted to Sui), a loss occurs.

🟠However, if the price continues to range-bound within the range, you can continue to earn trading fees.

🟠In other words, V3 can be seen as a very advantageous method in a sideways market.

——

💧However, in a bear market like the current one, isn't Sui V3 extremely risky?

🟠As you've probably seen so far, DeFi isn't immune to market fluctuations.

🟠If you've followed the explanation, DeFi isn't an area unrelated to market fluctuations.

🟠If a downward breakout leads to a further decline, all Sui will be converted to spot, resulting in a loss. 🟠Sui is an altcoin that has consistently shown a weaker price range than the market sentiment.

🟠Since there's no guarantee of a return to the average range in the event of a downward trend, caution is advised when farming V3.

The best option, rather than focusing on Suipool, would be to focus on Magma's "stable pools" that offer generous rewards.

V3 trading in a bear market is truly the domain of experts, so you need to make wise decisions.