[1/3]

[Crypto/TradFi Merger Update] 2026-02-06 16:00 (Beijing Time)

━━ Important News ━━

1. Crypto market experiences "flash crash-rebound," with 24-hour liquidations reaching approximately $2.6 billion and the Fear & Greed Index falling to 9.

BTC briefly dipped to around $60,000 before recovering to $65,000-$66,000; ETH initially fell to around $1,750 before rebounding to $1,890-$1,900. Multiple sources indicate that approximately $2.2-$2.6 billion was liquidated in the past 24 hours, primarily long positions (the largest single transaction was approximately $12.02 million), and market sentiment has entered a state of "extreme fear" (reading 9).

(BlockBeats | TechFlow | BlockBeats | CoinDesk)

2. Trend Research 'long ETH position experienced a significant pullback, with suspected continued reduction in leverage and a downward revision of the liquidation range. Monitoring indicates that the company has accumulated losses of approximately $763 million in this round of ETH long. Starting February 1st, the company sold approximately 255,500 ETH at an average price of approximately $2,168 per ETH, triggering stop-loss orders, and withdrew approximately 483 million USDT from Binance to repay loans and reduce leverage. Latest developments show that the company continues to transfer ETH to Binance, seemingly selling to avoid liquidation, with the liquidation range updated to approximately $1,509–$1,800 (primarily concentrated around $1,560).

(BlockBeats | Foresight News | PANews)

3. US Spot ETF Funding Weakens: BTC/ETH ETFs See Net Outflows on the Same Day, IBIT Trading Volume Hits Record High. February 5th, US Eastern Time: Spot BTC ETF saw a net outflow of approximately $434 million (IBIT saw a net outflow of approximately $175 million, FBTC approximately $109 million), and spot ETH ETF saw a net outflow of approximately $80.79 million; meanwhile, IBIT's single-day trading volume was reported to have reached a record high of approximately $10 billion, reflecting increased trading demand amidst sharp fluctuations.

(SoSoValue | PANews | PANews)

4. Tether makes a strategic investment of $150 million and integrates XAUT to explore the use of stablecoins to purchase physical gold.

Tether Investments acquired approximately 12% of Tether Gold (XAUT) for $150 million, with plans to integrate Tether Gold and explore the use of USDT and its "US federally regulated" USD stablecoins USAT/USAt (USAT) to purchase physical gold (subject to regulatory and technical/commercial considerations).

(BlockBeats | Coindesk | Cointelegraph)

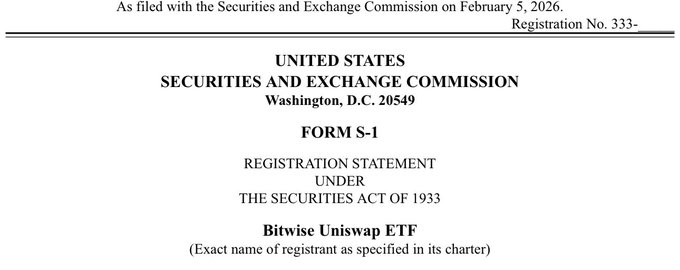

5. Bitwise has filed an S-1 registration statement with the SEC for a proposed "Bitwise Uniswap ETF," managed by Bitwise Investment Advisers and custodied by Coinbase Custody. The statement currently discloses that Bitwise will not participate in staking, but this may be adjusted in the future through document revisions.

(Odaily | Foresight News | Cointelegraph)

6. Pump.fun Acquired the cross-chain transaction terminal Vyper, and will gradually cease service starting February 10th.

Pump.fun The acquisition amount was not disclosed. It was stated that the Vyper team and technology would be integrated into its product system, the infrastructure would be migrated to Terminal, and Vyper services would be gradually discontinued starting from February 10.

(The Block | BlockBeats)

7. Strategy (formerly MicroStrategy) Financial Report and Risk Statement: Q4 net loss of approximately $12.4-12.6 billion; CEO stated that "it would take a drop to $8,000 and maintain that level for 5-6 years to pose a real threat."

The company disclosed a huge net loss in Q4 due to changes in the fair value of BTC; CEO Phong Le said that in extreme scenarios, restructuring, issuing new shares, or taking out additional debt could be considered; Michael Saylor referred to concerns about quantum computing as "FUD".

(The Block | BlockBeats | PANews)

8. Binance SAFU Fund address again increased/transferred 3,600 BTC (approximately US$233 million).

On-chain monitoring shows that the SAFU fund address added 3,600 BTC; some sources say its total BTC holdings are approximately 6,230.

(BlockBeats | Odaily | Cointelegraph)

9. Regulatory and Policy Updates: US Treasury Secretary Criticizes "Anti-Regulatory" Stance; Senator Calls on Banks to Embrace Stablecoins; South Korea Investigates Bithumb's Advertising and Promotional Terms. US Treasury Secretary Bessenter criticized industry figures resisting the Digital Asset Market Transparency Act at a hearing; Senator Lummis stated that stablecoins could become a "new financial product" for banks, but negotiations for the Clarity Act are reportedly stalled; The Korea Fair Trade Commission launched an investigation into Bithumb's exaggerated advertising and suspected changes to its promotional terms.